PDF Attached

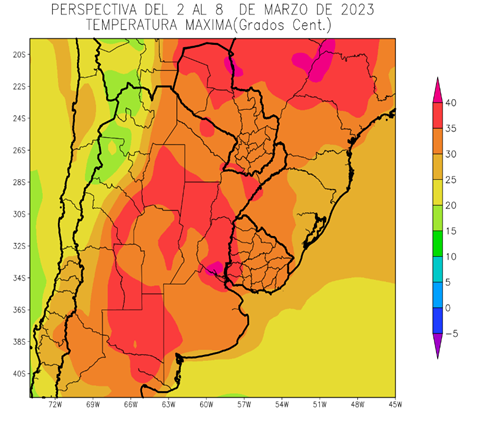

Argentina

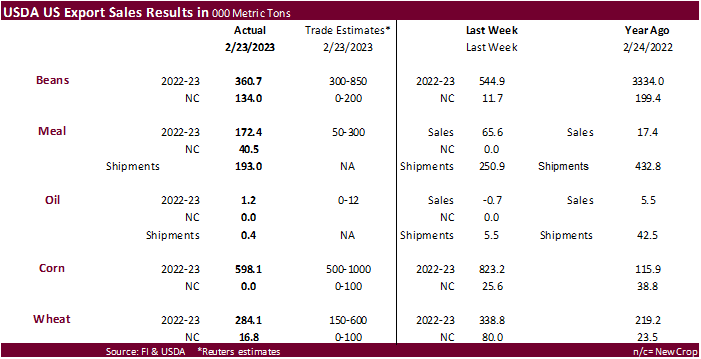

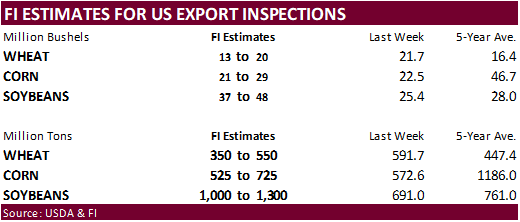

crop concerns sent soybeans higher. Wheat was higher mainly on technical buying. Corn ended mixed led by bear spreading. Black Sea shipping concerns have been supportive. Negotiations are underway. There were no USDA 24-hour sales. US export sales for soybeans,

corn and wheat slowed from the previous week and were near the lower end of their respected trade range. Product sales were low.

WTI crude oil was higher and USD sharply higher.

Brazil

and Argentina rains were near expectations yesterday. Most of southern and central Brazil will see rain through the end of this week while net drying in the northeast may stress the corn crop. Argentina’s northern Santa Fe and northern Entre Rios will see

rain today before drying down through Monday. The far west of Argentina will see rain next week. Temperatures will remain hot resulting in net drying for many areas. The upper WCB saw snow yesterday. A wintery mix of showers bias south, and snow bias north

will sweep across the central and eastern US over the next three days. Rain should favor southeastern KS, OK, and northern and eastern TX through early Friday.

MOST

IMPORTANT WEATHER FOR THE DAY

-

India

will continue warmer and drier than usual over the next two weeks, despite some showers for a little while next week -

The

showers will not produce enough rain to counter evaporation, but they will help to put a cap on the warmer than usual temperatures -

Production

potentials continue to slip lower in some of the unirrigated winter crop areas because of warmer than usual temperatures and no rain in the heart of the production region -

Eastern

China is drying out, but temperatures have been mild enough recently to conserve soil moisture -

Rapeseed

and some wheat areas will need rain later this month, but conditions for now are mostly good -

Rice

and corn planting may require greater rainfall in southern China and some sugarcane and citrus crops would benefit from greater rain as well -

Central

and southern Argentina will continue drier than usual for the next ten days -

Today’s

Ensembles of GFS and ECMWF model runs have suggested increasing rainfall in the south after March 12, confidence is low, but there is more support for it now than there has been

-

Argentina

crops will see some relief if it rains, but mid-March is just too late for some production to improve

-

No

change in the Brazil forecast was noted overnight -

Bahia,

northeastern Minas Gerais and Espirito Santo will continue drier than usual for the next two weeks -

Timely

rainfall is expected in Mato Grosso and Rio Grande do Sul -

Rain

will fall too frequently in parts of Paraguay, Parana, Sao Paulo and Mato Grosso do Sul for aggressive harvesting and planting to take place -

These

states need a break from the rainy weather, but not much is expected for a while -

The

bottom line for Brazil will remain good for late season crops, although concern remains for Safrinha corn planting in Parana and immediate neighboring states because of rain and wet field delays. Safrinha corn yields may end up lower than usual because of

late planting. Mato Grosso crops are in relatively good condition. Monsoonal precipitation in Brazil is expected to continue into April.

-

U.S.

weather has not changed much today in an official capacity, but the GFS model run was wetter for the Great Plains and that may not verify very well -

U.S.

Delta, Tennessee River Basin and central and eastern Midwest crop areas will see frequent rainfall over the next two weeks maintaining saturated field conditions and raising the potential for flooding -

Red

River Basin of the North flood potentials are rising because of recent heavy snowfall and large amounts of water tied up in the snow that may cause significant runoff and flood issues later this spring if the snow melts too quickly -

Another

snowstorm is expected in the northern Plains and upper Midwest Saturday night and Sunday with 2 to 6 inches and local totals over 8 inches possible impacting central and southern North Dakota, northeastern South Dakota and central and northern Minnesota -

These

same areas received 3 to 10 inches of snow and local totals to 14 inches Tuesday into Wednesday morning there was already substantial snow present across the region -

California

precipitation is on hold for a few days, but will resume this weekend and continue into next week briefly maintaining a favorable soil moisture and runoff situation -

South

Texas, northeastern Mexico and the Texas Coastal Bend will experience limited rainfall over the next week, but there will be some potential for rain in the second week of the outlook -

U.S.

Gulf coastal crop areas from Louisiana to Florida and Georgia will have opportunity for rain a little later this month -

The

moisture will be needed after an extended period without precipitation and warm biased conditions that accelerated net drying -

U.S.

hard red winter wheat areas will continue drier biased in the southwestern Plains, but some snow and rain will impact northern and eastern crop areas during the week next week

-

Florida

is becoming too dry, although irrigation is being used to support crops -

Rain

is need across the state and it will soon be needed in southern and southern Alabama as well -

Canada’s

Prairies weather will be drier biased except in western and southern Alberta and southwestern Saskatchewan where some waves of snow will occur through this first week of the outlook -

North

America temperatures into early next week will be colder than usual in the western parts of both the United States and Canada while temperatures are warmer biased in the Midwest, Delta, southeastern states, southern Plains and the Middle and North Atlantic

Coast States -

Some

of the cold in the west will begin spreading to the east in the second week of March including much of the Great Plains and part of the Midwest -

South-central

and southeastern Europe will receive additional precipitation over the next few days while other parts of the continent are dry or mostly dry

-

A

boost in precipitation would be welcome and good for agriculture across the continent starting next week -

Eastern

Spain and the lower Danube River Basin continue driest -

Temperatures

will also be cooler biased across much of Europe into the weekend and the mostly in the north next week

-

Europe

should trend warmer in the second week of March -

Western

CIS crop weather will continue wet over the next ten days with waves of snow and rain expected to continue -

Flood

potentials continue to rise for this spring due to saturated soil and significant snow accumulations on top of the ground -

Additional

moisture totals this week will vary from 0.30 to 1.00 inch with a few 1.00- to 2.00-inch totals -

Eastern

Australia’s dryland cotton, sorghum and other summer crops are unlikely to get much precipitation over the next ten days resulting in additional crop stress and lower production potentials -

Some

rain is expected near the Pacific Coast, but interior areas of Queensland and New South Wales will remain dry -

Irrigated

crops in eastern Australia continue in good condition with normal to above normal yields expected -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

South

Africa weather will be favorably mixed during the next two weeks with alternating periods of rain and sunshine likely -

West-central

Africa rainfall should increase in the next two weeks -

A

seasonal increase in rainfall is expected to continue gradually over the next two weeks helping coffee, cocoa, rice and sugarcane to begin development normally -

Recent

precipitation has been erratic and light -

Middle

East precipitation is expected to be erratic and sometimes light over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

-

Wheat

conditions are rated favorably, but would benefit from additional rain -

Turkey

should be wettest while Syria, Iraq and Jordan need greater rainfall -

Eastern

Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year -

Some

rain is expected to develop in Ethiopia, Uganda and Kenya over time, although amounts should be light -

Today’s

Southern Oscillation Index was +10.71 and it was expected to move erratically over the next week

Source:

World Weather and FI

Thursday,

March 2:

- Dubai

Sugar Conference, day 4 - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Global

Grain and Animal Feed Asia 2023, day 2

Friday,

March 3:

- FAO

World Food Price Index, grains report - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - Global

Grain and Animal Feed Asia 2023, day 3

Source:

Bloomberg and FI

Selected

Brazil commodity exports via Reuters

Commodity

February 2023 February 2022

CRUDE

OIL (TNS) 2,527,864 6,474,032

IRON

ORE (TNS) 23,412,934 18,654,057

SOYBEANS

(TNS) 5,199,853 6,271,312

CORN

(TNS) 2,276,989 768,396

GREEN

COFFEE(TNS) 122,402 208,279

SUGAR

(TNS) 1,147,588 1,723,741

BEEF

(TNS) 126,449 158,506

POULTRY

(TNS) 353,421 339,409

PULP

(TNS) 1,622,155 1,130,700

Due

out March 9

Macros

US

Initial Jobless Claims Feb-24: 190K (exp 195K; prev 192K)

US

Continuing Claims Feb-18: 1655K (exp 1669K; prev 1654K)

US

Nonfarm Productivity Q4 F: 1.7% (exp 2.5%; prev 3.0%)

US

Unit Labour Cost Q4 F: 3.2% (exp 1.6%; prev 1.1%)

US

EIA NatGas Storage Change (BCF) 24-Feb: -81 (est -76; prev -71)

–

Salt Dome Cavern NatGas Stocks (BCF): -1 (prev 0)

Wells

Fargo: No Longer Expects Fed To Cut Rates In 2023

99

Counterparties Take $2.192 Tln At Fed Reverse Repo Op. (prev $2.134 Tln, 100 Bids)

·

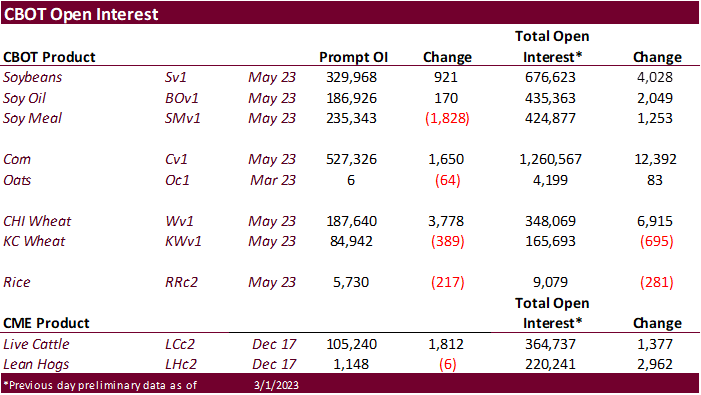

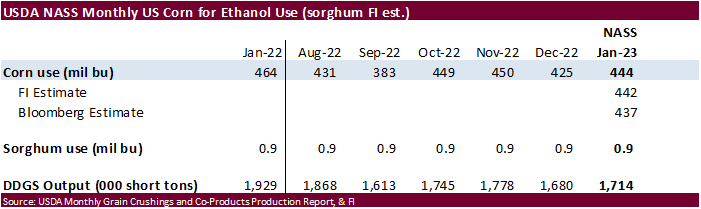

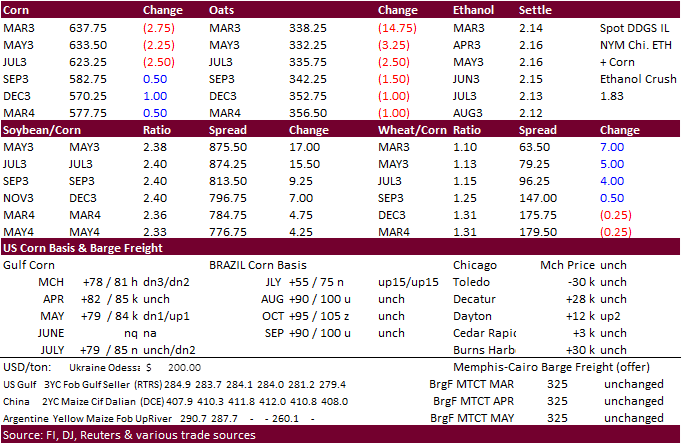

Corn futures traded

two-sided, turning lower early during the day session in part to soybean/corn spreading, higher US dollar, and slowing export sales. SK’s NOFI passed on corn overnight.

·

The front three positions ended lower and back months higher. Losses for the front months were limited from sharply higher soybeans, higher wheat, and poor Argentina weather conditions.

·

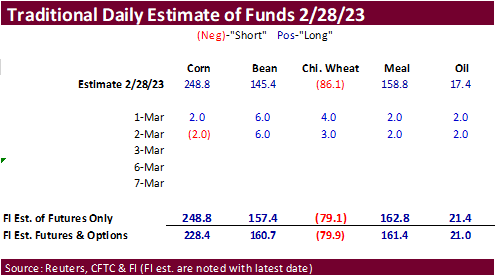

Funds sold an estimated net 2,000 corn contracts.

·

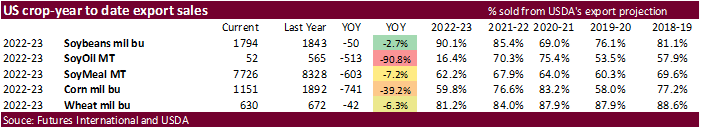

There were no USDA 24-hour export sales reported this morning and the trade is now second guessing if the China corn purchases from the US are true. Meanwhile, USDA export sales were near the low end of a range of trade expectations.

US crop-year to date export sales for corn are running 39% below this time a year ago, so there is some catching up to do, and with less than 600,000 tons reported sold last week, the trade might be rethinking USDA’s corn export estimate for the current crop-year.

·

India has become a good source for Asian corn buyers that traditionally buy from Argentina. It’s priced about $15-$20/ton below SA corn. About 200k tons of India corn has been book each month over the past few months.

·

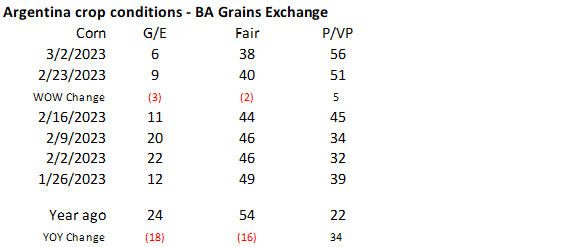

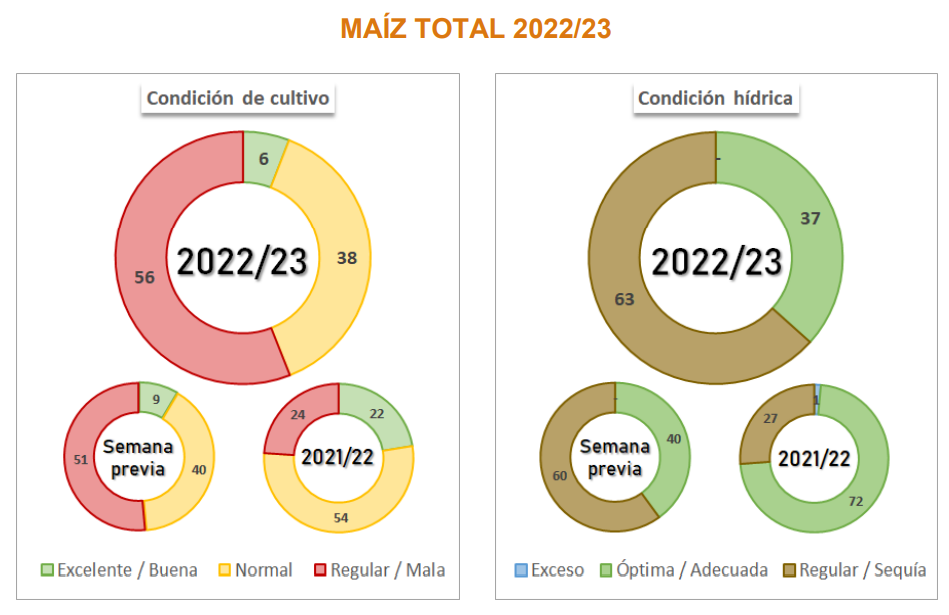

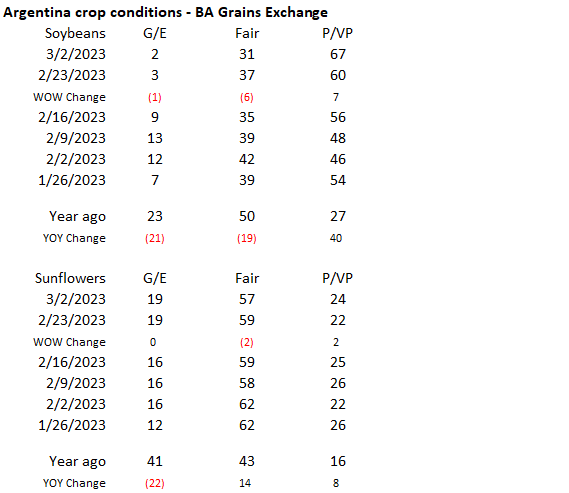

BA Grains Exchange reported a 3 point decline in the G/E categories to only 6 percent for the corn crop conditions from the previous week and 5 points increase in poor/very poor.

Export

developments.

-

South

Korea’s NOFI group passed on 138,000 tons of corn for July arrival. Lowest offer was $332.81/ton c&f.

-

No

USDA 24-H sales this morning (not since February 16 for any announcement).

U

of I: Trends in the Operational Efficiency of the U.S. Ethanol Industry: 2022 Update

Irwin,

S. “Trends in the Operational Efficiency of the U.S. Ethanol Industry: 2022 Update.”

farmdoc

daily

(13):37, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 1, 2023.

Updated

02/28/23

·

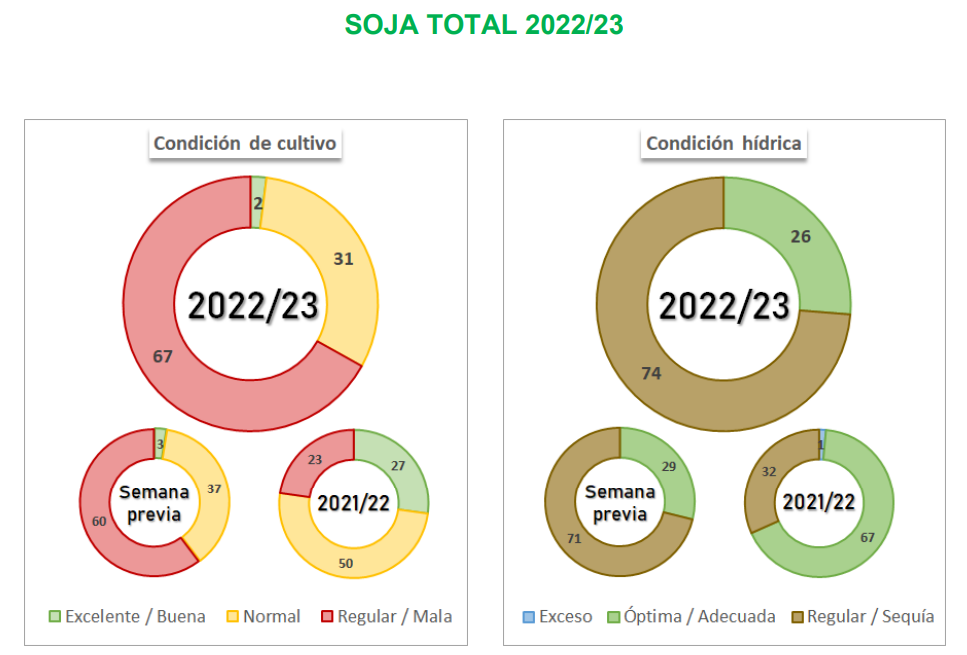

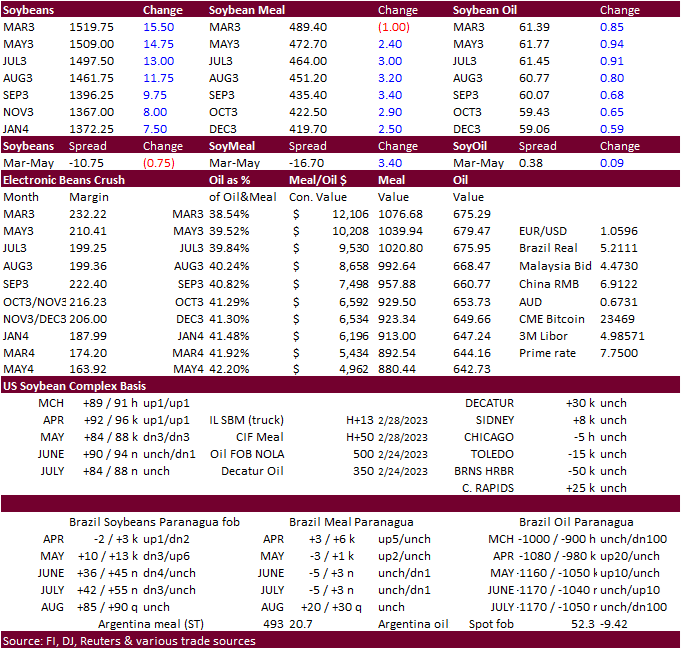

CBOT soybeans were higher mid-day on weather forecasts calling for hot temperature for Argentina, a USDA Attaché report covering Brazil that warned persistent rains are threatening the quality of soybeans, spreading against corn,

and reversal in soybean oil futures to the upside.

·

Argentina’s BA Grains Exchange warned their Argentina soybean crop estimate will be lowered again due to drought conditions and recent hot temperatures. They are currently at 33.5 million tons, down from the initial projection

of 48 million tons. The trade is now sub 30MMT soybeans and sub 40 corn. One estimate is as low as 24 million tons.

·

None expiring soybean meal contracts ended higher but off session highs. The May contract has the chance to test the $485-$490 area (would take out contract its absolute contract higher of $488.60) if the Argentina soybean crop

continues to shrink. Note the March absolute contract high was $508.80. A few weeks ago, we had a $515 target for March. May soybean meal is at a $17.10 discount to soon to expire March, so May, in our opinion, has some upside potential. It will be important

to monitor Argentina crush rates during the March and April period.

·

Funds bought an estimated net 6,000 soybeans, 2,000 soybean meal and 2,000 soybean oil.

·

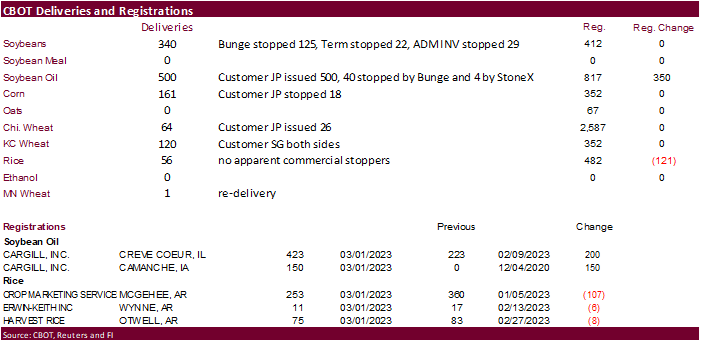

CBOT soybean oil deliveries (Wed night) were 500, with an increase in 350 registrations.

·

USDA export sales were poor for the soybean complex.

·

Flooding across Malaysia and a weaker ringgit drove palm oil to a 4-month high.

·

Indonesia is looking to roll out a domestic palm oil trade exchange using a domestic benchmark price, initially set by exporters trading through the new exchange. Exporters will be required to trade palm oil domestically before

committing to shipments outside the country by June.

·

India’s palm oil imports during February fell to 586,000 tons, the lowest since June 2022, according to a Reuters poll.

·

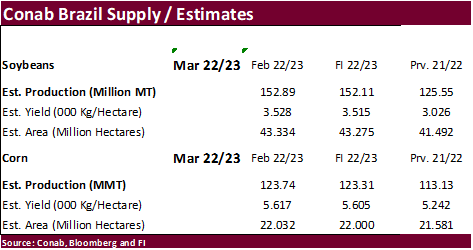

Brazil combined Jan-Feb soybean exports are down 31 percent from year ago.

·

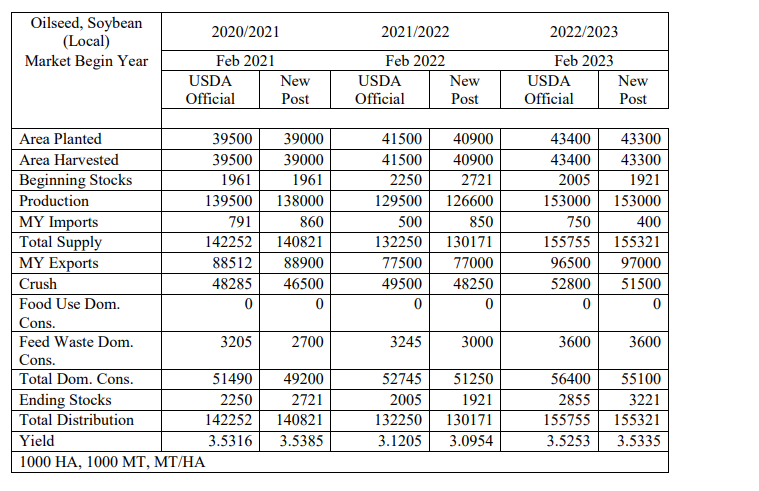

The USDA Attaché estimated Brazil 2022-23 soybean production unchanged at 153 million tons and pegged exports at a record 97 million tons. Crush was projected at 51.5 MMT.

·

StoneX: Brazil soybean crop 154.7MMT, above 154.2MMT previous.

·

Agroconsult: Brazil soybean crop 153MMT, unchanged from previous.

Updated

02/28/23

Soybean

meal – May $430-$490

Wheat

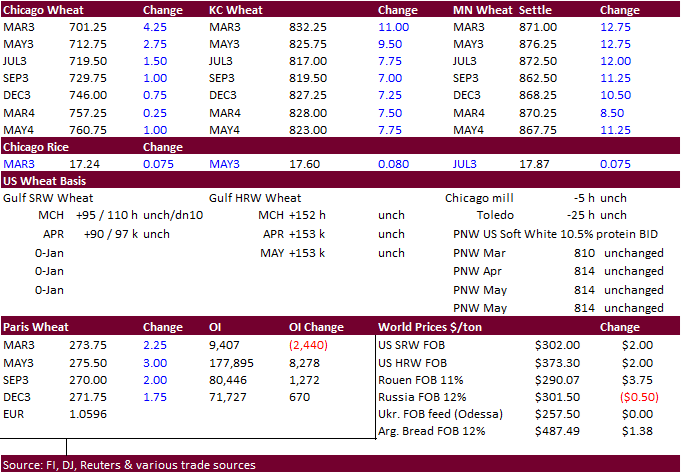

·

Wheat futures ended higher after Russia said the West is burying the grain export deal. Expect headlines to influence price direction until a decision is reached. At least discussions are underway. The current grain shipment deal

expires mid-March.

·

Funds bought an estimated net 3,000 Chicago wheat contracts.

·

USDA export sales were near the low end of a range of trade expectations.

·

The 6-10 day for US hard red winter wheat areas show a good chance for precipitation.

·

Paris May wheat was higher by 2.75 euros earlier at 275.25 per ton.

·

China will auction off 140,000 tons of wheat from state reserves on March 8.

·

Graincorp Ltd sees the 2023-24 Australian wheat crop around 25-26 million tons, down from 36.6 million for 2022-23.

·

Russia is loading wheat and barley for Middle Eastern and North African countries. Russia does not plan to change the export quota until new-crop.

·

Bloomberg, citing a major global grain company, reported India may need to import wheat in 2023-24. Note earlier India estimated their wheat production to end up at a record.

·

(Bloomberg) — India, the world’s second-biggest consumer of wheat, plans to buy about 34.2m tons of the grain from the 2022-23 crop for its food program, according to a food ministry statement. That compares with 18.79m tons

procured in 2022-23

Export

Developments.

·

Iran bought an unknown amount of Russian wheat.

·

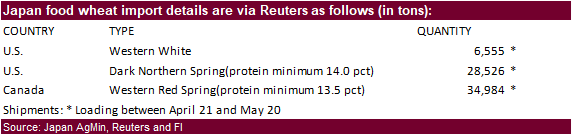

Japan’s AgMin bought 70,065 tons of food-quality wheat from the United States and Canada later this week. Original details as follows:

·

Turkey bought 465,000 tons of barley at $276.00-$294.60 per ton c&f for shipment between March 10-April 10 and April 11-May 11.

·

Japan in a SBS import tender seeks 70,000 tons of feed wheat and 40,000 tons of barley for arrival in Japan by August 31 on March 8.

·

Jordan seeks 120,000 tons of wheat and 120,000 tons of barley on March 7 and March 8, respectively.

Rice/Other

·

(Reuters) – Rates for India’s 5% broken parboiled variety RI-INBKN5-P1 fell to $390-$395 per ton from $397-$404, which was the highest in about two years, were also hurt by a depreciation in the rupee. Buying from African countries

has slowed a bit due to the recent rally in prices, said a Mumbai-based dealer with a global trade house. India does not plan to lift a ban on broken rice exports and cut a 20% tax on overseas shipments of white rice as the top exporter tries to keep a lid

on domestic prices, two government sources said last month.

Updated

02/28/23

KC

– May $7.50-$9.25

MN

– May

$8.00-$10.00

U.S.

EXPORT SALES FOR WEEK ENDING 2/23/2023

|

|

CURRENT |

NEXT |

||||||

|

COMMODITY |

NET |

OUTSTANDING |

WEEKLY |

ACCUMULATED |

NET |

OUTSTANDING |

||

|

CURRENT |

YEAR AGO |

CURRENT |

YEAR AGO |

|||||

|

|

THOUSAND |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

|

81.9 |

685.3 |

1,884.3 |

153.5 |

3,989.0 |

5,472.9 |

11.0 |

112.3 |

|

|

26.7 |

587.4 |

589.3 |

71.8 |

2,085.2 |

2,084.8 |

5.0 |

188.1 |

|

|

133.0 |

948.1 |

1,060.0 |

240.8 |

4,254.3 |

3,795.9 |

0.0 |

49.8 |

|

|

42.6 |

934.1 |

583.0 |

144.0 |

3,338.3 |

2,623.4 |

0.8 |

43.2 |

|

|

0.0 |

68.6 |

18.8 |

0.0 |

244.5 |

169.7 |

0.0 |

36.9 |

|

|

284.1 |

3,223.4 |

4,135.3 |

610.0 |

13,911.3 |

14,146.7 |

16.8 |

430.3 |

|

BARLEY |

0.0 |

3.9 |

13.8 |

0.0 |

8.0 |

14.7 |

0.0 |

0.0 |

|

CORN |

598.1 |

14,208.2 |

22,288.8 |

666.4 |

15,029.8 |

25,769.7 |

0.0 |

1,562.7 |

|

SORGHUM |

52.8 |

581.1 |

3,886.5 |

105.7 |

471.7 |

2,781.0 |

0.0 |

0.0 |

|

SOYBEANS |

360.7 |

7,208.6 |

9,390.2 |

880.8 |

41,605.2 |

40,776.3 |

134.0 |

1,307.8 |

|

SOY |

172.4 |

2,878.7 |

3,140.5 |

193.0 |

4,846.7 |

5,187.9 |

40.5 |

119.0 |

|

SOY |

1.2 |

20.5 |

172.4 |

0.4 |

31.5 |

392.7 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

|

-0.1 |

162.4 |

228.6 |

2.1 |

310.8 |

867.5 |

0.0 |

0.0 |

|

|

0.0 |

32.1 |

9.0 |

0.0 |

18.3 |

4.7 |

0.0 |

0.0 |

|

|

2.4 |

4.7 |

18.0 |

0.9 |

13.8 |

31.4 |

0.0 |

0.0 |

|

|

0.0 |

35.7 |

44.0 |

0.0 |

8.6 |

41.9 |

0.0 |

0.0 |

|

|

1.0 |

127.9 |

106.8 |

1.1 |

368.8 |

506.4 |

0.0 |

0.0 |

|

|

14.3 |

129.0 |

179.1 |

27.4 |

173.5 |

249.2 |

0.0 |

0.0 |

|

|

17.6 |

491.9 |

585.4 |

31.5 |

894.0 |

1,701.1 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND |

||||||

|

UPLAND |

170.6 |

5,141.9 |

7,727.2 |

207.7 |

5,386.9 |

5,203.0 |

97.2 |

1,394.3 |

|

|

1.2 |

39.3 |

180.8 |

3.0 |

96.9 |

234.4 |

0.0 |

3.5 |

Export

Sales Highlights

This

summary is based on reports from exporters for the period February 17-23, 2023.

Wheat:

Net sales of 284,100 metric tons (MT) for 2022/2023 were down 16 percent from the previous week, but up 39 percent from the prior 4-week average. Increases primarily for Japan (70,800 MT, including decreases of 1,000 MT), Iraq (55,000 MT, including 50,000

MT switched from unknown destinations), Mexico (43,000 MT), South Korea (33,700 MT), and the Philippines (32,800 MT, including decreases of 300 MT), were offset by reductions for unknown destinations (78,000 MT) and Barbados (700 MT). Net sales of 16,800 MT

for 2023/2024 were reported for Mexico (11,000 MT), Honduras (5,000 MT), and Japan (800 MT). Exports of 610,000 MT were up 81 percent from the previous week and 30 percent from the prior 4-week average. The destinations were primarily to Iraq (105,000 MT),

South Korea (96,900 MT), Mexico (78,600 MT), Japan (73,900 MT), and Indonesia (68,200 MT).

Corn:

Net sales of 598,100 MT for 2022/2023 were down 27 percent from the previous week and 48 percent from the prior 4-week average. Increases primarily for Mexico (207,400 MT, including decreases of 6,200 MT), Japan (111,900 MT, including 50,400 MT switched from

unknown destinations and decreases of 500 MT), Colombia (103,700 MT, including 66,500 MT switched from unknown destinations and decreases of 10,900 MT), China (76,000 MT), and unknown destinations (30,800 MT), were offset by reductions for Honduras (2,200

MT) and El Salvador (2,000 MT). Exports of 666,400 MT were down 3 percent from the previous week, but up 13 percent from the prior 4-week average. The destinations were primarily to Mexico (338,700 MT), Colombia (126,700 MT), Japan (85,400 MT), Honduras (51,900

MT), and Canada (14,600 MT).

Optional

Origin Sales:

For 2022/2023, new optional sales of 90,000 MT were for South Korea (50,000 MT) and Egypt (40,000 MT). The current outstanding balance of 190,000 MT were for South Korea (150,000 MT) and Egypt (40,000 MT).

Barley:

No net sales or exports were reported for the week.

Sorghum:

Net sales of 52,800 MT for 2022/2023 were down 49 percent from the previous week and 44 percent from the prior 4-week average. Increases reported for China (55,300 MT, including 56,300 MT switched from unknown destinations and decreases of 1,000 MT), were

offset by reductions for unknown destinations (2,500 MT). Exports of 105,700 MT–a marketing-year high–were up 48 percent from the previous week and up noticeably from the prior 4-week average. The destinations were to China (105,300 MT) and Mexico (400 MT).

Rice:

Net sales of 17,600 MT for 2022/2023 were down 45 percent from the previous week and 69 percent from the prior 4-week average. Increases primarily for Japan (13,200 MT), Canada (3,400 MT), Saudi Arabia (600 MT), and Austria (300 MT), were offset by reductions

for Honduras (100 MT). Exports of 31,500 MT were up 42 percent from the previous week, but down 14 percent from the prior 4-week average. The destinations were primarily to Japan (26,000 MT), Canada (2,400 MT), Mexico (2,100 MT), Austria (300 MT), and Saudi

Arabia (300 MT).

Soybeans:

Net sales of 360,700 MT for 2022/2023–a marketing-year low–were down 14 percent from the previous week and 25 percent from the prior 4-week average. Increases primarily for China (218,400 MT, including 202,000 MT switched from unknown destinations and decreases

of 2,400 MT), Germany (125,200 MT), Mexico (91,300 MT, including 47,500 MT switched from unknown destinations and decreases of 1,500 MT), Pakistan (66,000 MT), and the Netherlands (52,300 MT, including 57,000 MT switched from unknown destinations and decreases

of 4,700 MT), were offset by reductions primarily for unknown destinations (300,700 MT). Net sales of 134,000 MT for 2023/2024 were reported for China (132,000 MT) and Taiwan (2,000 MT). Exports of 880,800 MT were down 45 percent from the previous week and

50 percent from the prior 4-week average. The destinations were primarily to China (432,100 MT), Germany (125,200 MT), Mexico (105,300 MT), the Netherlands (52,300 MT), and Algeria (42,100 MT).

Optional

Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export

for Own Account: For

2022/2023, the current exports for own account outstanding balance of 1,600 MT are for Canada (1,500 MT) and Taiwan (100 MT).

Export

Adjustments: Accumulated

exports of soybeans to the Netherlands were adjusted down 125,243 MT for week ending February 16th. The correct destination for this shipment is Germany.

Soybean

Cake and Meal:

Net sales of 172,400 MT for 2022/2023 were up noticeably from the previous week and up 1 percent from the prior 4-week average. Increases primarily for Ecuador (80,000 MT), the Philippines (46,200 MT), Colombia (21,900 MT, including decreases of 25,100 MT),

Ireland (19,400 MT switched from the United Kingdom), and Canada (10,800 MT, including decreases of 16,400 MT), were offset by reductions for the United Kingdom (19,400 MT), Mexico (18,600 MT), and Belgium (1,000 MT). Net sales of 40,500 MT for 2023/2024 were

reported for Ecuador (40,000 MT) and Japan (500 MT). Exports of 193,000 MT were down 23 percent from the previous week and 27 percent from the prior 4-week average. The destinations were primarily to South Korea (50,100 MT), Morocco (45,000 MT), Honduras (19,700

MT), Canada (19,600 MT), and Ireland (19,400 MT).

Soybean

Oil:

Net sales of 1,200 MT for 2022/2023 were down noticeably from the previous week and down 54 percent from the prior 4-week average. Increases were reported for Canada (1,100 MT) and the United Arab Emirates (100 MT). Exports of 400 MT were down 92 percent from

the previous week and 82 percent from the prior 4-week average. The destination was to Canada (400 MT).

Cotton:

Net sales of 170,600 RB for 2022/2023 were down 60 percent from the previous week and 37 percent from the prior 4-week average. Increases primarily for China (81,600 RB), Vietnam (78,900 RB, including 900 RB switched from China and 100 RB switched from Japan),

India (18,400 RB), Turkey (15,200 RB), and South Korea (7,900 RB), were offset by reductions for Pakistan (48,000 RB) and Thailand (6,300 RB). Net sales of 97,200 RB for 2023/2024 were reported for Pakistan (88,000 RB), Thailand (7,000 RB), and Indonesia (2,200

RB). Exports of 207,700 RB were up 7 percent from the previous week and 4 percent from the prior 4-week average. The destinations were primarily to Vietnam (50,300 RB), Pakistan (40,900 RB), China (23,200 RB), Turkey (17,600 RB), and Mexico (13,000 RB). Net

sales of Pima totaling 1,200 RB for 2022/2023 were down 14 percent from the previous week, but up 23 percent from the prior 4-week average. Increases primarily for China (900 RB switched from Vietnam), Colombia (500 RB), Thailand (300 RB), Turkey (100 RB,

including decreases of 200 RB), and Indonesia (100 RB), were offset by reductions for Vietnam (900 RB). Exports of 3,000 RB were down 25 percent from the previous week and 52 percent from the prior 4-week average. The destinations were to Egypt (900 RB), China

(900 RB), India (400 RB), Pakistan (400 RB), and Guatemala (100 RB).

Optional

Origin Sales: For

2022/2023, the current outstanding balance of 9,300 RB, all Malaysia.

Export

for Own Account: For

2022/2023, new exports for own account totaling 26,600 RB were to China (13,800 RB) and Vietnam (12,800 RB). Exports for own account totaling 3,500 RB to China were applied to new or outstanding sales. The current exports for own account outstanding balance

of 120,100 RB are for China (66,400 RB), Vietnam (39,100 RB), Turkey (5,700 RB), Pakistan (5,000 RB), South Korea (2,400 RB), and India (1,500 RB).

Hides

and Skins:

Net sales of 390,200 pieces for 2023 were up 7 percent from the previous week, but down 12 percent from the prior 4-week average. Increases primarily for China (267,500 whole cattle hides, including decreases of 25,400 pieces), Mexico (62,500 whole cattle

hides, including decreases of 10,900 pieces), South Korea (39,800 whole cattle hides, including decreases of 4,500 pieces), Indonesia (6,000 whole cattle hides, including decreases of 600 pieces), and Turkey (5,100 MT), were offset by reductions for Italy

(200 pieces). Total net sales reductions of 400 calf skins were for China. In addition, total net sales reductions of 200 kip skins were for China. Exports of 512,300 pieces were up 13 percent from the previous week and 7 percent from the prior 4-week average.

Whole cattle hides exports were primarily to China (345,300 pieces), South Korea (60,200 pieces), Mexico (54,500 pieces), Turkey (14,100 pieces), and Thailand (11,400 pieces). Exports of 1,800 calf skins were to China. In addition, export of 1,000 kip skins

were to China.

Net

sales of 152,100 wet blues for 2023 were up 48 percent from the previous week and 71 percent from the prior 4-week average. Increases primarily for China (52,300 unsplit, including decreases of 100 unsplit), Hong Kong (24,900 unsplit, including decreases of

100 unsplit), Vietnam (19,600 unsplit), Italy (19,400 unsplit, including decreases of 200 unsplit), and Thailand (17,600 unsplit), were offset by reductions for Brazil (100 grain splits). Exports of 163,000 wet blues were down 2 percent from the previous week,

but up 19 percent from the prior 4-week average. The destinations were primarily to Italy (45,700 unsplit), China (35,800 unsplit), Vietnam (31,600 unsplit), Thailand (23,500 unsplit), and Taiwan (10,800 unsplit). Net sales reductions of 1,600 splits resulting

in increases for Taiwan (800 pounds), were more than offset by reductions for Vietnam (2,400 pounds). Exports of 115,800 pounds were primarily to Vietnam (74,100 pounds).

Beef:

Net sales of 8,100 MT for 2023 were down 48 percent from the previous week and 62 percent from the prior 4-week average. Increases primarily for Japan (2,600 MT, including decreases of 300 MT), Taiwan (2,300 MT, including decreases of 100 MT), China (1,500

MT, including decreases of 200 MT), Mexico (400 MT), and Hong Kong (400 MT, including decreases of 100 MT), were offset by reductions for South Korea (200 MT) and Colombia (100 MT). Exports of 16,100 MT were down 4 percent from the previous week and 5 percent

from the prior 4-week average. The destinations were primarily to Japan (4,900 MT), South Korea (4,000 MT), China (2,800 MT), Mexico (1,300 MT), and Taiwan (1,000 MT).

Pork:

Net sales of 31,000 MT for 2023 were down 40 percent from the previous week and 21 percent from the prior 4-week average. Increases primarily for Mexico (13,400 MT, including decreases of 100 MT), South Korea (4,500 MT, including decreases of 600 MT), Japan

(4,300 MT, including decreases of 300 MT), Canada (2,300 MT, including decreases of 300 MT), and Australia (1,400 MT), were offset by reductions for Nicaragua (100 MT). Exports of 30,400 MT were up 4 percent from the previous week, but down 3 percent from

the prior 4-week average. The destinations were primarily to Mexico (13,800 MT), China (4,100 MT), Japan (3,800 MT), South Korea (2,200 MT), and Canada (1,500 MT).

March

2, 2023 1 FOREIGN AGRICULTURAL SERVICE/USDA

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |