PDF Attached

CBOT

agriculture markets rallied in part to positive sign the US economy will gradually recover, poor SA weather, and rumors of US export demand. US equities rebounded to close sharply higher and WTI crude oil made new contract highs (April added about $2.45).

US jobs were better than expected (we noted disappointing in our am note). Most jobs were added in the bar and restaurant industries, a good sign of the economy reopening. Unemployment stands at 6.2%.

World

Weather Inc.

CHANGES

OVERNIGHT

- Rain

fell overnight from eastern Colorado into Kansas from the northwest into south-central parts of the state as well as in north-central Oklahoma - The

event occurred as expected with moisture totals of 0.20 to 0.65 inch common and Goodland, Kansas (in the northwest) reporting 0.87 inch - Argentina’s

forecast was wetter in the far southern part of the nation March 12-13 relative to the previous model run and a small part of the north was also a little wetter - Northern

Argentina was also wetter March 16-18 - Central

Argentina was still advertised with restricted rainfall, although some showers and thunderstorms will occur form Cordoba into central Buenos Aires Sunday into Monday that might help slow some of the region’s drying - No

serious changes were noted in Brazil’s outlook overnight - U.S.

weather was a little wetter from eastern Kansas to Ohio March 11-12 and central Texas to Southern Illinois precipitation was reduced during that same period of time.

- Model

divergence remains for the southern Plains - The

GFS model brought in significant moisture to the region March 18-19, but this event was likely overdone - The

European model run suggested greater precipitation for the southern Plains March 13-14

- This

event does not look like it will verify either - Not

much change of significance for other areas in the world

WEATHER

TO WATCH THIS WEEKEND

- Argentina’s

rainfall outlook is not very good and many areas in the nation will experience net drying over the coming week, despite some periodic showers of varying significance - Most

of the precipitation will not counter evaporation for a while - World

Weather, Inc. sees some changes in the upper air wind pattern evolving in the second week of the forecast that may help to bring a little better opportunity for rain periodically - But

confidence is still low on how much relief might occur - Crop

stress will remain a serious concern for many summer crops in Argentina until a generalized soaking rain evolves. Pockets of improvement may occur if the rain advertised in the next two weeks verifies, but some areas will remain too dry to support the best

yields and crop quality. - Temperatures

will be very warm to hot which may limit the benefit of lighter showers that occur over the next seven days.

- Some

cooling is expected March 12-18 - Brazil’s

weather has not changed overnight and for the next two weeks most of the nation will be impacted by alternating periods of rain and sunshine - The

moisture will be mostly near normal except in the northeast where drier than usual conditions are expected - A

few locations in southern Rio Grande do Sul may also receive a more limited amount of rain - Fieldwork

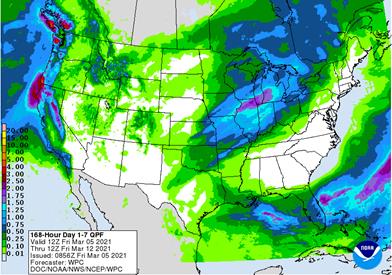

will advance around the expected shower activity, but there will be enough drier days for favorable progress to be made - U.S.

hard red winter wheat areas will trend drier after this morning’s rain ends - Southwestern

U.S. Plains may continue missing rain events for a while - Rain

may be possible again in the second week of the outlook, but confidence is low - U.S.

central Plains wheat will benefit from the next ten days of periodic moisture and sunshine, but there will still be need for more precipitation especially in the southwest where rainfall will likely be lightest - Frequent

rain and mild temperatures are needed to induce new tillering and to stimulate some crop recovery and improvement in production potentials after dryness last autumn and the bitter cold event of February - Southeastern

parts of the U.S. northern Plains will have a good opportunity for some needed moisture Monday night into Wednesday morning - Moisture

totals will vary from 0.05 to 0.50 inch - Minnesota

and eastern South Dakota will likely be wettest - Drought

to the west will not likely be impacted - Temperatures

will be unusually warm in these areas through the weekend with extreme highs in the 60s and 70s expected Saturday - Much

of the U.S. Midwest will be dry into early next week and what little moisture occurs in the north is not likely to create a problem as the region’s snow cover continues to melt - Central

parts of the Midwest will trend wetter during the second half of next week with another storm system in the second week of the outlook - U.S.

southeastern states will see less frequent and less significant rain in the coming ten days resulting in needed drying and some spring planting - Unseasonably

warm temperatures in the central U.S. will send temperatures into the 60s and lower 70s Fahrenheit this weekend as far north as Montana, southwestern North Dakota and South Dakota - Normal

highs in the northern Plains should be in the 30s and 40s followed by lows in the teens and 20s - The

warmup in the northern Plains should set the stage for some needed moisture to fall when colder weather returns next week - Drought

remains a serious concern across the Dakotas, eastern Montana and areas north into the Canada Prairies - Temperatures

in the 50s and lower 60s might also reach into southern Saskatchewan and southern Alberta, Canada

- Unusual

warmth in the central Plains and light precipitation overnight may also stimulate some new wheat development

- Soil

temperatures are already rising, and some greening has begun in the southern Plains - Southern

U.S. spring planting is getting off to a slow start in southern Texas due to dryness in unirrigated areas, but it has begun - Slow

planting has also occurred near the central Gulf of Mexico coast from Louisiana to northern Florida and Georgia because of wet fields, but some fieldwork has likely evolved recently

- Improving

weather in the lower Delta and southeastern states in this coming week will lead to improved corn and rice planting conditions in time. - Canada’s

central, eastern and southwestern Prairies will remain drier than usual through the next ten days

- Precipitation

elsewhere is expected to be infrequent and light limiting the potential for increasing soil moisture - Temperatures

will be near to above average - Southeast

Canada will experience a seasonable mix of precipitation and sunshine with temperatures a little cooler than usual - North

Africa rainfall will improve over this coming week with many areas from northern Morocco through northern Tunisia getting rain at one time or another lifting topsoil moisture for future crop development - Winter

crops are semi-dormant, but expected to resume development soon - Ivory

Coast, Ghana, Benin and southern Nigeria will experience a boost in rainfall for a while late this week into next week favoring coffee and cocoa flowering

- East-central

Africa rainfall will continue greatest in Tanzania this week and probably next week, as well - A

more erratic and light precipitation pattern is expected elsewhere with net drying in Ethiopia, northern Uganda and in a few southwestern Kenya locations - South

Africa will experience an erratic rainfall pattern through the next two weeks with temperatures mostly in a seasonable range with a slight warmer bias in the west - Showers

will be greatest in Natal and eastern portions of both Mpumalanga and Limpopo - Net

drying will occur in most other areas - Summer

crop conditions will remain favorably rated, although there will be a growing need for showers by mid-March - India

was mostly dry Thursday - Very

little rainfall is expected over the next week to ten days and temperatures will be seasonably warm - Showers

will occur in the far north, extreme south and far east - Some

mild crop stress is expected resulting in some minor yield loss - Rain

is needed to support the best potential yields before filling ends this month - China

weather over the coming week will include seasonably warm temperatures and near to above average precipitation in the south - The

greatest precipitation relative to normal will be in the Yangtze River Basin and areas to the south - Rainfall

near and south of the Yangtze River will vary from 1.00 to more than 5.00 inches except in the coastal provinces where amounts will be less than 1.00 inch - Local

flooding is possible - Yunnan

will remain dry and produces 3% of the corn crop and quite a bit of rice and sugarcane - Australia

weather in the coming week is expected to bring back scattered showers and thunderstorms to northeastern New South Wales and southern Queensland this weekend into next week - The

precipitation will be good for late season crops and for improving topsoil moisture for autumn planting - Early

maturing cotton might not welcome the precipitation - Mexico

drought conditions are still prevailing, although the impact on winter crops is low due to irrigation - Water

supply is low in some areas and a notable improvement in rainfall is needed, but not very likely - Dryland

winter crops are stressed and will yield poorly - Freeze

damage is common in northern parts of the nation due to a couple of cold surges this winter - Rain

in the coming week will be mostly confined to the east coast and temperatures will be seasonable with a slight warmer bias in the driest areas - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast is relatively dry - Southeast

Asia rainfall will occur relatively normally over the next two weeks - Mainland

areas will experience few showers periodically in the next week to ten days - The

resulting rainfall will be sporadic and light with net drying probably continuing in many areas for a while longer - Philippines

rainfall will be scattered and mostly light to moderate until late next week when a boost in precipitation is expected - Indonesia

and Malaysia weather during the next two weeks will bring rain to most crop areas maintaining a very good outlook for crop development - A

boost in precipitation is expected and will be welcome - Sumatra,

Peninsular Malaysia and western parts of Borneo have been drying out recently and greater rain is needed especially in Peninsular Malaysia - New

Zealand weather over the next ten days will include a mix of sunshine and rain while temperatures are a little cooler than usual

- The

nation’s soil moisture has drifted below average especially in the north - Southern

Oscillation Index has been falling and was at +8.29 this morning. The index is expected to continue to fall notably over the next several days - Warming

in Europe and the western CIS has been melting some snow - Snow-free

conditions are present today in Russia’s Southern Region, much of Ukraine and in many areas across Europe to the west of Ukraine and eastern Poland

- There

is no threatening cold in any winter crop region for the next ten days - Europe

weather will be tranquil over the coming week with only brief periods of light precipitation and temperatures close to normal - A

boost in precipitation is expected March 11-17 - Western

CIS temperatures will be seasonable with a slight warmer bias this week in the south and while a little cooler than usual in the north - Precipitation

will remain periodic keeping the region plenty moist in snow free areas and some significant runoff is expected in areas warm enough for melting snow

- Cooling

next week will bring some threatening cold air into the western CIS, but snow cover will adequately protect most crops

Source:

World Weather Inc.

Bloomberg

Ag Calendar

Sunday,

March 7:

- China

National People’s Congress in Beijing - China

customs to publish trade data, including import numbers for soy, edible oils, meat and rubber

Monday,

March 8:

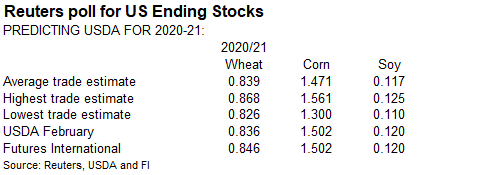

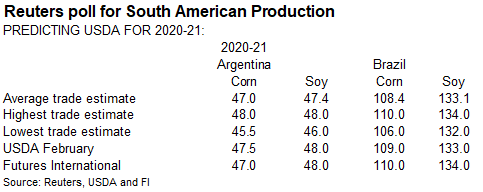

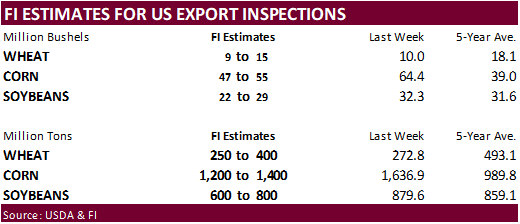

- USDA

Export Inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - China

National People’s Congress in Beijing - Ivory

Coast cocoa arrivals - HOLIDAY:

Russia - EARNINGS:

Marfrig

Tuesday,

March 9:

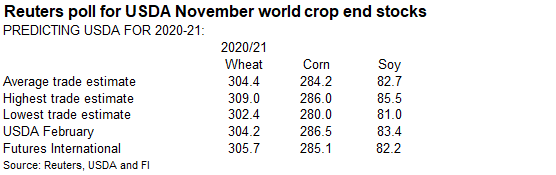

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - China

National People’s Congress in Beijing

Wednesday,

March 10:

- EIA

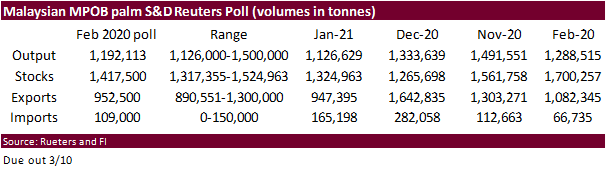

weekly U.S. ethanol inventories, production - Malaysian

Palm Oil Board data on February palm oil end-stockpiles, output, exports - China

National People’s Congress in Beijing - Malaysia’s

March 1-10 palm oil export data - ISO

sugar conference - FranceAgriMer

monthly grains report

Thursday,

March 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - China

National People’s Congress in Beijing - New

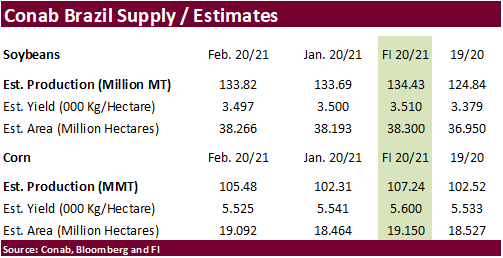

Zealand Food Prices - Conab’s

data on yield, area and output of corn and soybeans in Brazil - HOLIDAY:

India, Indonesia

Friday,

March 12:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

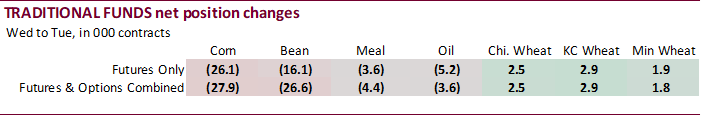

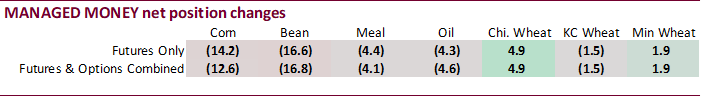

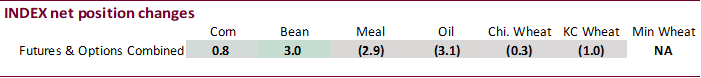

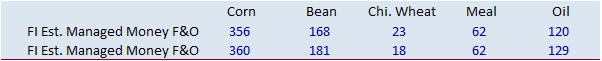

CFTC

Commitment of Traders

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

348,615 -24,212 406,940 811 -744,997 17,850

Soybeans

126,532 -25,259 167,637 2,976 -288,118 19,482

Soyoil

78,735 -2,113 126,140 -3,068 -226,378 4,916

CBOT

wheat 413 5,301 156,286 -318 -142,653 -3,913

KCBT

wheat 32,695 3,691 69,192 -965 -96,775 4,930

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

348,546 -12,605 263,609 3,677 -729,567 18,654

Soybeans

155,561 -16,803 91,099 14,753 -273,369 9,091

Soymeal

65,424 -4,063 69,673 -1,054 -182,079 6,231

Soyoil

108,081 -4,564 92,538 -2,233 -239,062 5,609

CBOT

wheat 31,803 4,893 93,392 2,511 -121,574 -3,928

KCBT

wheat 51,724 -1,484 42,173 -380 -88,975 5,173

MGEX

wheat 14,101 1,948 4,192 711 -25,511 -3,549

Total

wheat 97,628 5,357 139,757 2,842 -236,060 -2,304

Live

cattle 80,570 -7,594 84,277 561 -170,476 5,555

Feeder

cattle 1,164 -570 7,692 -300 -1,988 235

Lean

hogs 74,133 1,352 55,032 -147 -128,516 -3,746

Source:

Reuters, CFTC and FI

US

Change In Nonfarm Payrolls Feb: 379K (est 198K; prevR 166K; prev 49K)

US

Unemployment Rate Feb: 6.2% (est 6.3%; prev 6.3%)

US

Average Hourly Earnings (M/M) Feb: 0.2% (est 0.2%; prevR 0.1%; prev 0.2%)

US

Average Hourly Earnings (Y/Y) Feb: 5.3% (est 5.3%; prevR 5.3%; prev 5.4%)

US

Change In Private Payrolls Feb: 465K (est 195K; prevR 90K; prev 6K)

US

Change In Manufacturing Payrolls Feb: 21K (est 15K; prevR -14K; prev -10K)

US

Average Weekly Hourly All Employees Feb: 34.6 (est 34.9; prevR 34.9; prev 35.0)

US

Labour Force Participation Rate Feb: 61.4% (est 61.4%; prev 61.4%)

US

Underemployment Rate Feb: 11.1% (prev 11.1%)

US

Trade Balance (USD) Jan: -68.2B (est -67.5B; prevR -67.0B; prev -66.6B)

Canadian

International Merchandise Trade Jan: 1.41B (est -1.4B; prev -1.67B)

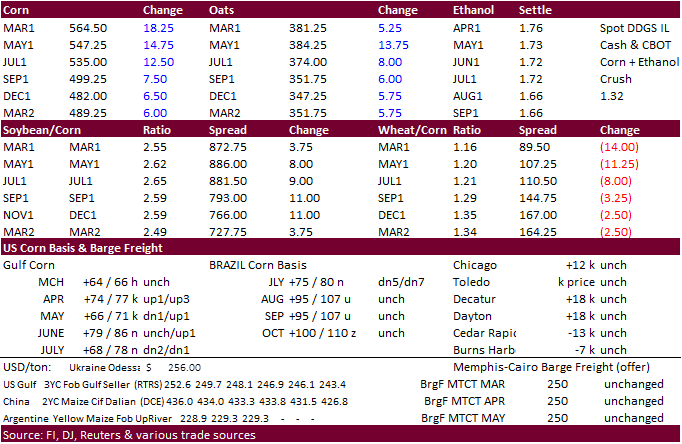

Corn

- Corn

futures ended the week on a high note on US corn export chatter, Brazilian production concerns, Algeria buying 30,000 tons of corn, and WTI crude oil establishing new contract highs. May corn saw some resistance at its 20-day MA. Talk of China pig crop rebound

may also supported US corn futures. We picked up Brazil and China are close to an agreement on phytosanitary certificates for corn, and China may have recently bought Brazilian corn. This was on top of rumors the US could see a large sale corn sales announcement

on Monday. We already look for corn inspections north of 1.2 million tons to be reported by USDA midmorning Monday. Fresh US corn sales commitments, however, could provide additional support to CBOT futures next week. 89.5% of USDA’s corn export projection

is already sold, highest for this time of year since at least 2001 in our history.

- China

latest five-year plan promotes agriculture food security. China plans to raise the minimum purchase price for wheat and rice and expand corn planting. The lowered support prices for most commodities in 2018 due to high inventories. For wheat this would

be the first increase since 2014. - Meanwhile,

we are hearing its “a mess” for central and northern Brazil producers for collecting soybeans and plating second crop corn, bias Mato Grosso.

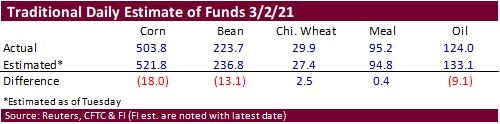

- Funds

were net buyers of 33,000 corn contracts on the session. - Vietnam

and other countries are relaxing on German pork import bans after ASF was discovered in wild boar last year.

- (Reuters)

– China’s first hog breeding exchange traded fund (ETF) makes its debut on the Shenzhen Stock Exchange on Friday, the first of three tied to the country’s booming pork sector that is rebuilding after African swine fever decimated herds in 2018.

Export

developments.

- Algeria

bought about 30,000 tons of corn, optional origin, at $289/ton to $293/ton c&f, for shipment by April 15.

EIA:

Cold weather brings near record-high natural gas spot prices

https://www.eia.gov/todayinenergy/detail.php?id=47016&src=email

Updated

3/1/21

May

corn is seen in a $5.20 and $5.75 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.85-$5.50 range.

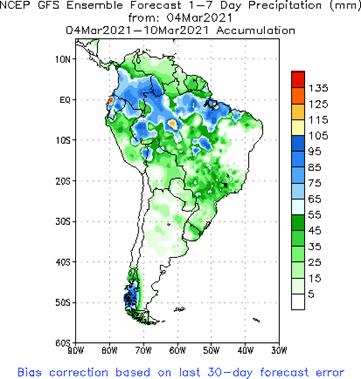

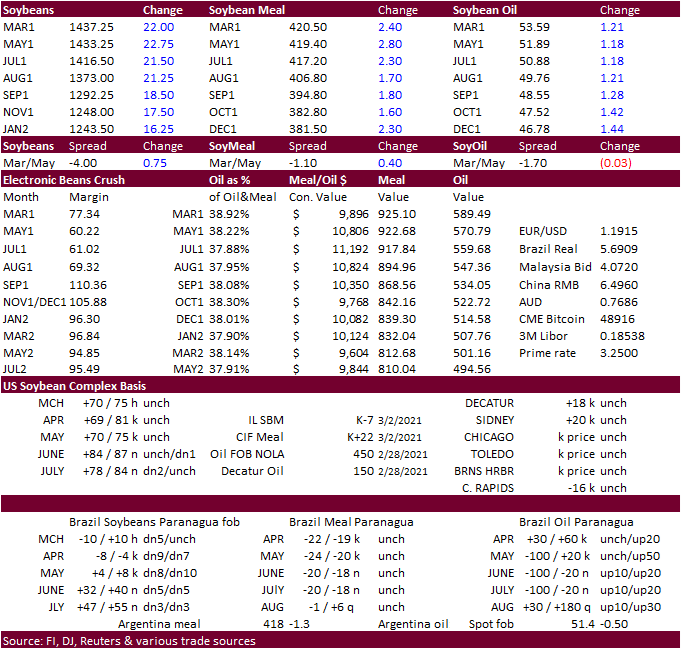

- Soybeans

traded higher in part to a dry outlook for Argentina and too much rain for parts of Brazil (raising concerns over quality) but a higher USD and Brazilian soybean shipments increasing over the next few weeks limited gains. Anec sees Brazil soybean exports

during March at 13.79 million tons. - May

soybeans has seen about a 13.40 to 14.45 trading range since late January. There is a potential for the contract to make a new high if SA weather fails to improve.

- We

are hearing US soybeans are starting to get tight in the ECB but WCB buyers are still able to source them.

- CBOT

soybean meal traded two-sided, ended higher. Strong corn prices and sharply higher soybeans supported meal. Soybean meal prices in China are starting to get cheap enough to entice an increase for feed use but importers may want to see better returns on crush

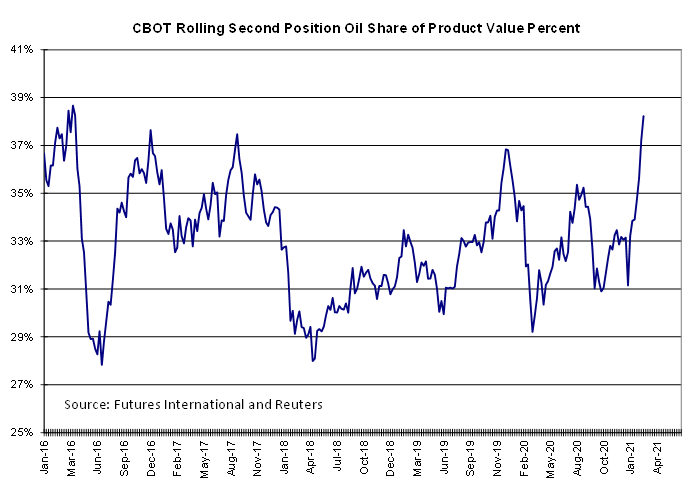

margins before setting off another round of soybean purchasing. - Soybean

oil had another 100+ point rally on ongoing concerns global vegetable oil supplies will continue to tighten.

- ICE

canola, May position, was up 3.10 as of to 785.40. Futures were up 6 straight sessions.

- The

SA weather forecast was unchanged Friday morning. Brazil rains will occur across the east central and northern areas through Tuesday while east central and northwest areas will see ongoing delays in fieldwork. Argentina rains, although light, should favor

southern Cordoba, northern La Pampa, and northwestern Buenos Aires on Monday.

- US

Census reported US January soybean exports at 324 million bushels, as expected, down from 397 million in December and 195 million during January 2020.

- The

funds were net buyers 15,000 soybean contracts, buyers of 2,000 soybean meal contracts and net buyers of 6,000 bean oil contracts. - Egypt

said they have enough vegetable oil strategic reserves for five months. - Indonesia

today will see heavy rain for parts of Indonesia’s Sumatra, Java, Kalimantan and Sulawesi.

- Offshore

values are leading soybean oil 83 lower (25 lower week to date) and SBM CBOT futures $1.80 lower ($7.00 lower for the week). - China

cash crush margins on our analysis were 101 cents, down from 112 cents late last week. China soybean meal prices fell to their lowest levels this year in China.

Export

Developments

- None

reported

Updated

3/4/21

May

soybeans are seen in a $13.50 and $15.00 range.

May

soymeal is seen in a $400 and $460 range.

May

soybean oil is seen in a 49.00 and 54.00 cent range.

- Wheat

futures started

lower but turned higher following strength in corn and soybeans and higher outside markets, despite a higher USD and Pakistan passing on 300,000 tons of wheat due to high prices. The Philippines bought less than expected wheat, but SK picked up a couple cargoes

of opt. origin wheat. - The

USD was up 35 points by Friday afternoon. - Funds

were net buyers of 4,000 net soft wheat contracts on the session. - Black

Sea trades were quiet towards the end of this week as producers start to shift focus on new crop. The inverse in Paris wheat is also keeping some traders away.

- Ukraine

producers are expected to kick off the spring planting season next week, a little later than last year because of snow coverage.

- Over

in France barley plantings reached 50 percent as of March 11, up from 19 percent week earlier. French soft wheat was rated 88 percent good/excellent, up one point from previous week.

- French

wheat shipments outside EU and Britain: 821,000 tons in February, up from 561,000 tons in January and below the season high of 877,000 tons in November.

- EU

May milling wheat was up 0.25 at 208.75 euros.

Export

Developments.

- South

Korea’s MFG bought 130,000 tons of feed wheat, optional origin. Both 65,000 ton consignments were bought at an estimated $282.86 a ton c&f for arrival in South Korea around Aug. 24 and at $275.14 a ton c&f for arrival in South Korea around Sept. 24. (Reuters) - The

Philippines bought about 55,000 tons (145,000 sought) of milling wheat for April and June shipment. No prices were given but traders thought it was below $310/ton.

- Pakistan

may have passed on 300,000 tons of wheat due to high prices. - Results

awaited: Saudi Arabia seeks 540,000 tons of barley on Friday, valid until Monday, for April – May shipment.

- Results

awaited: Iran’s SLAL seeks up to 400,000 tons of animal feed barley on Wednesday, March 3, for shipment between March 10 and April 10.

Rice/Other

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 38,889 tons of rice from the United States and China, part arrival in South Korea around Sept. 30 from the US. Another 16,667 tons of non-glutinous

short grain brown rice from China is sought for arrival around June 30.

·

Syria seeks 25,000 tons of white rice on March 29, from China or Egypt.

Updated

3/4/21

May

Chicago wheat is seen in a $6.25‐$6.90 range.

May

KC wheat is seen in a $5.50‐$6.75 range.

May

MN wheat is seen in a $6.20‐$6.65 range.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.