PDF Attached

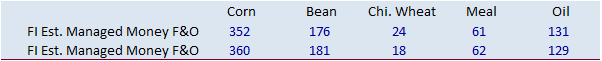

Wild

trade that ended on a higher note for soybeans, front month meal, back month corn, and US wheat contracts. Soybean oil rallied more than 100 points.

USDA

released their March S&D.

Reaction:

Initially

bearish corn and soybeans. Wheat held gains but turned lower after corn made another leg down. But a recovery in soybeans from bottom picking added renewed support to wheat and limited losses in corn. Prices traded choppy for the remainder of the session.

USDA

WASDE executive briefing slides: https://bit.ly/38rZV2i

USDA

its 2020-21 US ending stocks for corn, all-wheat, and soybean unchanged. Analysts had looked for a reduction in US corn and soybean stocks. The US SBO carryout was revised higher. By 19 million pounds with various changes to supply (yield 11.65 vs. 11.62

last month) and use (domestic food/feed/other industrial use up 200 million pounds). Could this be the beginning USDA is starting to incorporate SBO use for renewable diesel? USDA did announce they are adding SBO for renewable use to their balance sheets

sometime this spring. See below US soybean oil balance changes.

USDA

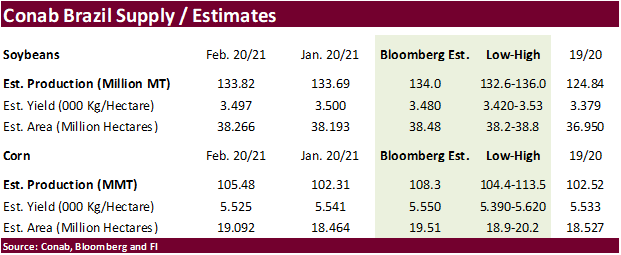

took Brazil soybeans up 1 MMT, left Brazil corn, Argentina corn, and lowered Argentina soybeans by 0.5 MMT. World soybean production (+0.7) and corn output (+2.3) were upward revised from the previous month. There were no changes to China soybean imports.

They also left China corn imports unchanged.

World

wheat stocks fell 3.0 million tons, which provides some support, but corn on hitting session lows as of 11:15 weighed on wheat futures, only to rebound after soybeans paired losses. KC wheat initially was under the most pressure from upward revision to HRW

stocks (MN/KC spreading). With some planned spring wheat area expected to be lost this spring to corn, canola and soybeans, we like MN over Chicago and MN over KC.

We

made no changes to our price outlooks, expect for front end KC wheat taken up 25 cents.

Look

for the trade to shift focus to March planting intentions and US weather.

Weather

World

Weather Inc.

WORLD

WEATHER THAT IS MOST IMPORTANT

- Northern

Brazil unharvested soybean quality declined in some areas last week due to excessive and persistent rainfall in Mato Grosso and many areas to the south - Fieldwork

is still behind the normal pace and worry over Safrinha corn planting continues because of delayed soybean harvesting - Rain

is expected to continue periodically through the next ten days to two weeks, although it will be less intensive

- Southern

Brazil will experience net drying for at least the coming week and some model data suggests drying for ten days - The

ground will firm up and some crop stress is expected in time - Subsoil

moisture is still favorable for most of the region today and that will carry crops through a large part of the coming week of dryness without a serious threat to production - Timely

rain will be needed after that - Argentina’s

rain prospects for next week are still looking very good - Showers

and thunderstorms until then will be limited through the balance of this workweek and then confined to the west during the weekend - Most

models have increased rain coverage and intensity in Argentina with nearly all areas impacted at one time or another from this weekend through the middle part of next week

- Relief

from dryness is expected - Declines

in late season crop yield potential should stop if the rain falls as advertised - Very

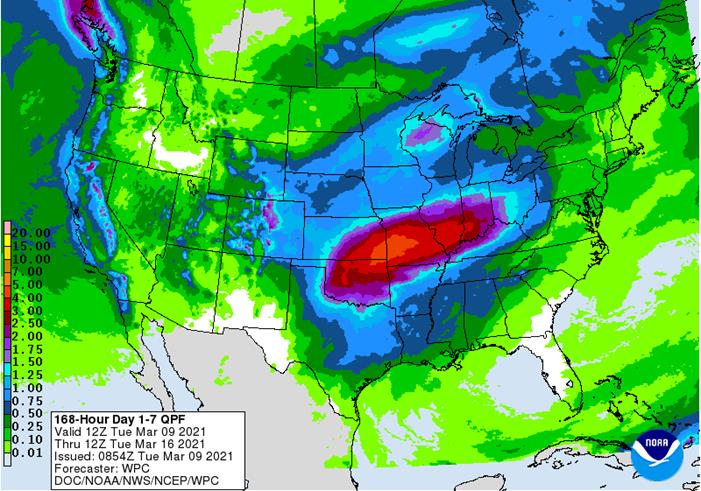

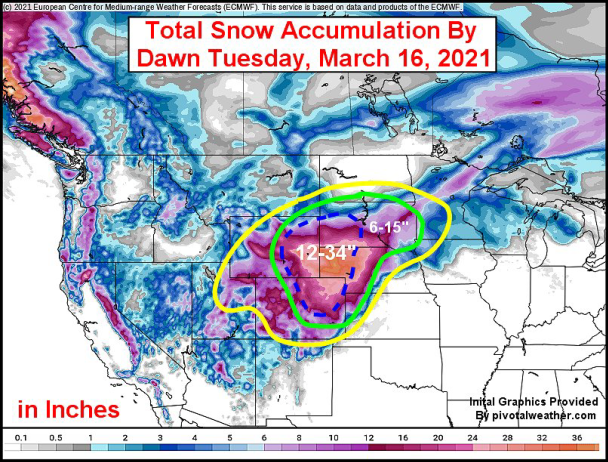

warm and relative dry conditions are expected until then - U.S.

Central Plains will get generalized precipitation Friday into Monday offering “significant” relief to drought in Kansas, Nebraska and Colorado - Some

caution is still advised because of the potential that the greatest rain may drift a little farther to the north - Nevertheless,

significant moisture in the heart of hard red winter wheat areas cant and should induce new tillers as the spring growing season gets under way and those new tillers could produce a new head of wheat to possibly replace any potential wheat loss resulting from

plant damage in February - Freezes

returning to the central and southern Plains late this weekend and next week will not cause any permanent damage to wheat that is greening

- Snow

will fall from South Dakota to Minnesota Wednesday offering some relief to dryness in South Dakota

- A

follow up storm (the one from the central Plains) is expected during the early part of next week to further improve soil moisture in South Dakota and maintain favorable soil moisture in Minnesota and southeastern North Dakota - Drought

in the northwestern U.S. Plains and Canada’s Prairies will not be significantly changed by brief periods of light precipitation in this coming week to ten days - The

pattern of weather in the central and eastern United States, however, does suggest improved weather will come to these drought stricken areas later this spring - U.S.

southeastern states will experience net drying and warmer temperatures that will support more aggressive corn planting and other farming activities through the weekend - U.S.

lower Delta will experience favorable rice and corn planting conditions for a little while in the coming week, but showers late this week and into the weekend will interrupt some fieldwork - U.S.

northern Delta crop areas will stay quite wet over the coming week to ten days and drying will be needed before fieldwork can begin this spring - U.S.

South Texas and the Texas Coastal Bend is still too dry with little rain potential for a while - Unirrigated

crops in the region may not get planted as aggressively as usual and will need moisture for seed germination and plant emergence - Planting

in irrigated areas will increase while the weather is dry and soil temperatures are rising - U.S.

west Texas precipitation will be welcome this weekend into next week, but it is not likely to be great enough to seriously change soil conditions and long term planting prospects are not very good without greater precipitation - Planting

is still several weeks away leaving time for improvement - U.S.

Midwest field moisture will remain adequate to abundant over the next ten days to two weeks - Canada’s

Prairies received some snow overnight in Saskatchewan and it will shift into Manitoba today - The

moisture from melting snow later this winter will improve topsoil moisture for spring planting - Most

of the southern and eastern Prairies will still need much more precipitation to restore moisture in the soil after multiple years of below average precipitation - Southeast

Canada will experience near to below average precipitation and near to above average temperatures during the coming week to ten days - North

Africa rainfall Monday was light and erratic, but still welcome - The

moisture will be welcome, but more will be needed to ensure the best yields later this spring - Additional

showers will occur into Wednesday and then dry conditions are expected for a while - Ivory

Coast, Ghana, Benin and southern Nigeria will receive brief bouts of precipitation during the coming week to ten days

- New

rain totals will vary from 0.50 to 3.00 inches and locally more will be supportive of coffee and cocoa flowering and help increase soil moisture for future rice, sugarcane and cotton production - East-central

Africa rainfall will continue greatest in Tanzania this week and probably next week, as well - A

more erratic and light precipitation pattern is expected elsewhere with net drying in Ethiopia, northern Uganda and in a few southwestern Kenya locations - South

Africa will experience an erratic rainfall pattern through the next week with temperatures mostly a little warmer than usual

- The

drying trend will encourage early season crop maturation, but subsoil moisture and irrigation will support late season crops

- Summer

crop conditions will remain favorably rated, although there will be a growing need for showers by mid-March - Some

increase in precipitation is expected next week - India

was mostly dry Monday - Rain

will be mostly limited to the extreme north, extreme south and far Eastern States during the coming week leaving most key crop areas in a net drying mode - China

weather over the next ten days will continue dry in Yunnan while periodic rain and thunderstorms occur near and south of the Yangtze River

- Rainfall

will be greatest in Guizhou, Hunan and northern Guangxi where 2.00 to 6.00 inches will result - Other

showers and thunderstorms will occur in east-central China periodically during the next ten days, but periods of sunshine will also occur and rain totals will be mostly under 1.00 inch

- Northeastern

Sichuan and immediate neighboring areas will receive 1.00 to 3.00 inches of rain

- Northeastern

China and the Yellow River Basin will see alternating periods of precipitation and sunshine through the next two weeks maintaining a very good outlook for winter crop development when seasonal warming begins - Spring

planting prospects remain exceptionally good. but seasonal warming is needed in many areas - Temperatures

will be above normal in most of the nation during the coming week to ten days

- Winter

crops will continue to come out of dormancy in the central and south. Spring planting will advance around periods of rain in the south

- Australia

weather in the coming week is expected to bring back scattered showers and thunderstorms to northeastern New South Wales and southern Queensland

- The

precipitation will be good for late season crops and for improving topsoil moisture for autumn planting - Early

maturing cotton might not welcome the precipitation and could become a little too wet - Mexico

drought conditions are still prevailing, although the impact on winter crops is low due to irrigation - Water

supply is low in some areas and a notable improvement in rainfall is needed, but not very likely - Dryland

winter crops are stressed and will yield poorly - Freeze

damage is common in northern parts of the nation due to a couple of cold surges this winter - Rain

in the coming week will be mostly confined to the east coast and temperatures will be seasonable with a slight warmer bias in the driest areas - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast receives the lightest and most erratic rainfall, but some precipitation will fall especially in Costa Rica and Panama. - Southeast

Asia rainfall will occur relatively normally over the next two weeks - Mainland

areas will experience few showers periodically in the next week to ten days - The

resulting rainfall will be sporadic and light with net drying probably continuing in many areas for a while longer - Philippines

rainfall will be scattered and mostly light to moderate until mid- to late-week this week when a boost in precipitation is expected due to a tropical disturbance impacting the nation - Indonesia

and Malaysia weather during the next two weeks will bring rain to most crop areas maintaining a very good outlook for crop development - A

boost in precipitation is expected and will be welcome - Sumatra,

Peninsular Malaysia and western parts of Borneo have been drying out recently and greater rain is needed especially in Peninsular Malaysia - Indonesia

and Malaysia rainfall will occur frequently over the next two weeks - New

Zealand weather over the next ten days will include a mix of sunshine and rain while temperatures are a little cooler than usual

- The

nation’s soil moisture has drifted below average especially in the north - Southern

Oscillation Index has been falling and was at +6.31 this morning. The index is expected to continue to fall over the next several days - Europe

weather will be mixed over the next two weeks with periods of rain, mountain snow and sunshine occurring while temperatures are seasonable - The

environment will be good in maintaining moisture abundance in much of the continent and seasonal warming will bring more winter crops out of dormancy in parts of the west and south - Net

drying is expected in Spain and Portugal - Western

CIS temperatures will be cooler than usual this week while waves of snow and rain prevail - The

environment will be good for spring crop development, but for now there will not be much greening or crop development for a while longer - Too

much moisture is also present in the soil in western Russia and flooding may be an issue for a while this spring as a deep layer of snow melts while new precipitation falls

Source:

World Weather inc.

Source:

World Weather inc.

Bloomberg

Ag Calendar

Tuesday,

March 9:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China

National People’s Congress in Beijing

Wednesday,

March 10:

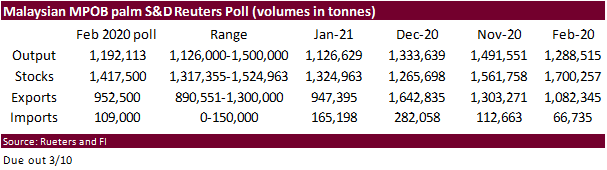

- EIA

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board data on February palm oil end-stockpiles, output, exports - China

National People’s Congress in Beijing - Malaysia’s

March 1-10 palm oil export data - ISO

sugar conference - FranceAgriMer

monthly grains report

Thursday,

March 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - China

National People’s Congress in Beijing - New

Zealand Food Prices - Conab’s

data on yield, area and output of corn and soybeans in Brazil - HOLIDAY:

India, Indonesia

Friday,

March 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

US

CPI due out on Wed.

US

House Of Representatives To Take Up $1.9 Trillion Covid-19 Relief Bill Wednesday – House Majority Leader Hoyer’s Office

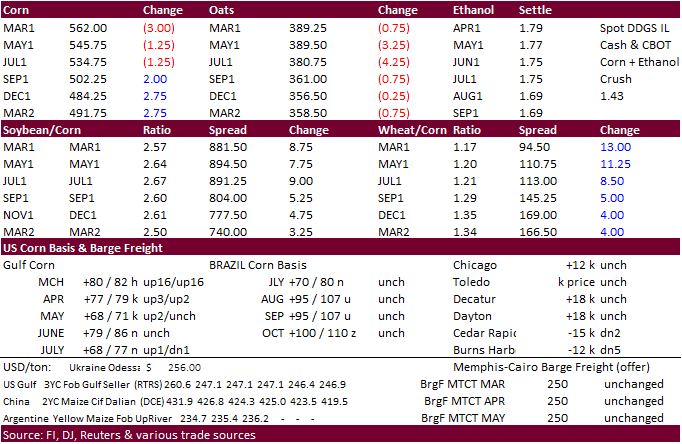

Corn

- May

corn futures saw a wide 11 cent trading range, settling at $545.75, 1.25 cents lower on USDA report day. Trading was very choppy pre and post USDA report. USDA left their US carryout unchanged whereas most traders were looking for a smaller carryout. Why?

USDA export sales are running at nearly 90 percent of USDA’s export projection, so people were looking for USDA to raise exports, which were left unchanged. IMO, US corn shipments need to increase before USDA makes upward adjustments. There were no sales

announcements this morning, following up with the rumors of a large sale late last week. USDA 24-hour sales are really starting to dry up. Last 24-hour corn sale was March 2 for 175k to Japan and before that Feb 12 with old and new-crop to Central America.

- Look

for traders to focus on US spring plantings and US weather, and ongoing Argentina crop stress and delayed second crop Brazil corn plantings. A large precipitation event is expected to impact the WCB areas later this week. This is badly needed.

- Look

for US producers to plant up to the roads this spring. New crop December corn and November soybeans futures closed today at contract highs. As a coworker pointed out, this is when USDA starts collecting producer surveys for March Intentions. But if history

repeats itself with weakening La Nina, a very wet US Midwest and upper Delta spring weather pattern could cause more harm than good.

- Funds

were net sellers of 8,000 corn contracts on the session. - Reuters

noted there are three vessels loaded with US ethanol headed to China (about 240,000 barrels or 30k x 3 tons).

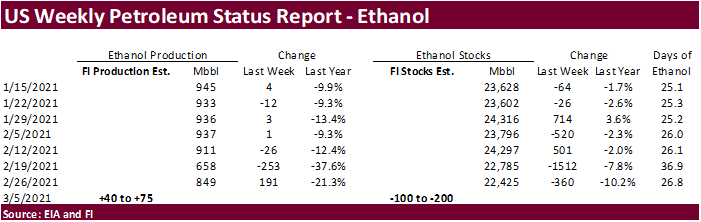

- A

Bloomberg poll looks for weekly US ethanol production to be up 57,000 barrels (876-935 range) from the previous week and stocks up to 8,000 barrels to 22.433 million.

Export

developments.

- None

reported

Updated

3/1/21

May

corn is seen in a $5.20 and $5.75 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.85-$5.50 range.

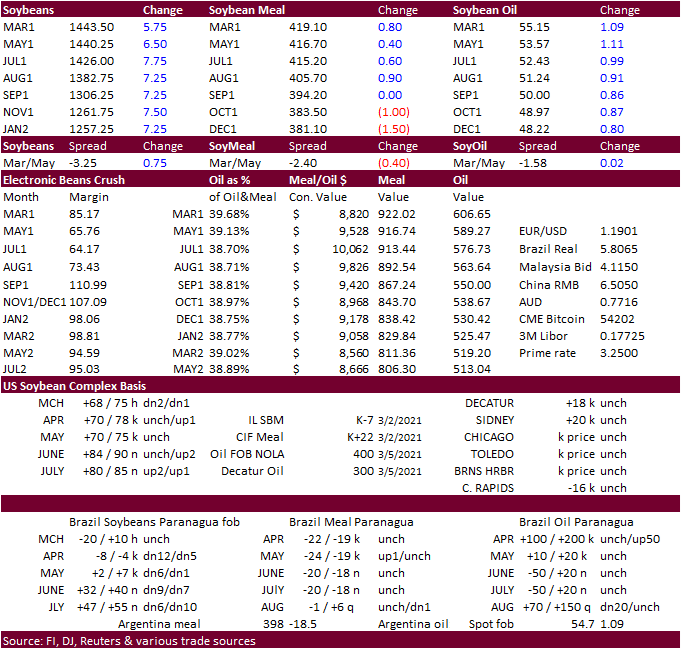

- The

soybean complex traded in a choppy range today. Soybean oil rallied more than 100 points in the May contract to close at a high of 53.55 cents.

Soybean

meal was on the defensive but the front months through August closed slightly higher. Fluctuations in the soybean contracts were most notable. May ended 6.25 cents higher and November up 7.75 cents. We are hearing Brazil shipment delays are pushing some

of the beans out onto the curve due to slow arrivals of supply. Some truck lines are running up to two days. China slowed securing soybeans over the last week, in part to weaker cash crush margins and decent supply of soybeans at their ports. Brazilian

arrivals are around the corner. USDA reported an unchanged carryout for US soybeans despite nearly 99 percent of USDA’s export projection had been sold as of early March. US SBO ending stocks were revised slightly higher with USDA increasing production amid

a higher yield. They adjusted SBO demand to reflect a higher food use for the current marketing year. We think they are gearing up to include SBO for renewable diesel in their balance sheets. This line item might be seen by the trade in USDA’s May update,

same month they roll out new-crop projections. - Outside

(US) vegetable oil markets were again on fire today. Paris rapeseed oil futures traded up limit at one point.

Paris

May rapeseed settled 5.50 euros lower at 528.75 euros a ton after reaching all time high during the session. Reuters noted traders have reported sales of European Union rapeseed oil to China of around 200,000-300,000 tons for the coming months.

- ICE

May canola ended up 10 cents to $796.20 per ton after pairing back from a fresh contract high earlier. - Keep

an eye on US CPI inflation data due out Wednesday. This could attract new agriculture longs from hedge funds if inflation is reported above expectations.

- Funds

were net buyers 4,000 soybean contracts, buyers of 1,000 soybean meal contracts and net buyers of 6,000 bean oil contracts. - There

was a headline Argentina stevedores will go on strike March 10. For this time of year strikes tend to be short lived.

- China’s

AgMin in its monthly WASDE report raised its forecast on 2020-21 rapeseed oil production to 5.43 million tons, up from 5.32 million tons last month. Much of the soybean and corn balance figures were unchanged from last month. They still see corn imports

at 10 million tons and soybean imports at 98.10 million tons.

Export

Developments

- Pakistan

bought 594,000 tons of soybean in recent weeks from Brazil and the US. Pakistan is currently buying 200,000 to 250,000 tons of soybeans per month.

- The

USDA CCC seeks 2,030 tons of packaged oil on March 16 for shipment Apr 16 – May 15.

Updated

3/4/21

May

soybeans are seen in a $13.50 and $15.00 range.

May

soymeal is seen in a $400 and $460 range.

May

soybean oil is seen in a 49.00 and 54.00 cent range.

- US

wheat futures ended higher on renewed fund buying, Algeria securing more wheat in their latest import tender than originally sought and declines in KS and TX winter wheat conditions from the previous week. A sharply lower USD also provided strength. USDA

cut US white wheat stocks by 20 million bushels and raised KC HRW wheat by 21 million, promoting MN/KC spreading. Holding today’s gains in all three markets might be tough, and we would not be surprised if KC wheat, for example, trades below its recent two-month

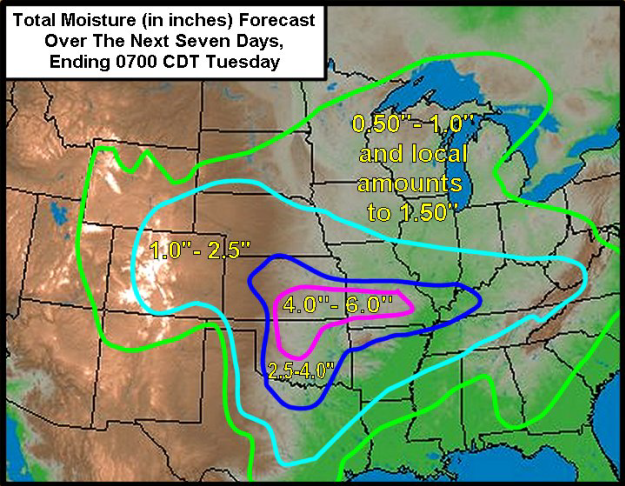

sideways trading channel. - As

we noted earlier, Kansas (36%, dn 1) and Texas (27%, dn 1) winter ratings declined from the previous week while Oklahoma ratings rebounded 7 points to 53%, but a multimillion dollar precipitation event is about to bring widespread relief to the central and

southern Great Plains and parched areas of the western Corn Belt. The below map was generated by World Weather Inc.

- Funds

were net buyers of 6,000 net soft wheat contracts on the session.

- The

USD was down 34 points as of 3:10 pm CT. - May

milling wheat settled 1.00 euro, or 0.4%, down at 229.25 euros ($272.44) ton. Germany 12% protein wheat for March delivery was offered for sale at around 6.5 euros over Paris May against 7 euros Monday. Traders were awaiting results on Algeria in for wheat.

- Egypt

said they have enough wheat for strategic reserves for four months. We might see them tender this week if the futures market breaks.

Export

Developments.

- Algeria’s

OAIC bought an estimated four consignments of optional-origin milling wheat, with volumes ranging from 100,000 tons to 270,000 tons. They were in for 50,000 tons initially. Prices were around $323 a ton c&f, for April-August shipment.

- Pakistan

seeks 300,000 tons of wheat on March 16 .

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on March 18.

·

Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

Updated

3/9/21

May

Chicago wheat is seen in a $6.25‐$6.90 range

May

KC wheat is seen in a $5.75‐$6.75 range (up 25, unch)

May

MN wheat is seen in a $6.20‐$6.65 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.