PDF Attached

Nearby

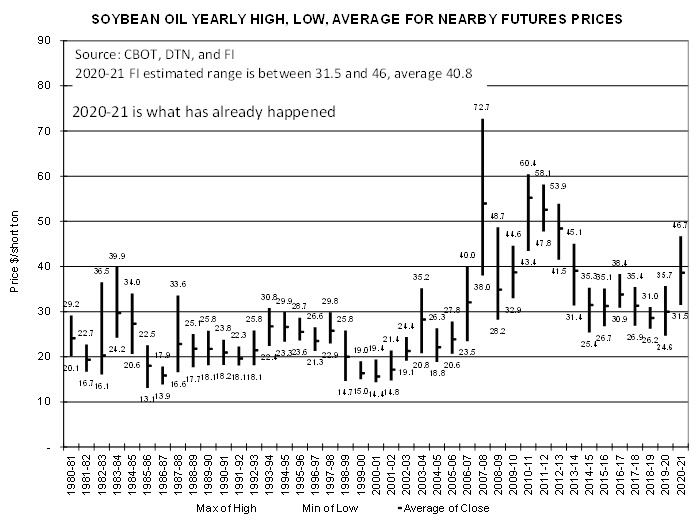

SBO crushed our 12 month outlook: SBO rises above 49.25. 46 was my predicted high in October 2020. As a LT bullish component of vegetable oil based on supplies drying up over years, never thought oils share would finally see gains around this time of year.

The

US Senate voted 92-7 in favor for Tom Vilsack as the US secretary of agriculture. Soybean oil was the feature today rising more than 2 percent on fund and option buying. First notice day for deliveries against CBOT March futures contracts is Friday. There

are 6 days left until the end of the meteorological winter.

World

Weather Inc.

MARKET

WEATHER MENTALITY FOR CORN AND SOYBEANS:

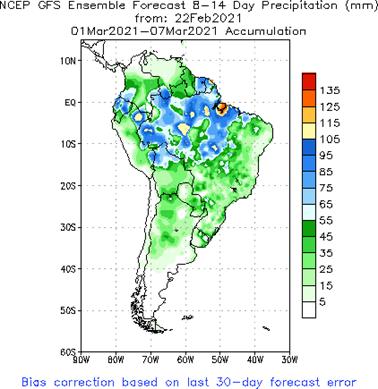

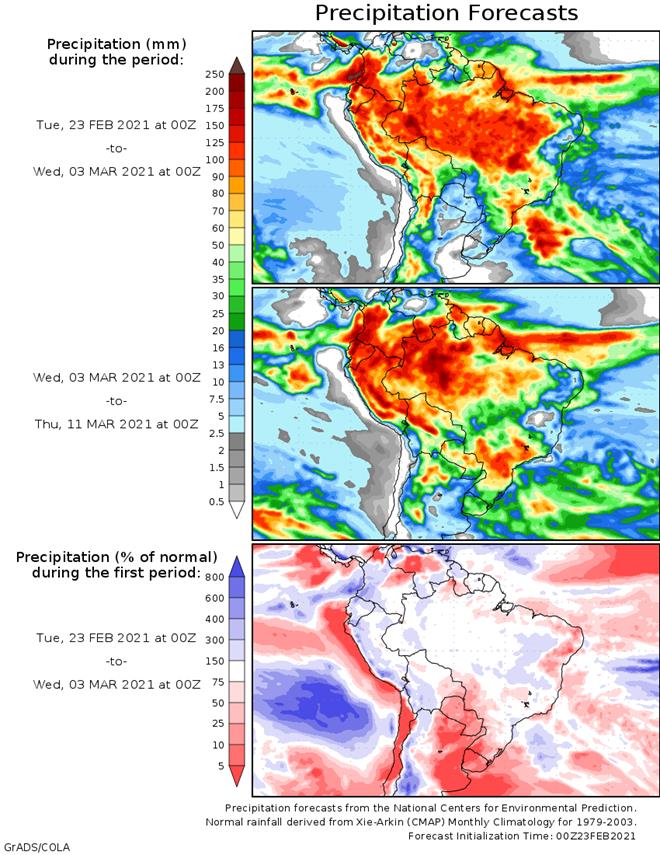

No

major trend changes were suggested this evening for Argentina or Brazil. That will leave some market concern over long term crop development potential in both countries. Pockets of crop stress in Argentina will expand and deepen over time. In Brazil, good

weather is expected in the south from southernmost Mato Grosso to southwestern Sao Paulo and into Rio Grande do Sul and Paraguay while there will be some ongoing concern about field progress and general crop and field conditions in northern and eastern Mato

Grosso and a few areas in Tocantins, Goias and Minas Gerais.

Weather

in the rest of the world is mostly not adverse enough to have much sway on market mentality. India will trend dry and warmer this week into next week and China’s southern rapeseed will continue breaking dormancy while experiencing a wetter bias in soil conditions

for a while.

Overall,

weather today will likely generate a mixed influence on market mentality with a bullish floor remaining for support.

MARKET

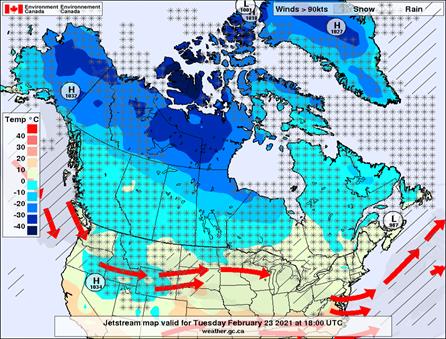

WEATHER MENTALITY FOR WHEAT: No crop damaging cold is expected around the world in the next ten days. Bitter cold is likely later this week in Russia’s southern region, but snow will precede the event tonight into Tuesday with Wednesday the coldest morning.

China

precipitation in the coming ten days will be good for future wheat development. Recent rain in India was good for minor wheat areas in the south, but the north still needs more moisture to induce the best yields.

Middle

East weather looks favorable while North Africa will still need a more generalized rain after sporadic showers occur this week.

Europe

crop areas will dry down for a while this week and that will help reduce flood potentials.

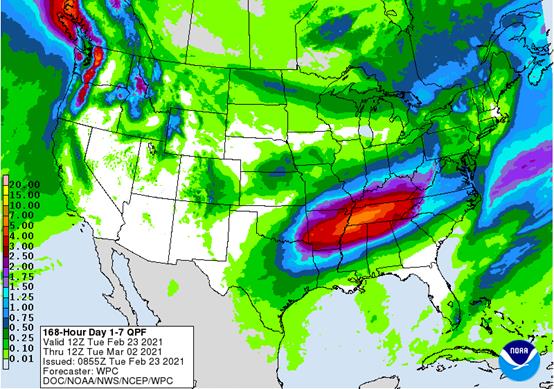

U.S.

hard red winter wheat areas may get a little more precipitation later in the week and next week, but it will be light.

U.S.

Midwest, Delta and southeastern wheat areas will stay plenty wet as will southeastern Canada.

Overall

weather today will likely produce a mixed influence on market mentality.

Source:

World Weather Inc. and FI

Wednesday,

Feb 24:

- EIA

weekly U.S. ethanol inventories, production - Amsterdam

sustainable cocoa conference (Feb 24-26) - U.S.

poultry slaughter, 3pm - MPOB

palm oil prices seminar

Thursday,

Feb 25:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - Malaysia’s

Feb. 1-25 palm oil export data - USDA

red meat production, 3pm - EARNINGS:

Minerva, BRF, FGV (tentative), Golden Agri

Friday,

Feb 26:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received, 3pm - Earnings:

Olam - HOLIDAY:

Thailand

About

5% To 10% Of Shuttered US Oil Production May Never Recover Post-Freeze -Trafigura

Philadelphia

Fed Non-Manufacturing Regional Business Activity Index Feb: 3.9 (prev -17.5)

Philadelphia

Fed Non-Manufacturing Full-Time Employment Index Feb: 2.8 (prev 3.1)

Philadelphia

Fed Wage And Benefit Cost Index Feb: 21.7 (prev 16.4)

Philadelphia

Fed Non-Manufacturing Firm-Level Business Activity Index Feb: 7.5 (prev -14.3)

Philadelphia

Fed Non-Manufacturing New Orders Index Feb: 4.0 (prev 0.2)

Canada

Factory Sales Rose 2.5% M/M In January – StatsCan Flash

Corn.

-

Corn

futures were higher (2-week high) on follow through buying and sharply higher soybeans. Lower wheat was seen capping gains but as prices turned nearby corn caught a bid. March and May corn are back above the psychological $5.50 level. Higher WTI crude oil

is aiding gains. -

Funds

bought an estimated net 7,000 corn contracts. -

China

apparently is not out of the woods to achieve fully pre ASF hog production, at least in the northern provinces. Cold weather has increased the spread of the disease, according to a Bloomberg article. One analyst they cited noted China’s hog herd could have

fallen as much as 15 percent over the winter from new outbreaks, including new variants. Pork prices will help sort through actual supply as about 90 percent of the population has returned back to normal levels from Covid restrictions.

-

Poland’s

egg supply is threatened by bird flu outbreaks across Europe, particularly Poland. Bird flu cases are approaching 2016 levels. Prices for eggs on the wholesale market in Poland increased by about 18% to 20% at the end of January.

-

Soybean

and Corn Advisory: -

2020/21

Brazil Corn Estimate Unchanged at 105.0 Million tons -

2020/21

Argentina Corn Estimate Unchanged at 45.5 Million Tons -

A

Reuters poll calls for South Africa’s CEC to initially report their 2020-21 corn production at 16.872 million tons, up from the 15.300 million tons last season. The first survey of the season is expected to show 8.929 million tons of white maize and 7.943

million tons of yellow maize. They will release the report on Thursday. -

A

Bloomberg poll looks for weekly US ethanol production to be down 92,000 barrels (727-910 range) from the previous week and stocks down to 207,000 barrels to 24.090 million.

Corn

Export Developments

·

None reported

Updated

2/22/21

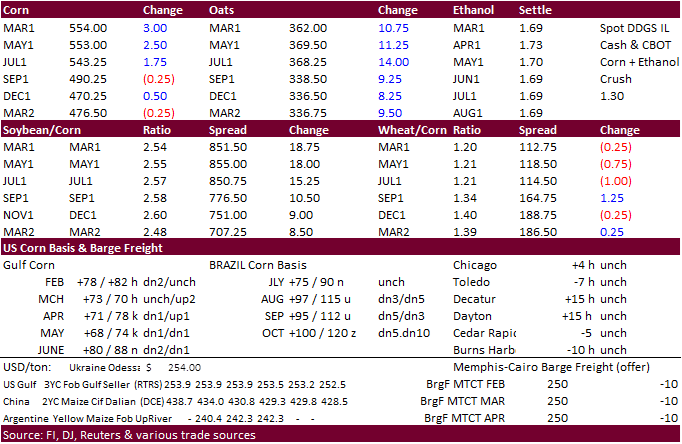

March

corn is seen trading in a $5.25 and $5.75 range.

May

corn is seen in a $5.15 and $6.00 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.75-$6.00 range.