PDF Attached

Poor

US USDA export sales created a landslide in all major COT agriculture commodities. Soybean meal attempted to rebound but was back to red by afternoon trading. We saw a wild trade in many outside markets, including the US bond market and USD.

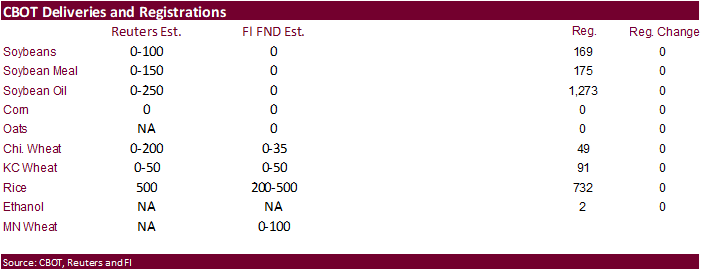

FND

deliveries will be posted overnight by CME.

World

Weather Inc.

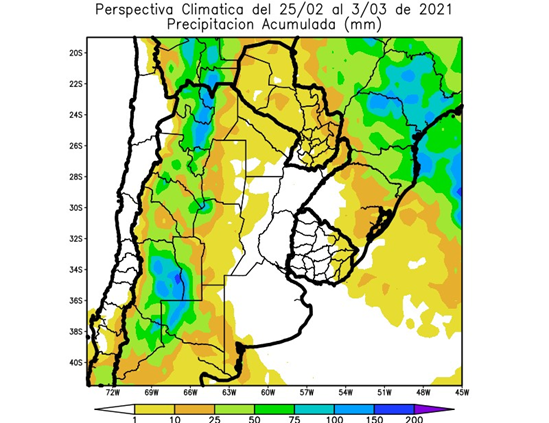

- Northern

and west-central Argentina has been advertised wetter next week - Both

the GFS and European model runs are onboard with this change today, although the GFS is a little overboard on the precipitation - The

European model run is preferred, and it brings the greatest rain into Santa Fe, Cordoba and areas to the north into Formosa during the middle part of next week with a only a few thunderstorms in westernmost parts of the nation’s crop areas prior to that - The

rain would bolster topsoil moisture and reduce crop stress that is expected to steadily rise through the weekend and into Monday due to very warm to hot temperatures and no rain - Portions

of southern Argentina is not included in the relief that comes next week - Buenos

Aires, southern Entre Rios and southeastern Santa Fe stay mostly dry for ten days - Crop

stress will continue to build in these areas - The

bottom line for Argentina is still one of concern, but if next week’s rain occurs as advertised the percentage of Argentina suffering from serious crop stress will be greatly reduced and that may protect some of its production potential. The change seems to

fit a little better with the World Weather, Inc.’s Trend Model which has been suggesting “pockets” of dryness and crop stress will occur, but no widespread serious drought-like pattern is likely that would severely shut down the nation’s production. The situation

still needs to be closely monitored and some additional changes in next week’s outlook may still evolve. In the meantime, there will certainly be rising amounts of crop stress during the next five days for much of the nation’s crops and then for another five

days after that in the southeast. - China’s

southern Yellow River Basin and southern parts of the North China Plain received heavy rainfall Wednesday and early today - Rain

totals of 0.40 to 1.77 inches were common with local totals to 2.68 inches - Southern

Shanxi and Henan to Shandong were wettest - Rainfall

in this region of this volume is rather rare at this time of year - Soil

moisture was bolstered significantly for long term use by winter and future spring crops

- Winter

crops in the region are still dormant - Flooding

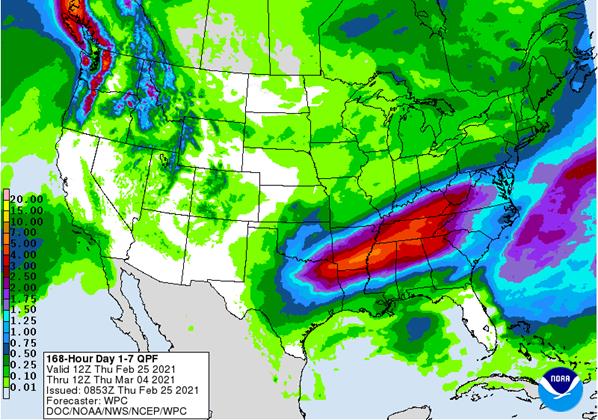

rain is still expected in the U.S. Delta and Tennessee River Basin as waves of rain begin tonight and continue through early next week. more than 6.00 inches of rain will result in some areas and that will lead to some flooding

REST

OF THE WORLD

- Brazil

continues to struggle with its soybean harvest in the wetter areas of Mato Grosso and a few other areas - The

rain, even though not unusual at this time of year, will hinder field progress at times - This

matters more this year than in the past because the harvest is already notably late due to delayed seasonal rainfall in the spring which delayed the planting of soybeans - Weather

patterns are not likely to change much during the next ten days to two weeks

- Portions

of Rio Grande do Sul, Brazil and Paraguay will dry down along with Argentina over the next five to seven days

- Crop

moisture stress will be on the rise and there is some potential for dryness to limit production in portions of both areas as time moves along - Some

forecast models have been generous in bringing some timely rain to these areas during the second week of the forecast and the situation will be closely monitored - World

Weather, Inc. does expect “some” relief, but how long it lasts remains to be seen

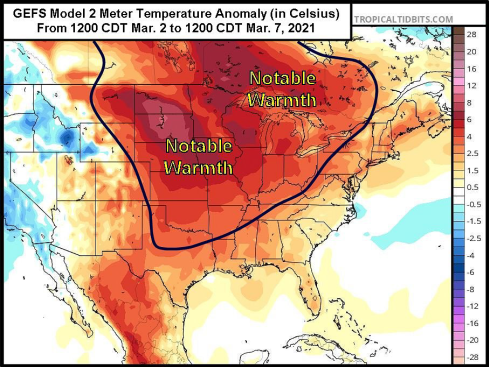

- U.S.

Midwest weather is still not very active for the first week of today’s forecast.

- The

region is likely to encounter a larger storm system in the second week of the forecast to maintain moisture abundance in the south, especially after snow melt occurs in this coming week - U.S.

northern Delta and Tennessee River Basin flood potentials will rise as waves of rain move across these areas late this week through Monday - The

ground is already saturated and rainfall of 3.00 to 6.00 inches and locally more will lead to significant runoff and small river and stream flooding - Follow

up rainfall may continue into the second week of the forecast - Flooding

of low-lying crop areas is also expected, and early season fieldwork could be delayed if the pattern prevails too long into March - U.S.

Midwest snowmelt will increase runoff over the coming week, but no flooding of major rivers is expected, but some low-lying areas will experience days of standing water for a while - River

ice on the Mississippi, Missouri and Illinois rivers will slowly decrease during the next week to ten days

- Western

parts of U.S. hard red winter wheat is not likely to get much precipitation over the next ten days and net drying will result - Some

precipitation has been advertised for the Texas Panhandle for early next week, but moisture totals will be quite light and some of it will move through Oklahoma to southeastern wheat areas of Kansas - Another

chance for precipitation will occur a week from now, but the high Plains may not get much more than very light snow and rain briefly - Temperatures

will be warm enough at times to increase evaporation leading to net drying and rising need for greater precipitation

- Northern

U.S. Plains and parts of Canada’s Prairies will receive brief bouts of light precipitation in the coming week, but no change in drought status is expected - Significant

early spring precipitation is needed to recharge the soil with moisture to support planting - Southwestern

U.S. drought is not likely to change anytime soon - West

Texas dryness will prevail despite a few showers early next week and a few more late next week.

- Warming

temperatures will increase drying rates between precipitation events - No

relief is expected through the next ten days - South

Texas crop areas are still too dry - 70-

and 80-degree Fahrenheit high temperatures in the coming week will accelerate the dryness while raising soil temperatures. Planting in irrigated areas will occur soon - Assessments

of freeze damage in South Texas and northeastern Mexico from earlier this month are ongoing, but damage to fruits and vegetables has been significant

- Portions

of North Africa are still too dry raising concern over spring crop development - Rain

will fall in Morocco today into Monday improving soil conditions in some areas - Northwestern

Algeria and southwestern Morocco are driest in North Africa, although Tunisia and northeastern Algeria have been drying down recently and may not get much moisture for a while. - India’s

winter crop areas are drying down and will continue to do so for the next ten days - Yield

potentials may slip a little during this period of time due to moisture stress, but production will still be favorable – just not as good as last year for some areas and some crops - Mexico

drought conditions are still prevailing, although the impact on winter crops is low due to irrigation - Water

supply is low in some areas and a notable improvement in rainfall is needed, but not very likely - Dryland

winter crops are stressed and will yield poorly - Freeze

damage is common in northern parts of the nation due to a couple of cold surges this winter - Eastern

Australia has received periodic showers and thunderstorms this summer supplementing irrigation and supporting good production in irrigated areas - Dryland

crop production may not be as good as expected this year especially in Queensland due to a somewhat restricted rainfall pattern in some areas at times - Russia’s

winter crop areas have not been bothered by much winterkill this year - Bitter

cold has occurred periodically, but snow cover has been present in most cases preventing significant losses - Production

in Russia’s Southern Region is still expected to be down because of drought during the planting season - Long

term moisture deficits are continuing in many areas from Turkey to Kazakhstan, southern Russia and Ukraine, despite improved soil moisture in parts of the region - Winter

precipitation has been best in improving topsoil moisture in Ukraine, southeastern Europe and Turkey - Europe

weather has become drier biased and a little warmer than usual. - Winter

crops are still dormant or semi-dormant with little change likely into early March - Recent

drier weather has reduced runoff and thus lowering the potential for spring flooding - West

Africa rainfall will remain mostly confined to coastal areas for a while, but may drift to the north into some coffee and cocoa production areas early next week - East-central

Africa precipitation will be scattered over the coming week - The

lightest and most infrequent rain occurring in Ethiopia and parts of Uganda while the most significant rain occurs in Tanzania where all crop areas will get moisture - Southeast

Asia rainfall will occur relatively normally over the next two weeks - Mainland

areas will be mostly dry, although a few showers could pop up across the region next week - All

of the precipitation will be sporadic and light having little to no impact on crops or soil conditions - Philippines

rainfall will be scattered and light - Indonesia

and Malaysia weather during the next two weeks will bring rain to most crop areas maintaining a very good outlook for crop development - Sumatra,

Peninsular Malaysia and eastern Borneo have been drying out recently and greater rain is needed - New

Zealand weather over the next ten days will include erratic and often light rainfall and seasonable temperatures

- Mexico

precipitation in the coming ten days will be mostly confined to the east coast - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast is relatively dry - Southern

Oscillation Index is beginning to fall once again and was at +14.79 this morning. The index is expected to continue to fall over the next several days - Canada

Prairies will experience seasonable temperatures over the next ten days with precipitation mostly near to below average - Some

occasional precipitation will occur along the front range of mountains in Alberta and across the southwestern Prairies as well as in a few northeastern crop areas - Southeast

Canada will experience near to above normal amounts of precipitation in the coming week while temperatures are seasonable.

Source:

World Weather Inc. and FI

Source:

World Weather Inc.

Thursday,

Feb 25:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - Malaysia’s

Feb. 1-25 palm oil export data - USDA

red meat production, 3pm - EARNINGS:

Minerva, BRF, FGV (tentative), Golden Agri

Friday,

Feb 26:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received, 3pm - Earnings:

Olam - HOLIDAY:

Thailand

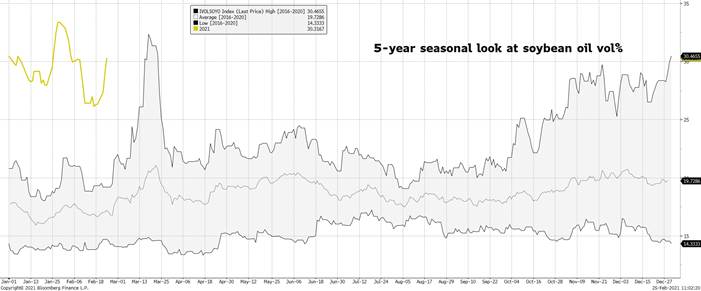

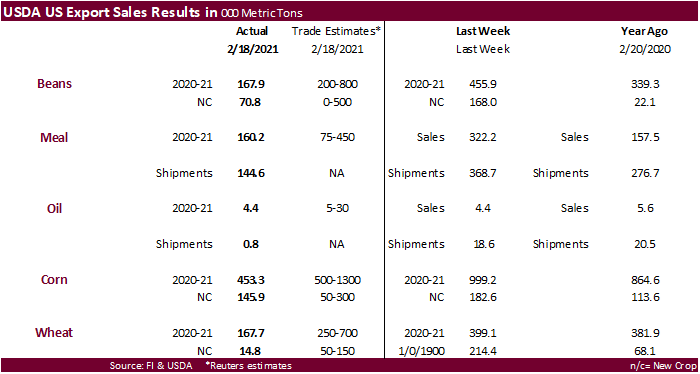

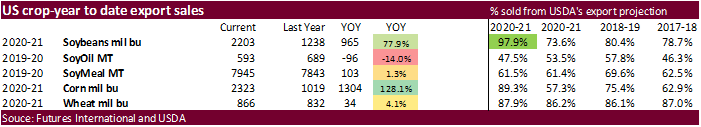

USDA

export sales

were well below expectations for soybeans and we saw the market sell off after 167,900 tons old crop and 70,800 tons posted. Soybean meal sales were a poor 160,200 tons and soybean oil sales were only 4,400 tons. SBO futures are holding some of its overnight

gains while meal futures turned lower. Corn export sales were below expectations for old crop at 453,300 tons and new-crop came in at 145,900 tons, within expectations. All-wheat export sales were 167,700 tons, below trade expectations.

USDA

Secretary

Tom Vilsack said they are still accepting CFAP COVID-19 financial aid applications, in a news conference, and China was living up to their Phase 1 responsibilities. The US will continue to prioritize expanding U.S. export markets beyond top customer China.

US

10-year is up sharply

US

GDP Price Index Q4 S: 2.1% (est 2.0%; prev 2.0%)

US

Core PCE (Q/Q) Q4 S: 1.4% (est 1.4%; prev 1.4%)

US

Initial Jobless Claims Feb 20: 730K (est 825K; prevR 841K; prev 861K)

US

Continuing Claims Feb 13: 4419K (est 4460K; prevR 4520K; prev 4494K)

US

Durable Goods Orders Jan P: 3.4% (est 1.1%; prevR 1.2%; prev 0.5%)

US

Durables Ex Transportation Jan P: 1.4% (est 0.7%; prevR 1.7%; prev 1.1%)

US

Cap Goods Orders Nondef Ex-Air Jan P: 0.5% (est 0.8%; prevR 1.5%; prev 0.7%)

US

Cap Goods Ship Non-Def Ex-Air Jan P: 2.1% (est 0.6%; prevR 1.0%; prev 0.7%)

US

GDP Annualized (Q/Q) Q4 S: 4.1% (est 4.2%; prev 4.0%)

US

Personal Consumption Q4 S: 2.4% (est 2.5%; prev 2.5%)

Canada

Non-Farm Payrolls Rose 44.3k In Dec. To 16 Mln

Canada

Average Earnings Rose 6.4% From Year Earlier In Dec.

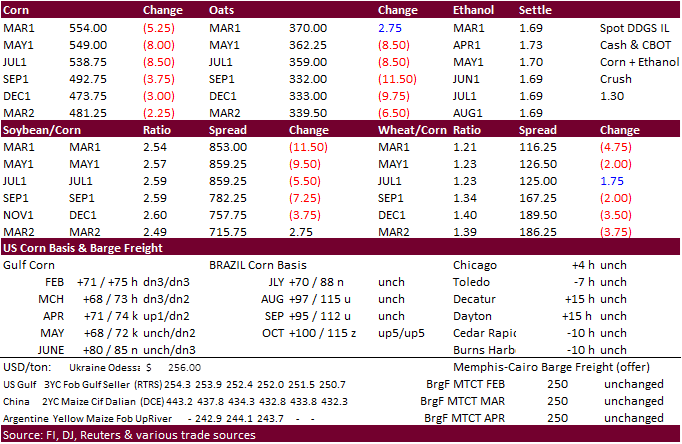

Corn.

-

Corn

futures traded lower on poor USDA export sales, lack of US export tender announcements and profit taking.

USDA

export sales came in below expectations at 453,300 tons, lowest level since August 27. Average weekly sales for 2021 are around 1.4 million tons (does not take into account the 7.4 million posted late Jan).

-

Deral

reported Brazil’s state Parana first corn production at 3.17 million tons vs. 3.36 million previously and compares to 3.565 million tons in 2019-20. For the second crop, they see 13.55 million tons versus 13.58 million tons previously and compares to 11.9

million tons in 2019-20. Parana as of Feb 22 has collected 37 percent of their first corn crop and planted 69 percent of their second corn crop.

-

Afghanistan

reported an outbreak of H5N8 bird flu on a poultry farm in Herat province, killing 794 birds with another 22,000 flock ordered to be culled.

-

Ukraine’s

grain exports fell nearly 20% to 31.7 million tons so far this season. Traders sold 13.6 million tons of wheat, 13.6 million tons of corn and 3.96 million tons of barley. -

For

its initial estimate for the 2020-21 season, South Africa’s CEC corn producers expect a corn production of 15.849 million tons, (below a Reuters poll of 16.872 million) up from 15.300 million tons last season, 4 percent mor than year earlier. They pegged

white corn at 8.799 million tons and 7.050 million for yellow. -

IGC

pegged the 2020-21 world corn production at 1.134 billion tons versus 1.133 billion previously. -

There

were no changes in CBOT registrations Wednesday evening. CME is expected to post FND deliveries tonight.

-

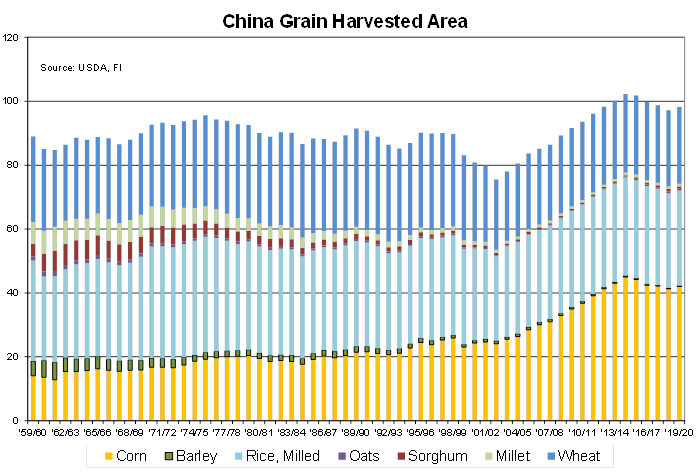

China’s

Ministry of Agriculture mentioned corn acreage in 2021 will increase by more than 667,000 hectares in key growing areas. We were looking for up around 900,000 hectares to about 42.2 million. Below is USDA official data through only 2019-20 (they have not

posted 2020).

Corn

Export Developments

·

None reported

EIA:

Texas natural gas production fell by almost half during recent cold snap

Updated

2/22/21

March

corn is seen trading in a $5.25 and $5.75 range.

May

corn is seen in a $5.15 and $6.00 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.75-$6.00 range.