Chicago

temperatures reached above the 32 degree freeze level for the first time since February 4. The concentration for past cold US temperatures lies in the southern half of the country, where ice and snowstorms drove up agriculture basis and wreaked havoc on the

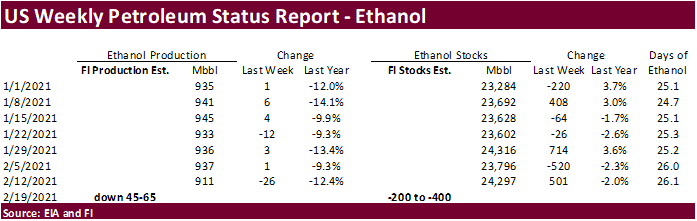

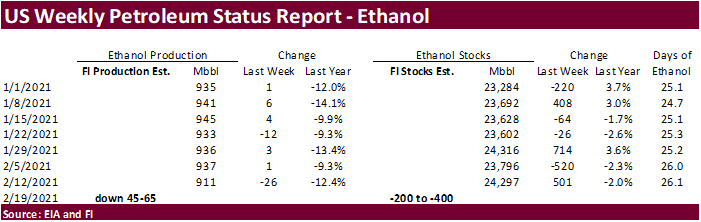

energy, animal unit and transportation industries, among others. It will take weeks to determine monetary loss, and the dent in US GPD. The first real indicator, for ags, of the extend from cold weather will be reflected in this week’s EIA ethanol production

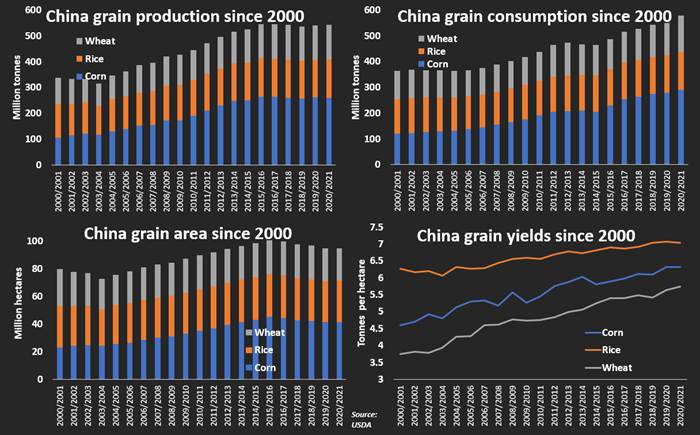

figure. We included an early preliminary figure below (not PDF). Most CBOT major agriculture markets rallied today on widespread commodity buying and spillover sentiment from USDA’s outlook for tight US 2021-22 ending stocks. China is expected to step up

on food security, a hint they may buy additional agriculture products.

World

Weather Inc.

- Buenos

Aires, Argentina rainfall overnight was greater than expected with some central areas getting 1.00 to 2.83 inches. Most other areas in the province reported 0.08 to 0.60 inch with a few totals in the east-central crop areas getting up to 1.14 inches - The

added moisture will shrink the area of concern over dryness temporarily - The

driest areas in Argentina are in La Pampa and western and southern Buenos Aires - Heavy

snow fell in eastern Nebraska through western and central Iowa to west-central and southern Wisconsin Sunday with 3 to 7 inches common and local totals to 9.5 inches - High

wind speeds are expected in the Northern U.S. Plains and Canada’s Prairies today and again late this week causing travel issues and possible property damage - Argentina

rainfall in early March has been increased in the latest GFS model run - World

Weather, Inc. has been flagging this as a viable possibility because our Trend Model suggests the change as well - The

GFS is probably too wet in some areas, but the trend may be correct

MOST

IMPORTANT WEATHER IN THE WORLD

- Argentina

will be very warm to hot and experience net drying conditions in many areas during the coming week after a few early week thunderstorms - Rain

and thunderstorms will occur tonight into Tuesday with total coverage of 40% and most rain amounts under 0.50 inch; however, a narrow band of greater rain may occur Tuesday into Wednesday morning from central Cordoba into northern Entre Rios where 0.50 to

1.50 inches will result with a possible locally greater amount - Temperatures

will be in the 90s to 106 degrees Fahrenheit often later this week into early next week after the early week precipitation clears the region - Accelerated

drying is likely, although short term benefits will come from the stronger thunderstorms early this week - Crop

stress will steadily rise this week in pockets - There

is some potential for scattered showers in southern and western Argentina late this week and next week, but the resulting rainfall should not counter evaporation very well, but a few locations might get temporary relief

- The

forecast will need to be closely monitored for the possibility for surprise thunderstorms especially during the first week of March - Argentina

rain during the weekend was concentrated on southeastern Santiago del Estero, northwestern Santa Fe and some immediate neighboring areas Friday into Sunday afternoon - Most

of the rain was greatest in northwestern Santa Fe and southeastern Santiago del Estero where 0.68 to 0.92 inch resulted - Surrounding

areas received less than 0.20 inch and the remainder of the nation was dry - Temperatures

were mild to cool Friday into Sunday morning with highest afternoon temperatures in the upper 70s and 80s Fahrenheit except in the north where the 90s were noted - Lowest

morning temperatures slipped into the upper 30s and 40s in the southern one-third of the nation - No

frost was noted, but the cool conditions conserved topsoil moisture through slower evaporation - Argentina’s

bottom line is still one of concern about net drying. Some showers will be around, but it will be hard for many areas to get enough rain to seriously bolster soil moisture for improved crop and field conditions. Temperatures are going to be very warm to hot

and that will accelerate drying rates resulting in a rising amount of plant stress during the forecast period of the week and possibly a little longer. Totally dry weather is not expected, but the few showers that occur will offer only temporary relief to

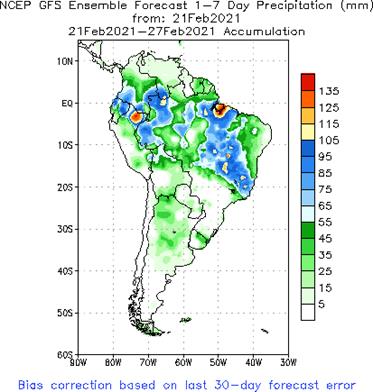

the drying trend. Greater amounts of rain will be needed to reverse the drying trend and protect production potentials. There will be a few areas of exception where significant rain may fall. The first week in March might also trend a little wetter. - Brazil’s

general weather theme for the next ten days has not changed much since Friday - Restricted

rainfall is expected from Mato Grosso and southwestern Sao Paulo to Rio Grande do Sul and Paraguay - Some

rain will occur, but it will be infrequent enough to lead the region into a steady rate of drying

- Improved

soybean maturation and harvest conditions will result along with faster Safrinha corn planting - Rain

will be needed later in March and April to support second season crops - Rain

will fall most frequently and significantly from northeastern Sao Paulo through Minas Gerais to central and northern Goias, Tocantins and northern and eastern parts of Mato Grosso - The

wet weather will slow soybean maturation and harvest progress and maintain some concern over crop conditions - Sugarcane,

coffee, minor rice, and minor corn and soybean production areas from northeastern Sao Paulo through Minas Gerais to Goias and Tocantins will get enough rain in the next ten days to result in some excessively wet field conditions and flooding is possible - A

few areas in Sao Paulo citrus and sugarcane areas need greater rain - Western

Bahia, Piaui and Maranhao will be plenty wet throughout the forecast period - Temperatures

in Brazil will be seasonable throughout the outlook period - Brazil

weather during the weekend occurred as expected - Rain

fell mostly from Mato Grosso and Tocantins through Goias and western Bahia to central and northern Minas Gerais - Rainfall

varied from 1.00 to 2.75 inches in northern and central Minas Gerais and varied from 1.00 to 2.25 inches in parts of central Goias while varying from 0.30 to 0.70 inch in most other areas with local totals to 1.50 inches - Net

drying occurred in the remainder of the nation, including most of the south

- Temperatures

were seasonable with highs in the 80s and lower 90s most often followed by lows in the 60s and lower to a few middle 70s Fahrenheit - Brazil’s

bottom line is mostly good for southern Brazil with infrequent rainfall occurring in the next ten days to support the maturation and harvest of soybeans as well as the planting of Safrinha crops. Enough soil moisture and/or rainfall will occur to support ongoing

full season and second season crop development. In the meantime, northern Brazil will continue fighting a wetter bias that will result in slow soybean harvest and Safrinha planting rates and could raise a little crop quality issue in a few areas. Most of

the excessive rain will occur from central Minas Gerais to Tocantins. Drier weather must evolve for a little while in the north to promote better field working conditions and to get Safrinha corn planted as quickly as possible to protect production potentials.

Some coffee areas of Zona de Mata and Cerrado Mineiro will be among the wettest areas.

- Tropical

Depression Dujuan was moving through the central Philippines Sunday, but was diminishing in the Visayan Islands today - The

storm center was 373 miles southeast of Manila at 10.7 north, 125.2 east at 0 - 0300

GMT today moving west northwesterly at 6 mph and producing maximum sustained wind speeds of 30mph - Dujuan’s

center will move from across the heart of the Visayan Islands today while further diminishing

- Rain

totals of 3.00 to 8.00 inches and local totals over 10.00 inches will result by 1200 GMT Wednesday, despite the storm’s weakening trend - Already

more than 5.00 inches was reported in northeastern Mindanao - Some

flooding is expected, but crop damage will be kept to a few low lying areas

- Rice,

sugarcane, corn and a few herbs and spices will be most impacted - India’s

rain ended in central India late last week and was expected to end in the south early this week - Resulting

rainfall was a little too light and sporadic for a lasting impact on winter crops as they reproduced, but short term improvements in crop and soil conditions occurred

- Yield

potentials remain favorable from southern and eastern Madhya Pradesh southward into northern Tamil Nadu where the precipitation was greatest over the past week - Greater

rain is still desired - India

will be dry warm to hot after showers end in the far south early this week - Some

crop stress is expected in the north where temperatures will eventually be hottest - China

temperatures soared into the 70s and slightly over 80 degrees Fahrenheit briefly during the weekend in east-central and southeastern parts of the nation - The

warm weather stimulated more greening in southern wheat and rapeseed areas and quickened the drying rate

- Crop

conditions were still favorably rated - East-central

China will receive rain and some snow this week while a little snow falls in the northeastern provinces as well - Waves

of snow will fall in the northeastern provinces through the next two weeks

- Resulting

precipitation totals will be greater than usual - Snowfall

will be widespread with parts of Heilongjiang getting 3 to more than 10 inches of snow over the entire forecast period

- Travel

delays and livestock stress are expected - Most

of the snow in Liaoning and Jilin will occur in the coming weekend - Snow

and rain will impact the Yellow River Basin and southern parts of the North China Plain during the middle part of this week (Tuesday and Wednesday) with 3 to 8 inches common and local totals as great as 12 inches - Shandong,

southern Hebei, Shanxi and northern Shaanxi will be most impacted by the snow along with northern parts of Henan - Moisture

totals will vary from 0.20 to 0.75 inch with a few amounts to 1.25 inches - Another

storm system may impact the Yellow River Basin and North China Plain this weekend into Monday with moisture totals of 0.20 to 0.75 inch and local totals over 1.00 inch

- Snow

totals will vary from 1 to 4 inches with a few local totals to 6 inches - The

snow will not be nearly as widespread and significant as that of mid-week this week - Waves

of rain will impact the Yangtze River Basin and the southern coastal provinces from mid-week this week through the first week in March - Rain

totals of 0.70 to 2.50 inches with local totals over 3.00 inches are likely in each of the next two weeks

- Excessively

great moisture will be present in the Yangtze River Basin and areas to the south favoring rice planting, but raising a little concern over early season rapeseed condition. Some drying would be welcome. In the meantime, the greater than usual moisture in the

North China Plain, Yellow River Basin and northeastern provinces will ensure abundant early season soil moisture for winter wheat development and spring planting, although not much planting is expected for a few weeks outside of the Yangtze River Basin and

areas farther to the south. - East-central

Australia cotton and sorghum areas will get alternating periods of rain and sunshine during the next ten days to two weeks favoring cotton, sorghum and other late season crops in northeastern New South Wales and parts of southeastern Queensland

- Western

New South Wales and southwestern Queensland will not get much rain - Wet

weather will continue the Cape York Peninsula as well - Australia

weekend rainfall was erratic and mostly significant in the Cape York Peninsula and along the upper New South Wales coast where amounts of 2.00 to more than 4.00 inches resulted - Net

drying occurred elsewhere with some very warm to hot temperatures stressing livestock and minor crop areas from western Queensland and western New South Wales into South Australia and northwestern Victoria - South

Africa experienced net drying during the weekend and temperatures were seasonable - South

Africa will experience periodic showers and thunderstorms during the next couple of weeks along with periods of sunshine and seasonable temperatures - The

bottom line will be very good for summer crop development. Yield potentials are already very good and this pattern will preserve that outlook - Europe

temperatures will be above average except in the far west and in the Italian Peninsula where readings will be near average - Europe

precipitation will continue restricted in the heart of the continent this week while rain falls more significantly in far northwestern parts of the United Kingdom, western Norway and parts of Spain where rain will be a little greater than usual - Europe

Precipitation next week will be a little more significant in south-central parts of the continent while still restricted in many other areas

- Temperatures

are not likely to change much - Winter

crops will remain dormant and in fair to good condition with little change likely - Russia’s

New Lands will remain colder biased and some of the coolness will reach into Russia’s Southern Region, but no crop damaging cold is expected because of snowfall that will occur today and Monday ahead of Tuesday and Wednesday’s bitter cold - Extreme

low temperatures will fall below zero Fahrenheit Wednesday morning in Russia’s New Lands and the snow free area today will have snow by that time protecting winter crops

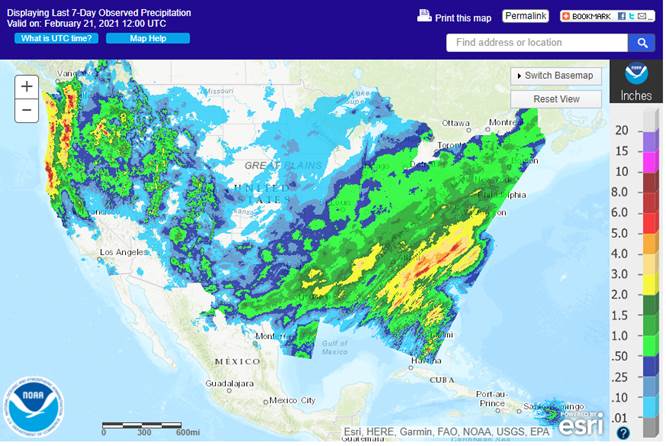

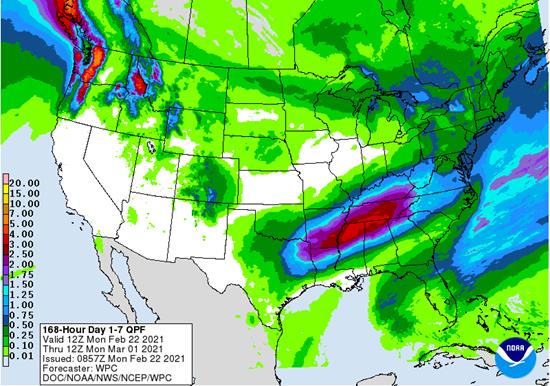

- U.S.

temperatures in the coming two weeks will be seasonable with a cooler bias in the western states and a slight warmer bias in the east - There

is potential for cooling in the north-central states during the second week of March - U.S.

precipitation this week - A

weak weather system will move through the northeastern states today - Rain

will develop in the southeastern Plains and Delta late this week into the weekend that will bring moisture to the southeastern and middle Atlantic Coast states as well during the weekend - Sufficient

rain will occur to maintain wet field conditions in the Delta and southeastern states possibly leading to delays in early season farming activity - Another

storm system is possible late in the weekend and especially early next week from the southeastern Plains and Delta the lower Midwest and middle Atlantic Coast States

- Moisture

totals will vary from 0.40 to 1.35 inches and local totals over 1.50 inches

- A

band of heavy snow will occur across the Great Lakes region into the northeastern U.S. and southeastern Canada Sunday into next Monday

- Some

significant accumulations of more than 6 inches will be possible - U.S.

weather the remainder of next week will generate another weak storm system possibly in the southern Plains that might move to the lower Midwest and Delta March 1-2

- Another

storm may evolve in the Plains March 3-4 before moving to the Midwest March 4-5 - Confidence

in these last two storm systems is very low - U.S.

Northern Plains and southwestern Plains will experience limited precipitation during the coming ten days, although not necessarily completely dry - Dry

biases will remain in the soil - U.S.

Delta and much of the southeastern states will remain very wet over the next ten days excepting southern Georgia, Florida and southeastern Alabama where net drying is expected - Northern

Florida, southern Georgia and southeastern Alabama may not be impacted as much as other areas in the southeastern states - U.S.

Midwest will remain plenty wet across most of the region over the next two weeks with some drier bias in the northwest - U.S.

Pacific Northwest will remain plenty moist over the next ten days to two weeks - U.S.

southwestern states will remain drier biased for the next ten days to two weeks - Southwestern

Morocco received up to 0.60 inch of moisture through this morning while a few showers also occurred in north-central Morocco and north-central Algeria with rainfall of up to 0.92 inch and 0.47 inch respectively - Temperatures

were seasonable - North

Africa precipitation will be erratic and light during the next ten days - The

moisture will be welcome, but probably not enough to seriously bolster soil moisture

- The

greatest need for rain remains in southwestern Morocco and northwestern Algeria along with a few northeastern border areas of Morocco - Temperatures

will remain seasonable

- West-central

Africa precipitation during the weekend was restricted and net drying occurred in most areas - Showers

will occur mostly near the coast through Friday, but may expand northward into Ivory Coast and Ghana coffee and cocoa production areas briefly during the weekend and early next week - Resulting

rainfall will be light, but still welcome and good for early season flowering that began in some areas earlier this month - East-central

Africa precipitation during the weekend was most significant in Tanzania and lightest in Uganda and Ethiopia - Scattered

showers and thunderstorms will occur this week with the lightest and most infrequent rain occurring in Ethiopia and parts of Uganda while the most significant rain occurs in Tanzania where all crop areas will get moisture - Next

week will be drier in Ethiopia and Kenya while little change occurs elsewhere - Southeast

Asia rainfall will occur relatively normally over the next two weeks except for heavy Philippines rainfall early this week due to Tropical Depression Dujuan - Mainland

areas were mostly dry during the weekend and not much change is likely, although a few showers could pop up across the region next week - All

the precipitation will be sporadic and light having little to no impact on crops

- Rain

will fall excessively in the central Philippines as Tropical Depression Dujuan moves across the Visayan Islands from southeast to northwest today into Tuesday - Some

flooding will occur and a little damage is possible - Rainfall

otherwise is expected to be scattered and mostly light to moderate over the next two weeks - Indonesia

and Malaysia weather during the next two weeks will bring rain to most crop areas maintaining a very good outlook for crop development - Sumatra,

Peninsular Malaysia and eastern Borneo were dry Friday into Sunday morning and some areas in Sulawesi reported minimal amounts of rain - New

Zealand weather during the weekend was wettest in North Island where rainfall was lightest in January - South

Island trended drier with very little or significance during the weekend - Temperatures

were mild to warm - New

Zealand Weather is expected to be a little drier biased in the coming week with temperatures near to above average - Tropical

Storm Guambe was located over open water south southeast of Madagascar moving away from southern Africa and Madagascar today - The

storm poses no threat to land

- Southern

Oscillation Index today was +15.18 today and the index will level off this week after rising during the weekend and there is a good chance it will fall later this week - Indian

Ocean Dipole remains neutral and is expected to remain that way through May, but could drift to a slight negative IOD bias during the late summer - Mexico

precipitation in the coming ten days will be mostly confined to the east coast - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast is relatively dry - Canada

Prairies will experience seasonable temperatures over the next ten days with precipitation mostly below average - Some

occasional precipitation will occur along the front range of mountains in Alberta and in the extreme northern parts of the crop country

-

Southeast

Canada will experience near normal amounts of precipitation in the coming week while temperatures are seasonable.

Source:

World Weather Inc. and FI

Monday,

Feb 22:

- USDA

Export Inspections – corn, soybeans, wheat, 11am - EU

weekly grain, oilseed import and export data - MARS

crop bulletin - Ivory

Coast cocoa arrivals - EARNINGS:

Wilmar - HOLIDAY:

Russia

Tuesday,

Feb 23:

- USDA

Milk production, 3pm - U.S.

pork, beef, poultry cold storage data, 3pm - U.K.

National Farmers Union virtual annual conference to discuss the future of agriculture, horticulture - EARNINGS:

IOI Corp. - HOLIDAYS:

Japan, Russia

Wednesday,

Feb 24:

- EIA

weekly U.S. ethanol inventories, production - Amsterdam

sustainable cocoa conference (Feb 24-26) - U.S.

poultry slaughter, 3pm - MPOB

palm oil prices seminar

Thursday,

Feb 25:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - International

Grains Council monthly report - Malaysia’s

Feb. 1-25 palm oil export data - USDA

red meat production, 3pm - EARNINGS:

Minerva, BRF, FGV (tentative), Golden Agri

Friday,

Feb 26:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

agricultural prices paid, received, 3pm - Earnings:

Olam - HOLIDAY:

Thailand

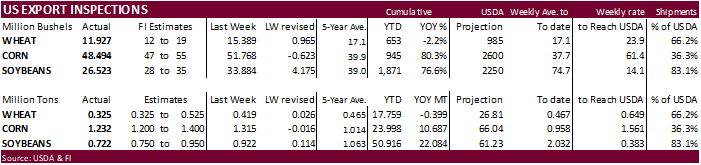

USDA

inspections versus Reuters trade range

Wheat

324,597 versus 300000-550000 range

Corn

1,231,810 versus 500000-1400000 range

Soybeans

721,845 versus 300000-950000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING FEB 18, 2021

— METRIC TONS —

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 02/18/2021 02/11/2021 02/20/2020 TO DATE TO DATE

BARLEY

2,395 1,597 0 28,628 28,432

CORN

1,231,810 1,314,960 923,999 23,997,794 13,310,308

FLAXSEED

0 0 0 509 520

MIXED

0 0 0 0 0

OATS

100 0 0 2,493 3,143

RYE

0 0 0 0 0

SORGHUM

124,101 71,084 16,661 3,461,982 1,328,470

SOYBEANS

721,845 922,181 573,450 50,916,438 28,832,628

SUNFLOWER

0 0 0 0 0

WHEAT

324,597 418,816 437,336 17,758,763 18,157,632

Total

2,404,848 2,728,638 1,951,446 96,166,607 61,661,133

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

US

Chicago Fed National Activity Index Jan: 0.66 (est 0.50; prevR 0.41; prev 0.52)

StatsCan

Revises Canadian January Core Inflation To 1.77%

Corn.

-

Corn

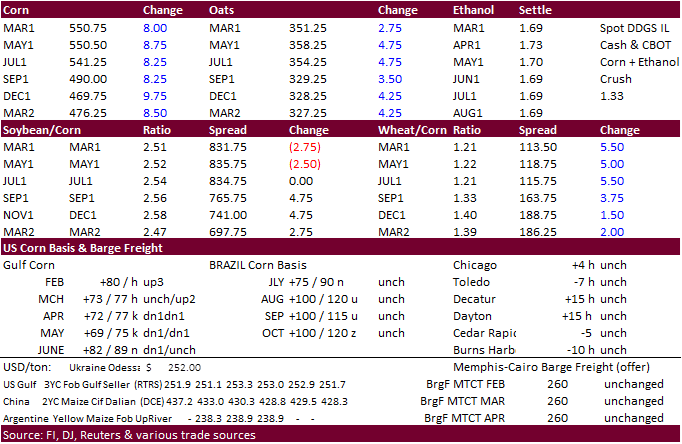

futures traded higher on technical buying and expectations US corn shipments will increase after February on slowing Black Sea exports. Slow Mato Grosso, Brazil, corn plantings was also seen supportive. Back month contracts gained over current crop year.

-

Funds

bought an estimated net 25,000 corn contracts.

-

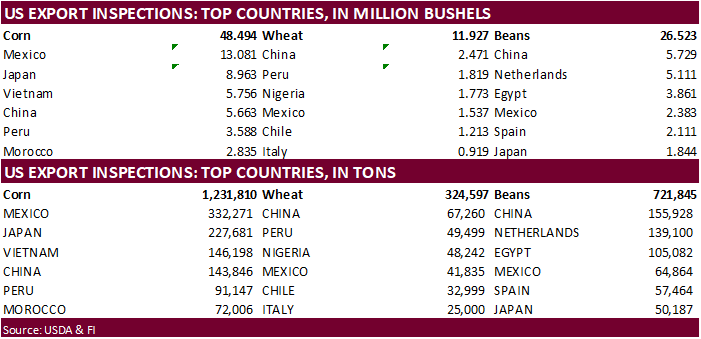

USDA

US corn export inspections as of February 18, 2021 were 1,231,810 tons, within a range of trade expectations, below 1,314,960 tons previous week and compares to 923,999 tons year ago. Major countries included Mexico for 332,271 tons, Japan for 227,681 tons,

and Vietnam for 146,198 tons. -

China’s

AgMin said hog inventories are expected to return to end-2017 levels by around June. Officials also said they will enhance its ability to secure supplies of grains and other agricultural products, and support companies to integrate into supply chains of global

agricultural products. -

During

the trading session, the US EPA announced they will not move on any decision on facility blending exemptions until the US Supreme Court rules on it. This could take months. Separately they sided with the appeals court’s decision that sided with limiting

oil refiners exemptions to U.S. biofuel blending laws a win for agriculture lobby groups. In January 2020 the 10th U.S. Circuit Court of Appeals ruled waivers granted to small refineries after 2010 should only be approved as extensions. -

In

our opinion, with introduction of new methods of renewable energy, RSF2 needs to be reexamined.

-

US

DDGS exports could slow over the next 1-2 months over container shortages and rising freights rates along with slowing US ethanol production and high soybean meal prices that make the commodity attractive for domestic feeding.

-

We

look for US ethanol production to be down 30 to 40 thousand barrels per day for the week ending February 19 due to plant closers and slowdowns.

-

IMEA

reported Just under 36% of the corn crop was planted by mid-February, below 80% year ago and 5-year average of 62.5%.

-

A

Reuters poll calls for South Africa’s CEC to initially report their 2020-21 corn production at 16.872 million tons, up from the 15.300 million tons last season. The first survey of the season is expected to show 8.929 million tons of white maize and 7.943

million tons of yellow maize. They will release the report on Thursday. -

The

European Union granted imports licenses for 3,372 tons of corn imports, bringing cumulative 2020-21 imports to 14.348 MMT, 28 percent below same period year ago.

Corn

Export Developments

·

South Korea’s NOFI passed on 69,000 tons of corn for arrival in South Korea around June 20. Prices were too high. Lowest price offered was $298.02 a ton c&f.

Source:

Reuters

Updated

2/22/21

March

corn is seen trading in a $5.25 and $5.75 range (up 5, lowered 25)

May

corn is seen in a $5.15 and $6.00 range.

July

is seen in a $5.00 and $6.00 range.

December

corn is seen in a $3.75-$6.00 range. (unchanged, up 25)