PDF Attached

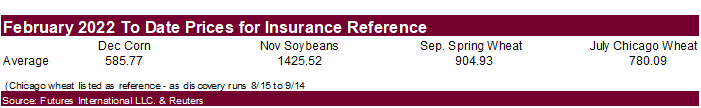

US

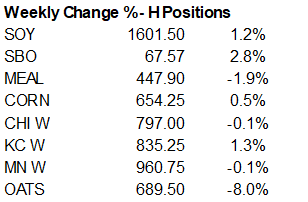

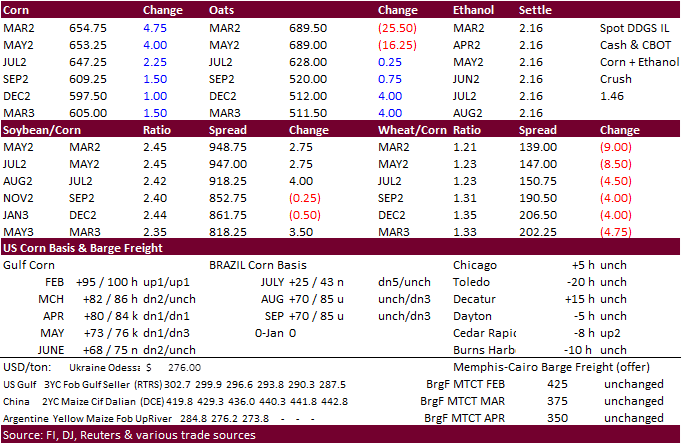

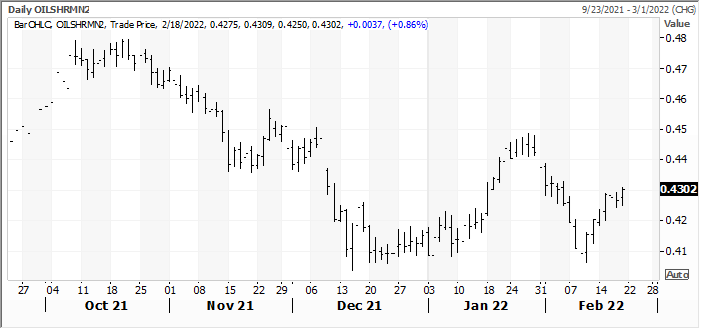

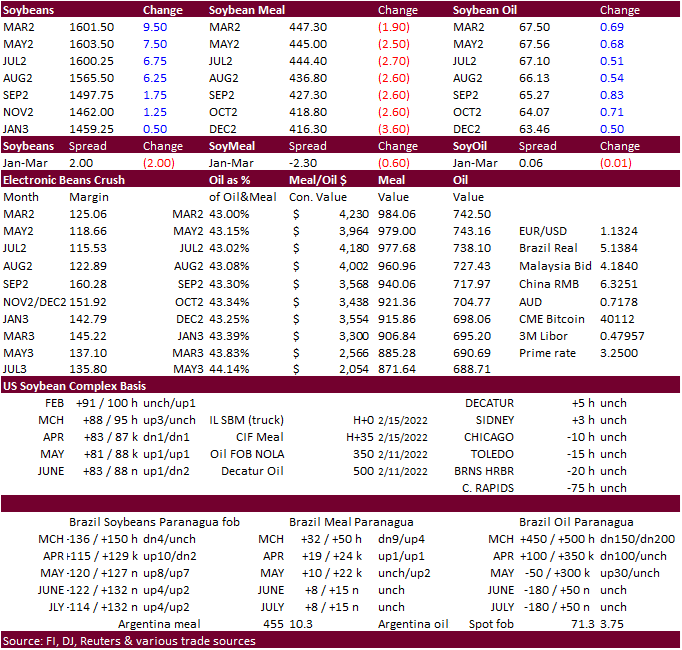

and Canada are on holiday Monday. Friday we saw some positioning early ahead of the three day holiday weekend. CBOT soybeans extended gains on SA dryness concerns. Meal was lower and after a two-sided trade soybean oil closed higher, in part of WTI crude

oil pairing some losses in the nearby contract. For the week soybean oil made an impressive gain over soybean meal. Rain is forecast to show up late this month for Argentina and southern Brazil, but models vary for intensity. Corn was higher led by March

from talk of Chinese demand, although nothing showed up this week to confirm that. Chicago wheat settled mixed while KC and MN rallied. CFTC Commitment of Traders report showed funds were more long than estimated for CBOT soybeans and meal. They were in line

with corn and less long than expected for soybean oil. We see no impact on futures prices when they reopen Monday as the trade will be digesting three days of weather model changes for South America.

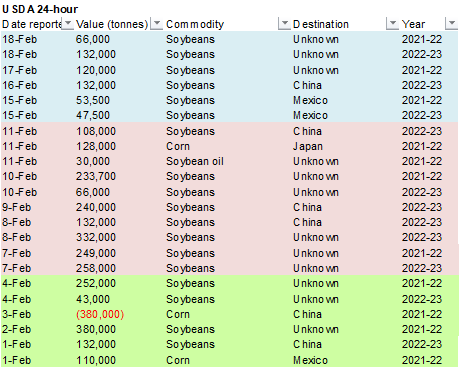

Private

exporters reported sales of 198,000 metric tons of soybeans for delivery to unknown destinations. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 132,000 metric tons is for delivery during the 2022/2023 marketing year.

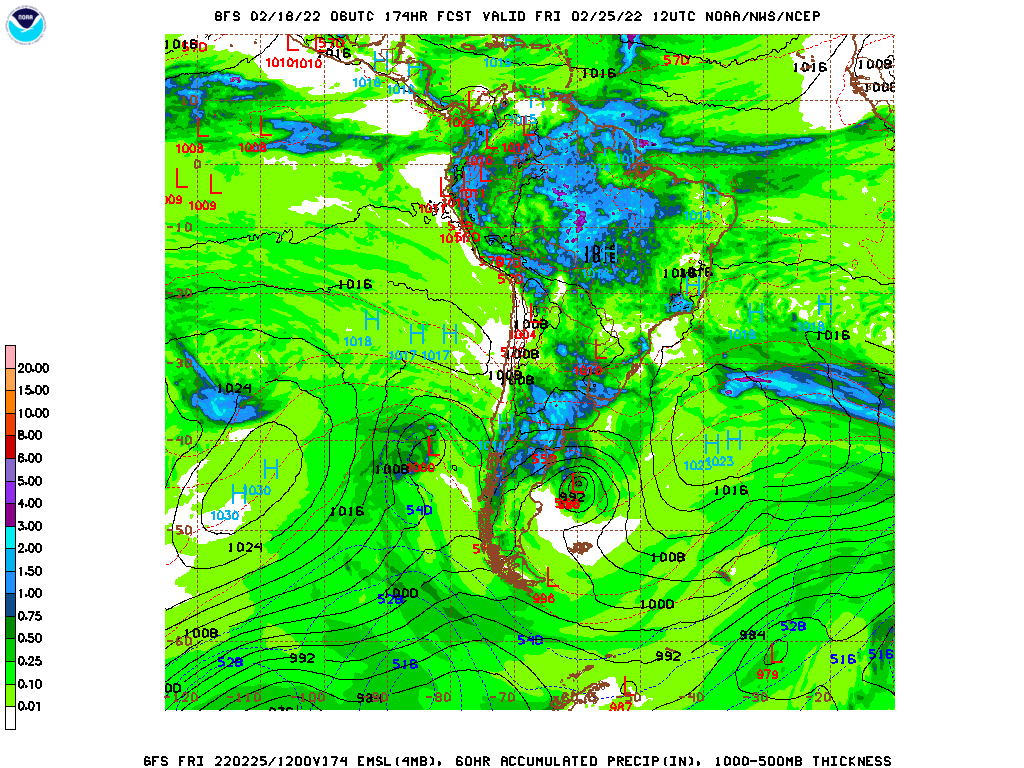

Argentina’s

central and southern areas may still see good rain during the 23-25 February period, before getting rain bias north during the 25-26 period. Southern Brazil will also see rain later this month. Northern and central Brazil weather will improve with less precipitation

than that of this week. 23-25 period below.

WORLD

WEATHER HIGHLIGHTS FOR February 18, 2022

- The

European model run was wetter in Argentina during the second week of the outlook today.

- Rain

is advertised Wednesday, Thursday and again Feb. 27 with enough to improve soil moisture in at least a part of the driest region.

- Additional

adjustments to the second week South America outlook are anticipated over the weekend with the bottom line allowing some rain into central and southern Argentina periodically while the north stays dry biased.

- Paraguay

and southwestern Brazil will also receive less than usual rainfall during the coming ten days to two weeks, although some showers will occur periodically.

- The

resulting rain amounts will help slow crop deterioration, but it may not be enough to turn around crop conditions that may still deteriorate for a while especially into early next week.

- In

the U.S., concern is rising over too much moisture in the spring for areas from the lower Ohio River Valley southward to the Tennessee River Basin and northern Delta.

- Rain

in those areas Thursday has the ground saturated and poised for a more significant bout of runoff and flooding as greater rain falls next week from Tuesday night into Friday.

- Rainfall

of 2.00 to 5.00 inches will be sufficient to cause flooding, although it may not be severe quite yet.

- There

will be more rain in March impacting these same areas. - U.S.

hard red winter wheat areas will get a little moisture periodically over the next couple of weeks but resulting amounts will still be too light for a serious change in soil moisture throughout the high Plains.

- Not

much changed in the remainder of the world - There

is still some interest over west-central Africa rainfall for coffee and cocoa, but World Weather, Inc. believes seasonal rainfall will increase gradually during March and that delayed showers in February will not have much impact on the bottom line.

- Most

of Europe and Asia will not encounter any threatening cold weather to winter crops over the next ten days - Eastern

Australia is still expecting some beneficial rainfall next week - South

Africa will dry down next week - A

few showers in the Iberian Peninsula and northwestern Africa over the next ten days will have little influence on the status of dryness in the region.

Source:

World Weather Inc.

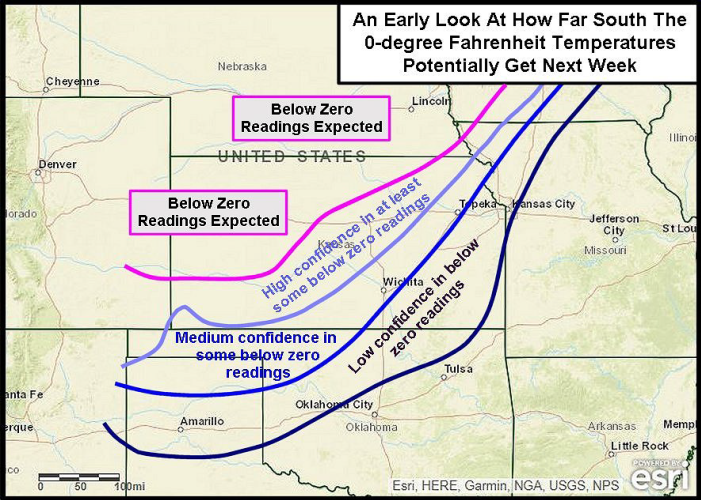

Cold

next week for the US HRW wheat areas…

Source:

World Weather Inc.

Bloomberg

Ag Calendar

- Monthly

MARS bulletin on crop conditions in Europe - USDA

export inspections – corn, soybeans, wheat, 11am - Malaysia’s

Feb. 1-20 palm oil export data - Ivory

Coast cocoa arrivals - HOLIDAY:

U.S., Canada

Tuesday,

Feb. 22:

- EU

weekly grain, oilseed import and export data - Brazil’s

Unica may release cane crush and sugar output data during the week (tentative) - U.S.

cold storage data for beef, pork and poultry, 3pm - EARNINGS:

Wilmar International

Wednesday,

Feb. 23:

- USDA

total milk production, 3pm - EARNINGS:

IOI Corp. - HOLIDAY:

Japan, Russia

Thursday,

Feb. 24:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - USDA

corn, cotton, soybean and wheat acreage outlook, 8:30am - EIA

weekly U.S. ethanol inventories, production, 11am - U.S.

red meat production, 3pm

Friday,

Feb. 25:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - USDA

corn, cotton, soybean and wheat end-stockpile outlook, 8:30am - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Feb. 1-25 palm oil exports - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

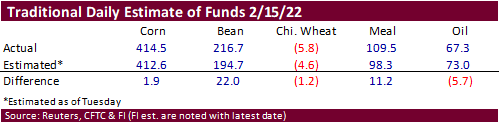

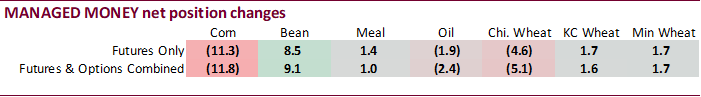

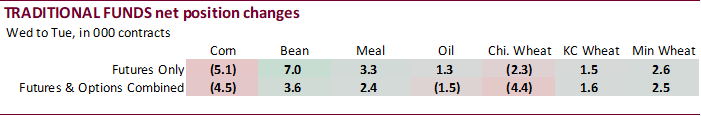

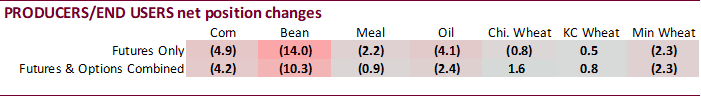

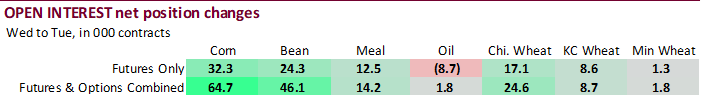

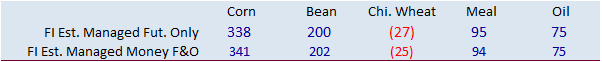

CFTC

Commitment of Traders report

The

traditional fund was more long than estimated for soybeans and meal. They were in line with corn and less long than expected for soybean oil. We see no impact on futures prices when they reopen Monday as the trade will be digesting three days of weather

model changes for South America.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

259,453 5,840 434,908 -6,847 -666,112 3,596

Soybeans

140,298 776 190,352 2,553 -297,073 -5,534

Soyoil

31,737 -812 120,689 1,720 -166,335 -2,405

CBOT

wheat -55,988 -5,754 146,811 3,650 -87,336 1,895

KCBT

wheat 12,614 748 57,435 337 -70,607 1,285

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

325,514 -11,818 289,981 11,311 -667,107 -4,189

Soybeans

175,372 9,057 131,763 4,458 -306,822 -10,297

Soymeal

89,170 1,031 92,305 -645 -227,598 -932

Soyoil

70,381 -2,402 91,982 2,356 -173,658 -2,362

CBOT

wheat -34,658 -5,106 96,188 2,576 -71,311 1,603

KCBT

wheat 36,050 1,578 26,919 -66 -61,033 789

MGEX

wheat 5,268 1,672 2,107 -259 -17,004 -2,264

———- ———- ———- ———- ———- ———-

Total

wheat 6,660 -1,856 125,214 2,251 -149,348 128

Live

cattle 86,061 4,219 83,598 -281 -170,896 -4,658

Feeder

cattle 3,256 2,541 6,954 388 -2,619 -1,034

Lean

hogs 79,242 571 62,392 305 -135,250 -2,113

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

79,860 7,285 -28,249 -2,589 2,062,677 64,665

Soybeans

33,264 -5,421 -33,577 2,204 1,124,836 46,146

Soymeal

16,866 1,386 29,259 -840 524,560 14,213

Soyoil

-2,613 911 13,908 1,498 486,365 1,797

CBOT

wheat 13,267 718 -3,487 210 511,039 24,561

KCBT

wheat -2,495 69 558 -2,370 249,029 8,655

MGEX

wheat 4,783 874 4,846 -24 74,066 1,797

———- ———- ———- ———- ———- ———-

Total

wheat 15,555 1,661 1,917 -2,184 834,134 35,013

Live

cattle 21,479 2,314 -20,241 -1,594 406,721 14,573

Feeder

cattle 2,453 -753 -10,045 -1,142 58,181 1,799

Lean

hogs 7,383 1,132 -13,768 106 367,616 9,460

=================================================================================

Source:

Reuters, CFTC and FI

Macros

Canadian

Retail Sales (M/M) Dec: -1.8% (est -2.1%; prev 0.7%)

–

Retail Sales Ex Auto (M/M) Dec: -2.5% (est -1.5%; prev 1.1%)

Canadian

Retail Sales – Retail sales fell 1.8% to $57.0 billion in December. Lower sales at clothing and clothing accessories stores (-9.5%) and furniture and home furnishings stores (-11.3%) led the decline, which coincided with concerns over the spread of the COVID-19

Omicron variant in December.

79

Counterparties Take $1.675 Tln At Fed Reverse Repo Op (prev $1.647 Tln, 79 Bids)

Corn

·

Corn was higher on Friday led by March position from talk of Chinese demand, although nothing showed up this week to confirm that.

·

CBOT corn futures ended 1.00-4.25 cents higher.

·

March WTI was trading about 50 cents lower while the back months were higher around the time corn settled. March WTI goes off the board Tuesday and Monday is a US holiday.

·

China granted imports of Chile beef and mutton products, another portal that extends their importing country list to ensure food security.

Export

developments.

- Iran’s

SLAL bought about 120,000 tons of feed barley, 120,000 tons of feed corn and 180,000 tons of soybean meal. Prices were not available. Shipment for all the grains and soymeal was sought in February and March. On Feb. 11 they passed on 60,000 tons of feed

barley and 60,000 tons of soymeal.

Updated

2/11/22

March

corn is seen in a $6.15 and $6.85 range

December

corn is seen in a wide $5.25-$7.00 range

·

March soybeans took out yesterday’s high during morning trade. Soybeans closed higher on ongoing SA weather concerns and general commodity buying as Ukraine/Russian tensions persist. Weekend profit taking dried up by early morning.

·

China needs to sell soybeans from reserves to satisfy spot consumption. We are hearing some crushing plants are very short of soybeans. If they ramp up to a 1.7 million ton crush this week, post to a slow holiday crush of less

than 700,000 tons, they need soybeans.

·

A Reuters poll averaged 113 million tons for Brazil soybean production. Lowest estimated was 106.8 million tons and highest 116.8 million.

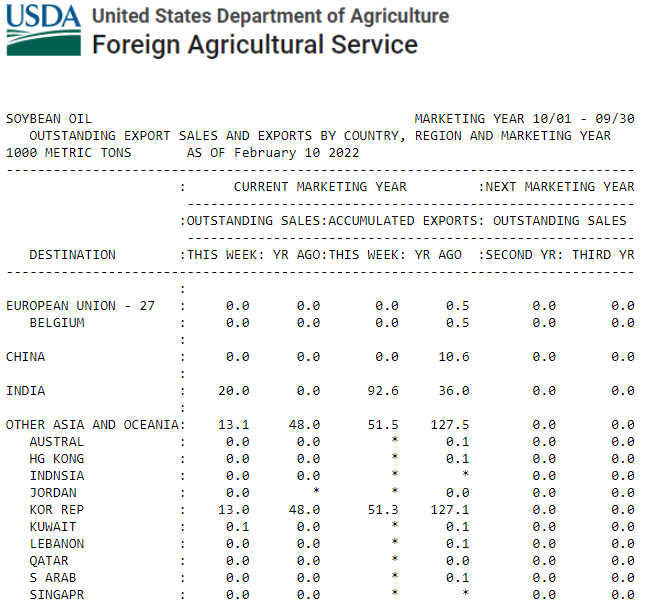

·

Reuters noted overnight that India contracted to import a record 100,000 tons of soyoil from the United States. Nearly 100,000 tons has been recorded for accumulated exports, not including unknown, per USDA export sales.

·

No US soybean oil was reported under the 24-hour reporting system for Friday. 198,000 tons of soybeans were sold to unknown, split crop years. We think there could be a Tuesday morning announcement if India was still in negotiations.

- Private

exporters reported sales of 198,000 metric tons of soybeans for delivery to unknown destinations. Of the total, 66,000 metric tons is for delivery during the 2021/2022 marketing year and 132,000 metric tons is for delivery during the 2022/2023 marketing year. - Iran’s

SLAL bought about 120,000 tons of feed barley, 120,000 tons of feed corn and 180,000 tons of soybean meal. Prices were not available. Shipment for all the grains and soymeal was sought in February and March. On Feb. 11 they passed on 60,000 tons of feed

barley and 60,000 tons of soymeal. - Turkey

seeks 6,000 tons of sunflower oil on February 23 for shipment between March 2 and March 25.

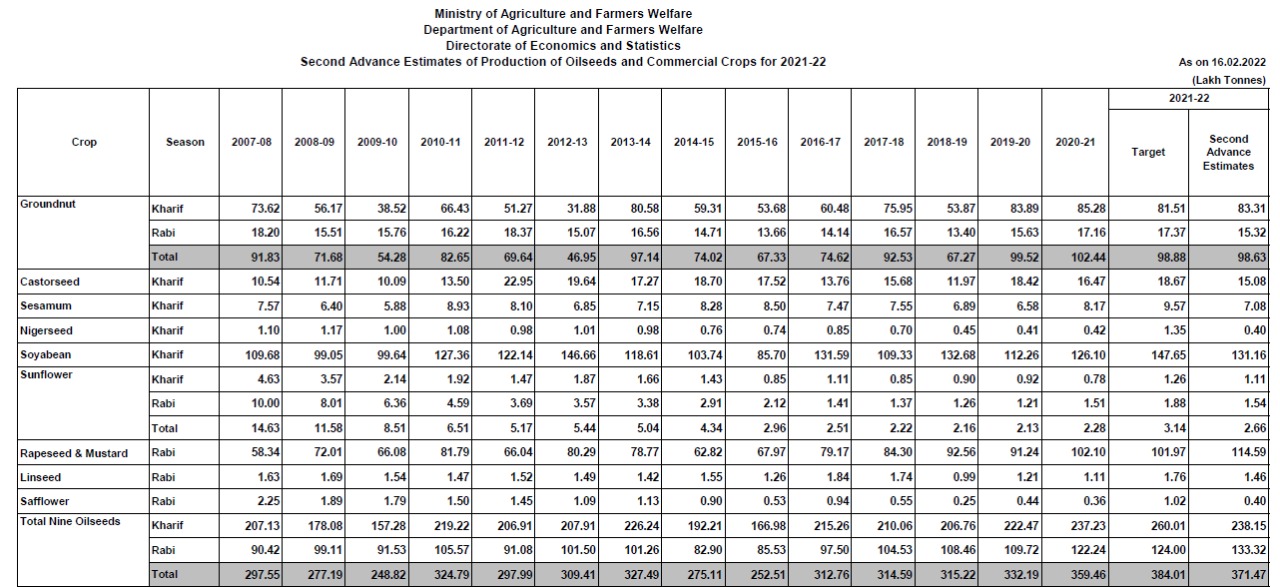

India

Ministry of Agriculture and Farmers Welfare – 2021-22 oilseeds

Soybean

oil share – July

Source:

Reuters and FI

Updated

2/15/22

Soybeans

– March $14.75-$16.50

Soybeans

– November is seen in a wide $12.00-$15.75 range

Soybean

meal – March $420-$480

Soybean

oil – March 64.00-68.00

·

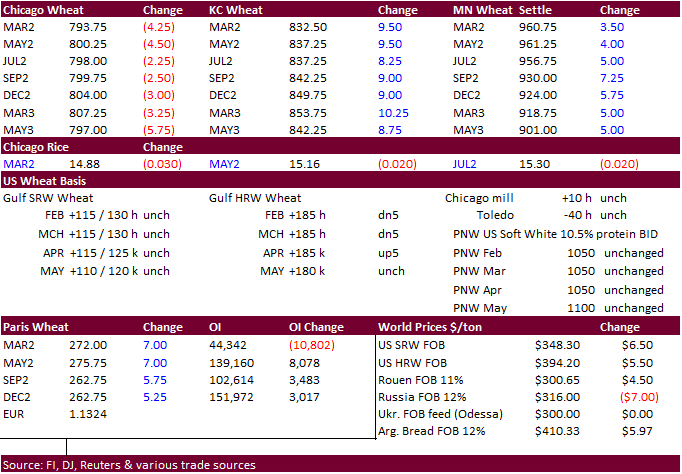

US wheat was higher for higher protein contracts on Black Sea shipping concerns as Ukraine/Russian tensions continue to spook traders. Chicago, the heavily weighted fund wheat contract, ended mixed. Positioning was noted.

·

May EU wheat futures that were trading up 7.00 euros at 275.75 euros per ton.

·

Other than political/headline news, we have not seen much to reports for Friday’s trade.

·

Export development were routine on Friday and as expected.

·

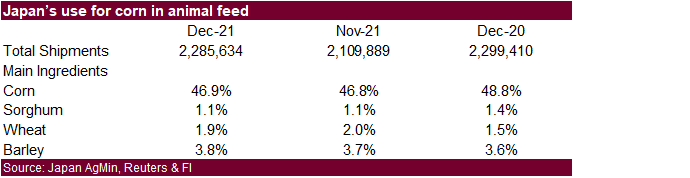

China is a wait and see if they are serios on cutting back on soybean dependency. Any soybean import cuts could lead to significant increase in imports of feedgrains.

·

Taiwan bought 54,920 tons of US wheat for April 4-18 shipment if off the PNW.

o

32,360 tons of U.S. dark northern spring wheat of 14.5% protein content bought at $409.69 a ton FOB

o

15,115 tons of hard red winter wheat of 12.5% protein was bought at $396.37 a ton FO

o

7,445 tons of soft white wheat of 10.5% protein was bought at $406.29 a ton FOB.

o

freight $52.79 per ton

·

Turkey seeks 255,000 tons of feed barley on February 22. Shipment is sought for March 1-31.

·

Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Feb. 23, with shipment in 60,000 ton consignments, for July 16-31, Aug. 1-15, Aug. 16-31 and Sept. 1-15. They also seek 120,000 tons of feed

barley on Feb. 22.

Rice/Other

·

South Korea seeks 72,200 tons rice from U.S. and Vietnam on Feb. 25.

·

(Reuters) – China’s state planner on Friday issued the minimum purchase prices for some rice products for 2022. The National Development and Reform Commission (NDRC) set the minimum purchase prices for early indica, late indica

and japonica rice at 124 yuan, 129 yuan and 131 yuan per 50kg respectively. That works out at a minimum purchase price of 2,480 yuan ($392.14), 2,580 yuan and 2,620 yuan per ton respectively. The prices are also higher than those set for 2021, signaling increasing

support for production of the crop.

Updated

2/2/22

Chicago

March $7.25 to $8.30 range

KC

March $7.45 to $8.55 range

MN

March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.