PDF Attached

Higher USD, sharply lower WTI crude oil, and other widespread commodity selling triggered profit taking in US agriculture markets. Soybean oil ended mixed.

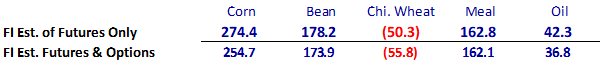

Daily estimate of funds

Light rain will favor Cordoba, Santa Fe, Entre Rios, southeast Buenos Aires Wednesday. Brazil’s Mato Grosso, Goias, south Minas, Sao Paulo, MGDS, Parana, and Santa Catarina through Saturday. The US will see multiple weather warnings/watches this week coast to coast. The upper US, today bias ECB, will see a winter storm through Thursday. Snow is expected to fall across north NE, north CO Wed, rain in east KS, east OK, east TX, and then rain for east OK Friday through Saturday. Some northern Plain states could see 2 feet of snow.

WORLD WEATHER HIGHLIGHTS FOR FEBRUARY 22, 2023

- Another week of poor rainfall is expected in southern Argentina and then some increase in shower activity is possible

- Brazil weather will continue moist over the next two weeks with periods of rain maintaining some challenge for soybean maturation and harvesting as well as Safrinha corn planting

- Progress will be made, albeit slowly especially in Parana, Sao Paulo, eastern Mato Grosso do Sul and southern Minas Gerais

- Net drying is likely in parts of northeastern Brazil

- Timely rain is expected in Rio Grande do Sul

- Bitter cold in Canada and the north-central U.S. will prevail into the weekend, but warming should follow for a few days before another round of bitter cold evolves in early March

- U.S. hard red winter wheat areas will not be harmed by the coming bitter cold because the coldest areas will get snow ahead of the coldest conditions

- West-central and southwestern portions of the U.S. Plains will continue drier biased for the next two weeks

- Unusually warm temperatures in the southern Plains, Delta and southeastern United States will continue through the weekend and then trend a little cooler next week

- Northern Europe and northwestern Asia will turn cooler in week 2 of the outlook, but temperatures will be warm in this first week of the outlook

- Southeastern China will be drier than usual over the next two weeks, but today’s soil moisture is favorably rated for rapeseed and the coming rice planting season

- Wheat in China is still in good condition with little change likely

- Snow and some rain will fall frequently in western Russia and Ukraine to maintain high flood potentials in the spring

- Negative North Atlantic Oscillation will bring cooler weather to northern Europe and a more active weather pattern across southern Europe and possible in North Africa as well

Source: World Weather and FI

Wednesday, Feb. 22:

- National Farmers’ Union Conference, Birmingham, day 2

- Grain Forum Dubai 2023, day 2

- USDA total milk production, 3pm

- US poultry slaughter, 3pm

Thursday, Feb. 23:

- Suspended until February 24 – CFTC commitments of traders

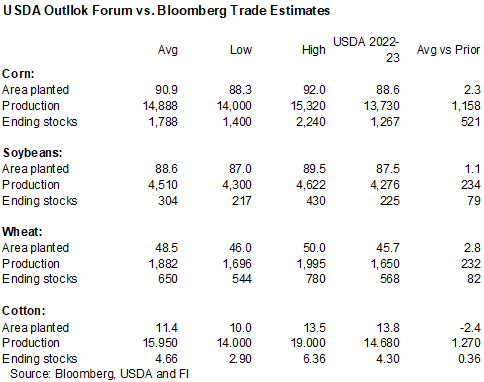

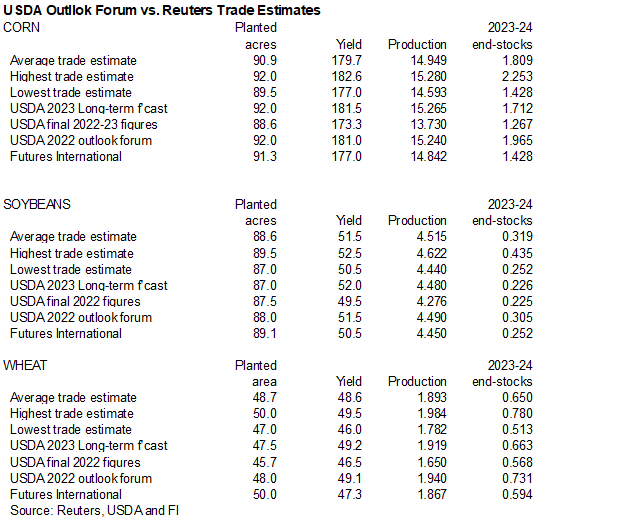

- USDA’s acreage outlook for corn, soy, wheat and cotton

- The USDA’s Agricultural Outlook Forum, Arlington, day 1

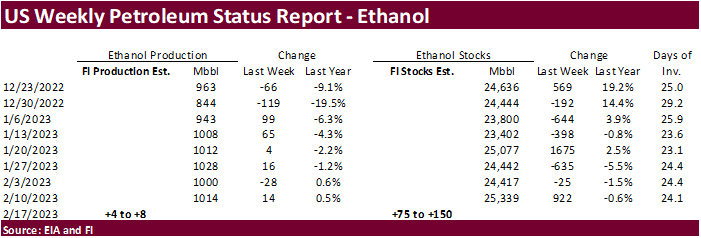

- EIA weekly US ethanol inventories, production, 10:30am

- Port of Rouen data on French grain exports

- Sugar production and cane crush data from Brazil’s Unica (tentative)

- USDA red meat production, 3pm

- HOLIDAY: Russia

Friday, Feb. 24:

- USDA’s full outlook for corn, soy, wheat and cotton

- The USDA’s Agricultural Outlook Forum, Arlington, day 2

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options, 3:30pm

- FranceAgriMer’s weekly crop conditions reports

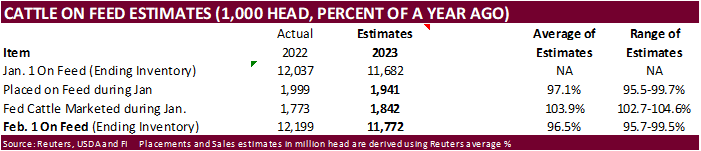

- US cattle on feed, 3pm

- US cold storage data for beef, pork and poultry, 3pm

Macros

100 Counterparties Take $2.114 Tln At Fed Reverse Repo Op. (prev $2.046 Tln, 100 Bids)

US MBA 30-Yr Mortgage Rate Feb 17: 6.62% (prev 6.39%)

US MBA Mortgage Applications Feb 17: -13.3% (prev -7.7%)

US Home-Purchase Applications Drop To 28-Year Low As Rates Jump – BBG

Redfin Reports U.S. Homeowners Have Lost $2.3 Trillion in Value Since June Peak

Median U.S. Home Sale Price Was $383,249 In Jan

Canada New Housing Price Index Jan: -0.2% ( prev 0.0%)

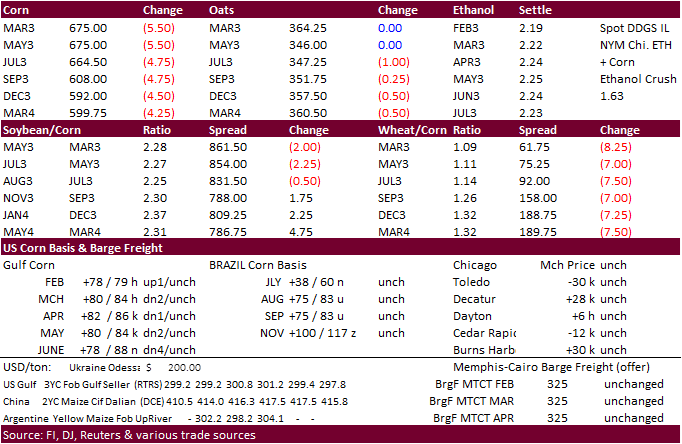

· With lack of news, corn futures followed weakness in soybeans and wheat. A higher USD and large decline in WTI crude oil prices added to the negative undertone. Early Thursday the trade will get a glimpse what USDA thinks for US new-crop supply and ending stocks. https://www.usda.gov/oce/ag-outlook-forum

· Cold temperatures this week for the northern US may slightly increase feed demand.

· Anec estimated Brazil will export 1.99 million tons of corn during the month of February, down from 2.11 projected week earlier and above 1.5 million tons exported year ago.

· USDA Cattle on Feed report is due out Friday and traders are looking for February 1 on feed to be reported slightly above January but down 3.5 percent from a year ago.

· A Bloomberg poll looks for weekly US ethanol production to be up 6,000 thousand barrels to 1020k (1015-1028 range) from the previous week and stocks up 60,000 barrels to 25.399 million.

Due out Friday…

Export developments.

Updated 02/22/23

March corn $6.60-$6.90 range. May $6.25-$7.15

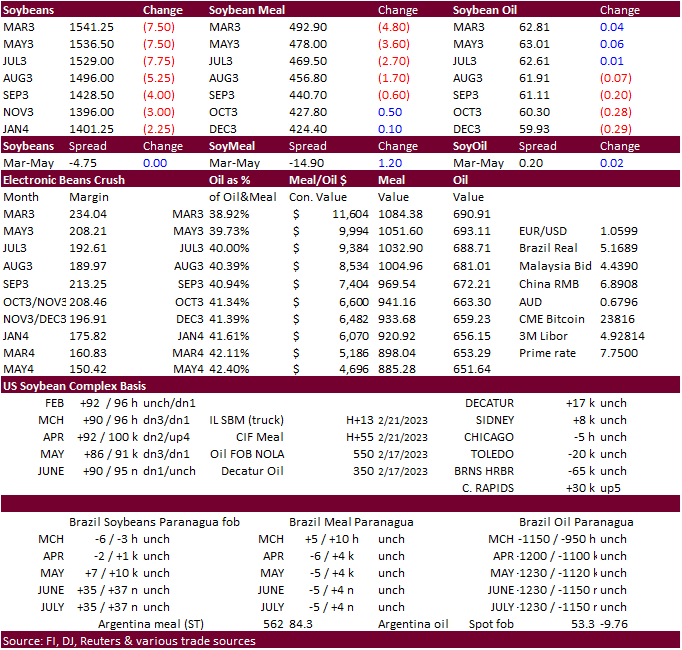

· Soybeans fell on profit taking and increase in Brazil harvest progress over the past week, but Brazil soybean collection is not expected to accelerate all that much this week with rain in the forecast. Crop quality, truck transportation, and shipments delays could become issues with the persistent rain. Soybean meal fell led by the nearby contract. Front month meal futures still hold a significant premium over back months, leading some to wonder if a large drop in spot SA and US cash prices could be on the horizon. Soybean oil traded two-sided, ending mixed led by bull spreading. Sharply lower crude trimmed earlier gains for soybean oil. India may slow sunflower imports due to uncertainty over Black Sea shipments, according to an article by AgriCensus. A disruption in sunflower oil exports out of the Black Sea coupled with the current slowdown in Argentina crush could shift some soybean oil business to Brazil and the US, in our opinion, and keep palm oil imports at high levels.

· Argentina soybean production is largely estimated by the trade between 30 and 34 million tons. We are at 34MMT. USDA is at 41 million tons. Corn production is seen around 40 to 43 million tons.

· Anec estimated Brazil will export up to 8.3 million tons of soybeans during the month of February, down from 9.39 projected week earlier and down from 9.1 million tons exported year ago. Brazil soybean meal exports were estimated at 1.54 million tons, above 1.86MMT projected week earlier.

· Brazil will see rain over the next 7-10 days, further delaying soybean harvesting progress and second corn planting progress. Second corn plantings usually wrap up by the end of this month but this year it will spill over into March.

· Palm oil futures hit a 7-week high after outside markets rallied on Tuesday over Argentina crop concerns.

· Malaysia will leave its March palm oil export tax at 8 percent and lowered the reference price to 3,710.35 ringgit ($835.85) per ton from 3,893.25 ringgit a ton from February.

Export Developments

· Turkey’s state grain board TMO seeks about 48,000 tons of crude sunflower oil Feb. 24 for delivery March 13-April 13 and April 14-May 14.

Updated 02/22/23

Soybeans – March $15.00-$15.50, May $14.75-$16.00

Soybean meal – March $480-$505, May $425-$500

Soybean oil – March 62.50-63.20, May 58-70

Wheat

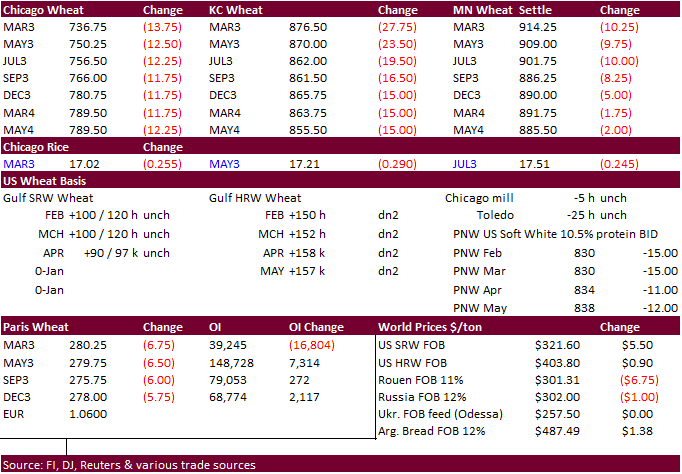

· US wheat futures extended losses from Russia competition. Lowest offer for Egypt in for wheat was $317.50/ton for Russian wheat. No results have been reported at the time this was written. Geopolitical concerns with Chinese leaders planning to travel to Russia were shrugged off. Several global import tenders were announced but many of them are not expected to be of US origin due to Black Sea and Australian prices.

· Paris May wheat was down 6.50 euros at 279.75 per ton, just below Paris June corn of 283.75 euros per ton.

· France has seen its driest winter in 64 years (1959), and they may start rationing water use.

· Ukraine is aiming to keep the grain 2023 planted area the same size as 2022. They want to see additional ports added to the grain export deal, if extended. Ukraine would ideally like to see it extended for one year.

Export Developments.

· Turkey seeks 440,000 tons of feed barley on March 2.

· Iraq seeks 200,000 tons of milling wheat this week from the US, Canada and/or Australia.

· Lowest offer $317.50 per ton for Russian wheat: Egypt’s GASC seeks wheat funded by the World Bank for April 1-15 shipment. They are in for cargoes of 30,000, 40,000 or 50,000, 55,000, or 60,000 tons plus or minus 5% from the last crop for supply C&F.

· Jordan’s state grain buyer bought about 60,000 tons of optional origin feed barley at an estimated $295/ton for shipment between June 1-15, June 16-30, July 1-15 and July 16-31.

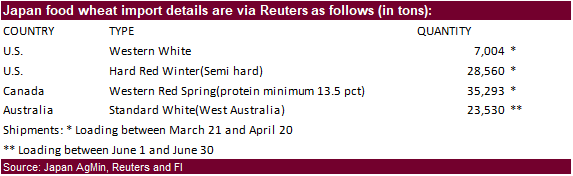

· Japan bought 94,387 tons of food wheat later this week. Original details as follows.

· Turkey seeks an estimated 790,000 tons of milling wheat on February 28 for March 8-April 7 and April 10-May 10 shipment.

Rice/Other

· May rice futures tanked today and yesterday after 1000+ sell orders/day. The wipe out in rice prices is leading some to think little if any expansion un US plantings for 2023. That would be three years in a row of low US rice area, which could lead to an explosion to the upside in rice prices later this crop year is US stocks continue to decline.

· Egypt’s GASC bought 50,000 tons of imported white rice from their tender announced earlier this month. The rice might be sold through the Egyptian Mercantile Exchange.

Updated 02/22/23

Chicago – March $7.20 to $7.45, May $7.00-$8.25

KC – March $8.60-$8.90, $7.50-$9.25

MN – March $9.00 to $9.30, $8.00-$10.00

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |