PDF attached

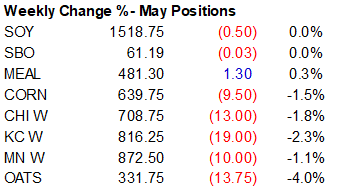

Soybean

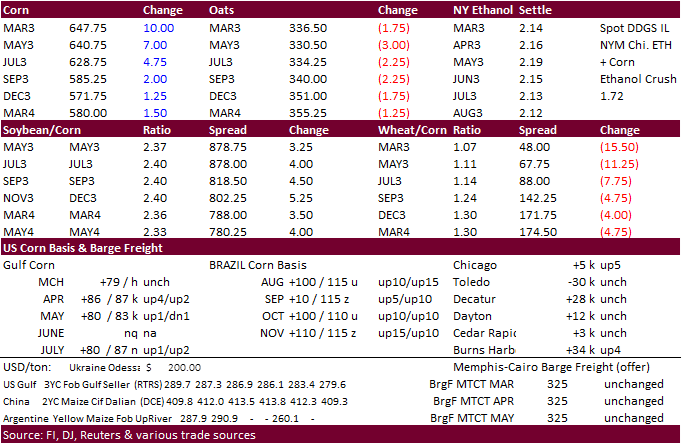

futures and soybean meal ended Friday on a strong note but for the week were mixed by a slight amount. Soybean oil for the day was lower on spreading. Higher energy and palm prices did little to stop the selling in SBO. Corn rallied led by nearby contracts

on talk of Chinese demand, although USDA has not reported a 24-H sales announcement since mid-February. The lack in USDA sales sent corn futures lower for the week. Funds as of week one February for corn remained (very) long while wheat hit a mid-2019 low,

looking a traditional position. Wheat futures on Friday ended lower on ample global supplies and US cash export prices well overpriced from the global export market, along with improving soil moisture for US winter wheat ahead of spring emergence for the crop.

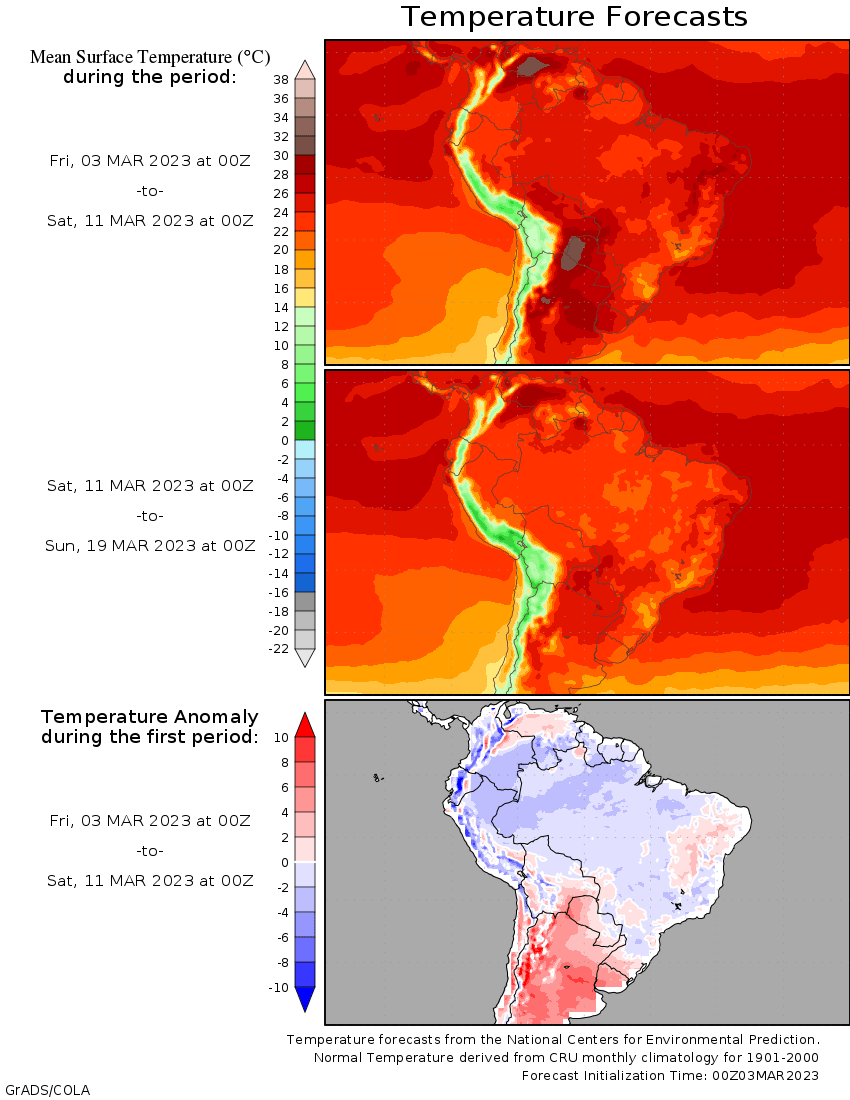

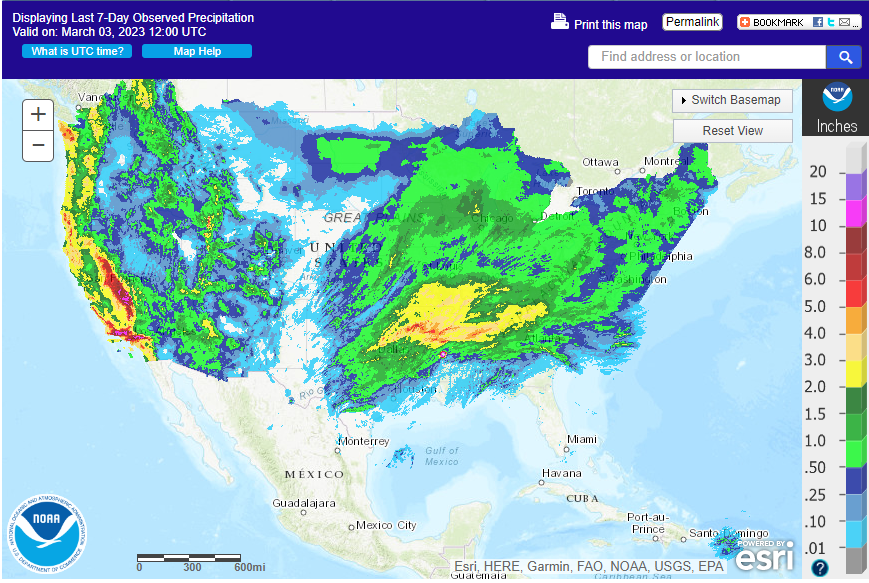

Weather

Most

of southern and central Brazil will see rain through the end of this week while net drying in the northeast may stress the corn crop. The far west of Argentina will see rain next week. Temperatures will remain hot for Argentina resulting in net drying for

many areas. A wintery mix will continue to sweep across the central and eastern US over the couple of days. Lingering rain should favor the far southern and central Great Plains today.

World

Weather Inc. –

MOST

IMPORTANT WEATHER FOR THE DAY

-

Brazil

rainfall in the center south is expected to slowly lighten up in the coming week -

That

should translate into better soybean maturation and harvest conditions over time, but it may take a while for ideal harvesting and planting conditions to return in Parana, Sao Paulo and Mato Grosso do Sul -

Crop

conditions in most other areas will be favorable, although drying in parts of Bahia, Espirito Santo and northeastern Minas Gerais may be of some interest to unirrigated coffee, sugarcane and cocoa production -

Some

of the dryness reaches down into northern parts of the Zona de Mata coffee region -

Argentina

was advertised slightly wetter in the southwest part of Buenos Aires, La Pampa and western and southern Cordoba for early and late next week, although the precipitation was advertised mostly light -

East-central

and southeastern parts of the nation will continue dry biased for ten days -

The

Antarctic Oscillation Index is trending more notably negative which should correspond to some increased potential for greater rain in Argentina as mid-month approaches -

India’s

second week of the forecast was a little wetter today than Thursday -

The

moisture boost will not be very great, but it will help to pull back the temperatures so that excessive heat is less likely to evolve for a while and after recent weeks of below normal rainfall and warm weather that could help protect production potentials

from falling more significantly -

Europe

was advertised wetter today in the second week of the forecast and the moisture boost will be good ahead of the start of spring crop development and planting -

Mostly

dry conditions are likely this weekend -

U.S.

hard red winter wheat areas may get some welcome moisture in the second half of next week with rain and snowfall expected, but confidence in the details of the outlook are low -

The

southwestern Plains are unlikely to get significant amount of moisture from the event -

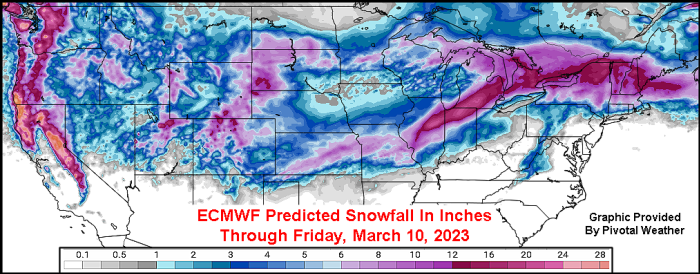

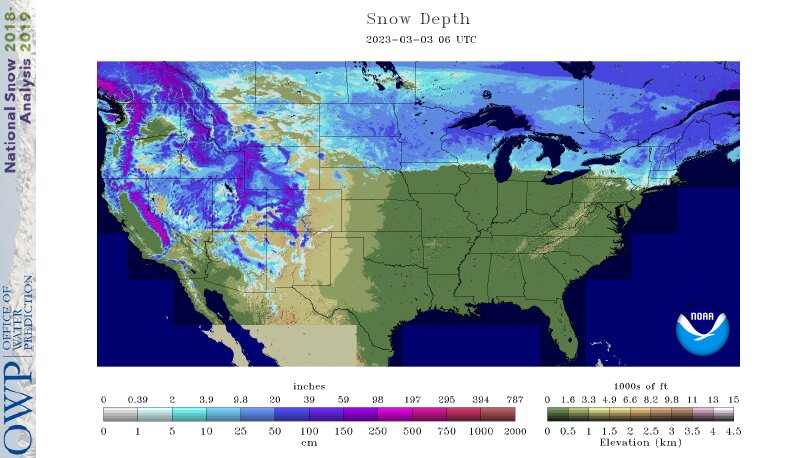

Another

northern U.S. Plains and upper Midwest snowstorm is expected this weekend resulting in additional heavy snowfall in portions of central and southern North Dakota and northern South Dakota as well as central Minnesota

-

Snowfall

of 2 to 6 inches will result with some potential for local totals of 6 to 10 inches -

The

additional moisture tied up in the snowfall will maintain a risk of spring flooding in the red River Basin -

South

Texas and northeastern Mexico are unlikely to get drought busting rainfall anytime soon, although a few showers might occur -

West

Texas precipitation will be restricted for the next ten days to two weeks leaving the ground quite dry in some areas -

Recent

excessive wind has induced blowing dust and raised concern about ongoing drought -

U.S.

Gulf of Mexico Coast States will experience a boost in precipitation in the second week of the forecast which will slow or stall the development of dryness across the region -

U.S.

temperatures will be cooler than usual in the far west and north-central states during the coming week, but starting late next week and prevailing through March 12 temperatures will fall below normal in the Great Plains and western Corn Belt as well -

Canada’s

Prairies will continue dealing with drought this spring especially in east-central and southeastern parts of Alberta and across western and south-central Saskatchewan

-

Recent

snow near the Alberta mountains will improve topsoil moisture in the spring when it melts -

U.S.

Midwest will remain abundantly moist over the next ten days, although the second week of the forecast will trend a little drier as a northwesterly flow pattern evolve aloft -

Florida

is becoming too dry, although irrigation is being used to support crops -

Rain

is need across the state and it will soon be needed in southern and southern Alabama as well -

Eastern

China is drying out, but temperatures have been mild enough recently to conserve soil moisture -

Rapeseed

and some wheat areas will need rain later this month, but conditions for now are mostly good -

Rice

and corn planting may require greater rainfall in southern China and some sugarcane and citrus crops would benefit from greater rain as well -

Western

CIS crop weather will continue wet over the next ten days with waves of snow and rain expected to continue -

Flood

potentials continue to rise for this spring in southwestern Russia and Belarus due to saturated soil and significant snow accumulations on top of the ground -

Additional

moisture totals over the next ten days will vary from 0.30 to 1.00 inch with a few 1.00- to 2.00-inch totals -

Eastern

Australia’s dryland cotton, sorghum and other summer crops are unlikely to get much precipitation over the next ten days resulting in additional crop stress and lower production potentials -

Some

rain is expected near the Pacific Coast, but interior areas of Queensland and New South Wales will remain dry -

Irrigated

crops in eastern Australia continue in good condition with normal to above normal yields expected -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

South

Africa weather will be favorably mixed during the next two weeks with alternating periods of rain and sunshine likely -

West-central

Africa rainfall should increase in the next two weeks -

A

seasonal increase in rainfall is expected to continue gradually over the next two weeks helping coffee, cocoa, rice and sugarcane to begin development normally -

Recent

precipitation has been erratic and light -

Middle

East precipitation is expected to be erratic and sometimes light over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

-

Wheat

conditions are rated favorably, but would benefit from additional rain -

Turkey

should be wettest while Syria, Iraq and Jordan need greater rainfall -

Eastern

Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year -

Some

rain is expected to develop in Ethiopia, Uganda and Kenya over time, although amounts should be light -

Today’s

Southern Oscillation Index was +10.71 and it was expected to move erratically over the next week

Source:

World Weather and FI

Bloomberg

Ag calendar

Monday,

March 6:

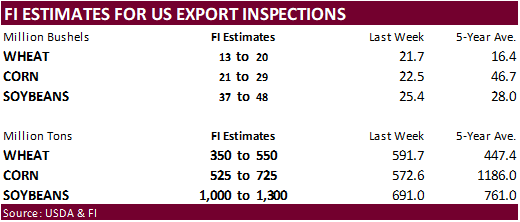

- USDA

export inspections – corn, soybeans, wheat, 11am - New

Zealand Commodity Price - Malaysia’s

March 1-5 palm oil export data - Bursa

Malaysia Palm Oil Conference and 2023 Outlook, Kuala Lumpur, day 1 - HOLIDAY:

Thailand

Tuesday,

March 7:

- EU

weekly grain, oilseed import and export data - US

Purdue Agriculture Sentiment - New

Zealand global dairy trade auction - Bursa

Malaysia’s palm oil conference and 2023 outlook, Kuala Lumpur, day 2 - ABARES

Outlook 2023 conference, Canberra, day 1 - HOLIDAY:

India

Wednesday,

March 8:

- USDA’s

World Agricultural Supply and Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Bursa

Malaysia Palm Oil Conference and 2023 Outlook, Kuala Lumpur, day 3 - EIA

weekly US ethanol inventories, production, 10:30am - ABARES

Outlook 2023 conference, Canberra, day 2

Thursday,

March 9:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Brazil’s

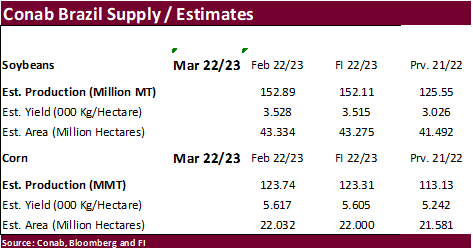

Conab releases data on production, yield and area for corn and soybeans

Friday,

March 10:

- ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - Malaysian

Palm Oil Board’s data on stockpiles, production and exports - FranceAgriMer’s

weekly crop conditions reports - Brazil’s

Unica may release cane crush and sugar output data (tentative) - Coffee

festival in Dak Lak province, Vietnam

Source:

Bloomberg and FI

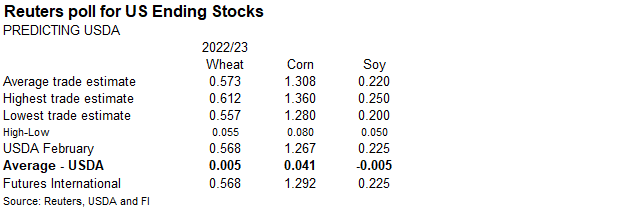

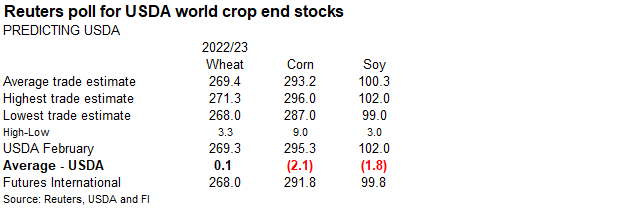

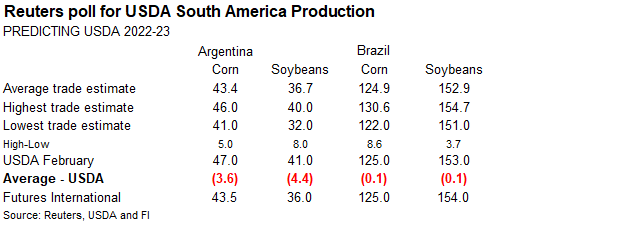

USDA

March report estimates

Due

out March 9

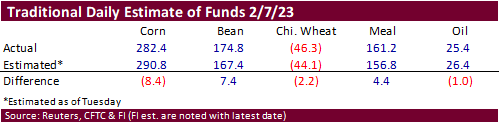

CFTC

COT through February 7

Funds

in Chicago wheat shorts hit mid 2019 levels. Prices haven’t but appears bearish for futures. However, might be oversold relative to corn fund + futures price.

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

131,566 -10,092 357,903 3,077 -405,295 16,330

Soybeans

125,015 -10,298 135,752 4,903 -214,645 5,741

Soyoil

-2,525 -7,031 104,649 3,408 -108,185 3,380

CBOT

wheat -79,474 -7,247 98,519 -112 -17,716 8,287

KCBT

wheat -8,637 3,482 48,860 2,445 -36,709 -5,879

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

202,018 -17,905 218,556 3,013 -399,749 17,344

Soybeans

165,075 -10,428 77,735 4,912 -203,823 4,922

Soymeal

142,710 1,766 78,645 1,950 -252,683 -3,750

Soyoil

22,495 -8,729 99,087 1,280 -127,541 7,039

CBOT

wheat -71,391 -7,763 65,692 1,444 -14,808 8,228

KCBT

wheat 3,782 2,443 36,816 1,291 -36,380 -5,559

MGEX

wheat -295 1,530 1,634 -12 -4,025 -2,038

———- ———- ———- ———- ———- ———-

Total

wheat -67,904 -3,790 104,142 2,723 -55,213 631

Live

cattle 95,610 7,778 45,175 1,092 -144,166 -10,134

Feeder

cattle -754 1,720 2,439 20 3,552 -570

Lean

hogs -11,918 -4,052 46,046 -955 -36,785 2,524

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

63,349 6,863 -84,174 -9,315 1,622,738 20,283

Soybeans

7,136 941 -46,123 -345 840,111 33,081

Soymeal

16,105 598 15,224 -565 488,770 10,788

Soyoil

-101 168 6,061 242 499,140 37,175

CBOT

wheat 21,835 -979 -1,328 -928 428,529 13,966

KCBT

wheat -704 1,874 -3,514 -49 206,406 3,451

MGEX

wheat 2,185 575 501 -55 59,797 -808

———- ———- ———- ———- ———- ———-

Total

wheat 23,316 1,470 -4,341 -1,032 694,732 16,609

Live

cattle 14,766 3,719 -11,385 -2,455 377,029 -4,491

Feeder

cattle 1,121 963 -6,359 -2,134 59,322 -469

Lean

hogs 89 1,872 2,568 613 297,821 8,418

Macros

103

Counterparties Take $2.186 Tln At Fed Reverse Repo Op. (prev $2.192 Tln, 99 Bids)

Canadian

Building Permits (M/M) Jan: -4.0% (exp 1.5%; prevR -7.7%)

Canadian

Labour Productivity (Q/Q) Q4: -0.5% (prevR -0.3%)

Saudi

Arabia And UAE Clash Over Oil, Yemen As Rift Grows – WSJ

–

UAE Debating Internally Whether to Leave OPEC

US

ISM Services Index Feb: 55.1 (est 54.5; prev 55.2)

–

Prices Paid: 65.6 (prev 67.8)

–

Employment: 54.0 (prev 50.0)

–

New Orders: 62.6 (prev 60.4)

·

Corn futures were

sharply higher on Friday from strength in soybeans, deteriorating Argentina crop conditions, and talk of China buying five cargoes (not 1.5MMT rumored earlier this week) of US corn out of the PNW this week. Bloomberg noted at least 300,000 tons of corn was

bought earlier their week for May and June delivery.

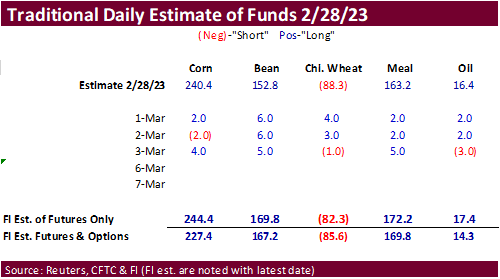

·

Funds bought an estimated net 4,000 corn contracts.

·

We heard a lot of rumors this week of China buying US corn and few cargoes of soybeans, but nothing has been reported under the USDA 24-hour sales.

·

Brazil said another 90 firms were cleared to export corn to China, bringing the total to 446 companies.

·

Brazil confirmed the Mad Cow disease in Para state was atypical. Beef exports to China may resume soon.

Export

developments.

-

No

USDA 24-H sales this morning. -

Taiwan’s

MFIG seeks up to 65,000 tons of corn on March 8 for April 25 and May 25 shipment.

Updated

02/28/23

·

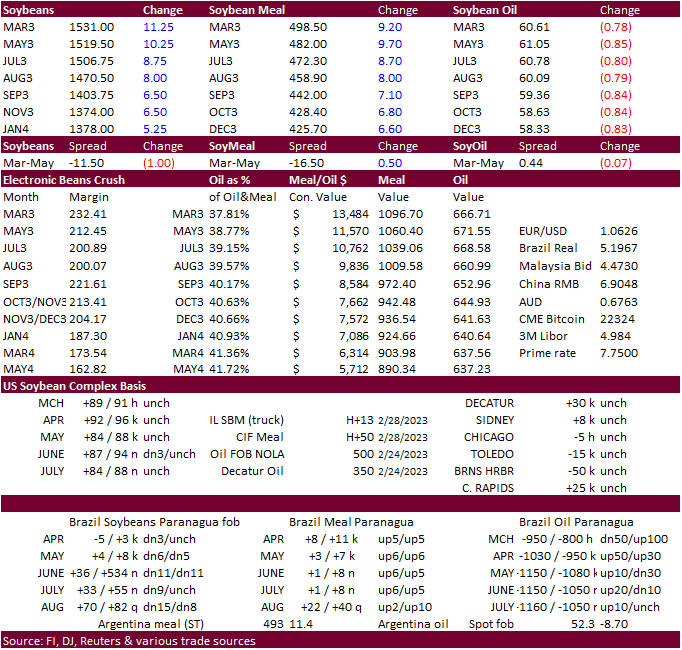

CBOT soybeans and soybean meal ended higher on follow through buying amid Argentina production concerns. Soybean oil was lower from product spreading despite a rebound in WTI crude oil and palm oil futures closing higher. The

spread, or oil share, is debatable where you see it, but in the end good crush product sales for both products is no reason for US crushing’s to accelerate from month on month 2-year levels (SBO domestic demand and SBM export exports).

·

We saw this Friday with good SA producer selling with the appreciation in in US futures.

·

Funds bought an estimated net 5,000 soybeans, 5,000 soybean meal and sold 3,000 soybean oil.

·

Yesterday Argentina’s BA Grains Exchange reported a one point decline in the combined good/excellent categories to only 2 percent for the soybean crop, and 7 point increase in the poor/very poor categories to 67 percent.

·

Argentina will continue to see hot temperatures over the next several days.

·

We look for USDA to lower Paraguay’s soybean crop estimate 1.0 million tons next week. USDA is currently at 10 million tons. Some private estimates are below 8.0 million tons. The country will see rain over the next week. 17%

of Paraguay’s soybean crop harvest progress was complete as of February 27.

·

Palm oil futures ended the week increased 3.7%. Indonesia’s move to trim exports by offering palm to the domestic market before entertaining tenders, and flooding across Malaysia, supported futures this week.

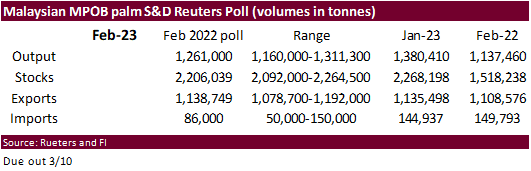

Reuters

trade estimates for Malaysian palm oil S&D due out March 10.

Export

Developments

·

None reported

Updated

03/03/23

Soybean

meal – May $440-$525

·

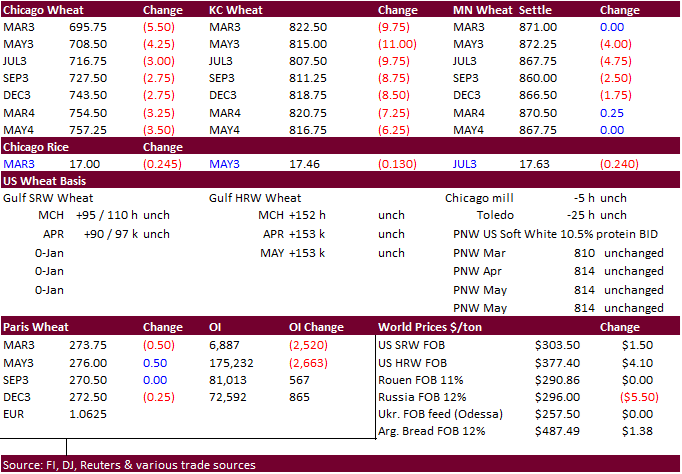

Wheat futures traded two sided, ending lower on lack of fresh bullish news, but (futures decline) limited on bottom picking, Black Sea shipping concerns. IMO prices traded mostly lower during the day session after the US saw widespread

precipitation over the past week, just in time for winter wheat emergence. For the week, Chicago wheat futures posted a third weekly decline. Funds have been sellers of wheat, so short covering may limit losses. Going forward, exports will dictate US wheat

direction. The US spring crop is rebounding, production wise. Wheat is a weed.

·

Funds sold an estimated net 1,000 Chicago wheat contracts.

·

India plans to keep their wheat export ban in place, as expected. Yesterday one broker suggested they may need to import wheat during the 2023-24 crop year.

·

Paris May wheat was higher by 0.50 euro earlier at 275.25 per ton.

·

French wheat crop ratings were unchanged for the week ending February 27 from the previous week. At 95 percent for soft wheat, they are 2 points above this time year ago.

·

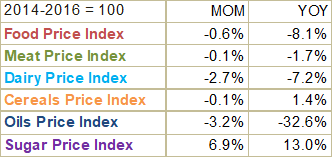

World food prices for the month of February fell to 129.8 points from 130.6 points for January, a 11-month low.

Export

Developments.

·

China will auction off 140,000 tons of wheat from state reserves on March 8.

·

Recently Iran bought an unknown amount of Russian wheat.

·

Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons of barley for arrival in Japan by August 31 on March 8.

·

Jordan seeks 120,000 tons of wheat and 120,000 tons of barley on March 7 and March 8, respectively.

Rice/Other

·

BB: Coffee Set for First Weekly Loss Since January

·

(Bloomberg) — US 2022-23 ending stocks seen at 4.26m bales, little change from USDA’s previous estimate, according to the avg in a Bloomberg survey of seven analysts. The range of estimates varied from 4.05m to 4.5m bales.

Global

ending stocks seen at 89.07m bales, on par with last month’s est.

NOTE:

In last report, USDA raised US ending stocks to 4.3m bales from 4.2m; and cut global stocks to 89.08m bales from 89.93m

Updated

03/03/23

KC

– May $7.50-$9.25

MN

– May

$8.00-$9.75

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |