PDF Attached

Please note I will be out of the office Friday morning travelling.

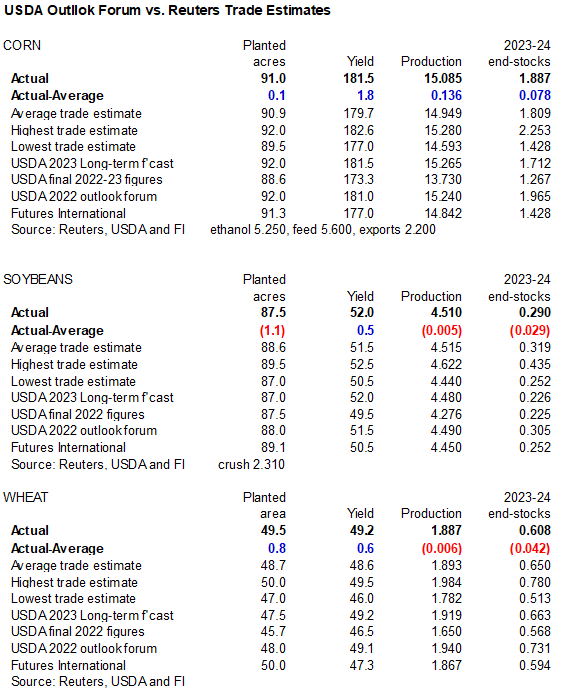

We attached our US S&D’s with no changes to FI’s 2023-24 projections, to compare against USDA’s Agricultural Outlook Forum (AOF). Day 1: https://www.usda.gov/oce/ag-outlook-forum/commodity-outlooks

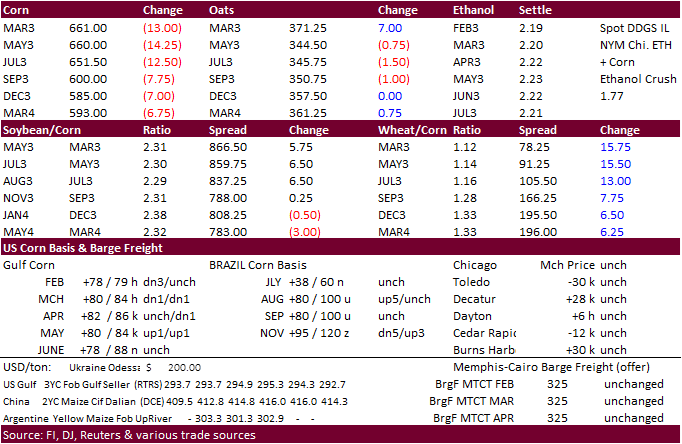

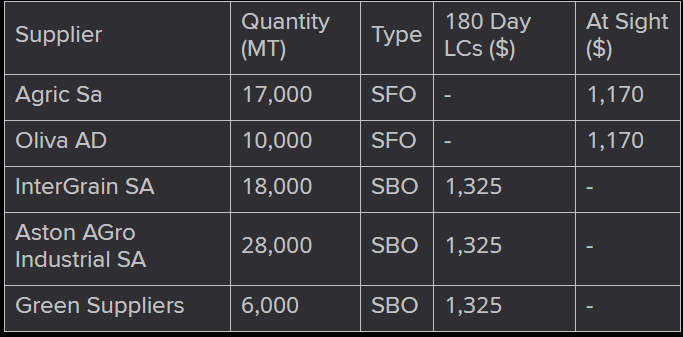

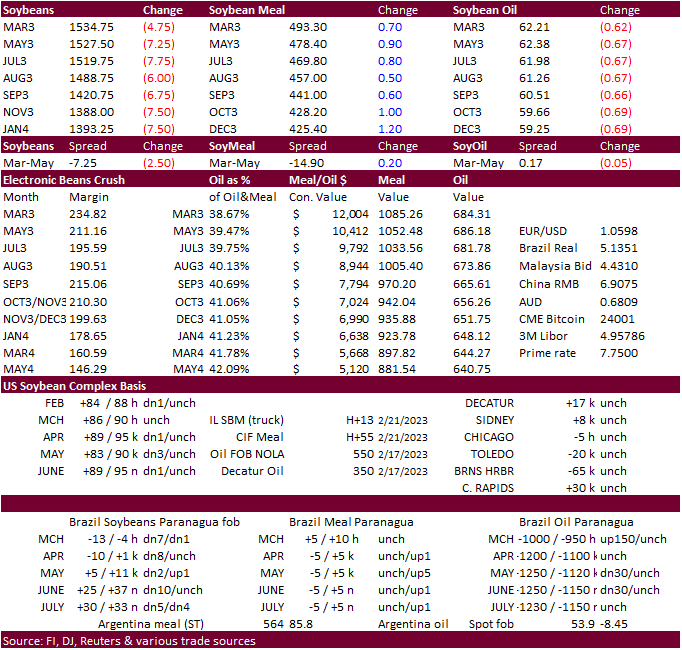

Wide trading range in US agriculture futures, with corn (touched a 6-week low) leading soybeans lower. Chicago wheat caught a bid a few times during the trade from unwinding of short wheat/long corn spreads, oversold conditions and less than expected USDA new-crop all-wheat carryout. Soybean meal opened sharply lower and soybean oil sharply higher, but that product spread saw a huge reversal. USDA’s new-crop soybean oil carryout was near unchanged from their latest 2022-23 carryout. The carryout for SBO is up for debate as USDA projected a large 80 million bushel rise in 2023-24 US soybean crush to 2.310 billion bushels, too high of an increase in our opinion. After the close we learned Egypt bought a combined 79,000 tons of vegetable oils. The USDA US 2023 soybean area was estimated at 87.5 million acres, less than trade expectations. Some think this is bullish with the expansion in biofuel production.

USDA’s outlook for 2023 issued today provides a glimpse into what supply and ending stocks could look like at by the end of the season. But like most years, final numbers could end up well off the initial projections. The 2023 soybean planted area was estimated at 87.5 million acres, 1.1 million below trade expectations, half million above the November budget, and near unchanged from 2022. This gave a little life to soybean futures post release. US soybean stocks are expected to rise to 290 million bushels from 225 million current, even though they see a massive increase in crush by 80 million bushels to record 2.310 million bushels. We think that is too high. Any shortfall could tighten the US soybean oil carryout. Many other commodity prices had little reaction to the USDA headlines. US corn acres of 91 million were near expectations and all-wheat of 49.5 million were 800,00 acres above a trade guess. Corn for ethanol was estimated at 5.250 billion bushels, unchanged from current 2022-23 estimate. We see little trade reaction going forward with these numbers, but something to work with until the March Intentions report is released.

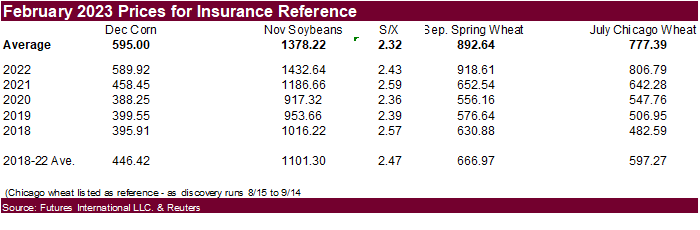

February to date SX/CZ stands at 2.32. A week ago, it was at 2.30

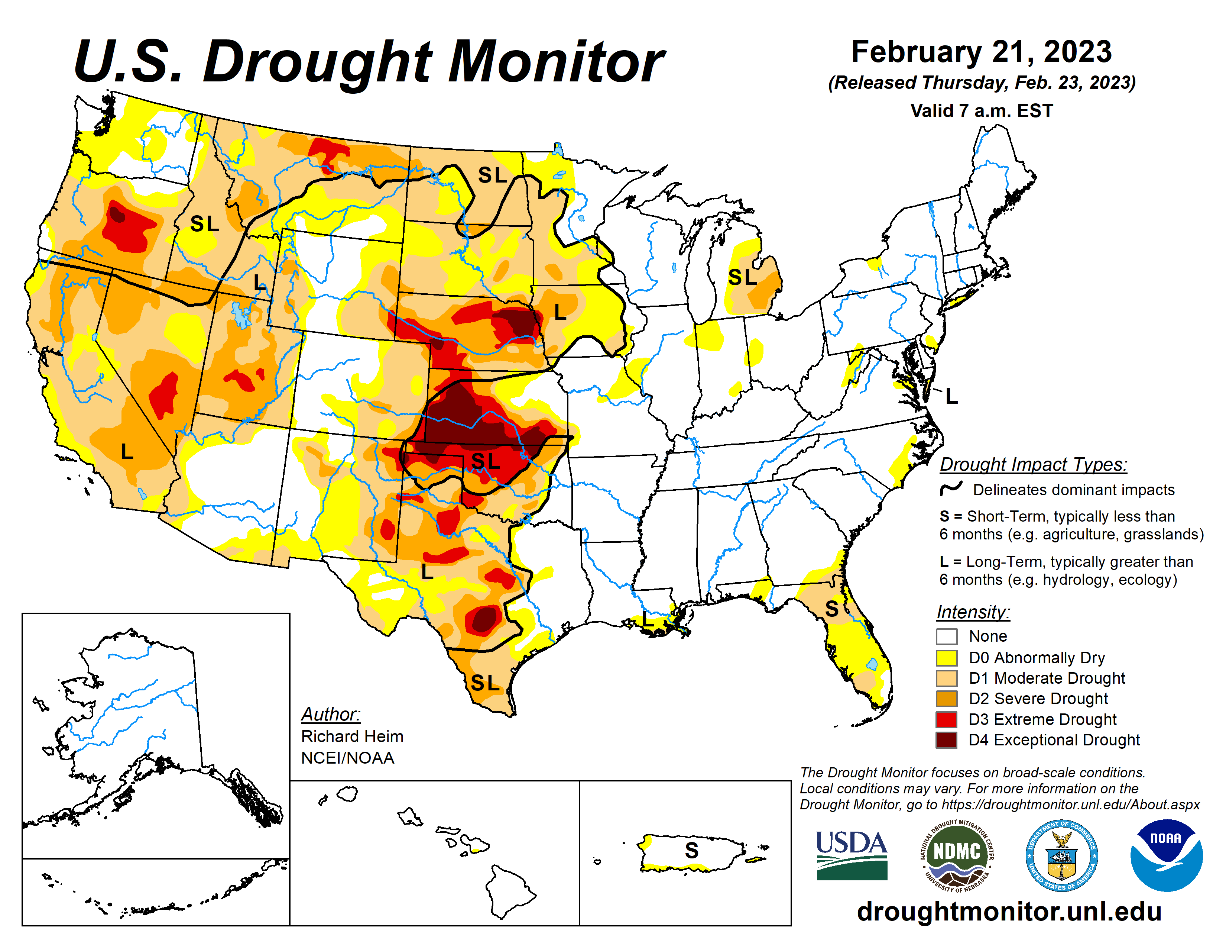

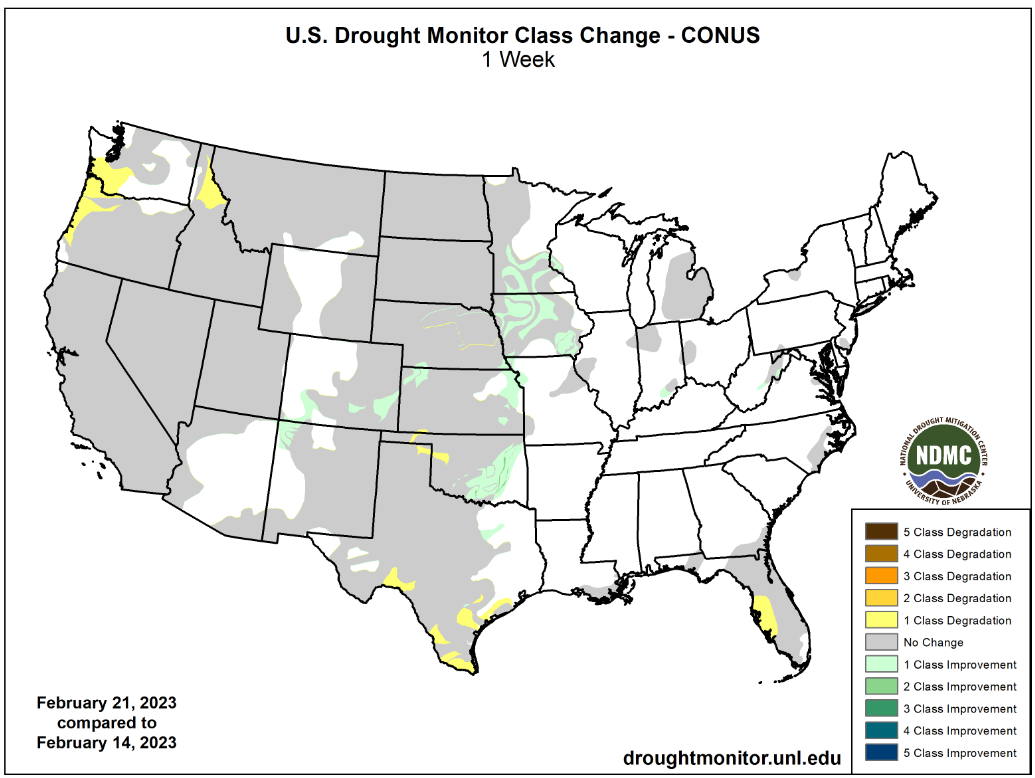

Weather

The weather outlook was mostly unchanged. Argentina will see light rain this week and Brazil rain will increase over the next 7 days. The upper US is still under a winter weather advisory bias eastern area. Over 2 feet of snow fell across some areas of the northern Plain states and upper Midwest. Rains favor southeast Oklahoma and northeast Texas Friday through Saturday.

World Weather, INC.

MOST IMPORTANT WEATHER FOR THE DAY

- Southern Argentina’s earliest opportunity for precipitation will occur in the second week of the forecast which represents little change from Wednesday’s outlook

- Too much rain will continue to fall in southern Brazil from eastern Paraguay through Mato Grosso do Sul to Sao Paulo and Parana during the next ten days

- Delays in farming activity will occur frequently until drier weather evolves

- Mato Grosso, Brazil rainfall will be infrequent and light enough at times in the next two weeks to support additional harvesting of soybeans and planting of Safrinha corn

- Northern Argentina rainfall will be sufficient for a notable increase in precipitation for cotton, northern grain and oilseed, dry bean, citrus and sugarcane production areas

- Mexico remains in a winter drought with little relief expected in the next two weeks

- California will start receiving rain and mountain snow once again during the balance of this week through much of next week

- The moisture will be good for runoff potentials later this spring

- U.S. hard red winter wheat areas turned much colder in the north Wednesday and early today and snow cover is not very great in some areas of northwestern Kansas, eastern Colorado and southwestern Nebraska.

- No serious crop damage was suspected today, despite the cold conditions and the sometimes limited snow cover

- Heavy snow and freezing rain impacted many areas from the northern U.S. Plains through the Great Lakes region to the northeastern states Wednesday and early today

- Travel delays have resulted along with some livestock stress and higher energy demand for parts of the northern Plains

- Stormy weather will continue in the northern Midwest and northeastern states today and early Friday

- Bitter cold will remain over the north-central United States into Saturday morning with a few extremes temperatures in the -20s and negative teens likely tonight in the Dakotas,, and Minnesota.

- Unusually warm to hot weather continued Wednesday from the southern Plains through the Delta to the southeastern states

- These areas will continue to experience warm weather for an extended period of time lasting into next week for some areas

- Winter wheat will break dormancy and begin developing more significantly

- Rising soil temperatures will improve planting conditions in South Texas and areas near the Gulf of Mexico coast.

- U.S. Gulf of Mexico coastal areas are unlikely to get much rain of significance in the next ten days

- Net drying will result because of limited rain and warmer than usual temperatures

- India rainfall continues unusually light leaving winter crops with a drier bias that may lead to lower yield this winter in unirrigated wheat, rapeseed, mustard, sorghum, groundnut, rice and pulse crops among others

- Greater rain is needed immediately, but unlikely to occur anytime soon

- Temperatures have not been excessively hot, but they have been and will continue to be a little warmer than usual which is likely to stress some of the reproducing and filling crops

- Southeastern and east-central China will be drying down over the next two weeks

- Rapeseed and wheat production areas in the nation are rated favorably with little change likely for a while, but rain will soon be needed

- Timely rain will be needed in March to maintain the best possible soil moisture

- Eastern Australia is still struggling with dryness in unirrigated cotton and sorghum areas of Queensland and New South Wales

- Some livestock stress has been occurring as well due to very warm to hot temperatures and limited soil moisture hurting grazing conditions

- Irrigated summer crops in eastern Australia are performing well with little change likely

- Tropical Cyclone Freddy moved through southern Madagascar Tuesday and was expected to reach Mozambique Friday

- The storm produced very heavy rain and induced damaging wind as well as some flooding over southern and east-central Madagascar impacting grain, oilseed, rice, coffee, sugarcane and other crops

- Damage assessments will be forthcoming later this week into next week

- Remnants of Tropical Storm Freddy may impact far northeastern Limpopo, South Africa as well as Mozambique Friday into the weekend, but crop damage should be limited to flooding in a few Mozambique locations

- Philippines heavy rain reported during the Friday through Monday period from eastern Mindanao to southeastern Luzon Island abated Tuesday and Wednesday allowing flood water to recede

- More rain is expected in eastern parts of the archipelago resulting in more flooding later this week and next week

- Some crop and property damage has likely occurred recently, but the extent of the damage is not known

- South Africa rainfall should be limited for a while in the next two weeks except where Tropical Cyclone Freddy brings heavy rain to Limpopo

- Crop and field conditions are rated quite well because of timely rain throughout the summer

- Western CIS crop areas will continue to be impacted by frequent snow and some rain in the next ten days

- Parts of western Russia, Ukraine, Belarus and Baltic States have saturated soil and need to dry down for a while especially when the spring snow melt season arrives

- The risk of flooding will be high in southwestern Russia if precipitation continues frequently while snow is melting

- Europe and Asia temperatures will remain warmer than usual during the coming week

- The developing negative phase of North Atlantic Oscillation promises to generate colder temperatures in northern Europe and northwestern Russia while bringing on greater storminess in southern parts of the continent

- This change may raise heating fuel demand in the north during March

- The change will also bring greater precipitation back to southern Europe which will be most welcome to winter and spring crop areas in eastern Spain and the lower Danube River Basin where low soil moisture is still present today

- Negative North Atlantic Oscillation in March may also bring greater rainfall to northern Africa which could improve wheat and barley development potential after a drier autumn and winter

- Rain is needed most in interior Tunisia, interior northeastern Algeria and southwestern Morocco

- Negative North Atlantic Oscillation might also cool down the eastern United States in the first week to ten days of March

- West-central Africa rainfall is expected to increase over the next two weeks resulting in greater soil moisture and a better environment for the flowering of coffee and cocoa next month

- Indonesia and Malaysia rainfall is expected to occur frequently for the balance of this week and the weekend and then parts of the region will start to trend a little drier in March

- Middle East precipitation is expected to be erratic over the next couple of weeks raising some need for greater precipitation prior to cotton and rice planting season.

- Wheat conditions are rated favorably, but would benefit from additional rain

- Turkey is wettest while Syria, Iraq and Lebanon need greater rainfall

- Eastern Africa precipitation will be greatest in Tanzania during the next ten days which is not unusual at this time of year

- Some rain is expected to develop in Ethiopia, Uganda and Kenya over time, although amounts should be light

- Today’s Southern Oscillation Index was +11.26 Wednesday and it was expected to fall significantly in the coming week

Source: World Weather and FI

Bloomberg Ag calendar

Friday, Feb. 24:

- The USDA’s Agricultural Outlook Forum, Arlington, day 2

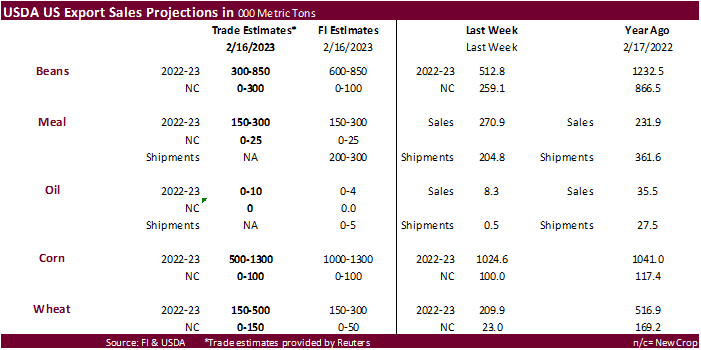

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

“Staff will begin with the CoT report that was originally scheduled to be published on Friday, February 3, 2023. Thereafter, staff intends to sequentially issue the missed CoT reports in an expedited manner, subject to reporting firms submitting accurate and complete data. https://www.cftc.gov/PressRoom/PressReleases/8662-23

- FranceAgriMer’s weekly crop conditions reports

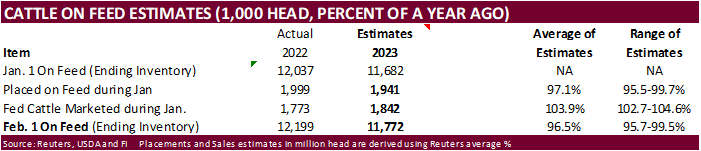

- US cattle on feed, 3pm

- US cold storage data for beef, pork and poultry, 3pm

Monday, Feb. 27:

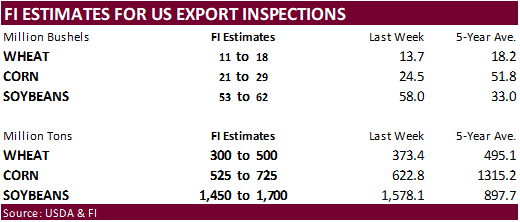

- USDA export inspections – corn, soybeans, wheat, 11am

- Dubai Sugar Conference, day 1

- EARNINGS: Olam, FGV

Tuesday, Feb. 28:

- Dubai Sugar Conference, day 2

- EU weekly grain, oilseed import and export data

- US agricultural prices paid, received, 3pm

- Malaysia’s Feb. palm oil export data

- Vietnam coffee, rice and rubber export data

- EARNINGS: Golden Agri

Wednesday, March 1:

- Dubai Sugar Conference, day 3

- EIA weekly US ethanol inventories, production, 10:30am

- USDA soybean crush, DDGS production, corn for ethanol, 3pm

- Global Grain and Animal Feed Asia 2023, Singapore, day 1

Thursday, March 2:

- Dubai Sugar Conference, day 4

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Port of Rouen data on French grain exports

- Global Grain and Animal Feed Asia 2023, day 2

Friday, March 3:

- FAO World Food Price Index, grains report

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

- Global Grain and Animal Feed Asia 2023, day 3

Source: Bloomberg and FI

Macros

102 Counterparties Take $2.147 Tln At Fed Reverse Repo Op.

US EIA NatGas Storage Change (BCF) 17-Feb: -71 (est -62; prev -100)

– Salt Dome Cavern NatGas Stocks (BCF): 0 (prev -9)

EIA US Crude Oil Inventories Change (W/W) 10-Feb: +7.648M (est +2.800M; prev 16.283M)

– Distillate: +2.698M (est -1.204M; prev -1.285M)

– Cushing OK Crude: +700K (prev -659K)

– Gasoline: -1.856M (est +900K; prev +2.316M)

– Refinery Utilization: -0.6% (est -0.2%; prev -1.4%)

EIA: US Crude Inventories Reach Highest Level Since May 2021

US GDP Annualized (Q/Q) Q4 S: 2.7% (est 2.9%; prev 2.9%)

US GDP Price Index Q4 S: 3.9% (est 3.5%; prev 3.5%)

US Core PCE (Q/Q) Q4 S: 4.3% (est 3.9%; prev 3.9%)

US Personal Consumption Q4 S: 1.4% (est 2.0%; prev 2.1%)

US Fourth-Quarter GDP Revised Lower On Weaker Consumer Spending – BBG

US Initial Jobless Claims Feb 18: 192K (est 200K; prev 194K)

US Continuing Claims Feb: 1654K (est 1700K; prev 1696K)

US Unemployment Claims Drop To Lowest Level In Four Weeks – BBG

US Chicago Fed Nat Activity Index Jan: 0.23 (est -0.25; prevR -0.46)

Canadian Payroll Employment Change- SEPH Dec: 91.4K (prev 7.1K)

Corn

· Corn futures ended sharply lower led by the nearby contracts on fund long liquidation (managed money is holding a large long position), unwinding of short Chicago wheat/long corn spreads, and USDA estimating a 91 million acre US planted area for new-crop. May corn reached a 6-week low earlier, ending at $6.5925, well below the sideways trading range the trade has seen since mid-January.

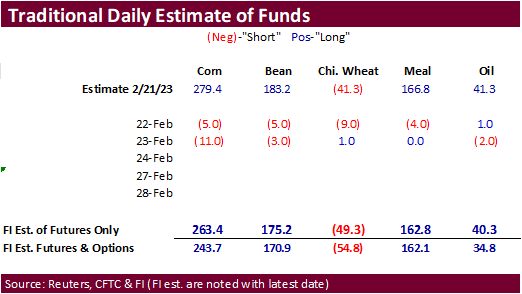

· Funds were estimated net sellers of 11,000 corn contracts.

· Brazil beef exports to China will be halted after a case of mad cow disease was confirmed in the northern state of Para. This supported US feeder and live cattle futures. We think the case is isolated and China will soon resume imports.

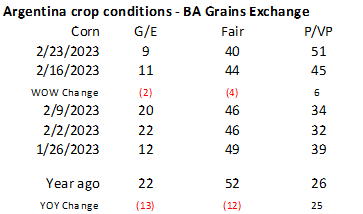

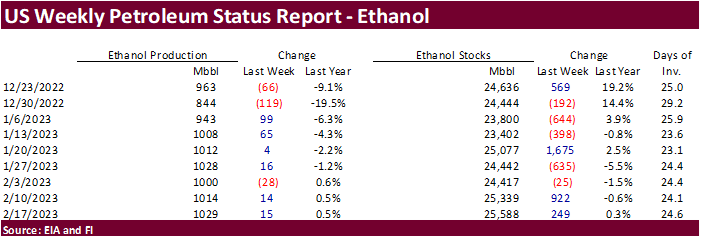

· US Ethanol production was up from the previous week but ethanol stocks reached nearly a 11-month high.

· The Baltic Dry index jumped 21.1% to 816 points. Capesize type vessels have rebounded sharply this week. For a while the Baltic Dry Index has been on the defensive, to lows not seen since June 2020, in part to concerns over China’s economic recovery.

EIA reported US ethanol production at 1.029 million barrels, up 15,000 barrels from the previous week and stocks at 25.588 million barrels, up 249,000 barrels from previous week and highest since early April 2022. For comparison, a Bloomberg poll looked for weekly US ethanol production to be up 6,000 thousand barrels and stocks up 60,000 barrels.

USDA Cattle on Feed report is due out Friday and traders are looking for February 1 on feed to be reported slightly above January but down 3.5 percent from a year ago.

Export developments.

- South Korea’s NOFI group passed on 138,000 tons of corn for in June. Lowest offer was $339.45 a ton c&f.

- Algeria’s ONAB bought 30,000 to 40,000 tons of corn from Argentina for shipment by April 10 at $342 to $346/ton c&f.

Updated 02/22/23

March corn $6.60-$6.90 range. May $6.25-$7.15

Soybeans

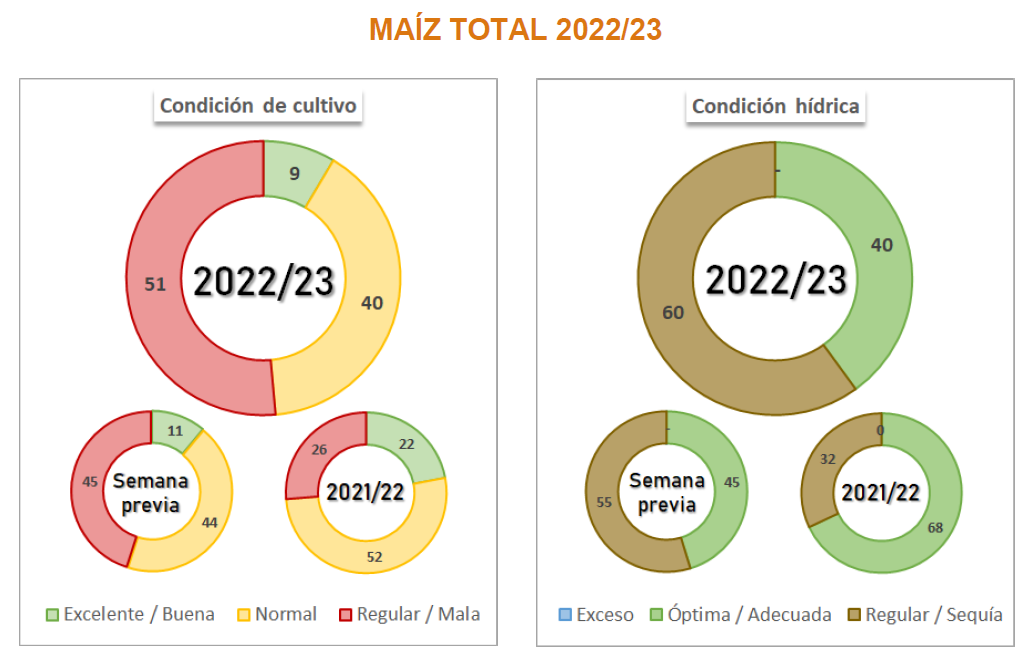

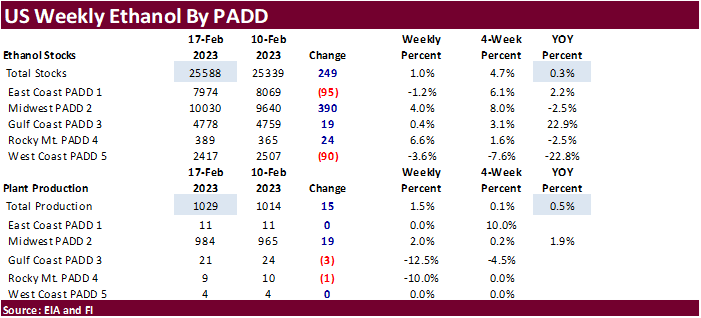

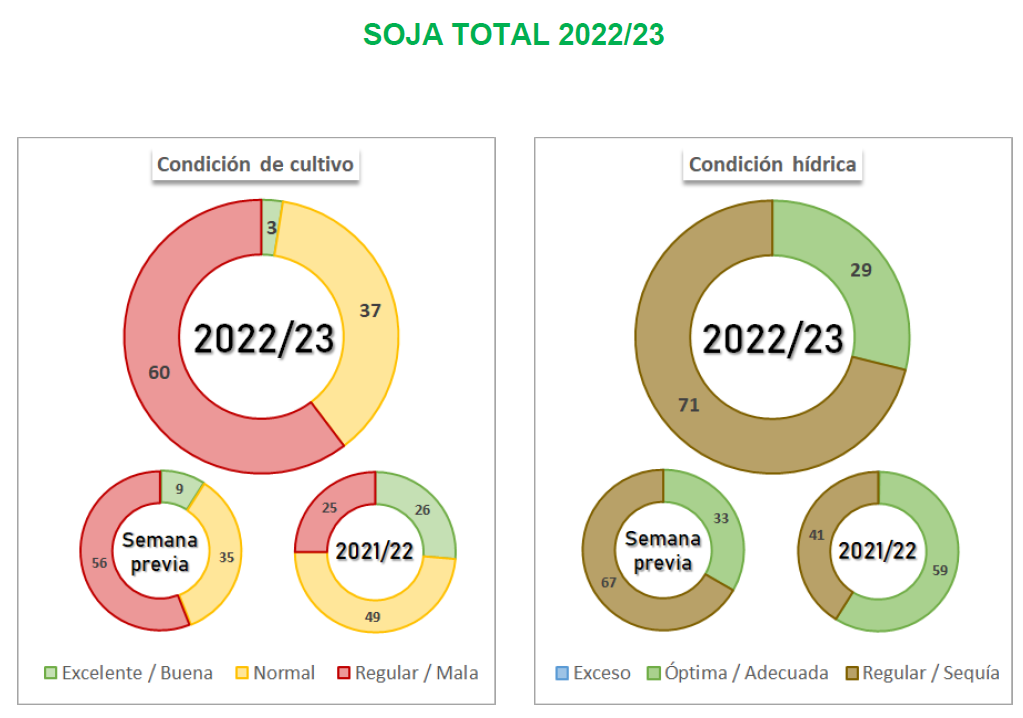

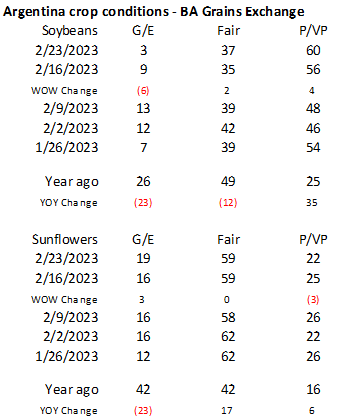

· Soybeans and soybean oil ended lower and meal moderately higher. Soybean basis May reached their highest level since June on Wednesday, so profit taking was not a surprise. The products saw a huge swing from a start with lower meal/higher soybean oil. Fund long buying eventually dried for soybean oil. Ongoing Argentina crop concerns supported meal, and this was reinforced after the BA Grains Exchange reported another decline in soybean crop conditions. WTI crude oil traded higher but did little to cool the sell off in SBO.

· After the close we learned Egypt bought a combined 79,000 tons of vegetable oils.

· Funds were net sellers of an estimated net 3,000 soybeans, flat in meal and sold 2,000 soybean oil.

· Argentina soybean conditions are down 6 points for G/E categories from the previous week to only 3 percent. That compares to 26 percent year ago. BA Grain Exchange estimated the Argentina soybean production at 33.5 million tons, down from 38 million previous. Some private estimates are now putting the Argentina soybean crop at 28 to 31 million tons.

U of I: Overview of the Production Capacity of U.S. Biodiesel Plants

Gerveni, M., T. Hubbs and S. Irwin. “Overview of the Production Capacity of U.S. Biodiesel Plants.” farmdoc daily (13):32, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 22, 2023.

Export Developments

· Turkey’s state grain board TMO seeks about 48,000 tons of crude sunflower oil Feb. 24 for delivery March 13-April 13 and April 14-May 14.

Updated 02/22/23

Soybeans – March $15.00-$15.50, May $14.75-$16.00

Soybean meal – March $480-$505, May $425-$500

Soybean oil – March 62.50-63.20, May 58-70

Wheat

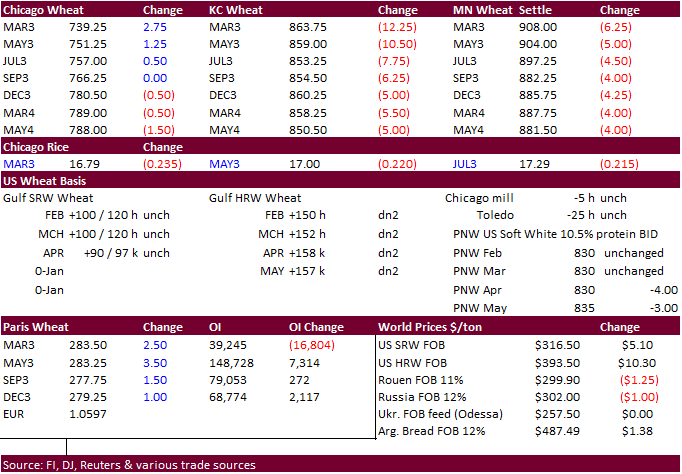

· US wheat futures traded two-sided. Chicago ended mixed on bull spreading, KC sharply lower and MN lower. There was unwinding of short Chicago wheat against corn and KC wheat. The USD was near unchanged by midafternoon. USDA projected 2023 US wheat plantings at 49.5 million acres, a seven year high.

· Funds were net buyers of an estimated net 1,000 Chicago wheat contracts.

· China will auction off 140,000 tons of wheat from state reserves on March 1. USDA export sales is delayed until Friday.

· Paris May wheat was up 2.25 euros earlier at 282 per ton, just below Paris June corn of 284.75 euros

Export Developments.

· Taiwan seeks 48,975 tons of US milling wheat on March 1 for PNW shipment between April 19 and May 3. Wheat types sought include dark northern spring, hard red winter and white wheat.

· Jordan’s state grain buyer seeks 120,000 tons of optional origin milling wheat on February 28 for shipment between Aug. 1-15 and Aug. 16-31.

· Jordan’s state grain buyer seeks 120,000 tons of optional origin feed barley for shipment between June 1-15, June 16-30, and July 1-15.

· Iraq seeks 200,000 tons of milling wheat this week from the US, Canada and/or Australia.

· Jordan’s state grain buyer bought about 60,000 tons of optional origin feed barley at an estimated $295/ton for shipment between June 1-15, June 16-30, July 1-15 and July 16-31.

· Turkey seeks an estimated 790,000 tons of milling wheat on February 28 for March 8-April 7 and April 10-May 10 shipment.

· Turkey seeks 440,000 tons of feed barley on March 2.

Rice/Other

· May rice futures tanked again today, leaving some to wonder if US plantings will live up to USDA’s 2.5-million-acre 2023 projection.

· India may extend their ban on broken rice exports and cut a 20% tax on overseas shipments of white rice.

Updated 02/22/23

Chicago – March $7.20 to $7.45, May $7.00-$8.25

KC – March $8.60-$8.90, $7.50-$9.25

MN – March $9.00 to $9.30, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |