PDF Attached

New

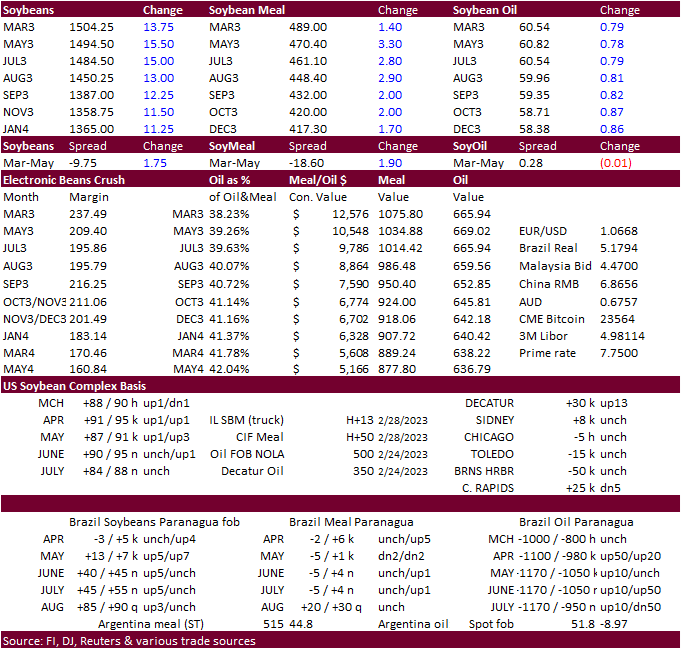

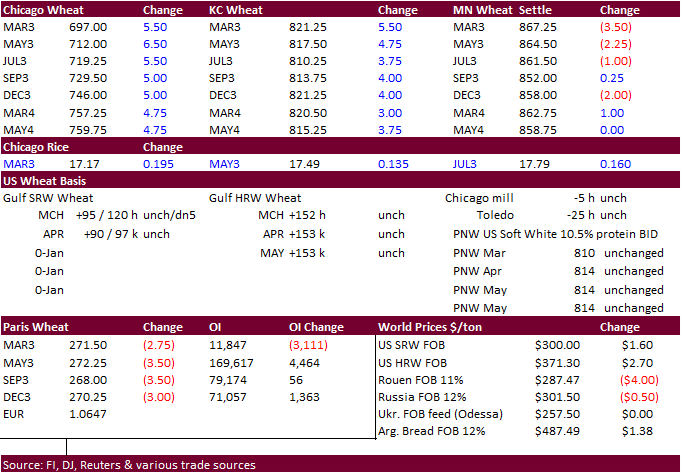

month/new money. The soybean complex rallied today from technical buying. Rumors (for the second time today) of Chinese soybean interest added to the strength in soybeans but could not be verified. Earlier we heard China bought US corn. Soybean oil traded

two-sided. A rebound in WTI crude oil supported that market. Soybean meal ended higher from ongoing SA weather concerns. Corn ended higher for the front months. Chicago and KC wheat finished higher on bottom picking.

MN was lower following weakness in EU wheat futures.

MOST

IMPORTANT WEATHER FOR THE DAY

-

Drought

continues to threaten Canada’s Prairies early 2023 planting, but there is still time for improved soil moisture and precipitation

-

Recent

snow in western and southern Alberta has attempted to improve topsoil moisture in the spring when the snow melts, but more moisture will be needed -

The

driest areas are in central and western Saskatchewan and east-central through interior southern Alberta -

There

is plenty of time for improvement before spring planting season begins, but the area needs to be more closely monitored over the next few weeks for signs of relief -

New

data from Argentina reflects the parallel between this year’s drought and that of 2009 and in that year the drought did not ease until late in the autumn season -

There

is no opportunity for rain in central or southern Argentina during the next ten days -

World

Weather, Inc. is still looking for relief from drought much sooner than May, but May 2009 was the month of greatest change that eased drought in that year -

The

latest study from World Weather, Inc. has revealed that abating multi-year La Nina events that develop into El Nino late in the same year tend to leave behind lighter than usual summer rainfall in the Midwest and Great Plains -

That

does not mean drought -

Temperatures

will have much more to say about the impact of dryness this summer -

1976

was the most similar year to that of 2023, but it was a milder summer and corn and soybean yields were higher than in the previous year -

This

summer should be warmer than that of 1976 especially in the Plains and western Corn Belt which might make the below average precipitation bias a little more important and potentially impacting on summer production -

An

excessive rain event is under way in peninsular Malaysia where torrential rain is expected over the next five days -

Already

overnight the southern tip of the peninsula including the Singapore area reported up to 11.73 inches of rain -

The

region has potential to end up with 15.00 to 20.00 inches of moisture before the stormy period is over -

Flooding

will induce more damage to infrastructure and personal property than to agriculture, but there is potential for some damage to rice, sugarcane and other crops produced low to the ground -

Argentina’s

weather is still poised to be quite dry in the central and south for the next ten days with above normal temperatures that will continue to stress crops

-

Brazil

weather has not changed overnight with waves of rain likely for most of the nation excepting the northeast half of Minas Gerais, Espirito Santo and Bahia where dry biased conditions are likely -

Delays

in soybean harvesting and Safrinha harvest progress will continue for a while -

Weather

in Mato Grosso and Rio Grande do Sul will be best over the next two weeks while the greatest delays in farming occur from Paraguay through Parana and portions of Mato Grosso do Sul to Sao Paulo and far southern Minas Gerais -

India’s

potential for showers has improved for this weekend and next week, but resulting rainfall should be too light to have much impact on late reproducing and filling winter crops -

The

moisture will help hold back temperatures a little which is needed after a warmer than usual and drier than usual February -

The

last thing India needs is a hot, dry, March – if such a pattern evolves there may be an acceleration in production cuts.

-

Eastern

China’s rapeseed region is drying out and the process will continue for a while -

Rain

will be needed later this month to maintain favorable yield potentials -

A

boost in precipitation will also be needed for early season rice planting which should be getting under way near and south of the Yangtze River Basin -

China’s

wheat region is also expecting warm temperatures, but the crop will not likely break dormancy for a while -

Dryness

in the Yellow River Basin and North China Plain is not unusual during the late winter and early spring, but if temperatures get too warm too soon there might be a greater impact on wheat and other crops

-

U.S.

Red River Basin of the North is seeing spring flood potentials rise because of additional snow over nearly saturated soil and a deep snowpack -

Snowfall

of 3 to 10 inches occurred from central through southern North Dakota into west-central Minnesota as well as in northern South Dakota -

Jamestown,

N.D. reported 14 inches of new snow -

Snow

water equivalencies across the basin were running 2.00 to 6.00 inches prior to Tuesday’s snow event and there is more snow coming this weekend -

Spring

flooding will also be possible this year in southwestern Russia and Belarus as well as some neighboring areas due to saturated soil and deep snowpack on top of the wet conditions -

Early

season wheat development has begun in the lower U.S. Midwest, mid-south, southeastern states and far southern Plains due to recent warm temperatures and favorable soil moisture -

Cooling

will be needed soon to keep crop development in check just a little while longer -

Cooling

is expected in the second week of March -

Early

season corn and other crop planting has begun in the lower U.S. Delta, South Texas and northeastern Mexico.

-

A

few areas in the far southeastern part of the U.S. may also be in their fields beginning spring planting -

Florida

is becoming too dry, although irrigation is being used to support crops -

Rain

is need across the state and it will soon be needed in southern and southern Alabama as well -

U.S.

dryness remains a concern in southern Texas, portions of West Texas and in the high Plains of hard red winter wheat country -

No

relief is expected in these areas for at least another week -

Some

forecast models are offering a chance for relief in the second week of the forecast, but confidence is low in regard to the potential event -

Recent

rain and snow in the U.S. central Plains has induced some short term improvement in soil moisture and crop conditions may improve if periodic precipitation continues while seasonal warming evolves

-

Light

precipitation Thursday into Friday and again March 8-9 will help maintain status quo conditions, but there will not be enough moisture to seriously improve the moisture profile until a more generalized precipitation event develops -

The

high Plains region needs rain more than any other part of the Plains -

U.S.

central and eastern Midwest, Delta and Tennessee River Basin will be the wettest crop areas for a while -

California’s

precipitation today will be confined to the south and a few days of drying will then follow -

More

storminess is expected next week that will further raise soil moisture and potential runoff for the spring when temperatures turn warm enough to melt mountain snow.

-

North

America temperatures into early next week will be colder than usual in the western parts of both the United States and Canada while temperatures are warmer biased in the Midwest, Delta, southeastern states, southern Plains and the Middle and North Atlantic

Coast States -

Some

of the cold in the west will begin spreading to the east in the second week of March including much of the Great Plains and part of the Midwest -

South-central

and southeastern Europe will receive additional precipitation over the next few days while other parts of the continent are dry or mostly dry

-

A

boost in precipitation would be welcome and good for agriculture across the continent

-

Eastern

Spain and the lower Danube River Basin continue driest -

Northern

Europe will not be completely dry, but precipitation amounts will be very light until next week when France and Germany trend wetter -

Temperatures

will also be cooler biased across much of Europe especially in the north into the weekend

-

Europe

should trend warmer in the second week of March -

Western

CIS crop weather will continue wet over the next ten days with waves of snow and rain expected to continue -

Flood

potentials continue to rise for this spring due to saturated soil and significant snow accumulations on top of the ground -

Additional

moisture totals this week will vary from 0.30 to 1.00 inch with a few 1.00- to 2.00-inch totals -

Europe

and Asia temperatures will remain warmer than usual during the coming two weeks except in Western Europe early this week and from Scandinavia through northwestern Russia next week when cooler than usual conditions are likely.

-

Eastern

Australia’s dryland cotton, sorghum and other summer crops are unlikely to get much precipitation over the next ten days resulting in additional crop stress and lower production potentials -

Some

rain is expected near the Pacific Coast, but interior areas of Queensland and New South Wales will remain dry -

Irrigated

crops in eastern Australia continue in good condition with normal to above normal yields expected -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

South

Africa rainfall will be restricted for another day or two and then increase late this week through next week

-

The

improved rainfall will maintain a very good summer crop outlook -

West-central

Africa rainfall should increase in the next two weeks -

A

seasonal increase in rainfall is expected to continue gradually over the next two weeks helping coffee, cocoa, rice and sugarcane to begin development normally -

Middle

East precipitation is expected to be erratic and sometimes light over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

-

Wheat

conditions are rated favorably, but would benefit from additional rain -

Turkey

should be wettest while Syria, Iraq and Jordan need greater rainfall -

Eastern

Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year -

Some

rain is expected to develop in Ethiopia, Uganda and Kenya over time, although amounts should be light -

Sunday’s

Southern Oscillation Index was +10.51 and it was expected to move erratically over the next week

Source:

World Weather and FI

Wednesday,

March 1:

- Dubai

Sugar Conference, day 3 - EIA

weekly US ethanol inventories, production, 10:30am - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - Global

Grain and Animal Feed Asia 2023, Singapore, day 1

Thursday,

March 2:

- Dubai

Sugar Conference, day 4 - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Global

Grain and Animal Feed Asia 2023, day 2

Friday,

March 3:

- FAO

World Food Price Index, grains report - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - Global

Grain and Animal Feed Asia 2023, day 3

Source:

Bloomberg and FI

Selected

Brazil commodity exports via Reuters

Commodity

February 2023 February 2022

CRUDE

OIL (TNS) 2,527,864 6,474,032

IRON

ORE (TNS) 23,412,934 18,654,057

SOYBEANS

(TNS) 5,199,853 6,271,312

CORN

(TNS) 2,276,989 768,396

GREEN

COFFEE(TNS) 122,402 208,279

SUGAR

(TNS) 1,147,588 1,723,741

BEEF

(TNS) 126,449 158,506

POULTRY

(TNS) 353,421 339,409

PULP

(TNS) 1,622,155 1,130,700

Macros

100

Counterparties Take $2.134 Tln At Fed Reverse Repo Op. (prev $2.188 Tln, 107 Bids)

US

ISM Manufacturing Feb: 47.7 (est 48.0; prev 47.4)

–

Prices Paid: 51.3 (est 46.5; prev 44.5)

–

Employment: 49.1 (prev 50.6)

–

New Orders: 47.0 (prev 42.5)

US

Construction Spending (M/M) Jan: -0.1% (est 0.2%; prev R -0.7%)

·

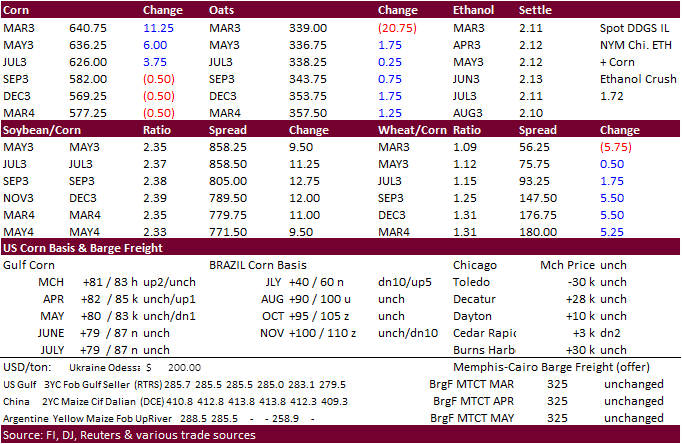

Corn futures ended

higher in the front months on talk China bought 1.5 million tons of US corn for April and May shipment. Back months were under pressure from prospects for a large Brazil second corn crop. US corn is cheapest among the largest exporters through early June.

·

Argentina confirmed a case of bird flu disease at an industrial poultry farm, prompting them to poultry exports ($350 million annual value).

·

China’s sow herd fell by 0.5% at the end of January compared with the prior month, data from the Ministry of Agriculture and Rural Affairs showed on Wednesday. The herd of 43.67 million sows was 1.8% higher than a year earlier.

·

Brazil as expected (gradually) resumed taxes on gasoline and ethanol at 0.47 real and 0.02 real per liter, respectively.

·

StoneX: Brazil total corn crop 130.6MMT, a record. 100.8 second corn crop.

·

Agroconsult: Brazil total corn crop 128.5MMT, up 8.6% from the previous season. 2nd corn crop 99.1MMT.

·

The Biden Administration is expected to go forward with year-round E15 gasoline sales this week. The EPA proposed that it would go into effect summer 2024.

·

Global freight rates are starting to rise on increasing Chinese demand.

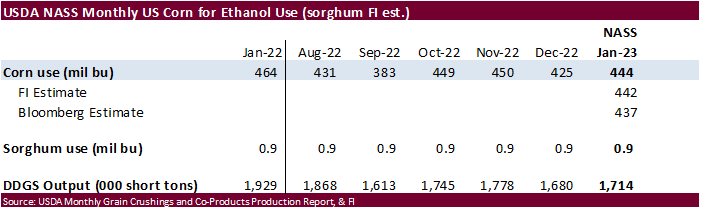

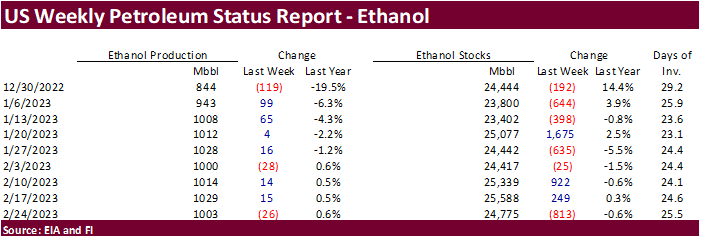

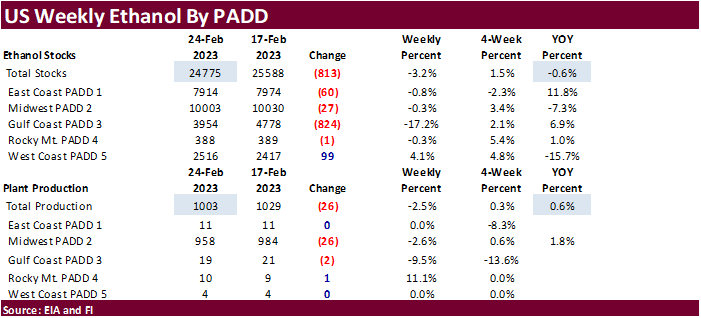

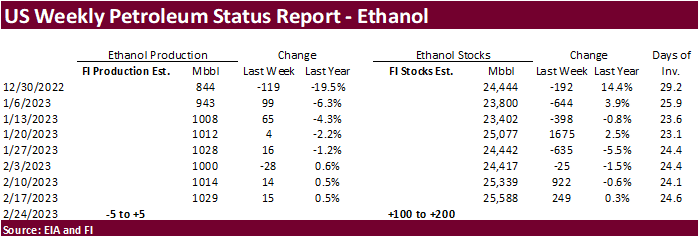

EIA

reported weekly ethanol production

down 26,000 barrels to 1.003 million barrels and stocks down 813,0000 barrels TO 24.775 million. For reference, a Bloomberg poll looked for weekly US ethanol production to be down 5,000 thousand barrels and stocks up 188,000 barrels.

US

gasoline stocks decreased 874,000 barrels to 239.2 million and implied gasoline demand increased 202,000 barrels to 9.112 million. Net production of combined finished reformulated and conventional motor gasoline with ethanol was 8.607 million barrels, up 203,000

barrels from the previous week and represents 92.7 percent of total finished motor gasoline, down from 93.9% previous week.

US

DoE Crude Oil Inventories (W/W) 24-Feb: +1.166M (est +1.900M; prev +7.647M)

–

Distillate Inventories: +179K (est -500K; prev +2.698M)

–

Cushing OK Crude Inventories: +307K (prev +700K)

–

Gasoline Inventories: -874K (est -1.000M; prev -1.856M)

–

Refinery Utilization: -0.10% (est -0.30%; prev -0.60%)

EIA:

Weekly US Crude Exports Hit New Record High

EIA:

US Crude Stocks Rose Last Week To Most Since May

U

of I: Fertilizer Prices and Company Profits Going into Spring 2023

Schnitkey,

G., N. Paulson, C. Zulauf and J. Baltz. “Fertilizer Prices and Company Profits Going into Spring 2023.”

farmdoc

daily

(13):36, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 28, 2023.

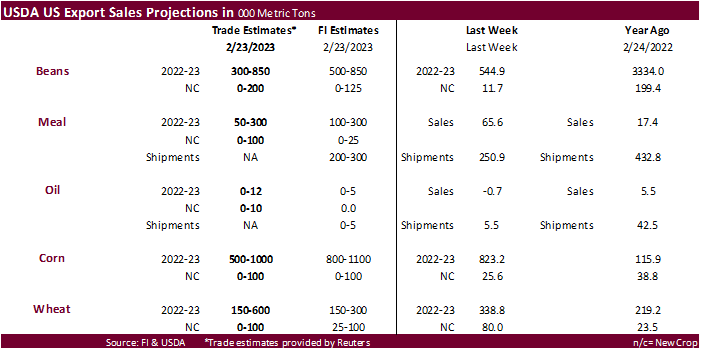

Export

developments.

-

No

24-hour sales

Updated

02/28/23

Soybeans

·

CBOT soybeans ended

higher on rumors China bought US PNW and/or Gulf soybeans. This was downplayed by the time CBOT day session opened but resurfaced by late morning trading. We could not verify the Chinese purchases.

·

Soybean oil and meal ended higher. A rebound in WTI crude oil supported soybean oil but a rally in meal limited gains.

·

Argentina producers launched a protest this week over taxes, exchange rates and financial support.

·

StoneX: Brazil soybean crop 154.7MMT, above 154.2MMT previous.

·

Agroconsult: Brazil soybean crop 153MMT, unchanged from previous.

·

India will end their duty-free import quota of 2 million tons of crude sunflower oil for the next fiscal starting from April 1, which could increase imports of palm oil. This comes after they already decided to end duty free imports

of crude soybean oil for the new fiscal year.

·

Cargo surveyor SGS reported February Malaysian palm exports at 1,131,939 tons, 18,647 tons above a month ago or up 1.7%, and 110,348 tons below a year ago or down 8.9%.

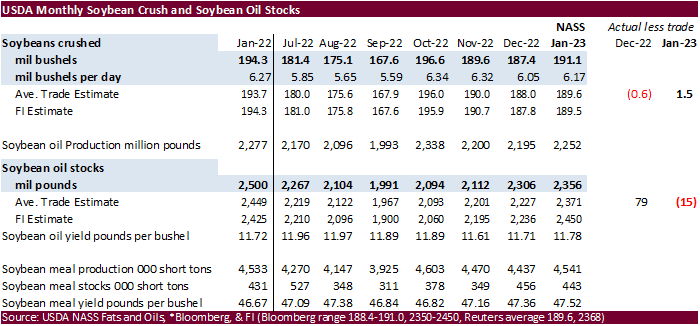

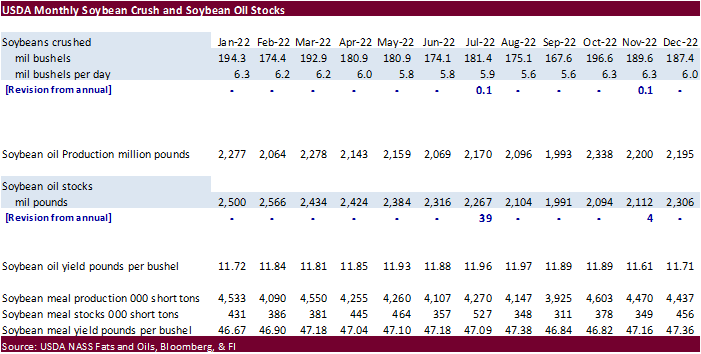

USDA

NASS reported

the January US soybean crush at 191.1 million bushels, 1.5 million above trade expectations and below 194.3 million year ago. 6.17 million bushels were crusher per day, below 6.27 million January 2022. Soybean oil stocks of 2.356 million were only 15 million

pounds below an average trade guess, and below 2.500 billion at the end of January 2022. The larger than expected crush should have inflated the bean oil carryout above trade expectations. So SBO demand during January was better than expected. The crush and

SBO stocks is slightly supportive for both commodities. Meal stocks are down a touch from last month and seen neutral for price reaction. Both soybean oil and meal yields were up month over month, so implied product demand was decent. The annual report was

also released today.

Annual

revisions

Export

Developments

·

None reported

Updated

02/28/23

Soybean

meal – May $430-$490

Wheat

·

Chicago and KC wheat futures appreciated on Wednesday after trading two-sided earlier. Headed into today, Chicago wheat was down five consecutive session and some longs took advantage of the significant price drop over the last

two weeks. Note Chicago wheat fell 66.25 cents since a week ago Friday (2/17). Minneapolis wheat ended lower, in part to EU wheat futures hitting a one year low during the session.

·

May Paris milling wheat officially closed down 3.50 euro, or 1.3%, at 274.25 euros a ton (about $290.00/ton).

·

Ukrainian grain exports reached 5.2 million tons in February, above 5.05 million tons year ago. 2022-23 grain exports are running nearly 26% below year ago at 32.3 million tons. It included 11.3 million tons of wheat, 18.6 million

tons of corn and about 2 million tons of barley.

·

Traders are waiting for news over the Black Sea grain export deal.

Export

Developments.

·

Taiwan flour millers bought 48,975 tons of US wheat for PNW shipment between April 19 and May 3. Wheat types sought include dark northern spring, hard red winter and white wheat.

·

Thailand bought 30,000 tons of Australian wheat at $336/ton c&f for May shipment.

- 32,550

tons of U.S. dark northern spring wheat of a minimum 14.5% protein content bought at an estimated $367.76 a ton FOB U.S. Pacific Northwest coast - 9,500

tons of hard red winter wheat of a minimum 12.5% protein content bought at $360.76 a ton FOB - 6,925

tons of soft white wheat between a minimum 8.5% and maximum 10% protein bought at $306.26 a ton FOB. (Reuters)

·

Jordan’s state grain buyer bought 100,000 tons of optional origin feed barley at $284/ton c&f for LH June and FH July shipment.

·

Yesterday Turkey bought 790,000 tons of wheat for March 8-April 7 and April 10-May 10 shipment.

·

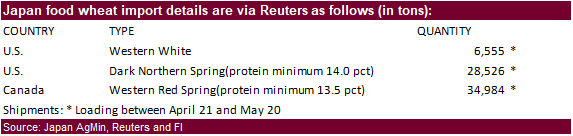

Japan’s AgMin seeks 70,065 tons of food-quality wheat from the United States and Canada later this week.

·

Turkey seeks 440,000 tons of feed barley on March 2.

Rice/Other

·

(Reuters) – Indonesia’s rice output is estimated at 13.79 million tons for the January to April harvest period this year, up 0.56% from a year earlier, data from the country’s statistics bureau showed on Wednesday. The figure

represents rice produced for household consumption and do not include output used in industries and animal feed. Around 4.51 million hectares of rice plantations are expected to reach harvest between January and April this year, compared with 4.41 million

hectares in the same period last year, although the bureau warned the threat of heavy rain in some regions could disrupt production.

Updated

02/28/23

KC

– May $7.50-$9.25

MN

– May

$8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |