PDF Attached

Attached are our updated US corn and soybean S&D’s

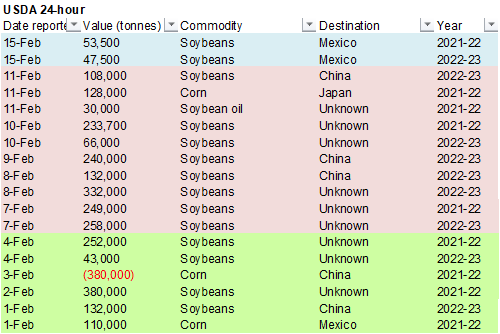

Private exporters reported sales of 101,000 metric tons of soybeans for delivery to Mexico. Of the total, 53,500 metric tons is for delivery during the 2021/2022 marketing year and 47,500 metric tons is for delivery during the 2022/2023 marketing year.

Risk off trade today on headline trading. Some Russian troops “returned to base”, easing fears of an invasion of Ukraine. Global equities were higher, USD 40 points lower, and crude oil sharply lower. Full moon tonight. Look for some traders to remain on the sidelines until market volatility cools.

WEATHER EVENTS AND FEATURES TO WATCH

- Some precipitation will impact southeastern U.S. hard red winter wheat production areas Wednesday into Thursday resulting in a short term improvement in topsoil moisture

- Oklahoma will see the greatest increase in topsoil moisture along with some crop areas in southeastern Kansas wheat areas

- These areas could receive 0.50 to 1.50 inches of moisture

- The Texas and Oklahoma Panhandles will receive4 0.10 to 0.40 inch of moisture

- Relief from drought is expected, but the relief will be limited in the southwestern Plains

- U.S. hard red winter wheat areas may also get some moisture from another storm system one week later, Feb. 23-24 impacting some of the same areas with lighter amounts of moisture

- U.S. storm Wednesday into Friday will produce severe thunderstorms in the southeastern Plains, Delta and possibly the Tennessee River Basin

- U.S. storm Wednesday and Thursday will produce heavy rain from southeastern Kansas and central Oklahoma into the lower eastern Midwest where 1.00 to 2.00 inches and locally more will result

- A band of heavy snow will extend from a part of eastern Kansas to Michigan with 6 to 10 inches and locally more possible

- West Texas is not likely to get much precipitation this week, although a few showers may occur briefly Wednesday night into Thursday morning

- Another opportunity for rain is expected one week later on Feb. 23-24

- Moisture from this latter event should be light as well

- California precipitation is expected to be limited over the next couple of weeks

- U.S. Rocky Mountain region will get some welcome precipitation from storm systems this week and again next week

- The snowfall boost will be good for spring runoff and water supply

- U.S. northwestern Plains “may” get some snow late this coming weekend into early next week

- U.S. Delta and Tennessee River Basin could become too wet by the end of next week with one storm system impacting the region Wednesday into Thursday and another about one week later

- Rainfall from the second storm may be greater than that of this week

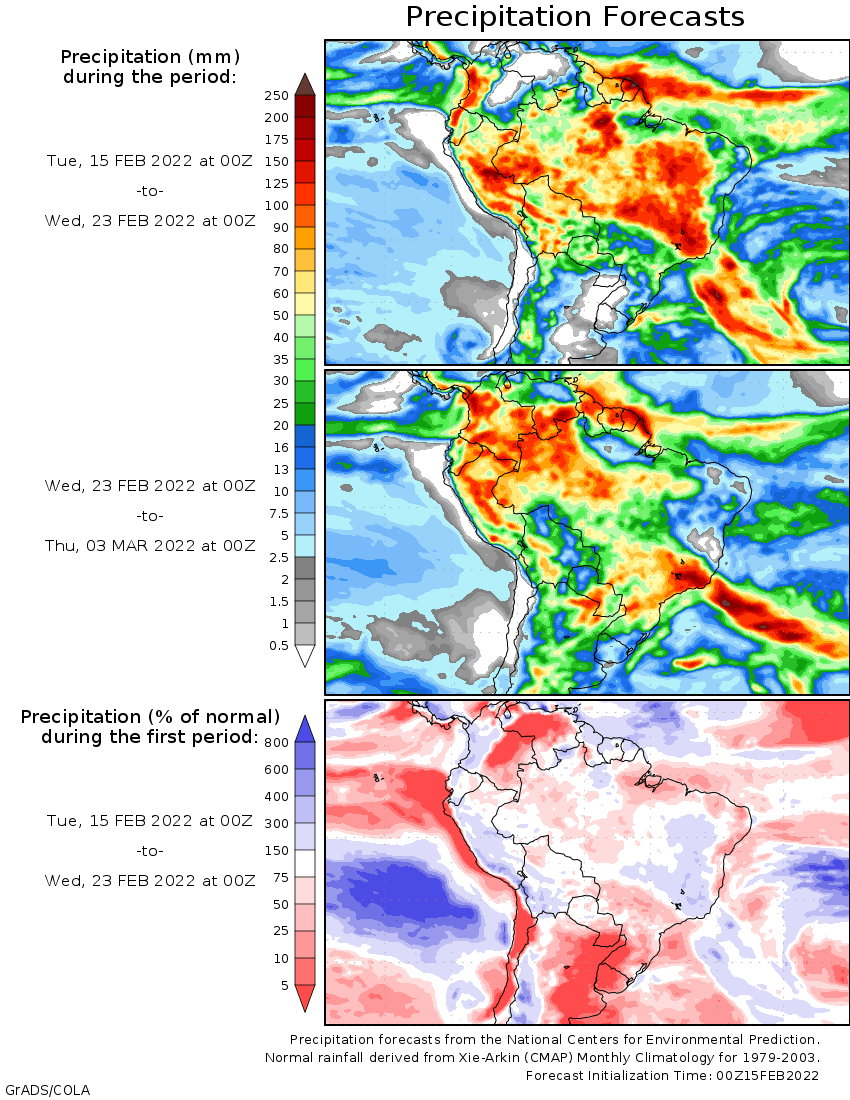

- Argentina rainfall will be restricted over the next eight to nine days in the central and east leading to additional crop stress and production declines

- Good crop conditions will continue from the heart of Buenos Aires into southern Cordoba, southern Santa Fe and neighboring areas

- Argentina temperatures will be warmer than usual this week and more seasonable in the following week

- Brazil’s interior southern soil moisture is still supporting crops while rain fall is lacking and this should prevail into the weekend, although some slowly rising crop stress may raise some concern over crop yield

- Losses in this region from then current dry spell should not be nearly as great as that of early to mid-January.

- Rio Grande do Sul and far southern Paraguay dryness is hurting production

- Minas Gerais to Mato Grosso will continue wet into the weekend with frequent rainfall, but less precipitation may evolve next week which could promote better crop conditions and improved field working conditions

- Central and southern Argentina and far southern Brazil should experience some increase in shower and thunderstorm activity in the last days of February and early March

- Ecuador, Peru and Colombia crop areas will continue to see frequent rain over the next week maintaining moisture abundance for some areas and raising soil moisture in other areas

- Northwest Africa and southwestern Europe “may” see a boost in precipitation after Feb. 23, although confidence is low and the precipitation should be light

- Frequent precipitation in other parts of Europe and the western CIS will maintain moisture abundance and good snow cover protecting winter crops and leaving the potential for good spring moisture high

- There is no threatening cold temperatures expected in Europe or any part of Europe during the next ten days to two weeks

- Kazakhstan and southern Russia’s New Lands will receive only light amounts of precipitation in the next ten days, but any moisture would be welcome for improved topsoil conditions in the spring

- Recent snowfall has changed the early spring moisture outlook at least a little, but the region still has moisture deficits left over from drought last summer and greater precipitation will be needed in the spring.

- India’s weather will be relatively tranquil for the next week to ten days with restricted precipitation and seasonable temperatures

- One more rain event would be perfect in supporting the best possible winter crop yields

- Tropical Cyclone Dumako was moving into northern Madagascar this morning

- Dumako was located 204 miles northeast of Antananarivo, Madagascar near 16.8 south, 49.9 east at 0900 GMT today moving westerly at 16 mph and producing maximum sustained wind speeds of 46 mph

- The storm will move inland with wind speeds of 45 mph and some heavy rain today

- 2.00 to 8.00 inches of moisture is expected resulting in some flooding

- Damage to crops and property should be low, but some flooding will induce a little damage

- Xinjiang, China has reported some light snow in the far northeast and in the mountains of the north and west recently

- Much more precipitation is needed to induce better soil conditions and improved runoff potentials for irrigation water during the spring and summer

- Periodic precipitation is expected, but no major rain or snow events are perceived for a while

- The greatest precipitation this week will be today into Thursday when snow will fall in the northeast of Xinjiang and in the mountains of the west and north

- China’s most recent precipitation has been concentrated on the Yangtze River Basin and areas south to the coast

- The region is plenty wet, if not a little too wet

- Some drying would be welcome

- Additional waves of precipitation will continue to come and go through the next ten days to two weeks

- Resulting precipitation will maintain a wet environment for rapeseed and future rice and corn planting

- Temperatures will be near to below average in most of the nation this week

- Australia’s summer crop areas in the east will be dry or mostly dry away from the Pacific Coast this week and temperatures will continue near to above average

- Rain late in the weekend and next week should increase in the form of scattered showers and thunderstorms

- The precipitation will be erratic benefiting some areas more than others

- South Africa rainfall will increase during this coming week to ten days

- The moisture boost will be welcome for some areas after recent drying

- The drying was more beneficial than detrimental, though, as parts of the nation have been a little too wet at times this growing season

- Temperatures will be seasonable

- West-central Africa coffee and cocoa production areas experienced some increase in shower activity during the weekend, but most of the rain was enough to increase topsoil moisture

- Additional showers are expected in the Feb. 16-22 period that may stimulate a few areas of localized flowering, but most of the precipitation will be too light and sporadic to have much impact on crops

- The rainy season is expected to begin relatively well with March wetter than late February

- Late February rainfall is expected to be sporadic and mostly light with a few pockets of moderate rain

- East-central Africa precipitation has been and will continue to be most significant in Tanzania which is normal for this time of year.

- Ethiopia is dry biased along with northern Uganda and that is also normal

- Southeast Asia precipitation will continue erratic from one day to the next, but most of Indonesia and Malaysia precipitation will continue frequent and abundant

- Mainland areas of Southeast Asia seem poised to see an early start to scattered showers and thunderstorms during the next couple of weeks with next week wettest

- Heavy rain fell Monday and early today in Peninsular Malaysia easing dryness and inducing some local flooding. Far southern Thailand was also impacted

- Rainfall to more than 9.00 inches occurred in southern Thailand while up 6.53 inches occurred in southeastern parts of Peninsular Malaysia

- Middle East snow cover has been favorable recently

- Rain and snow will be limited in this coming week

- Some greater precipitation is possible next week

- Today’s Southern Oscillation Index is +10.21

- The index will move lower over the next seven days

- Mexico will experience seasonable temperatures and a limited amount of rainfall during the coming week

- Central America precipitation will be greatest along the Caribbean Coast during the next seven to ten days

- Guatemala will also get some showers periodically

Source: World Weather Inc.

Bloomberg Ag Calendar

- EU weekly grain, oilseed import and export data

- Malaysia’s Feb. 1-15 palm oil exports

- Malaysia crude palm oil export tax for March (tentative)

- New Zealand global dairy trade auction

Wednesday, Feb. 16:

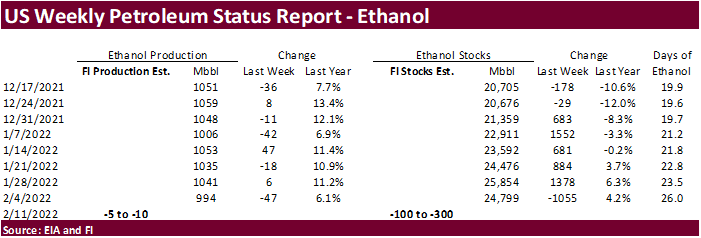

- EIA weekly U.S. ethanol inventories, production

- FranceAgriMer report; monthly grains outlook

- HOLIDAY: Thailand

Thursday, Feb. 17:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- International Grains Council monthly report

Friday, Feb. 18:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly crop condition report

Source: Bloomberg and FI

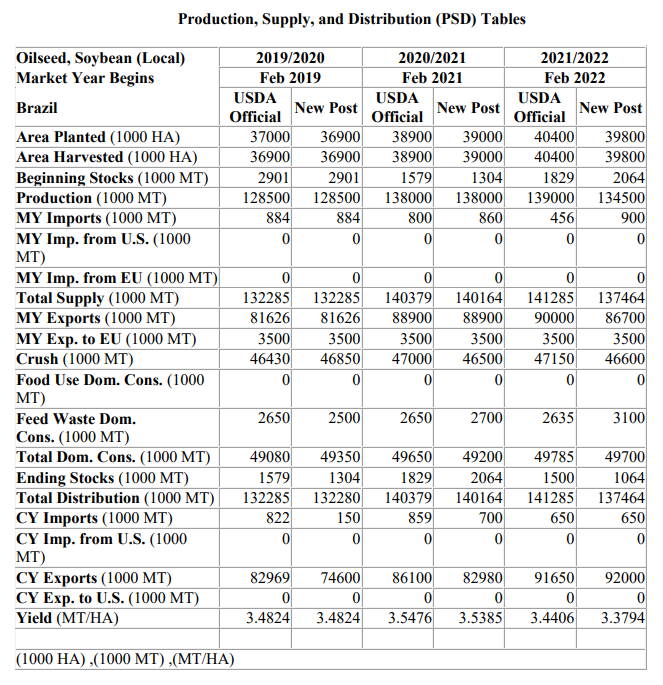

Soybean and Corn Advisor

2021/22 Brazil Soybean Estimate Lowered 6 mt to 124.0 Million

2021/22 Argentina Soybean Estimate Lowered 2.0 mt to 40.0 Million

2021/22 Paraguay Soybean Estimate Unchanged at 5.0 Million Tons

2021/22 Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22 Argentina Corn Estimate Lowered 1.0 mt to 50.0 Million

US PPI Final Demands (M/M) Jan: 1.0% (est 0.5%; prev 0.2%; prevR 0.3%)

– PPI Ex Food And Energy (M/M) Jan: 0.8% (est 0.5%; prev 0.5%)

– PPI Final Demand (Y/Y) Jan: 9.7% (est 9.1%; prev 9.7%)

– PPI Ex Food And Energy (Y/Y) Jan: 8.3% (est 7.9%; prev 8.3%)

7:32:05 AM livesquawk US Empire Manufacturing Feb: 3.1 (est 12.0; prev -0.7)

Canadian Existing Home Sales (M/M) Jan: 1.0% (est -1.5%; prev 0.2%)

81 Counterparties Take $1.608Tln At Fed Reverse Repo Op (prev $1.666 Tln, 81 Bids)

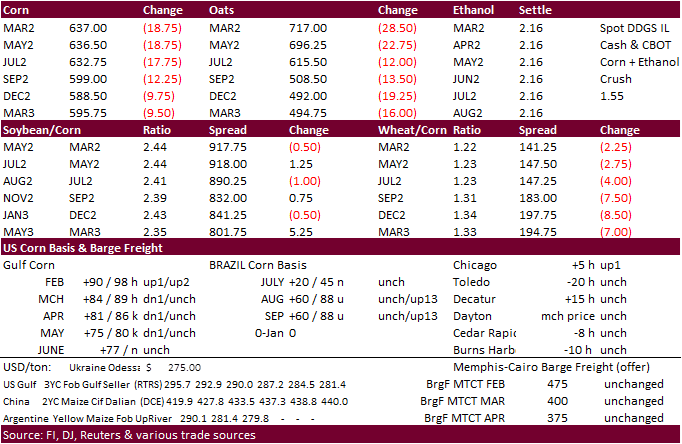

Corn

· March corn traded 17.75 lower in a risk off session as Ukraine/Russia concerns eased.

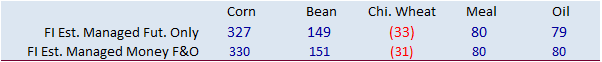

· Funds sold an estimated net 25,000 CBOT corn contracts.

· In our updated US corn S&D attached , we took US corn acres higher, from 91.750 million to 92.200 million. Also lowered our US corn yield estimate from 178.0 to 176.0 to recognize a potential yield drag after producers plan to scale back on fertilizer use due to high prices and/or lack of supplies.

· The highly lethal bird flu case (H5N1) in Fulton County, Kentucky, affected about 240,000 chickens. In 2015 about 50 million poultry perished across the US from several outbreaks.

· A Bloomberg poll looks for weekly US ethanol production to be up 9,000 barrels to 1.003 million (987-1020 range) from the previous week and stocks up 167,000 barrels to 24.966 million.

Export developments.

· None reported

Updated 2/11/22

March corn is seen in a $6.15 and $6.85 range

December corn is seen in a wide $5.25-$7.00 range

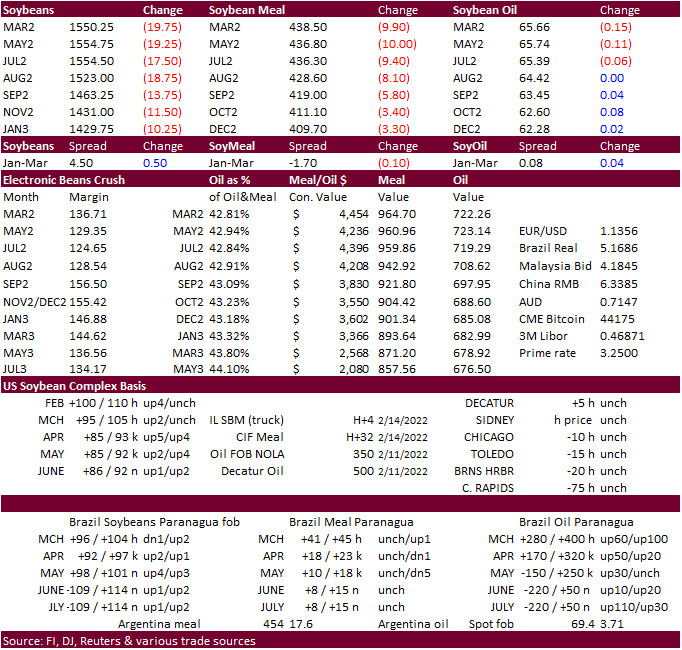

· Soybeans traded lower for the second consecutive day as traders weigh in on South American supplies. There were rumors China may release bulk agriculture products out of reserves. Yesterday we heard China washed out at least five Brazilian soybean cargoes over the past week, and two may have been switched to the US. Today we are hearing up to 12 boats were washed.

· Soybean meal was down $5.80-$9.60/short ton and soybean oil ended mixed (bear spreading).

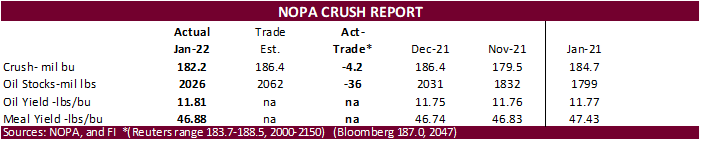

· NOPA’s Jan crush was reported less than expected and implied soybean oil demand was good (see below).

· Funds sold an estimated net 15,000 soybeans, 6,000 meal and net 2,000 soybean oil.

· CBOT March crush fell 3.72 cents to $1.3675.

· South America’s weather situation still calls for mostly dry weather across drought areas for the balance of the week before rain develops during the second week of the outlook.

· USDA Attaché updated their Brazil soybean supply and demand projections. They lowered 2021-22 Brazil soybean production to 134.5 million tons and exports to 86.8 MMT. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Oilseeds%20and%20Products%20Update_Brasilia_Brazil_01-31-2022

· February 1-15 Malaysian palm oil exports were reported by AmSpec at 496,983 tons, up 23.6 percent from 402,243 tons during the Jan 1-15 period. This is an improvement from the Feb 1-10 period. ITS reported Feb 1-15 palm oil exports up 18.8 percent to 506,183 tons from 426,111 tons previous month period.

· Most recent Brazil soy estimates:

Agroconsult 125.8 million tons

Soybean and Corn Advisor 124.0

Pátria Agronegócios 122

Conab 125.5 million tons

AgRural 128.5 million tons

USDA 134 million tons

USDA last year 138

Soybean oil stocks of 2.026 were 36 million pounds below trade expectation and down slightly from December. For the month of January, soybean oil stocks are highest since 2013 (IA stocks highest since April 2020). Implied US domestic use for soybean oil was better than expected. This comes after the crush was reported below expectations and the January oil yield of 11.81 climbed from 11.75 pounds per bushel reported in December 2021. The yield is a record for the month of January but ranks 14th highest for any month going back to 2002. Note the highest recorded monthly NOPA yield was 11.94 for March 2013.

NOPA’s implied domestic use for soybean oil is near record and highest since July 2020. January soybean oil production of 2.151 billion pounds was down a small amount from 2.192 billion during December. The US soybean meal yield increased to 46.88 from 46.74 during December and compared to 47.43 January 2021.

We will consider lowering out 2021-22 US soybean estimate if February crush rates fail to rebound from January. Currently we stand at 2.215 billion, same as USDA.

- Turkey seeks 6,000 tons of sunflower oil on February 23 for shipment between March 2 and March 25.

- Private exporters reported sales of 101,000 metric tons of soybeans for delivery to Mexico. Of the total, 53,500 metric tons is for delivery during the 2021/2022 marketing year and 47,500 metric tons is for delivery during the 2022/2023 marketing year.

- Egypt’s GASC seeks vegetable oils on February 16 for April 5-25 arrival. They seek a minimum 10,000 tons of sunflower oil and 30,000 tons of sunflower oil. They are also seeking local vegetable oils of at least 3,000 tons of soyoil and 1,000 tons of sunflower oil for arrival April 1-20.

Updated 2/15/22

Soybeans – March $14.75-$16.50

Soybeans – November is seen in a wide $12.00-$15.75 range

Soybean meal – March $420-$480

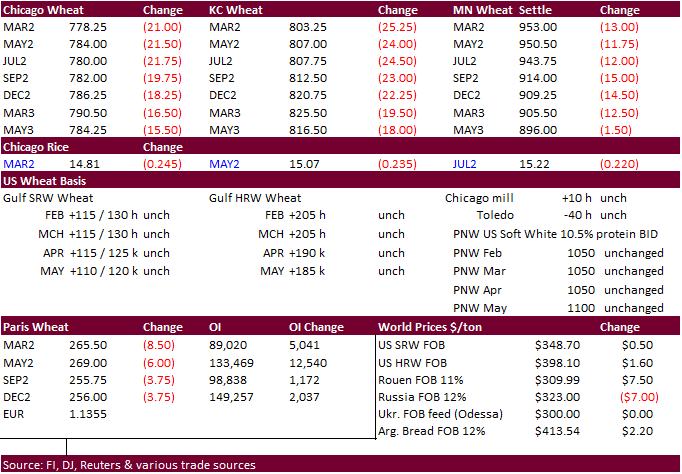

· Risk off session in wheat as some Russian troops “returned to base”, easing fears of an invasion of Ukraine. This news pressured wheat futures early and that last all session. Some traders remain cautious over the recent headline trading. The headline trading has kept some traders on the sidelines.

· Funds sold an estimated net 13,000 net Chicago wheat contracts.

· EU wheat futures are trading down 8.50 euros at 266.75 euros per ton.

· Egypt said they have enough wheat strategic reserves to last 4.2 months.

· Egypt plans to increase strategic stores of supply commodities to 8-9 months.

· Later in the day Egypt announced they float an import tender next week.

· SovEcon raised its forecast for Russia’s 2022 wheat crop by 3.6 million tons to 84.8 million toes, citing favorable weather.

· A major US winter storm expected will occur Wed-Thur this week. Abundant rain is seen near and south of the Ohio River and into the Delta and mid-south region Wednesday and Thursday with a band of snow coming out of the southern Plains into the lower eastern Midwest.

· The northern Plains and upper Midwest may get some greater precipitation next week.

· South Korean flour mills seek 50,000 tons of wheat from the US and 32,000 tons from Canada on Wednesday.

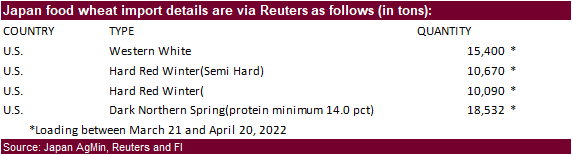

· Japan seeks 54,692 tons of food wheat from the US this week.

· Results awaited: The Philippines seek 45,000 tons of feed wheat on Tuesday. Shipment is sought in June and July.

· Results awaited: Syria seeks 200,000 tons of wheat on February 14, open for 15 days. Algeria seeks 50,000 tons of milling wheat on Feb 16, open until Feb 17, for April shipment. They last bought wheat on Jan 26, paying around $375/ton.

· Japan seeks 80,000 tons of feed wheat and 100,000 tons of barley on Feb 16 for arrival by July 28.

· Taiwan seeks 54,920 tons of US wheat on February 18, for April 4-18 shipment if off the PNW.

·

· Turkey seeks 255,000 tons of feed barley on February 22. Shipment is sought for March 1-31.

· Jordan seeks 120,000 tons of feed barley on February 22 for late July through FH September shipment.

Rice/Other

· None reported

Updated 2/2/22

Chicago March $7.25 to $8.30 range

KC March $7.45 to $8.55 range

MN March $8.75‐$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.