PDF Attached

FOMC

Hikes By 25Bps; Target Range Stands At 4.50% – 4.75%

–

Interest Rate On Reserves Balances Raised By 25Bps To 4.65%

US

equities rebounded post US Fed announcement. The USD was down 95 points by later afternoon and WTI was off $2.19. Soybeans fell in large part to weakness in soybean oil. Soybean meal was higher. Crude oil pressured soybean oil while ongoing Argentina crop

concerns supported soybean meal. Soybean saw some profit taking from Brazil harvest pressure. Grains ended higher on bottom picking (wheat) and spreading against soybeans (corn).

MOST

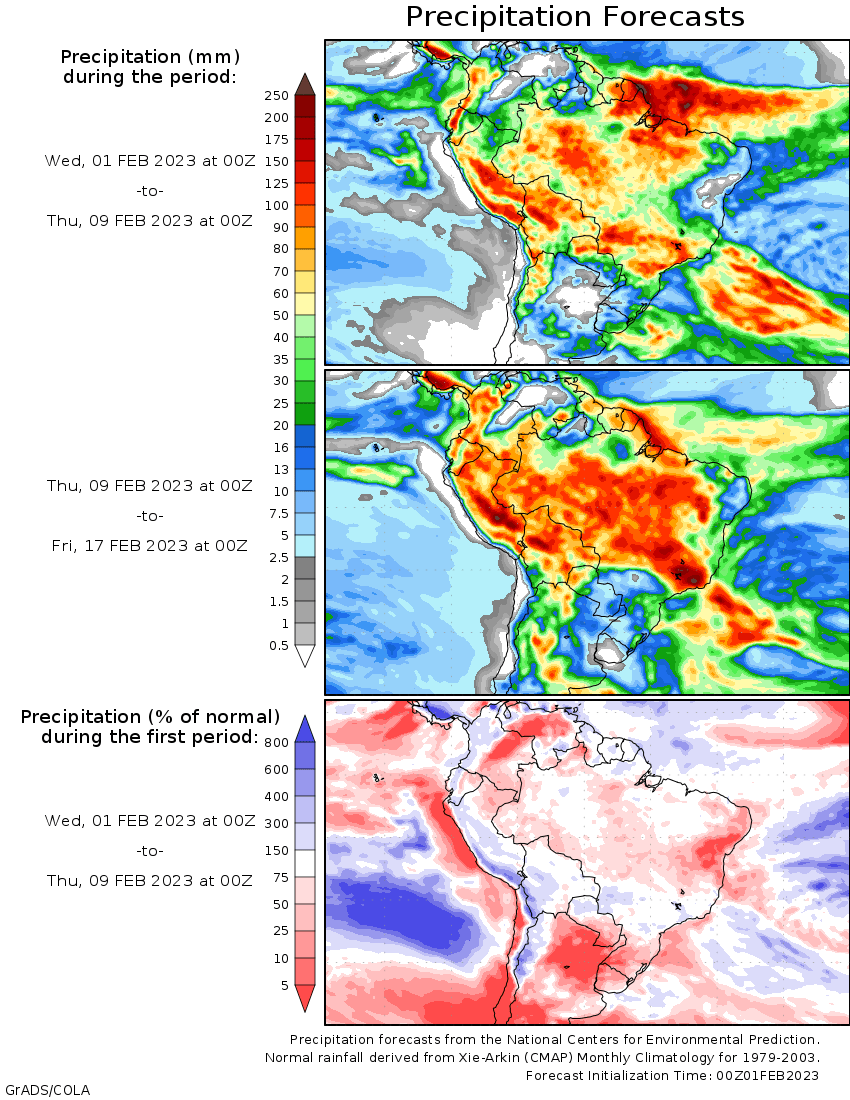

IMPORTANT WEATHER FOR THE COMING WEEK

-

Not

much change occurred overnight around the world -

Argentina

will get some welcome rain in the west and south today and Thursday, but drying is expected for a full week after that with some areas going ten days without rain -

Temperatures

will trend warmer than usual in the driest areas in northeastern Argentina -

Argentina’s

crop moisture stress will be greatest in Chaco, Formosa, Corrientes, Entre Rios and northeastern Santa Fe over the next two weeks -

These

areas have very poor soil moisture and will likely go ten days without rain while temperatures are rising above normal

-

Serious

crop stress and production cuts may result especially if these areas do not see greater rain later this month -

Argentina’s

soil moisture is best in the western parts of the nation and crops there should manage the drier weather of the next week to ten days relatively well as long as temperatures do not become oppressively hot -

Buenos

Aires soil moisture is expected to be a little too light to carry crops through the next week ten days (beginning Friday) of dry weather -

Follow

up rain will be very important -

Today

and Thursday’s rain will moist up the topsoil, but amounts will not be great enough to carry crop development for very long without significant follow up moisture -

Brazil’s

weather may be a little less intensive on rainfall through the weekend, although totally dry weather is not likely -

The

lighter rain will help some of the wetter areas see a little firming in the topsoil -

Once

the ground firms a little farmers will be able to harvest soybeans and plant Safrinha crops at a faster pace even though rain will resume a little more significantly next week -

Wetter

biased conditions are likely again next week -

Drying

Tuesday in Minas Gerais, Goias, Bahia and Espirito Santo was welcome and good for all crops -

Portions

of Mato Grosso also dried down a little -

South

Africa rainfall is expected to ramp up over the coming week and greater than usual rainfall is expected this weekend and next week -

The

wetter bias will help return favorable field moisture and better reproductive conditions for many summer crops -

Production

potentials are still high in the most of the nation -

India’s

recent rain was welcome, but not nearly enough to seriously change soil or crop conditions in the majority of winter crop areas -

Vegetative

health indies suggest crops are in mostly good shape, but perhaps a little less so in a part of Uttar Pradesh and eastern pulse production areas -

Greater

rain is needed in all winter crop areas -

Production

should be average if excessive heat is avoided in February, but if it gets hot too soon the crop will do poorly because of the limited moisture situation -

Southeastern

China will be trending wetter over the next ten days -

Areas

near and south of the Yangtze River will become abundantly wet soon which should help reduce market concerns about moisture in the region -

Rapeseed

is still poised to perform well this year – at least from World Weather, Inc.’s perspective -

North

Africa rainfall has diminished and net drying is expected over the coming week -

Soil

moisture is rated favorably in northern Algeria and near the coast in northern Morocco and northern Tunisia, but all other areas need rain -

Rain

should resume in the second week of the outlook, but mostly in northern Algeria and coastal Tunisia once again -

Eastern

Australia rainfall has been favorable for the past two to three days with short term moisture improvements occurring in pockets across Queensland and northern New South Wales

-

The

most abundant rain has been in the Darling Downs region of northeastern New South Wales and far southeastern Queensland

-

Net

drying is expected through the weekend -

The

next best opportunity for rain will evolve next week -

Western

Europe will be drier biased for the next week to ten days with rainfall expected to increase again during the latter part of next week -

Eastern

Europe precipitation will occur periodically and erratically with some areas getting far more moisture than others -

Europe

and Asia crop areas are not at risk of any crop damaging cold in the next two weeks -

U.S.

hard red winter wheat production areas are not likely to see much significant moisture in the next two weeks, but crops are dormant and unlikely to change much -

West

Texas will get a mix of precipitation types today into early Thursday -

Moisture

totals will be light, but the moisture will be welcome for use in the spring -

Some

follow up precipitation may occur for a little while next week -

U.S.

Delta and southeastern states will be wet biased for much of the next two weeks -

Some

areas are already a little too wet -

Freezing

rain is expected the northern Delta and a part of the lower Tennessee River Basin today -

Texas

precipitation today into tonight will fall largely as freeing rain with some snow and freezing rain in southern Oklahoma

-

Power

outages have already occurred and more are possible -

U.S.

Midwest weather will be relatively quiet in this first week of the forecast, although snow, rain and freezing rain will develop across the Great Lakes region early next week as warming arrives

-

U.S.

Northern Plains and upper Midwest will receive lighter than usual precipitation for a while over the next ten days and temperatures will trend warmer after being quite cool today and again Thursday into Friday morning of this week -

U.S.

Pacific Northwest is not likely to see much precipitation east of the Cascade Mountains for a while and temperatures will trend warmer -

Some

rain and snow will fall this weekend and periodically next week -

Temperatures

will be cooler than usual in the central United States the remainder of this week and then slowly warm up from west to east across the region this weekend into next week

-

California

will receive some rain and mountain snow late this week and a couple of times next week

-

Middle

East weather is expected to gradually turn a little wetter during the coming week to ten days and the precipitation will help improve soil moisture for future wheat development and eventual cotton planting later in the year -

Turkey

will be one of the wetter nations -

West-central

Africa will receive some coastal showers in the coming week with some of the precipitation expected to drift northward into coffee, cocoa and sugarcane production areas -

Any

rain that reaches into crop areas will be sporadic and light for a while -

Seasonal

rains usually develop in February -

Southeast

Asia rainfall will be most significant in Indonesia and Malaysia as well as eastern portions of central and southern Philippines over the next ten days -

The

moisture will be good for ongoing crop development, although a few areas may become a little too wet -

Central

Sumatra may be one of the drier areas -

East-central

Africa rainfall will remain most significant in Tanzania and southern Uganda while more limited in areas north into Ethiopia which is not unusual for this time of year -

Today’s

Southern Oscillation Index was +9.95 today and the index is expected to move erratically lower over the next week

Source:

World Weather and FI

Bloomberg

Ag calendar

Wednesday,

Feb. 1:

- EIA

weekly US ethanol inventories, production, 10:30am - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - HOLIDAY:

Malaysia

Thursday,

Feb. 2:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports

Friday,

Feb. 3:

- FAO

World Food Price Index - FAO

Cereal Supply and Demand Brief - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options

Source:

Bloomberg and FI

Due

out Feb 7 @ 7:30 am CT

Selected

Brazil commodities exports:

Commodity

January 2023 January 2022

CRUDE

OIL (TNS) 6,578,636 4,192,439

IRON

ORE (TNS) 24,686,106 24,894,012

SOYBEANS

(TNS) 851,878 2,452,064

CORN

(TNS) 6,348,030 2,732,473

GREEN

COFFEE(TNS) 169,553 178,051

SUGAR

(TNS) 2,119,507 1,349,529

BEEF

(TNS) 160,191 138,061

POULTRY

(TNS) 388,597 317,378

PULP

(TNS) 1,699,467 1,622,085

Reuters

table via Brazil AgMin

Macros

FOMC

Hikes By 25Bps; Target Range Stands At 4.50% – 4.75%

–

Interest Rate On Reserves Balances Raised By 25Bps To 4.65%

US

ADP Employment Change Jan: 106K (est 180K; prev 235K)

US

MBA Mortgage Applications Jan 27: -9.0% (prev 7.0%)

US

MBA 30-Yr Mortgage Rate Jan 27: 6.19% (prev 6.20%)

An

OPEC+ committee recommended keeping crude production steady, delegates said, as the oil market awaits clarity on demand in China and supplies from Russia, Saudi Arabia and its partners

US

ISM Manufacturing Jan: 47.4 (est 48.0; prev 48.4)

–

Prices Paid: 44.5 (est 40.4; prev 39.4)

–

Employment: 50.6 (prev 50.8)

–

New Orders: 42.5 (prev 45.1)

US

JOLTS Job Openings Dec: 11.012M (est 10.300M; prev R 10.440M)

US

Construction Spending (M/M) Dec: -0.4% (est 0.0%; prev R 0.5%)

US

DoE Crude Oil Inventories (W/W) 27-Jan: +4.140M (est -1.000M; prev +533K)

–

Distillate: +2.320M (est -1.500M; prev -507K)

–

Cushing: +2.315M (prev +4.267M)

–

Gasoline: +2.576M (est +2.000M; prev +1.763M)

–

Refinery Utilization: -0.4% (est +1.00%; prev +0.8%)

·

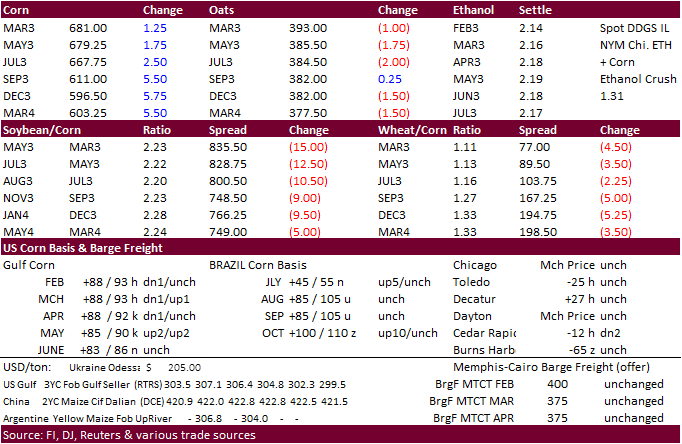

CBOT corn

traded

two-sided, ending higher on South American crop condition concerns. After seeing additional rain this week, Argentina will trend drier next week.

·

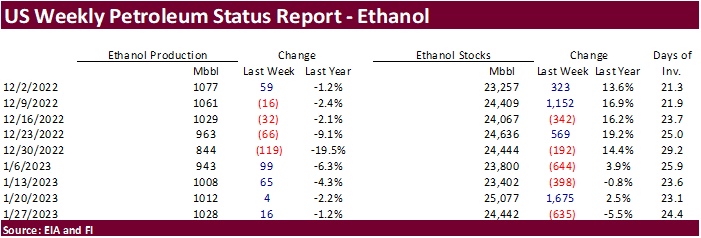

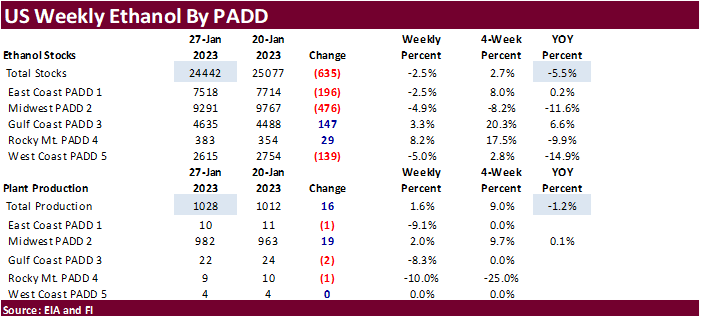

EIA reported a large draw in ethanol stocks and uptick in ethanol production, supportive for corn futures.

·

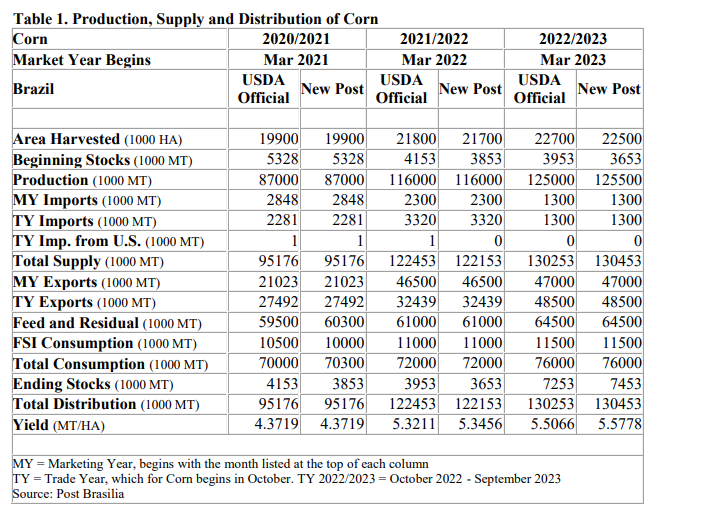

StoneX raised its forecast of the Brazil corn crop to 129.9 million tons from 128.71 million last month.

·

Egypt cancelled their import tender for yellow corn due to “high prices.” Earlier US corn was the lowest offer.

·

A backup in Ukraine boats (arriving and leaving) and uncertainty over the grain export corridor agreement, expiring mid-March, has some importers backing off from booking Ukraine grain shipments.

·

A mad cow disease case was discovered on a farm in the Netherlands.

·

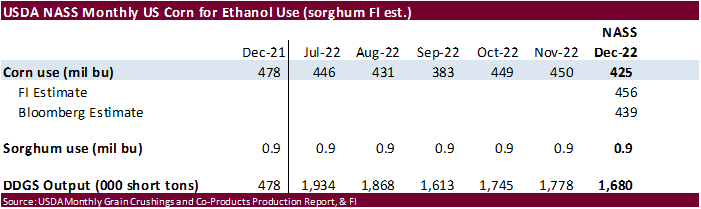

NASS corn for ethanol use for the month of December came in well below our estimate and trade expectations. .

·

We lowered our corn for ethanol use to 5.225 million, down from 5.250 billion from previous, and compares to USDA’s 5.275 billion bushel projection.

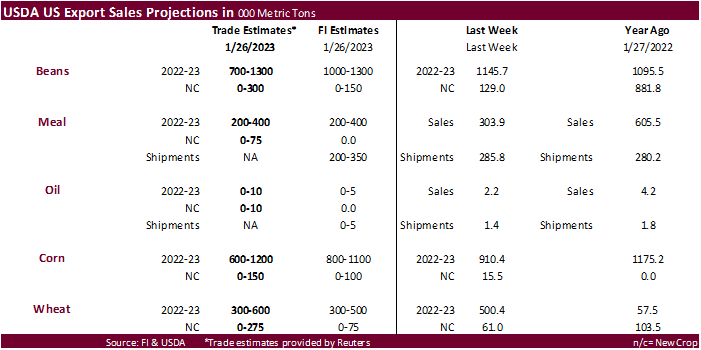

Export

developments.

·

South Korea’s NOFI group bought an estimated 117,500 tons of corn in two consignments, optional origin. 52,500 tons was for arrival in South Korea around May 5 at an estimated price of $337.99 a ton. Another 65,000 tons was for

arrival in South Korea around May 15 at an estimated $336.69 a ton c&f.

USDA

Attaché – Brazil grain and feed update.

Updated

01/31/23

March

corn $6.60-$7.00 range. May

$6.25-$7.00

·

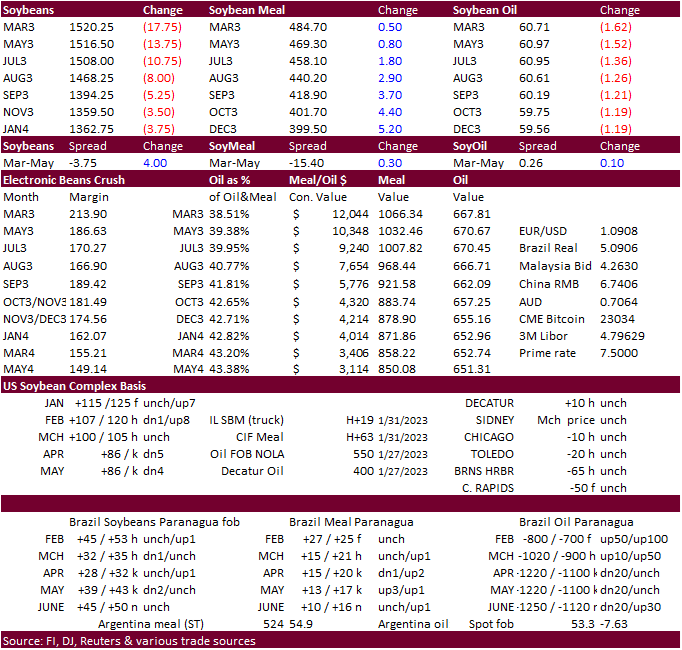

Soybeans sold off led by the nearby positions on sharply lower soybean oil and Brazil harvest pressure. Soybean oil was pressured by lower WTI crude oil. Soybean meal ended higher. Argentina is expected to return to a drier weather

pattern next week. Earlier we heard China was inquiring for US soybeans and corn off the PNW. During the day session, we understand China was pricing US and Brazilian soybeans.

·

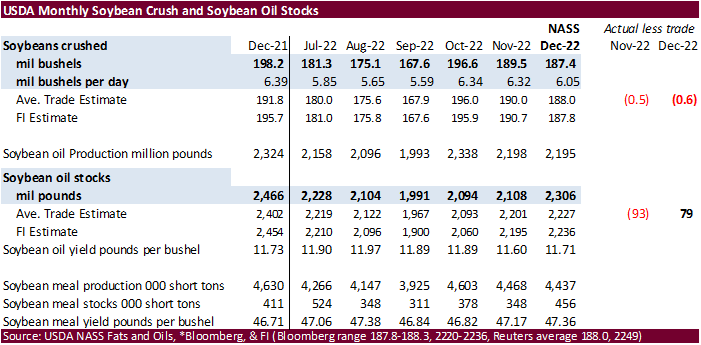

NASS crush came in slightly below expectations and soybean oil stocks were above an average trade guess. We think USDA will lower its crop years crush by 10 million bushels next week.

·

StoneX raised its forecast of the Brazil soybean crop to a record-high 154.2 million tons from 153.79 million last month.

·

Russia will leave its export duty on sunflower oil unchanged for the month of February a zero percent and raised meal to 2,200.7 rubles per ton from 1,826.9 rubles.

·

Indonesia rolled out B35 today. The government does not see a problem with stocks from this.

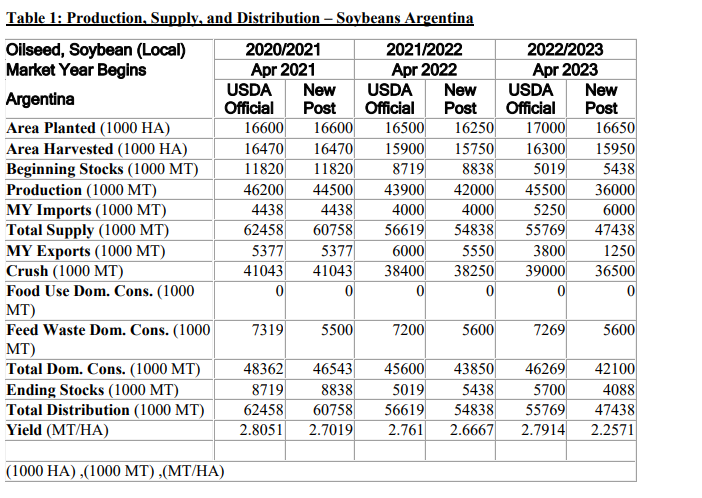

USDA

Attaché on Argentina soybeans – 36 million tons, 9.5MMT below USDA official

“Due

to hot, dry weather in late 2022, Post estimates MY 2022/23 soybean production at 36 million metric tons (MMT), 9.5 MMT below the official USDA estimate. A wide range of possibilities still exist for the 2022/23 Argentine soybean crop. With perfect growing

conditions for the rest of the season, it is still early enough that the large area planted to second-crop or late planted soybeans could compensate for losses in first-crop beans to yield a total production that exceeds the disastrous drought during the MY

2017/18 crop year. However, a return to high temperatures and dry conditions could drop production lower than Post’s current estimate.”

Argentina

crush was estimated 2.5MMT below USDA official at 36.5 MMT, below post 38.250 MMT for 2021-22. Exports were estimated at only 1.250 million tons, below 3.8 MMT USDA official and compares to 5.550 MMT post forecast for 2021-22.

·

Today the CCC was in for 3,770 tons of vegetable oils for last half March shipment.

·

The CCC seeks a total of 100,320 tons of bulk hi-pro soybean meal for shipment to Ghana, Ivory Coast and Senegal. One half will be shipped Mar 21-31, with the balance for Apr 1-10 shipment. All offers are due by Feb 2 at 2 PM

CT.

Updated

01/31/23

Soybeans

– March $15.00-$15.80, May $14.75-$16.00

Soybean

meal – March $450-$520, May $425-$550

Soybean

oil – March

60.00-67.00, May 58-70

·

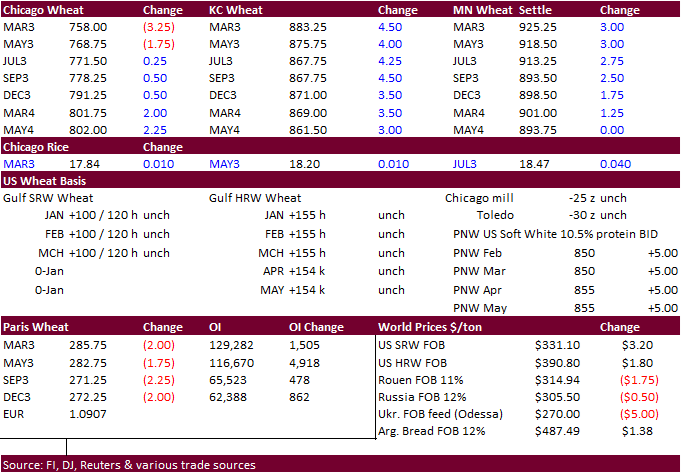

Chicago wheat traded two-sided, ending mostly higher on technical buying despite improving US temperatures (warmer) by the end of the workweek. Wheat is still trading at a discount to corn futures.

·

March Chicago wheat ended lower on spreading.

·

The USD tanked by late afternoon, down 94 points by 4:30 pm.

·

The recent cold blast should be uneventful for crop conditions for the central and northern Great Plains due to adequate snow coverage but the ice storm across parts of Texas and OK could yield minimal damage to the winter wheat

crop.

·

Paris March wheat was 2.00 euro lower at 285.25 per ton.

·

Interfax Ukraine news agency reported Ukraine’s AgMin may lower its outlook for 2023 grain production to 49.5 million tons from 51 million forecast for 2022, and well down from 86 million tons for 2021. Some are as low as 35 million

tons in 2023, including 12-15 million tons of wheat and 15-17 million tons of corn (Ukrainian agriculture producers).

Export

Developments.

·

Jordan bought 50,000 tons of feed barley at $302.30/ton c&f for LH June shipment.

·

South Korea’s NOFI group bought about 80,000 tons of feed wheat from Australia and other origins. 65,000 tons from Australia was bought at an estimated $339.67 a ton c&f. Another 15,000 tons was bought at an estimated $354.80

a ton c&f.

·

Yesterday Algeria started buying durum wheat. The tender closed today. Shipment is for three periods between Feb. 16-28, March 1-15 and March 16-31. Prices were thought to be $445 to $460 per ton, depending on ship size. Up to

400,000 tons was cited, and traders think some of the durum could originate from Canada.

·

Egypt seeks wheat on Feb 2 for late Feb through March 20 shipment. They seek the wheat within the framework of the Food Security and Resilience Support Program funded by the World Bank under Loan No. EG -9399 with at sight financing.

The tender is for a quantity of 30,000, 40,000, 50,000, 55,000 or 60,000 tons, +/- 5% should the seller choose from the last crop for supply C&F (cost and freight). (Reuters)

Rice/Other

·

South Korea seeks 79,439 tons of rice on February 8 for May 1-Dec 31 arrival.

Updated

01/31/23

Chicago

– March $7.25 to $8.00, May $7.00-$8.25

KC

– March $8.40-$9.00, $7.50-$9.25

MN

– March $8.90 to $9.75,

$8.00-$10.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

Work: 312.604.1366

ICE IM: treilly1

Skype IM: fi.treilly

DISCLAIMER:

The

contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative.

The sources for the information and any opinions in this communication are

believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions.

This communication may contain links to third party websites which are

not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions

where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions.

Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice

based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative

of future results.

#non-promo