PDF Attached

Equity

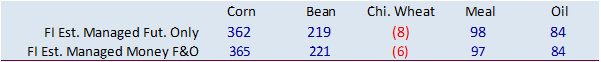

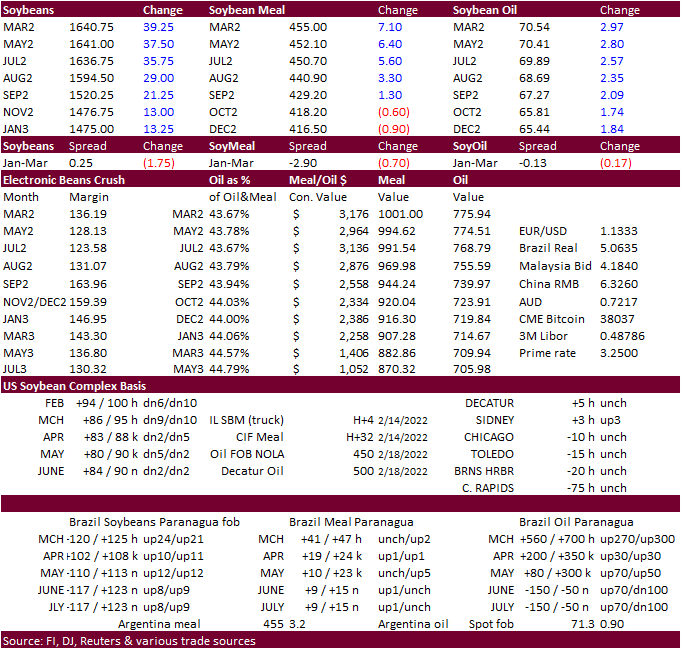

to commodity fund flow was in focus today. Ags were hot today compared to energies and metals. Chicago and KC wheat were some of the many leaders. Corn and soybean oil saw a boost from higher energy prices and outright fund buying. Soybeans rallied on SA

supply concerns and sharply higher wheat prices. Soybean meal traded two-sided, in part to product positioning with sharply higher SBO, and ended higher. Risk off is not out of question later this week as South American weather will improve. The USDA Agriculture

Forum will be held Thursday and Friday and the trade will get a glimpse of 2022 US supplies on Thursday, followed by full S&D’s Friday morning.

https://www.usda.gov/oce/ag-outlook-forum

Private

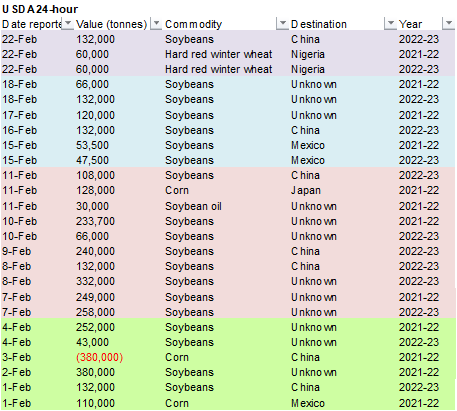

exporters reported the following activity:

-120,000

metric tons of hard red winter wheat for delivery to Nigeria. Of the total, 60,000 metric tons is for delivery during the 2021/2022 marketing year and 60,000 metric tons is for delivery during the 2022/2023 marketing year

-132,000

metric tons of soybeans for delivery to China during the 2022/2023 marketing year

WEATHER

EVENTS AND FEATURES TO WATCH

- Argentina’s

weather outlook is still wet looking for the coming week to ten days with all areas in the nation getting rain at one time or another by mid-week next week

- The

change occurred during the weekend suggesting greater rainfall than that advertised late last week – the change should verify - World

Weather, Inc. has been expecting this change and it is being advertised at about the same time our Trend Model suggested which adds confidence that this change will verify - Argentina

will experience restricted rainfall into Wednesday morning, but rain will develop late Wednesday and Thursday in much of the central and south (including the drier areas noted above) - Follow

up rainfall is expected Friday into the weekend impacting east-central and northern crop areas

- Northern

Argentina may continue getting some showers early next week - The

precipitation will see to it that all of the nation gets relief from dryness at one time or another. Some of the amounts advertised are a little too aggressive, but there will be sufficient amounts to stop the decline in late summer crop conditions and production

potentials – at least for a while - Seasonal

weather changes expected in March will make it very difficult for there to be a return of dryness to the levels seen in recent weeks, but there will be some breaks in the precipitation periodically - Rain

totals will vary from 1.00 to 2.00 inches in the central and south with a few areas getting 2.00 to more than 3.00 inches - Northern

Argentina’s rainfall is supposed to be significant in the interior north, but there may still be a little drier bias in parts of the region after next week - Future

model runs may back off of some of the predicted rain, but the coverage will remain sufficient to improve cop and field conditions in central parts of the nation while maintaining good soil moisture in the south - Argentina

rainfall during the weekend was scattered through portions of Buenos Aires, La Pampa, San Luis and Cordoba with a few showers and thunderstorms in northwestern parts of the nation as well - The

precipitation helped to maintain favorable crop moisture in these areas - Dry

weather occurred in most other areas of Argentina; including the areas that were drying out last week in central and northern Santa Fe, Corrientes, Chaco, southeastern Santiago del Estero and parts of Entre Rios - Crop

moisture stress remains high in central and northeastern parts of Argentina and rain is needed to support late season crops - Brazil

rainfall is still advertised to be a little lighter than usual in the interior south, but Rio Grande do Sul and immediate neighboring areas should get sufficient rain to improve topsoil moisture like that of Argentina - Mato

Grosso do Sul will be most closely monitored for less than usual rainfall along with a few areas in neighboring northern and western Parana - Northern

Brazil weather is still expected to see improving conditions later this week with less frequent and less significant precipitation that would help to mature late season soybeans and other crops faster after a prolonged period of wet weather - Brazil

rainfall during the weekend was still concentrated on areas from Mato Grosso to Minas Gerais and in portions of Bahia and Tocantins - The

greatest rainfall occurred in the northern half of Mato Grosso where fieldwork may have been most delayed.

- Net

drying occurred during the weekend from Mato Grosso do Sul and Sao Paulo into parts of Rio Grande do Sul - Temperatures

were warm enough to accelerate drying in the rain-free areas leading to more crop stress for areas that were already short of moisture late last week - Coffee,

citrus and sugarcane production areas in Brazil are still rated favorably with little change likely over the next ten days - Bitter

cold returning to central North America - Extreme

lows early this this week will drop to near -40 Fahrenheit in Saskatchewan and -28 near the U.S. border in the northern Plains - Temperatures

will fall below zero Fahrenheit into the central U.S. Plains during mid- to late-week this week - U.S.

hard red winter wheat will be vulnerable to some damage, but much will depend on wind speeds, cloud cover and snow cover - U.S.

hard red winter wheat temperatures during the weekend rose into the 60s and 70s Fahrenheit after being very cold earlier last week - The

constant bouncing of temperatures from one extreme to the other is creating heaving soil which may be damaging root systems - The

frequent warming has also reduced winter hardiness making some of the extreme temperature falls a little more of a concern for some of the wheat crop especially that which was not well established last autumn.

- Spring

will need to be mild to cool and moist for any damaged wheat to recover from the impact of drought and wild temperature swings - The

prospects for spring weather are going to be about the same as they have been with restricted precipitation and wild temperature swings - Mid-spring

temperatures will be warmer than usual and that will not bode well for the crop if dryness is still prevailing - Winterkill

is not expected from the wild weather this week, but plant injury is possible making a cool and wet spring a necessity to recover wheat production - Southern

U.S. Plains weekend temperatures peaked in the 60s and 70s with a few extreme near 80 degrees Fahrenheit in the southeastern Texas Panhandle

- Temperatures

in Kansas, Colorado and Nebraska will slip back to the negative and positive single digits during middle to latter part of this week for morning low temperatures - Very

little snowfall is expected in the U.S. central or southern Plains this week leaving wheat vulnerable to the cold - Some

snow is expected, but strong wind speeds will blow much of the snow off of crops leaving them exposed to the colder weather - Snow

and blowing snow across the U.S. northern Plains and upper Midwest Monday will linger while diminishing today - Snow

accumulations of 3 to 10 inches have occurred with Nashua, MN reporting 17 inches.

- U.S.

Midwest storm will evolved overnight and will continue today producing near blizzard conditions across the northern parts of the region and moderate rain and some thunderstorms to the south - Strong

wind speeds will also occur with gusts of 20-40 mph possible in the upper Midwest resulting in blowing and drifting snow - Additional

snow accumulations from portions of the Dakotas and across the Great Lakes region will vary from 2 to 5 inches favoring Minnesota, Wisconsin and northern Michigan - A

second U.S. Midwest storm is expected during the latter part of this week producing more rain, freezing rain, sleet and snow.

- Flooding

is expected in the lower U.S. Midwest, Tennessee River Basin and northern Delta this week as another 2.00 to nearly 5.00 inches of rain results from the two storm systems noted above.

- Concern

about spring planting concerns in Delta and Tennessee River Basin may evolve during March when it becomes obvious the frequent rainfall pattern will continue - U.S.

southeastern states will experience net drying this week and temperatures will be quite warm to hot for a while through the middle part of this week - Daily

afternoon temperatures will peak in the 70s and some 80s to accelerate drying - The

drier and warmer than usual pattern is probably going to be seen more often in the next few weeks raising concern over planting moisture in some areas of Florida, southern Georgia, southeastern Alabama and parts of South Carolina - It

will not be absolutely dry and each time rain falls there will be some support for a little planting and emergence of early season crops next month - West

Texas rainfall will continue restricted over the next ten days to two weeks resulting in rising concern over short soil moisture for the planting season which occur in May for cotton and a little sooner for corn and some other crops - California

precipitation is expected to be lighter than usual during the next ten days leaving some concern over mountain snowpack and snow water equivalency for runoff when the snow melts this spring and summer - Ecuador,

Peru and Colombia crop areas will continue to see frequent rain over the next week maintaining moisture abundance for some areas and raising soil moisture in other areas - Southern

China experienced flooding rain during the weekend - Rainfall

ranged from 4.00 to 8.00 inches with local totals as great as 11.81 inches - Flooding

occurred in rice and sugarcane production areas - The

moisture may be good for early rice planting that usually begins in March, but if drier weather does not evolve soon that planting could be delayed - Sugarcane

needs drier weather to support a better start to the growing season - Southern

China will get a break from recent wet weather this week with much less rain and less frequent precipitation.

- Temperatures

should trend a little warmer, but they will be cooler biased for a while this week. - Most

other areas in China are experiencing mostly good crop and field conditions - Wheat

and rapeseed are mostly dormant or semi-dormant, but poised to perform well this spring if temperatures warm up normally in March and April - Some

rapeseed areas in the Yangtze River Basin have been too wet recently and this week’s drier weather will be welcome - Northern

Vietnam and northern Laos received a general soaking rain during the weekend - The

precipitation was a part of the same system that also impacted southern China.

- Some

flooding resulted when rain totals reached up over 5.00 inches - The

precipitation was great enough to possibly induce some premature coffee flowering, although cool temperatures might have helped to curtail that event - Some

winter rice crop quality decline might have occurred - Drier

weather is expected over the next week to ten days - Indonesia

and Malaysia weather during the weekend was mixed with lighter than usual precipitation from Peninsula Malaysia through much of Sumatra - Rainfall

elsewhere was more plentiful except in a few areas of eastern Java and southern Kalimantan where rainfall was also lighter than usual - Philippines

rainfall during the weekend was sporadic and mostly too light for a boost in soil moisture except in Mindanao where southeastern parts of the Island received 1.00 to 2.00 inches of rain. - Spain

and Portugal need greater rainfall for their unirrigated winter and spring crops. Dryness could fester into a larger problem in the next few weeks as new crop development begins - Some

showers are expected late this week into early next week, but the distribution of rain may prove disappointing and much more rain will still be needed for unirrigated crops - Northwestern

Africa continues too dry, but some showers will develop this weekend into next week and any precipitation that occurs will be welcome - Morocco

is driest with a cut in area planted in the southwest because of a multi-year drought and no irrigation water - North-central

Morocco crops were favorably established in the autumn, but are dry now and need significant moisture soon to support aggressive crop development ahead of spring reproduction - Northeastern

Morocco and northwestern Algeria are also quite dry and poised to suffer a production cut without significant rain soon - Northeastern

Algeria and Tunisia winter wheat and barley are best established and have the greatest potential for high yields as long as timely rain falls over the next few weeks

- Greater

rain will still be needed, but any moisture in the coming week to ten days will be helpful giving the driest crops more time to avoid worsening stress until greater rain evolves - Most

of Europe outside of the Iberian Peninsula and parts of Romania are favorably moist with routinely occurring precipitation in the next ten days supporting status quo winter crop conditions.

- Greater

rain must occur soon for Spain and Portugal and at some time in the next few weeks in Romania to prevent dryness from threatening early season crop development - Weather

in the coming ten days will produce light and somewhat erratic precipitation, but soil moisture is good except as noted above leaving the outlook relatively benign on agriculture.

- Western

Russia, northwestern Ukraine, Belarus and Baltic States have abundant soil moisture underneath a significant accumulation of snow - Flood

potentials may be high for the spring this year if the region heats up too fast and all of the snow melts over a short period of time - There

is no threatening cold temperatures expected in Europe or any part of Europe during the next ten days to two weeks - Temperatures

will be above normal especially in Russia, Ukraine and eastern Europe - Kazakhstan

and southern Russia’s New Lands will receive only light amounts of precipitation in the next ten days, but any moisture would be welcome for improved topsoil conditions in the spring - Recent

snowfall has changed the early spring moisture outlook at least a little, but the region still has moisture deficits left over from drought last summer and greater precipitation will be needed in the spring.

- Middle

East winter crop conditions have improved in recent weeks because of a short term boost in precipitation, but more rain is needed to ensure the best possible production - Some

precipitation is expected in the coming ten days, but it will be greatest in Turkey - Other

areas may need greater precipitation soon - India

precipitation will be limited to a few sporadic very light showers during the next ten days except in the far north and extreme east where some moderate rain may impact a few areas - The

bulk of winter crops in the nation are poised to perform well barring no excessive heat in the next few weeks - At

least one more timely rain event would help push yields high than usual - Xinjiang,

China precipitation is expected to be restricted during the next week to ten days - The

province need moisture to support spring planting in a few weeks - Eastern

Australia’s summer crop areas will receive isolated to scattered showers and thunderstorms this week - The

resulting precipitation will be ideal for reducing moisture stress in unirrigated crops, although greater volumes of rain might still be needed for the late maturing crop - The

precipitation might not be as well distributed as desired, but the majority of most important cotton and sorghum areas will get at least a little moisture - Irrigated

crops will remain in mostly favorable condition - South

Africa rainfall will during the weekend was scattered over a large part of the nation, although the greater amounts were pocketed limiting the areas getting the most significant moisture - This

week’s weather will produce rain in the east from eastern Limpopo through Mpumalanga to Natal and Eastern Cape while other areas experience net drying - Precipitation

may continue in this manner into early next week before there is much chance for rain in western production areas - Summer

crop conditions are still rated quite favorably. - West-central

Africa coffee and cocoa production areas will experience additional showers in the coming week, but the precipitation will stay confined to coastal areas - There

is some potential for greater rain in Ivory Coast and Ghana next week - East-central

Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia

is dry biased along with northern Uganda and that is also normal - Today’s

Southern Oscillation Index is +10.11 - The

index will move erratically for a while this week - Mexico

will experience seasonable temperatures and a limited amount of rainfall during the coming week - Central

America precipitation will be greatest along the Caribbean Coast during the next seven to ten days - Guatemala

will also get some showers periodically - Tropical

Cyclone Emnati was located 186 miles north northwest of St. Denis, Reunion Island at 18.1 south latitude and 53.1 east longitude moving west southwesterly at 7 mph while producing maximum sustained wind speeds of 115 mph.

- The

storm will be the fourth since mid-January to impact Madagascar - Very

strong wind, heavy rain and flooding will damage crops and property - Emnati

also had an indirect impact on sugar production areas in Reunion and Mauritius during the weekend with waves of heavy rain causing floods and other impacts.

Source:

World Weather Inc.

Bloomberg

Ag Calendar

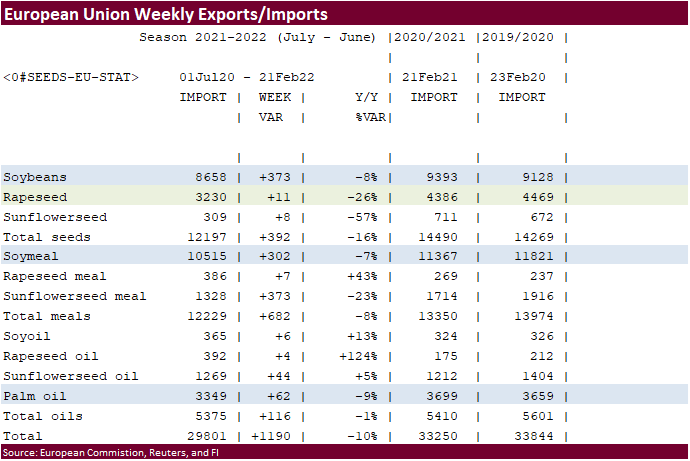

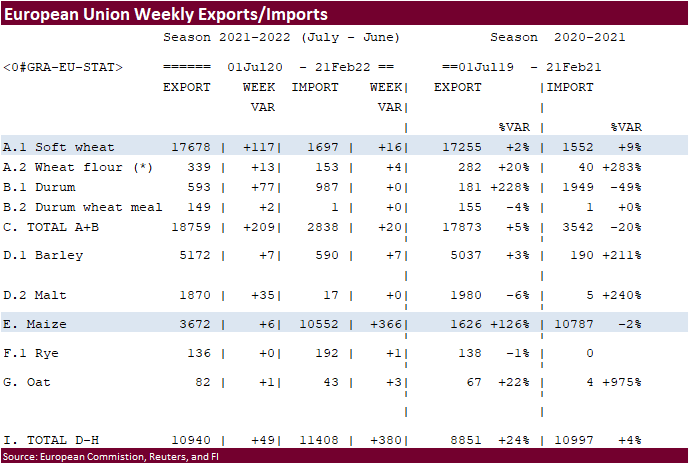

- EU

weekly grain, oilseed import and export data - Brazil’s

Unica may release cane crush and sugar output data during the week (tentative) - U.S.

cold storage data for beef, pork and poultry, 3pm - EARNINGS:

Wilmar International

Wednesday,

Feb. 23:

- USDA

total milk production, 3pm - EARNINGS:

IOI Corp. - HOLIDAY:

Japan, Russia

Thursday,

Feb. 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

corn, cotton, soybean and wheat acreage outlook, 8:30am - EIA

weekly U.S. ethanol inventories, production, 11am - U.S.

red meat production, 3pm

Friday,

Feb. 25:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

corn, cotton, soybean and wheat end-stockpile outlook, 8:30am - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Feb. 1-25 palm oil exports - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

Soybean

and Corn Advisor

2021/22

Brazil Soybean Estimate Unchanged at 124.0 Million Tons

2021/22

Argentina Soybean Estimate Lowered 1.0 mt to 39.0 Million

2021/22

Paraguay Soybean Estimate Unchanged at 5.0 Million Tons

2021/22

Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22

Argentina Corn Estimate Lowered 1.0 mt to 49.0 Million

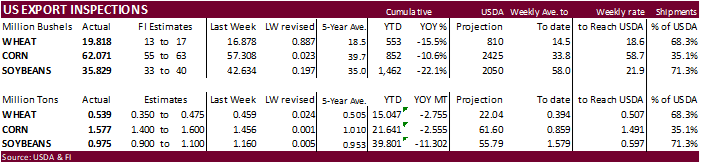

USDA

inspections versus Reuters trade range

Wheat

539,366 versus 200000-475000 range

Corn

1,576,666 versus 1000000-1750000 range

Soybeans

975,102 versus 900000-1250000 range

Macros

ICE

is adjusting margins for US gas

Germany

halted the Nord Stream 2 Baltic Sea gas pipeline project over the Ukraine/Russian situation.

US

FHFA House Price Index (M/M) Dec: 1.2% (est 1.0%; prev 1.1%; prevR 1.2%)

US

House Price Purchase Index (Q/Q) Q4: 3.3% (prev 4.2%)

US

Consumer Confidence Data

–

Consumer Confidence Feb: 110.5 (est 110.0; prev R 111.1)

–

Present Situation: 145.1 (prev R 144.5)

–

Expectations: 87.5 (prev R 88.8)

81

Counterparties Take $1.699 Tln At Fed Reverse Repo Op (prev $1.675 Tln, 79 Bids)

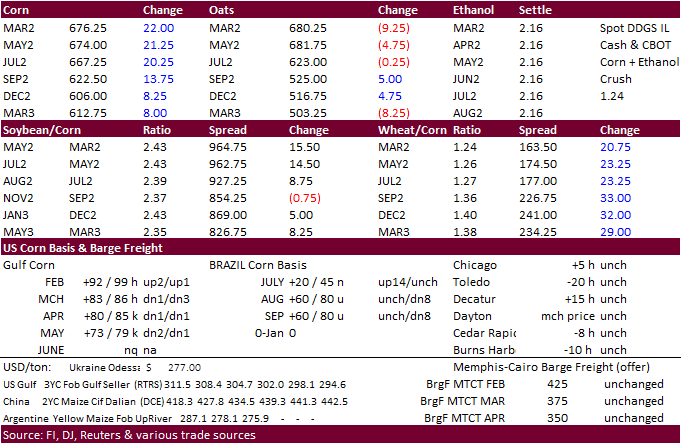

Corn

·

Most US commodities rallied on Tuesday after a three day holiday weekend (US & Canada) after Russia proclaimed separatist republics in eastern Ukraine. Sharply higher wheat futures and strength in energy prices supported corn

with nearby rolling spot prices reaching their highest level since July 2021.

·

March corn closed 20.50 cents higher, May up 19.75 and December up 8.00 cents.

·

One speculation for the strong bullish undertone in nearby corn was that China may shift away from Ukraine corn imports and take US corn. There is a large book on for Ukraine corn but unsure what that amount is around these days.

China also took 555,300 tons of US corn last week according to export inspections.

·

We think there could be some risk off selling later this week if Black Sea tensions ease, but that’s open for debate. Also, the Argentina and southern Brazil weather outlook improved from Friday’s forecast

·

Argentina will see rain will develop late Wednesday and Thursday in much of the central and south growing areas.

·

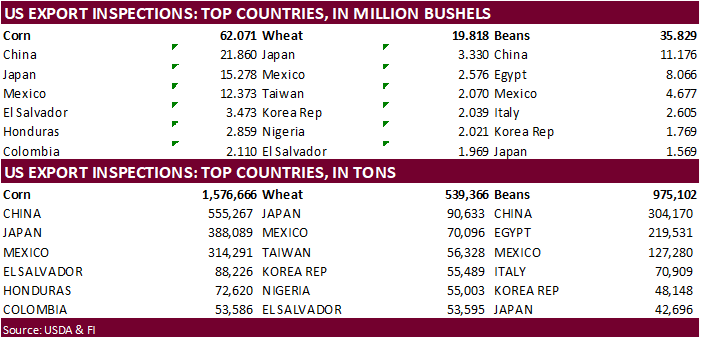

USDA US corn export inspections as of February 17, 2022 were 1,576,666 tons, within a range of trade expectations, above 1,455,693 tons previous week and compares to 1,277,332 tons year ago. Major countries included

China for 555,267 tons, Japan for 388,089 tons, and Mexico for 314,291 tons.

·

The US EPA is working on getting back on track to expand biofuels, including the review of all pending small refinery exemption applications. Last year, the EPA proposed denying all pending SREs, but also could change. No blending

targets have been finalized. June 3 was mentioned by Bloomberg as a deadline for US blending quotas.

·

CME lean hogs were up sharply today. Some believe China’s initiative to stockpile reserves has driven prices higher over the past couple of months. US export commitments on the other hand have been steady over recent weeks. We

think US worker shortages, which have been a problem since the beginning of the pandemic, have contributed to higher prices.

·

China banned poultry imports from Canada over bird flu concerns. If US cases continue to increase, that could be negative prices if countries take action.

·

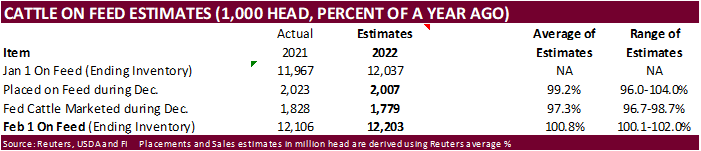

Bloomberg: LIVESTOCK SURVEY – U.S. Cattle on Feed Placements Seen Down 0.8%. January placements onto feedlots seen falling y/y to 2.01m head, according to a Bloomberg survey of ten analysts.

·

Reminder early Friday, USDA releases 2022-23 US S&D’s. Some acreage numbers will be out Thursday. March Intentions estimates should be a hot topic from late this week until release.

Export

developments.

- Taiwan’s

MFIG seeks up to 65,000 tons of corn which from the United States, Brazil, Argentina or South Africa, on Friday, Feb. 25, for shipment between May 1 and early June shipment, depending on origin.

Updated

2/22/22

March

corn is seen in a $6.35 and $7.10 range

December

corn is seen in a wide $5.50-$7.25 range

·

CBOT soybeans traded sharply higher in part to a 258 point rally in March soybean oil. Soybean oil was sharply higher on strength in energy markets and a large jump in Black Sea sunflower oil cash prices. Rotterdam vegetable oils

were also sharply higher from Friday levels. Soybean meal traded two-sided, ending higher in the front 5 months. Back month meal futures settled lower.

·

Brazil’s advancement of soybean harvesting may have limited upside movement in back month CBOT soybean futures, which ended 9.50 cents higher basis November compared to 29.25-33.50 cents for the March, May and July. Brazil is

a third complete with soybean harvest and compares to 24% week earlier and 15% year ago.

·

While Argentina and southern Brazil will see improving weather starting Wednesday, there are still crop concerns. The Buenos Aires Grain Exchange said only 31% of Argentina’s soybean crop were rated good or excellent, down from

37% the previous week.

·

AgRural forecasts Brazil’s 2021/22 soybean crop at 128.5 million tons, down 17 million tons from its initial forecast, but a new revision is expected in the coming days. (Rueters)

·

USDA US soybean export inspections as of February 17, 2022 were 975,102 tons, within a range of trade expectations, below 1,160,320 tons previous week and compares to 804,038 tons year ago. Major countries included China for 304,170

tons, Egypt for 219,531 tons, and Mexico for 127,280 tons.

·

China is looking to invest money in its state grain storage and processing plants to improve efficiency. This comes after a series of announcements last week to cut back on import dependency.

·

China will auction off soybeans from state reserves, but details of this announcement are lacking. Last week some Chinese crush plants were having a hard time sourcing soybeans, forcing them to slow or temporally shut down.

AgriCensus later noted there were rumors China may release 5 million tons of soybeans, and that could easily affect the amount of imports needed this year. We are now thinking Chinese imports for the October-September period at around 95.5 million tons, below

USDA’s 97 million. 99.76 MMT were imported during 2021-22.

·

Argentina grain inspectors launched a small 24-hour strike at selected port locations, but the trade thinks it will/will have little impact on flows.

·

The BA Grains Exchange issued a gloomy long term weather forecast for Argentina and looks for soybeans yields to decline through the end of March.

https://www.bolsadecereales.com/

·

SGS reported Malaysian February 1-20 palm oil exports up 30.5 percent to 817,088 tons from 626,029 tons during the same period month ago. AmSpec reported a 29.2 percent increase and ITS 24.9 percent rise from month ago.

·

The Malaysian palm oil market saw a volatile swing on Tuesday after prices hit a record high. The higher soybean oil and energy trade Tuesday morning/afternoon could spill into that market tonight.

·

Indonesia’s Sumatra and Kalimantan palm producing areas saw heavy rain today.

·

Oil World made an interesting point on Tuesday that South American

rapeseed exports have improved during the November and January period. Although small, they do put a small dent in the upcoming shortfall of global oilseed supplies.

May

Malaysian palm oil

Source:

Reuters and FI

- Turkey

seeks 6,000 tons of sunflower oil on February 23 for shipment between March 2 and March 25.

Updated

2/22/22

Soybeans

– May $15.00-$17.50

Soybeans

– November is seen in a wide $12.50-$16.00 range

Soybean

meal – May $425-$500

·

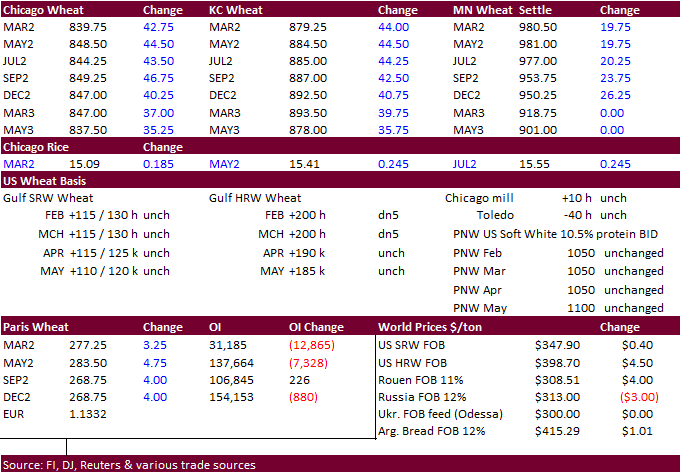

US wheat saw a wide trading range, ending sharply higher on improving US export developments, headline trading and Black Sea shipping concerns, although last we heard trade flows were unaffected.

·

Chicago and KC were up a whopping 45 cents by 12:40 pm CT. Note 50 cents is limit for KC & Chicago (60 MN). Chicago ended up settling 47.25 cents higher in the front month and March KC up 46.50 cents. MN wheat lost a lot of

ground to these contracts, despite a bitter cold US Great Plains forecast. US hard red winter wheat will be vulnerable to some damage this week. March MN was up 25 cents. The discrepancy between MN and Chicago & KC wheat may reflect how much the funds had

influence on today’s market.

·

USDA US all-wheat export inspections as of February 17, 2022 were 539,366 tons, above a range of trade expectations, above 459,337 tons previous week and compares to 324,597 tons year ago. Major countries included Japan for 90,633

tons, Mexico for 70,096 tons, and Taiwan for 56,328 tons.

·

China sold 508,089 tons of wheat out of auction, nearly 97 percent of wheat was offered. Since January 5, Chicago sold 93-100 percent of wheat offered at auction, amounting to about 3.4 million tons since October 20. This tells

us there is a need for feedgrains within China, including corn.

·

May EU wheat futures that were up 4.75 euros at 284.50 euros per ton, highest since Jan 26.

·

(Bloomberg) — Southern and southwest Mediterranean areas of Europe are facing drought due to “persistent” rain deficits, the EU’s Monitoring Agricultural Resources Unit says Monday in a report. Drier-than-usual conditions are

likely to continue there for the coming months, potentially hampering yields

·

India plans to send 50,000 tons of wheat to Afghanistan through Pakistan.

·

Turkey bought 255,000 tons of feed barley at $324-$330.90/ton. Shipment was sought for March 1-31.

·

Jordan passed on 120,000 tons of feed barley for late July through FH September shipment.

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Feb. 23, with shipment in 60,000 ton consignments, for July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15. They also seek 120,000 tons of feed

barley on Feb. 22.

Rice/Other

·

South Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

Updated

2/22/22

Chicago

May $7.85 to $9.00 range

KC

May $7.80 to $9.25 range

MN

May $9.00‐$10.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.