PDF Attached

Due

to the Martin Luther King, Jr. holiday remembrance, the next U.S. Export Sales Report will be released on Friday, January 21, 2022.

Soybeans

were higher early on follow through buying from ideas SA weather will turn unfavorable during early February. Rumors of China buying US soybeans added to the bullish sentiment. One rumor we heard 2 million tons were bought. Another around 1 million tons of

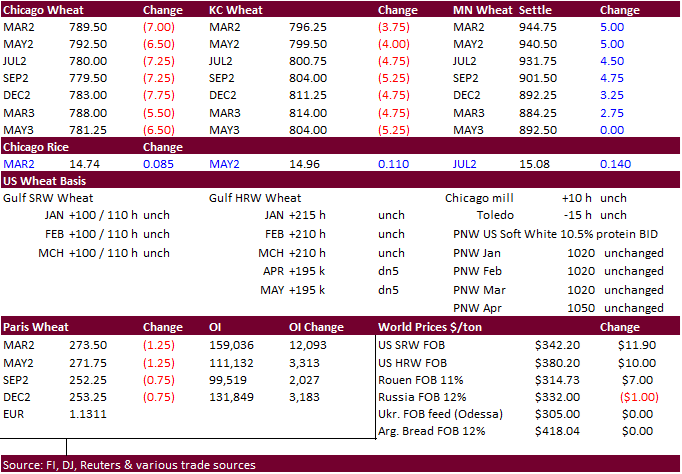

new-crop. Soybean oil surged on renewed oil share buying but CBOT crush values still lost value. Meal ended mostly higher. Corn ended mixed on bull spreading. Chicago and KC wheat ended lower and Minneapolis higher, singular to the direction we saw this morning.

![]()

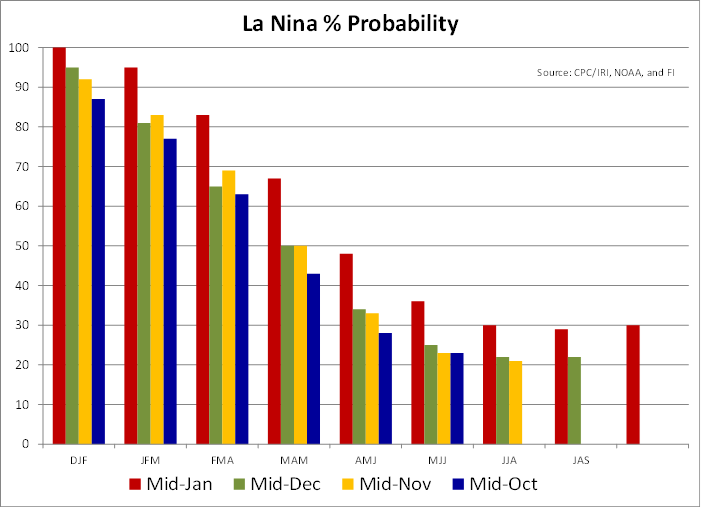

La

Nina

strengthened during December but eased a touch during FH January. The USDA Brazil yields for corn and soybeans seem to be a little on the high side, above trend, while Argentina yields are projected by USDA below trend. Attached after the text are Argentina

and Brazil yields versus USDA.

WEATHER

EVENTS AND FEATURES TO WATCH

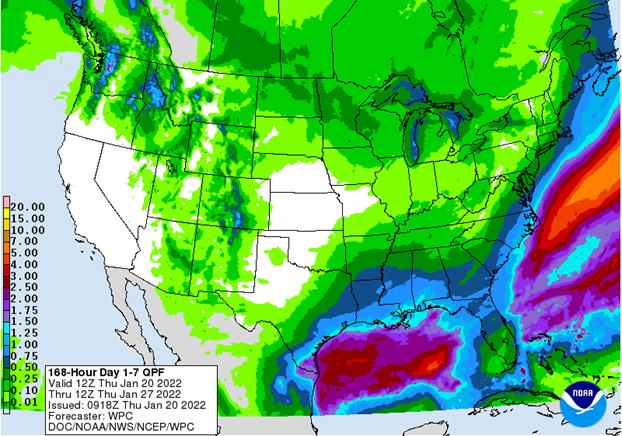

- U.S.

cold temperatures today have a low impact, but stress livestock and raise energy demand - Temperatures

dropped below zero Fahrenheit (-18C) as far south as northern Kansas, northern Missouri and northwestern and west-central Illinois - Snow

cover was minimal in the central Plains and lower Midwest raising a little concern over winter wheat, but the crop should have survived without much impact - Not

much, if any winterkill was suspected, although temperatures were near the damage threshold from northern Kansas and Nebraska into a few west-central Illinois locations - U.S.

cold air will shift to the eastern parts of the nation tonight with single digit and teen Fahrenheit lows expected throughout the lower Midwest while teens and 20s occur in the Delta and Tennessee River Basin - Extreme

lows in the negative teens and negative single digits will occur in the northern Midwest with subzero-degree lows as far south as Missouri and central Illinois again like today - Damage

potentials for wheat should be low, but some negative impact cannot be ruled out - Warming

is expected in hard red winter wheat areas - A

succession of cool air masses will advance from northwest to southeast from Canada’s Prairies through the northern U.S. Plains to the Midwest and eastern states during the balance of the coming ten days - Today’s

forecast temperatures are slightly warmer than those of Wednesday - Mid-week

next week will be coldest again in the Midwest and eastern states with one more surge of significance possible near the end of this month - Energy

consumption rates for heating purposes will be well up relative to that of December and early January, but only a few days of bitter cold is expected at a time and then temperatures will rebound back to near normal.

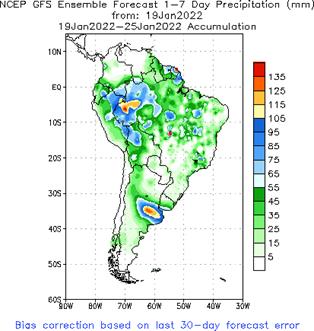

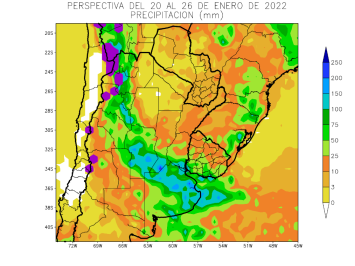

- Argentina’s

rainfall overnight was greater than expected in north-central Buenos Aires where 1.00 to 2.80 inches resulted - Other

areas from southern Cordoba to central Buenos Aires reported lighter rainfall to 0.55 inch

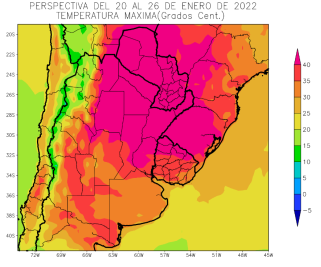

- Hot

and dry conditions continued Wednesday from northern Argentina through Paraguay and immediate neighboring areas of southern Brazil.

- Extreme

highs of 100 to 108 Fahrenheit (38-42C) occurred from northwestern Rio Grande do Sul through all of Paraguay

- Stress

to livestock and crops continued at an extreme - Production

cuts are continuing - Paraguay,

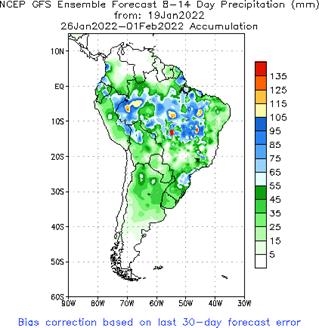

northern Argentina and neighboring areas of Mato Grosso do Sul, Parana and Rio Grande do Sul will continue hot and dry through Tuesday of next week - A

breakdown of high pressure aloft over South America is still expected during mid- to late-week next week resulting in a rising potential for rain in the drought stricken areas of Paraguay and all neighboring areas of southern Brazil and northern Argentina - Rainfall

will begin erratically, but most crop areas should get rain at one time or another by February 1 - Yield

losses will not be reversed, but the change will stop the decline in crop conditions and production - Argentina

is still expecting heavy rainfall tonight through Sunday morning from Buenos Aires into Cordoba and a part of Santiago del Estero

- Rainfall

of 2.00 to 4.00 inches and local totals to 6.00 inches or more will result - Local

flooding will be possible - The

moisture will soak deeply into the ground where there will finally be a boost in subsoil moisture - Argentina’s

weather during the last week of this month should be well mixed with periods of rain and sunshine for the majority of crop areas - There

is potential for another ridge of high pressure to evolve over Argentina during February, but its impact on agriculture should be less than that of earlier this month - Brazil

crop areas away from the southwest and Rio Grande do Sul will be favorably mixed during the next two weeks supporting good early season soybean maturation and harvest progress while supporting ongoing crop development - Sufficient

rainfall is expected in Safrinha crop areas to support planting, germination and emergence on into February - U.S.

hard red winter wheat production areas may see a little snowfall in the west-central high Plains region during the coming ten days as waves of cold air move through the northern Plains and into the Midwest and Atlantic Coast States - The

precipitation will fail to change drought status or crop conditions - Cold

air this morning may have threatened some damage to unprotected wheat in Nebraska and northern Kansas where snow cover was lacking, and temperatures fell near and below zero Fahrenheit

- U.S.

Midwest soft wheat areas will also have a lack of snow cover Friday when single digit and teen low temperatures are possible in a part of the lower Midwest - A

few extremes below zero are likely in Missouri and Illinois - Damage

to wheat is not likely, but it cannot be ruled out - Another

threat to soft wheat may evolve during the middle part of next week and it is questionable whether there will be any snow on the ground to protect crops at that time as well as on Friday morning - U.S.

northern Delta, Tennessee River Basin and southeastern states will see enough precipitation during the next ten days to maintain adequate to abundant soil moisture

- Recent

rainfall in the lower Delta has been restricted and a boost in precipitation is needed - Florida

is also a little dry as are a few areas in neighboring border areas southern Georgia and southeastern South Carolina - Florida

citrus areas will be closely monitored for cool weather, but as of today there is no threat of damaging cold in the production region - California

and the far western states will continue missing precipitation events over the next ten days and temperatures will be warmer than usual - Mountain

snowpack is still favorable for this time of year, but relative to the April 1 peak of the snowfall season the region is reporting 56-60% of that normal - There

is plenty of time for improving weather, but none is expected for a while - Canada’s

southwestern Prairies continue to miss significant precipitation and snow events - Drought

remains very serious from this region and southward into Montana and the western most Dakotas - Some

precipitation is expected in these areas during the coming ten days, but it will be light and probably will not impact the long term outlook - Interior

parts of Washington and Oregon will continue to get limited precipitation - Mountain

snowpack is abundant in the Cascade Mountains and the northern Rocky Mountains - Snow

will continue to fall often in these areas protecting runoff potentials for irrigated crops in the spring - Cold

air in the eastern U.S. during the next two weeks will bring waves of precipitation to the southeastern states preventing those areas from drying out

- West

Texas will be dry for the next ten days - Western

Europe precipitation is expected to be restricted during the next ten days while eastern parts of the continent get precipitation periodically - There

will be no threat of crop damaging cold - Eastern

Europe will see a boost in snow cover during the next week to ten days - Spain

and Portugal need moisture - Western

parts of Russia, Ukraine and neighboring areas will see waves of snow and some rain during the next ten days keeping winter crops adequately protected from any threatening cold – if such a risk evolves - No

damaging cold is expected in snow free areas - Northwestern

Africa will continue dry biased and a little warmer than usual during the next ten days and perhaps longer - Southwestern

Morocco is driest along in the northeast Morocco/northwestern Algeria border area - Rain

is needed in these areas, but winter crops are semi-dormant and do not need much moisture until the second half of February and March - Northern

India will get some light rain late this week into early next week - The

moisture will further support high yielding winter crops this year, although reproduction will occur mostly in February - Recent

rain events and that coming up should have crops in better than usual conditions ahead of reproduction - South

Africa’s forecast provides and erratic rainfall pattern for a while - Sufficient

soil moisture and timely showers will maintain a very good outlook for 2022 production, despite some pockets of excessive rain and hail damage this summer - Australia’s

weather is expected to be favorably mixed over the next two weeks, but a larger volume of rain might be better for some dryland crop areas in Queensland

- The

expected precipitation in this next ten days should be sufficient to help crops develop well - Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- Western

portions of Luzon Islands, Philippines will need a boost in rainfall soon - A

tropical cyclone may threaten the Philippines next week with some heavy rainfall and possible flooding - Wind

damage is not likely to be very significant - Northern

Laos and northern Vietnam received rain in the first half of this week bolstering topsoil moisture - Additional

light rain may come and go over the next week to ten days - Coffee

flowering is possible, although temperatures may be cool enough to restrict that potential - Any

flowering will be limited to the northern parts of Vietnam near the Red River - Most

other areas in mainland crop areas of Southeast Asia have been seasonably and are unlikely to see much precipitation which is normal for this time of year - Coastal

areas of Vietnam will get some rain periodically - China’s

weather will be wettest in the Yangtze River Basin and interior southern parts of the nation through the next two weeks - Winter

crops are dormant or semi-dormant and expected to remain in good condition for the next ten days - Some

snow and freezing rain may occur periodically as well - Northern

China precipitation will be restricted for the next two weeks which is normal for this time of year - West-central

Africa precipitation will remain confined to coastal areas for a while - Coffee

and cocoa maturation and harvest progress is advancing well - There

is very little risk of a notable Harmattan wind that would threat crops - Ethiopia

will turn dry biased again in the coming week while Tanzania, Uganda and southwestern Kenya get periodic rainfall all of which is normal for this time of year - Today’s

Southern Oscillation Index is +3.55 - The

index may move erratically for a while - New

Zealand rainfall will continue lighter than usual over the next ten days - The

nation has been drying out in recent weeks - Temperatures

have been seasonable - Mexico

will experience waves of rain in the east and in a few southern locations during the next ten days - No

general soaking of rain is expected, although precipitation will be greater than usual in the east - Any

precipitation would be welcome, but greater amounts are desired especially in northern parts of the nation where winter crops could be negatively impacted in unirrigated areas by ongoing dryness in the next few weeks

- Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - Guatemala

will also get some showers periodically - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Colombia

will be much wetter than Venezuela - Many

areas in Venezuela may experience net drying

Source:

World Weather, inc.

Thursday,

Jan. 20:

- EIA

weekly U.S. ethanol inventories, production - China’s

third batch of country-wise December trade data - Port

of Rouen data on French grain exports - Malaysia’s

Jan. 1-20 palm oil exports - New

Zealand food prices - USDA

red meat production, 3pm

Friday,

Jan. 21:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

US

Initial Jobless Claims Jan 15: 286K (est 250K; prev 230K; prevR 231K)

–

Continuing Jobless Claims Jan 8: 1635K (est 1580K; 1559K; prevR 1551K)

US

Philadelphia Fed Business Outlook Jan: 23.2 (est 20.0; prev 15.4)

Philadelphia

Fed Prices Paid Index January 72.5 VS December 66.1

–

New Orders Index January 17.9 VS December 13.7

–

Employment Index January 26.1 VS December 33.9

–

Six-Month Business Conditions January 28.7 VS December 19.0

–

Six-Month Capital Expenditures Outlook January 26.2 VS December 20.0

82

Counterparties Take $1.679Tln At Fed Reverse Repo Op. (prev $1.657Tln, 83 Bids)

·

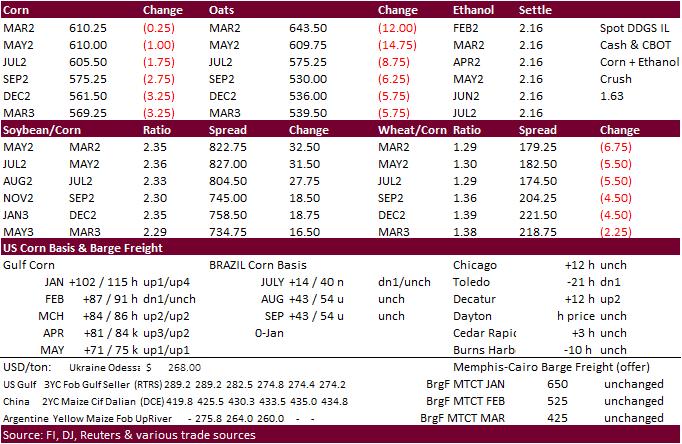

The high in March corn today was $6.1425, matching yesterday’s high, a resistance level. $6.1775 is the contract recent higher made in December and a breakout above that could lift prices into the $6.25-$6.30 area.

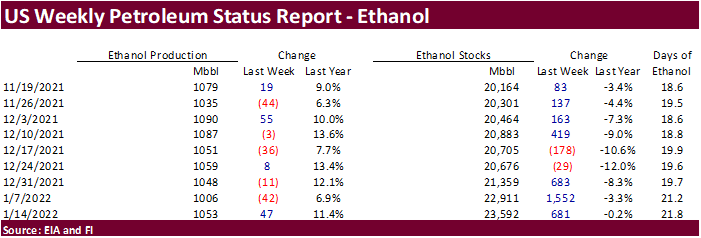

·

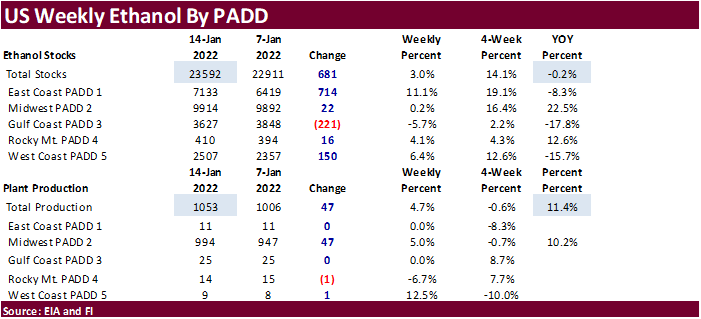

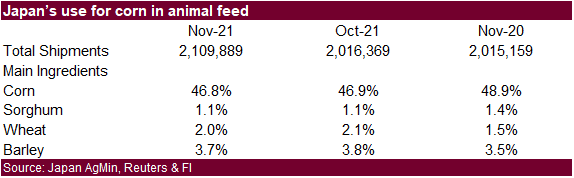

Weekly US ethanol production increased a large 47,000 barrels per day to 1.053 million compared to a Bloomberg poll looking for an increase of 7,000 barrels. Ethanol stocks were up 681,000 barrels to 23.592 million (poll was looking

for a 259,000 barrel increase). We thought the report was supportive for corn.

·

U.S. GENERATED 1.30 BLN ETHANOL (D6) BLENDING CREDITS IN DECEMBER, VS 1.26 BLN IN NOVEMBER -EPA

·

(Reuters) – The French farming ministry on Thursday said that a total of 2.5 million birds needed to be killed as the southwest of the country faces several outbreaks of bird flu. Around 1.2 million animals have already been culled.

·

The Baltic Dry Index fell 6.1% to 1,474 points.

POLL-U.S.

December cattle placements seen up 2.6% from year ago -analysts – Reuters News

Jan

19 (Reuters) – The following are analysts’ estimates for the U.S. Department of Agriculture’s monthly Cattle on Feed report, which is due on Friday at 2 p.m. CST (2000 GMT).

All

figures, except headcount, for feedlots with 1,000-plus head of cattle shown as percentage vs year ago:

Range Average Mln head

On

feed January 1 99.5-100.1 99.8 11.943

Placements

in December 100-105 102.6 1.892

Marketings

in December 100-102.1 100.8 1.868

USDA

Broiler Report:

-

Broiler-Type

Eggs Set in the United States Up 1 Percent -

Broiler-Type

Chicks Placed in the United States Down 2 Percent -

Cumulative

placements from the week ending January 8, 2022 through January 15, 2022 for the United States were 370 million. Cumulative placements were down 2 percent from the same period a year earlier.

Weekly

US ethanol production

increased a large 47,000 barrels per day to 1.053 million compared to a Bloomberg poll looking for an increase of 7,000 barrels. Plant production was highest in one month. Ethanol stocks were up 681,000 barrels to 23.592 million (poll was looking for a 259,000-barrel

increase). US gasoline stocks increased 5.873 million barrels to 246.6 million from the previous week. Refinery and blender net input of oxygenates fuel ethanol was 806,000 barrels per day, up from 755,000 barrels previous week.

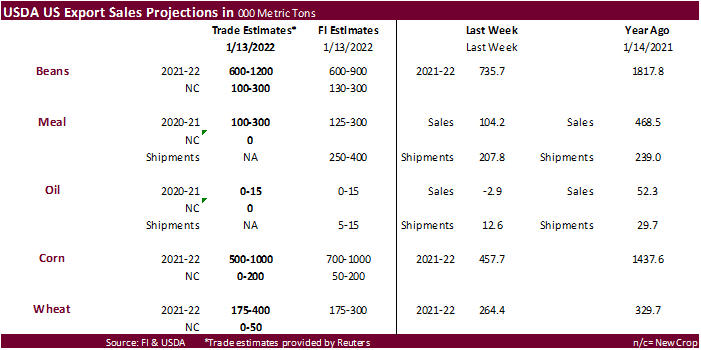

Export

developments.

·

None reported

Updated

1/18/22

March

corn is seen in a $5.80 to $6.20 range

·

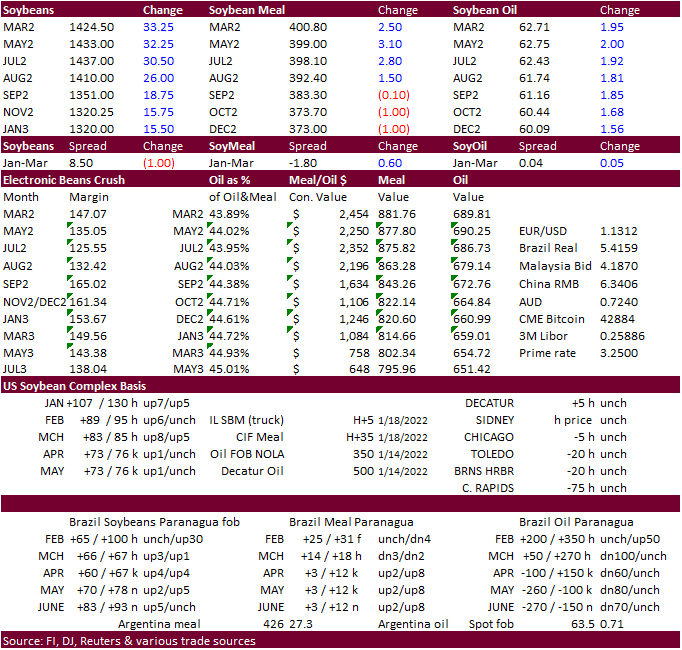

Soybeans and soybean oil traded sharply higher from follow through buying over chatter of unfavorable South American weather for early February followed by rumors around 10 am CT that China was buying/bought US soybeans. Meal

was on the defensive but ended higher in the front four months. CBOT crush values declined were weaker. Funds bought an estimated net 19,000 soybeans, 2,000 SBM and 10,000 SBO.

·

March soybeans hit their highest level since June 11, settling 34.50 cents higher at $14.2575. Contract absolute high was $14.4550. March soybean oil hit an October 21 high, just under 63 cents. Meal ended higher in the March

position but remains well off contract highs.

·

China buying rumors included 2 million tons sold then later one million tons new-crop. The forward crop buying would make sense if Brazil exports dried up by the end of July. August Brazil export premiums have firmed recently.

China soybean import demand has been lagging and they need to catch up. But expect a natural slowdown ahead of the China New Year holiday break.

·

US Gulf soybean supplies are nearly sold out through February.

·

USDA will likely need to lower their Argentina and Brazil soybean production estimates by at least 2.5 and 3.5 MMT, respectively.

·

Yesterday the USDA Attaché cut their Brazil soybean estimate to 136 million tons.

·

Argentina soybean plantings for the 2021-22 campaign was 95% complete while corn planting was 88% finished.

·

Argentina’s “political coalition Juntos por el Cambio presented a bill in the parliament Jan. 18 to eliminate export duties for soybean and corn farmers in regions where an agricultural emergency has been declared,” according

to a Platts story. We don’t think this will pass. Argentina needs the dollars. Argentina has an export duty of 33% on soybeans, 31% on soybean oil and soybean meal, each, and 12% on corn.

·

Malaysian palm futures traded higher by 71 ringgit to 5,326, a record high.

·

AmSpec Agri reported Jan 1-20 Malaysian palm oil exports at 633,531 tons, down 36.4 percent from 996,331 tons shipped during December 1 – 20. ITS reported a 38.4 percent decline to 660,866 tons.

·

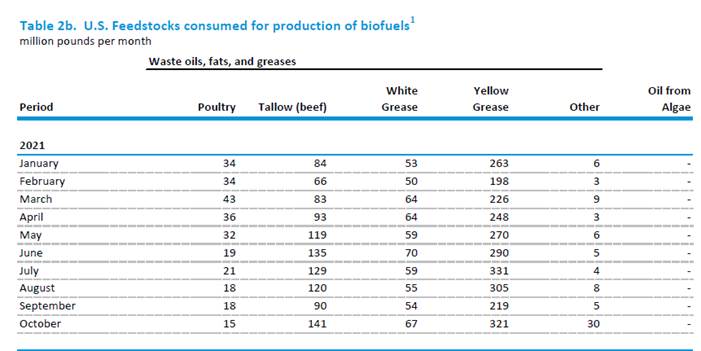

U.S. GENERATED 576 MLN BIODIESEL (D4) BLENDING CREDITS IN DECEMBER, VS 464 MLN IN NOVEMBER -EPA

·

Recall biodiesel production for D4 was much higher than expected in October. About 576 million biodiesel (D4) blending credits were generated last month, according to the EPA, up from 464 million the month prior, so look for

biodiesel production to improve in December compared to year earlier. Note it’s hard to peg SBO use for biodiesel production based in RIN generation. Consumption of other fats and oils increased during Q4 2021, especially for tallow and yellow grease.

Export

Developments

·

Today the USDA seeks 7,540 tons of vegetable oil in 4-liter cans for Feb 16-Mar 15 shipment.

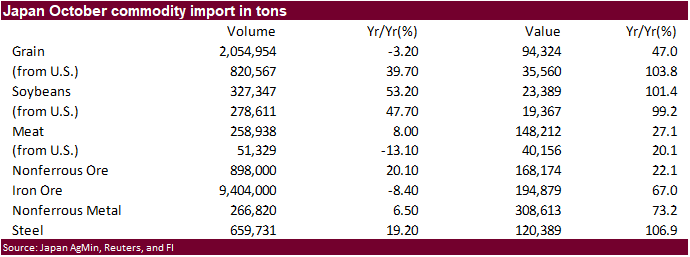

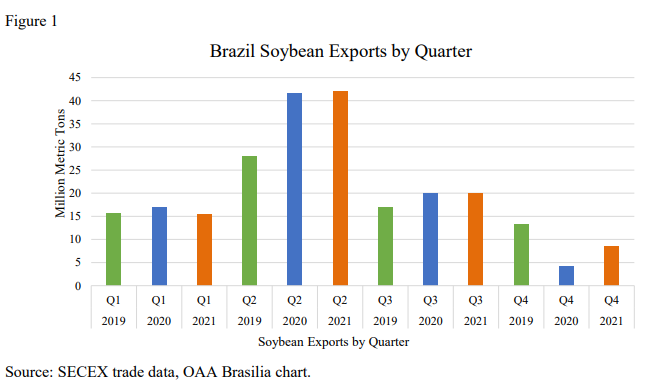

China

imported 32.3 million tons of U.S. soybeans in 2021,

up 25% from 25.89 million tons in 2020. Brazil supplied 58.15 million tons in 2021, down 9.5% from 64.28 million in 2020. For 2022, Brazil may supply less than 55 million tons, depending on crop size and quality, and the US should pick up for the balance of

3.5-4.5 million tons, assuming China imports expand 1-2 million tons from 2021.

Taken

from USDA Attaché report

Updated

1/20/22

Soybeans

– March $13.25-$14.75 (up 25, up 50 back end)

Soybean

meal – March $370-$435

Soybean

oil – March 59.00-64.50

(range revised sharply higher)

·

US Chicago and KC wheat futures were lower on technical selling while Minneapolis higher as Russian/Ukraine tensions continue to support high protein wheat. Several global import tenders are limiting losses. Funds sold an estimated

net 4,000 Chicago wheat contracts.

·

Commodity Weather Group suggested 20 percent of the US winter wheat crop could be exposed to winterkill this week with the cold snap and net drying.

·

EU wheat basis the March position was 1.25 lower at 273.75 eros a ton.

·

France shipped 4 more cargoes of wheat to Morocco and are loading barley for China.

·

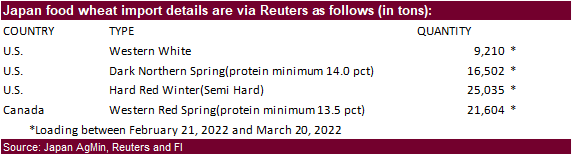

Japan bought 72,351 tons of food wheat.

·

Algeria bought 205,000 tons of feed barley at around $324/ton c&f for LH Feb/FH Mar shipment.

·

Turkey bought at least 275,000 tons of feed barley out of 345,000 tons sought, at $316-$331/ton. The tender seeks shipment between Feb. 15 and March 10.

·

Results awaited: Iran’s GTC seeks 60,000 tons of milling wheat on January 20 for February – March shipment.

·

Jordan seeks 120,000 tons of feed barley on January 26 for July – August shipment.

·

Jordan retendered on wheat seeking 120,000 tons on February 1 for July – August shipment.

Rice/Other

·

South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/20/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$10.00 (unch, up 50)

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.