PDF Attached

USDA

report day.

Wednesday:

MPOB (comes out tonight for Americas)

Thursday

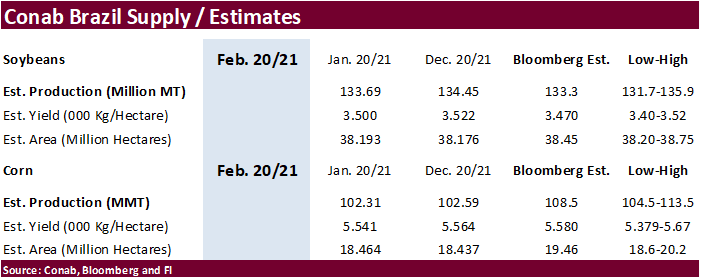

Conab

USDA

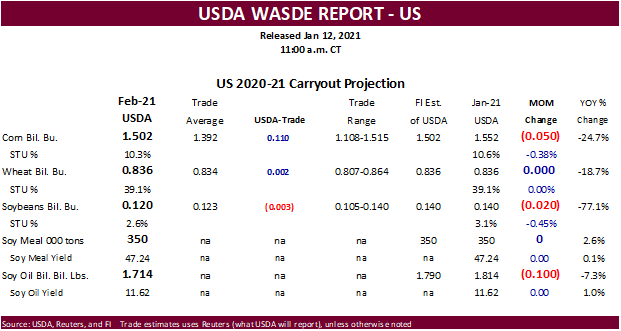

released their February S&D.

Reaction:

Perceived

bearish with corn and soybeans that were already trading higher pre report. Wheat on the other hand is seen supportive, for traders following global inventories. US corn stocks were well above trade expectations, but China remains the million dollar question

with final current crop year imports.

Recall

last S&D report CBOT corn traded limit higher. Nearby hit session lows post report. February USDA supply and demand report traditionally is a benign report. USDA made US demand adjustments this month to accommodate global trade flows, notably corn, despite

no 2020-21 production changes for Argentina and Brazil corn and soybean estimates. Note overnight China left their corn and soybean S&D’s unchanged. But USDA has a differs view on China corn imports as they raised it by 6.5 million tons to a record 24 million

tons.

We

wonder if the next round of large buying by China wheat will be.

Major

changes

China

corn imports were upward revised 6.5 million tons to 24 million tons.

USDA

upward revised US soybean exports by 20

US

SBO for biodiesel use up 100

US

corn exports up only 50

No

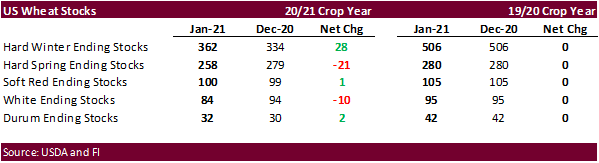

change to US wheat (ALL) balance, but notable by class below

Big

drop of 9.0 million tons for world wheat stocks

World

corn stocks up 2.7MMT and soybeans down 1.0MMT.

USDA

NASS executive summary

https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php

Weather

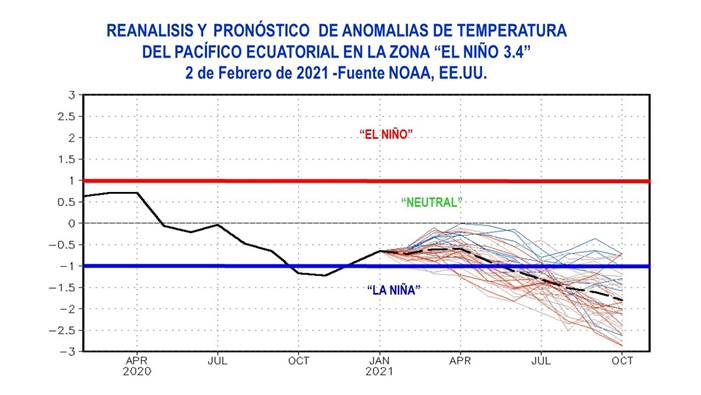

Argentina’s

exchange released an email updating La Nina prospects through October

MOST

SIGNIFICANT WEATHER AROUND THE WORLD

- Northwestern

Ukraine, southeastern Belarus and west-central Russia will experience heavy snow and blizzard conditions late this week and into the weekend with 12-20 inches of snow from a single storm - Livestock

stress and travel delays are likely - Bitter

cold will follow the event, but winter grains will be adequately protected from the cold - Snow

will continue to fall over many areas in eastern Europe and the western CIS during the next ten days keeping snow cover present to protect most winter crops from damaging cold - Russia’s

Southern region will also get some snow, but temperatures are not currently expected to be low enough to threaten crops in the near term - Flood

potentials remain high in western Europe due to saturated soil and frequent ongoing bouts of precipitation - No

large storms are expected in the coming week, but the following week may trend a little stormier - North

Africa will continue to experience erratic rainfall - Dryness

remains a concern in southwestern Morocco and northwestern Algeria with favorable conditions in most other areas - Winter

crops are semi-dormant and do not have much need for precipitation now, but greater precipitation will be needed in a few weeks as spring growth begins - India

may get some welcome precipitation in the central and southeast parts of the nation next week, but the coming seven days will remain mostly dry - Any

precipitation would be welcome for winter grain, oilseeds and pulse crops - Sugarcane

and rice would also benefit from the precipitation - Eastern

Australia weather still looks highly favorable in New South Wales where a mix of rain and sunshine is supporting many crops especially the irrigated cotton and sorghum - Little

change in the current trend is expected for the next two weeks - Queensland,

Australia will receive some important rainfall as scattered showers and thunderstorms during the next two weeks - Portions

of the state’s grain and cotton areas will not get enough rain to seriously bolster soil moisture, but other areas will see a good mix of weather - Irrigated

crops are in the best conditions and will remain that way - Argentina

weather Monday - Temperatures

Monday were mild in the southwest half of the nation with highs in the 70s Fahrenheit with a few 60s in San Luis and southern Cordoba - The

cool air was very helpful in conserving soil moisture through lower evaporation - Temperatures

were seasonably warm in the northeast where highs in the 80s and lower to a few middle 90s Fahrenheit were noted - Rainfall

was confined to San Luis, a few far western Cordoba locations and in portions of Santiago del Estero where amounts varied up to 0.79 inch - Argentina

will continue to experience restricted rainfall from La Pampa and western Buenos Aires into Santa Fe and southeastern Cordoba over the next ten days - Any

showers that occur (and there will be some) will be brief and light failing to counter evaporation, but will they will help slow the drying trend - Rain

will be a little more significant periodically in eastern Buenos Aires, Entre Rios and northern parts of Argentina; including Santiago del Estero and a few western Cordoba locations - Temperatures

will be seasonable - Most

crops in the nation will remain in favorable condition for the coming week due to either favorable subsoil moisture or due to timely rainfall. Some drying is expected and a rise in crop stress is probable for the drier areas noted above, but critically dry

conditions are not expected in this first week of the outlook. World Weather, Inc. still believes late February rainfall will increase in time to maintain a favorable – not ideal – outlook for summer crop development.

- Brazil

weather Monday was good for soybean and early corn maturation and harvest progress - Rain

was limited to Minas Gerais and a few neighboring areas while dry and warm conditions occurred to the west and south - Aggressive

fieldwork likely occurred - High

temperatures were in the 90s Fahrenheit in Mato Grosso which helped to accelerate drying and perpetuate fieldwork - Highs

in the 80s and lower 90s occurred in many other areas with some 70s in Minas Gerais and parts of both Espirito Santo and Rio de Janeiro - Brazil

weather is still expected to be favorably mixed over the next two weeks with alternating periods of rain and sunshine supporting crop maturation and fieldwork as well as supporting normal crop development - Rain

may fall a little more often than desired in several areas, but the pattern will not be anomalously wet enough to induce a serious crisis in fieldwork - Some

areas will need drier weather while others will experience sufficient drying time to support favorable advancements in the planting of Safrinha crops and the harvest of soybeans - South

Africa weather will include some net drying for a while especially in western crop areas - Most

of the nation was dry Monday - Rain

is possible periodically as scattered showers across the nation, but resulting amounts will be light - Natal

and some neighboring areas will be wettest Friday through the weekend with some heavy rainfall near the coast - Temperatures

will be seasonable with a warm bias in the west - Indonesia,

Malaysia and Philippines weather is expected to be varied over the next ten days with periods of rain expected – most of which will be light intensity - Some

locally moderate rain will be possible - Heavy

rain may impact a part of the east-central and southeastern Philippines in the February 17-23 period

- Northern

Laos, northern Vietnam and immediate neighboring areas received 1.00 to 2.25 inches of rain Monday and early today - The

moisture was welcome for winter crops, but it may have induced some coffee flowering in the north of Vietnam - Showers

from the same disturbance will move south through the remainder of Vietnam, Cambodia, Laos and eastern Thailand today and early Wednesday before dry weather resumes - Rainfall

today and early Wednesday will be much lighter than that of Monday and should not cause much concern for coffee flowering in Vietnam’s Central Highlands - Rain

in other areas will be good for winter crops - The

return of drier weather will be equally welcome since seasonal rainfall does not begin in the mainland areas of Southeast Asia until March normally - Much

needed rain will fall in southern China today and Wednesday impacting areas from Guangxi and Guangdong to Fujian and Zhejiang - These

provinces are quite dry and considered to be in various stages of drought, according to the China Meteorological Department - The

rain will be welcome and should range from 0.75 to 1.50 inches with a few amounts over 2.00 inches, but drought status will remain

- Greater

rain is needed in the next few weeks to support improved rice and corn planting conditions and to stimulate improved sugarcane and citrus development - China

temperatures have been warmer than usual in recent days, but did trend a little cooler Monday - The

warmth has stimulated a little rapeseed development in the south, but no aggressive plant development is expected for a while - Temperatures

will remain a little warmer than usual, but still cool enough to keep development in check for a while - No

threatening cold will occur in the nation’s wheat or rapeseed areas for the next ten days, although the northeast will trend colder next week - Bitter

cold will continue in North America through the weekend with some moderation in temperatures Sunday into early next week - Some

of the coldest air will push through a part of the U.S. Midwest this weekend and early next week before retreating into eastern Canada - Waves

of snow will continue while the bitter cold is in place and that snow will be extremely important for winter wheat in the Midwest and central Plains - No

winterkill is expected in soft wheat areas in the Midwest or in hard red winter wheat production areas - Snow

free areas in the northern Plains and a part of Saskatchewan might have induced winterkill for some minor wheat production areas in recent days and the losses are not expected to expand much further - These

are minor wheat production areas relative to the nation’s entire crop, although a few counties in South Dakota may lose some of their crop and that area does produce more winter wheat than North Dakota

- Heavy

snow will evolve from South Dakota and eastern Wyoming southward into northern Texas and east into the central and western Midwest Friday through Sunday - Accumulations

of 2 to 6 inches will occur in South Dakota while 4 to 10 inches occur in the central Plains and 5 to 12 and local totals over 14 inches may impact a part of the Midwest - Snowfall

in the southwestern Plains will vary from a trace to 4 inches while parts of Oklahoma will get 4 to 8 inches - Moisture

content in the snow will be low in the Plains and probably will not impact drought status much, but the moisture will be greater in the Midwest where some minor flood potentials will rise as spring approaches - River

icing on the upper Mississippi, upper and middle Missouri and Illinois Rivers will continue over the next several days slowing or shutting down barge traffic for a while - U.S.

Delta and southeastern states will experience waves of rain and some snow, freezing rain and sleet over the next ten days maintaining wet field conditions and inducing some travel delay while stressing livestock - U.S.

livestock stress will continue significant across the northern and central Plains and upper Midwest through the weekend and into early next week with some increase in animal stress in the southwestern Plains for a little while this weekend as well - Milk

production could slip lower and animal weight gains may be slow - There

will be some risk of animal death or injury because of the bitter cold, snow and extreme wind chills - U.S.

northwestern states will see waves of snow and rain from mid-week this week through next week, but the precipitation will be greatest along the coast and in the mountains - Drought

status is not likely to change much in the interior western states - U.S.

northern Plains drought will not be changed over the next week to ten days, despite some bouts of light snow from Montana to South Dakota - The

same is true for Canada’s eastern and southern Prairies drought - East-central

Africa rainfall will be erratic and mostly light each day through the next two weeks - Tanzania

will receive the greatest rain and experience the greatest daily coverage - A

few showers and thunderstorms will occur periodically in Ethiopia, Kenya and Uganda - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonably warm range for the next ten days - There

is potential for a few of the showers to reach northward into coffee and cocoa production areas of Ivory Coast and Ghana next week, but resulting rainfall should be light - Some

showers were noted in western Nigeria crop areas briefly Monday - Southern

Oscillation Index weakened during the weekend and this trend will continue this week - Today’s

SOI was +14.71 today and the index will continue to rise for a little while this week - Mexico

precipitation this week and next week will be mostly confined to the east coast

- The

precipitation will be erratic and mostly light, but still welcome wherever it occurs - Many

areas in Mexico are still dealing with long term drought - Central

America precipitation will continue greatest along the Caribbean Coast and in Guatemala while the Pacific Coast is relatively dry - Canada

Prairies will be much colder than usual into the weekend and then “some” warming is expected for a while late this weekend and next week - Temperatures

are not likely to become warmer than usual, but may rise a little closer to normal for a while - Bitter

cold conditions have been threaten unprotected wheat and livestock - Some

wheat damage has occurred in Saskatchewan and livestock stress has been extremely high - Southeast

Canada will experience less than usual precipitation and some colder biased conditions this week

Source:

World Weather Inc. and FI

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - (CASDE

?) - France

agriculture ministry updates 2021 winter-crop planting estimates

Wednesday,

Feb 10:

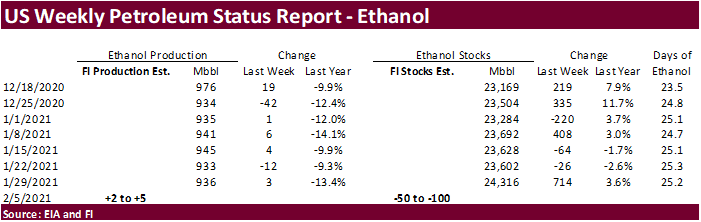

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysian

Palm Oil Board data on January palm oil end- stocks, output, exports - Malaysia

Feb. 1-10 palm oil export data from AmSpec, Intertek, SGS - FranceAgriMer

monthly grains report - HOLIDAY:

Vietnam

Thursday,

Feb 11:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Conab’s

data on yield, area and output of corn and soybeans in Brazil - Russian

consultant IKAR holds agricultural conference, day 1 - Port

of Rouen data on French grain exports - HOLIDAY:

China, Japan, South Korea, Vietnam

Friday,

Feb 12:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Russian

consultant IKAR holds agricultural conference, day 2 - New

Zealand Food Prices - HOLIDAY:

China, Hong Kong, Indonesia, Malaysia, South Korea, Singapore, Vietnam, Thailand, Philippines

European

Crude And Oil Products Stocks At 1.161 Bln Barrels In Jan, Up 0.5% From Dec, Up 4.5% Y/Y – Euroilstock

–

European Crude Oil Stocks At 483.41 Mln Barrels In Jan, Down 0.8% From Dec, Up 2.9% Y/Y

–

European Gasoline Stocks At 118.49 Mln Barrels In Jan, Up 1.3% From Dec, Down 0.7% Y/Y

–

European Middle Distillates Stocks At 461.18 Mln Barrels In Jan, Up 1.5% From Dec, Up 8.3 % Y/Y

US

EIA Raises Forecast For 2022 World Oil Demand Growth By 190K Bpd, Now Sees 3.50 Mln Bpd YoY Increase

–

Cuts Forecast For 2021 World Oil Demand Growth By 180K Bpd, Now Sees 5.38 Mln Bpd YoY Increase

–

2021 World Oil Demand Growth Unchanged At 5.56 Mln Bpd YoY Increase

–

2022 World Oil Demand Growth Unchanged At 3.31 Mln Bpd YoY Increase

Corn.

-

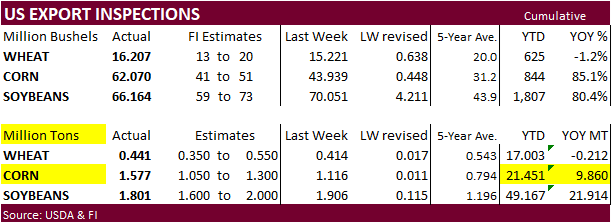

Corn

futures were lower as expected as futures money managed positions were already unusually high. Prices are not out of reach for new high though. China needs to import a record amount of US corn inspections which is not out of reach.

-

Meanwhile

China’s AgMin warned domestic corn prices are expected to remain high in 2020-21 from strong demand in the livestock sector.

-

Goldman

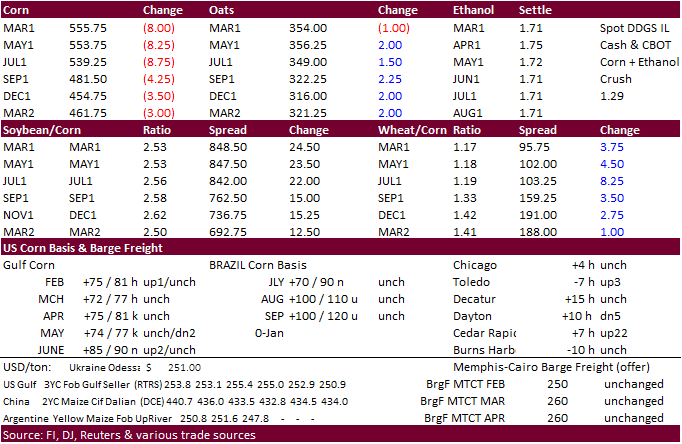

roll – day 3. Spreads were again active but more so USDA S&D report related, IMO.

-

Algeria

reported a H5N8 bird flu outbreak. -

A

Bloomberg poll looks for weekly US ethanol production to be unchanged at 936,000 barrels (929-941 range) from the previous week and stocks up to 181,000 barrels to 24.497 million.

Corn

Export Developments

Updated

2/9/21

March

corn is seen trading in a $5.30 and $6.00 range. (up 15, unch)

May

corn is seen in a $5.15 and $6.00 range. (up 15, unch)

July

is seen in a $5.00 and $6.00 range. (up 10, up 25)

December

corn is seen in a $3.75-$5.50 range. (no change)