PDF Attached

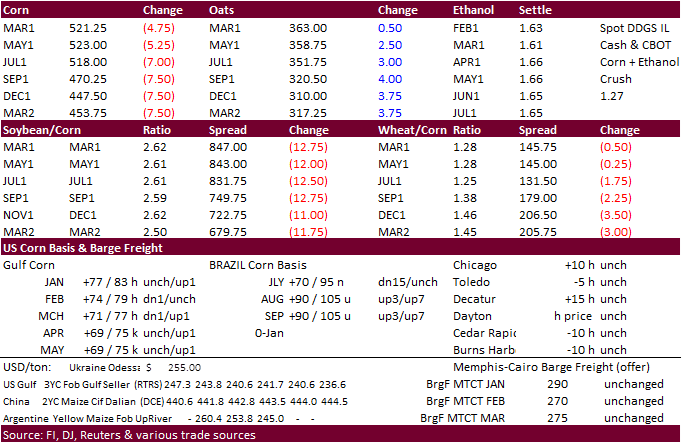

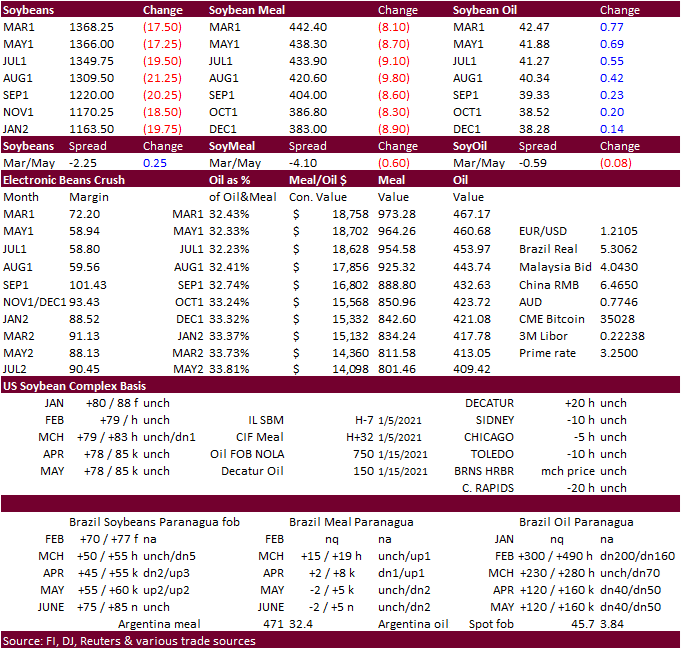

We

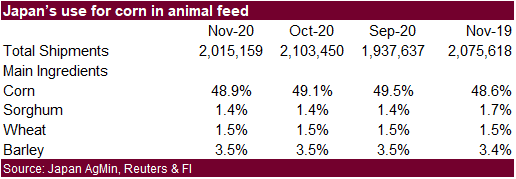

updated our US soybean complex S&D’s. There is uncertainty over soybean demand for second half 2020-21, most notably exports and crush. Some highlights:

-

Raised

soybean imports by 15 mil bushels, lowered crush by 2 million, and lowered exports by 15-20 million based on SA supplies overtaking US April-July period.

-

Increased

our SBO for biodiesel by 30 million pounds from previous, but still 150 million below USDA. Uncertainty over 2021 biodiesel mandates and margins is keeping up less optimistic than USDA.

-

K&N

CBOT crush margins of less than 60 cents suggest there could be rationing later this crop year as some domestic crushers are hedged out until around the end of April. We will have to see how cash margins play out if meal premiums continue to erode. Exports

depend on how much China will take from their commitments. We run the risk in seeing China defer China commitments into new-crop. They have done that in the past.

Selling

continued in the soybean complex and corn on improving SA weather and expectations for China to slow US soybean purchases. Soybean meal dropped hard while soybean oil rallied on unwinding of product spreads. Wheat settled lower on profit taking.

The

South American weather situation has not changed that much. Warm temperatures and lack rain in Argentina are seen through Friday. Rain will then increase this weekend through next Tuesday. Brazil conditions will still be mostly good for crops, with northeastern

areas too dry, and a little too wet in the south such as Santa Catarina and Parana.

![]()

THE

WORLD’S MOST IMPORTANT WEATHER

- Argentina

was dry Tuesday and limited rainfall is expected for a while - Southern

parts of the nation will struggle with net drying and soil moisture declines well into next week - The

most frequent periodic rain is expected in the north half of the nation where soil conditions will continue favorable for an extended period of time - Argentina’s

bottom line continues to be one of crop improvement following the past ten days of periodic rainfall and improved soil moisture. Rising temperatures and limited rainfall the remainder of this week will accelerate drying and raise the need for significant moisture

once again. However, crops will not likely experience any seriously threatening conditions until next week and that will be confined mostly to southern areas that miss rain during the next seven days - Brazil’s

crop weather has not changed much overnight - Rain

fell from Mato Grosso into western and southern Sao Paulo, Parana and eastern Santa Catarina while net drying occurred elsewhere - Crop

conditions are still rated favorably in the majority of the nation with soil conditions now favorably moist from Rio Grande do Sul to southwestern Minas Gerais and northwest to Mato Grosso and western Tocantins - Dryness

is mostly confined to minor crop areas in northern and central Minas Gerais, Bahia, eastern Tocantins and southern Piaui - Brazil’s

weather during the next ten days to two weeks will continue to generate sufficient rain in the west and south to maintain adequate to excessive soil moisture and perpetuate aggressive crop development - Some

eventual need for drying is expected for soybean maturation and harvesting in February - Recent

rain has been improving soybean yields and quality - Dryness

remains a concern for unirrigated coffee, cocoa and sugarcane from east-central Minas Gerais and parts of Rio de Janeiro into Bahia, although the situation has not get reached a critical stage - Northeastern

Brazil will continue to dry out through Monday with some relief in eastern Tocantins, western Bahia and western and southern Minas Gerais later in the week next week - China

winter crops are in good conditions with little to no winterkill so far this year - There

was some concern over bitter cold in the north earlier this season when snow cover was limited and if there was some damage it should be slight - China’s

weather over the next couple of week should be typical for this time of year - India

has been and will continue to be dry for a while - There

is need for more precipitation in winter crop areas outside of the far south - Recent

drying in the far south has been good for late season harvesting that had been delayed by too much moisture earlier this month and last - Indonesia,

Malaysia and eastern Philippines have been dealing with frequent precipitation events some of which have induced flooding in recent weeks - Some

drying would be welcome and should happen over the next two weeks - Soil

moisture and crop conditions are mostly good and any negative impact from recent flooding has likely been localized and not suspected of having a huge impact on any crop - Europe

is a bit too wet in the west and some southern locations and drier weather would be welcome - Crop

damage because of too much moisture has not likely occurred, but with the wet bias continuing the potential for flooding will increase and that could lead to some potential problems - Recent

precipitation in eastern Spain, Romania, Bulgaria, Greece, Moldova, Ukraine and Russia’s Southern Region has improved soil moisture for spring use - The

precipitation will continue periodically maintaining an improved outlook - Russia’s

Southern Region will not be as wet this week as it has been - Bitter

cold temperatures during the weekend brought temperatures below zero Fahrenheit from the Baltic Plain into Ukraine and northern parts of Russia’s Southern Region as well as other western Russia locations - The

cold induced no crop damage because of sufficient snow coverage - Temperatures

were bitterly cold again this morning in snow covered areas of Ukraine and northern parts of Russia’s Southern Region with no damage suspected. - Warming

will occur in eastern Europe and the western CIS the remainder of this week and into next week which may eventually melt snow cover in southern areas and reduce winter crop protection from harsh weather if it were to suddenly return - There

is no threat of damaging cold for the next two weeks - U.S.

crop weather is still fine in the Midwest, Delta and southeastern states with plenty of soil moisture present and no threat of winterkill in wheat areas - Hard

red winter wheat areas are still dry in Nebraska, northwestern Kansas and northeastern Colorado where significant precipitation is needed for spring crop use - That

precipitation may not come immediately – at least not significantly, but the spring outlook should trend a little more favorably - Northwestern

U.S. Plains and southwestern Canada’s Prairies will see temperatures fall near the damage threshold for winter wheat later this week and into next week, but the combination of sufficient crop hardening against the cold, at least a dusting of snow in some areas

and borderline damaging cold conditions the impact is expected to be low - Montana

and the southwestern Canada Prairies winter crops were not well established last autumn because of dryness - Drought

in the western United States might be eased ever so slightly late this week and during the weekend as snow and rain evolve briefly in some of the dry areas - Much

more precipitation will be needed to seriously change drought conditions and that is not very likely even though another bout of precipitation will evolve early next week - Parts

of West Texas will receive some light precipitation over the coming week, but it will not be well distributed and much more precipitation is needed to bolster long term soil moisture - South

Texas remains too dry and needs significant rain in the next few weeks to support early season planting in late February and March, but there is still another few weeks for possible change - Some

showers are expected today and again infrequently over the coming week, but resulting rainfall will not be enough to seriously change soil conditions - U.S.

Delta and southeastern states are still plenty moist and will stay that way for a while

- U.S.

soft wheat in the Midwest is in favorable condition with plenty of moisture available and no threat of damaging cold anytime soon - North

America weather still brings colder than usual air to Canada’s Prairies later this week and into early next week - Some

cooling is also expected in the western and north-central parts of the United States, but no seriously cold biased conditions are anticipated

- Average

temperatures during the coming week will be near to below average in most of the west and far northern sections of the U.S. while warmer than usual in the southern Plains and Gulf of Mexico Coast States - South

Africa weather recently has trended drier, but soil moisture is still carrying crops favorably

- South

Africa will experience additional net drying this week except in Limpopo where some significant rain may fall during the weekend and early next week from Tropical Cyclone Eloise which is expected to reach southern Mozambique this weekend before its remnants

move into northeastern South Africa - Rainfall

should improve next week over at least a part of the nation, but there may be need for greater precipitation - Tropical

Cyclone Eloise was over northern Madagascar this morning - Flooding

may be impacting the region, but damage to rice, corn, sugarcane or vanilla is not very likely - The

storm will move across the Mozambique Channel during the latter part of this week with some re-intensification expected. The storm may make landfall during the weekend in southern Mozambique producing heavy rain across some of that nation’s crop areas; however,

there is still some potential the storm could curve to the south and stay over open water - Damage

is expected to be light if the storm moves inland - Australia’s

southeastern Queensland and northern New South Wales weather outlook is not very good for significant rainfall in the next two weeks - Net

drying will increase unirrigated crop stress - Temperatures

will be near to below average in eastern Queensland and northeastern New South Wales and a little warmer than usual in the remainder of the nation - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - Some

rain fell in coastal areas of Ivory Coast and Ghana during the weekend, but key crop areas were dry - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +18.02 today and the index will fall over the next few days.

- Welcome

rain is expected in central and northern Mexico today into Friday - The

moisture will help bring some badly needed relief to drought conditions, but more rain will be needed

- Winter

crop planting and establishment conditions will improve briefly - Canada

Prairies will trend colder this week with periods of snow into the weekend and again late next week - The

snow will help improve crop protection for winter wheat in the south and east, but some areas in southern Alberta may stay snow free - Southeast

Canada will receive brief periods of snow into the weekend, but resulting moisture will be lighter than usual - Temperatures

will be seasonably cool

Source:

World Weather Inc. and FI

Wednesday,

Jan. 20:

- China

customs to publish import data split by country - European

Cocoa Association grinding data - Malaysia’s

Jan 1-20 palm oil exports

Thursday,

Jan. 21:

- Port

of Rouen data on French grain exports - USDA

red meat production

Friday,

Jan. 22:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - EIA

weekly U.S. ethanol inventories, production, 10:30am (two days later than usual due to federal holidays earlier in the week) - U.S.

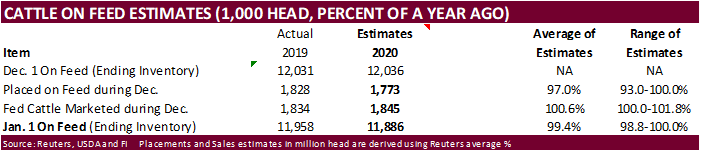

Cattle on Feed, poultry slaughter

Source:

Bloomberg and FI

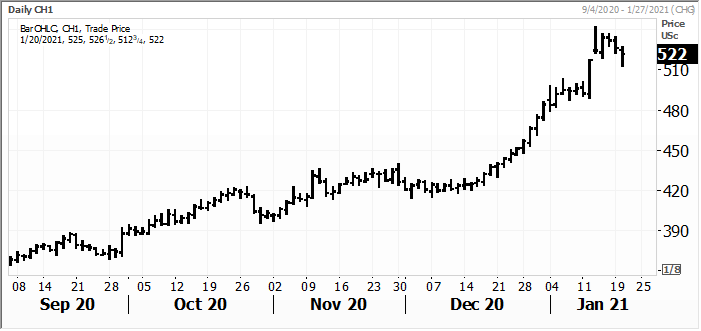

Corn.

-

Corn

futures settled lower but well off session lows, on improving South America weather and long liquidation. Aside from SA weather, export developments and fundamental news has been light. We believe the recent rains across Brazil and Argentina have slowed

the decay in crop conditions for summer crops. Northeastern Brazil crops are a different story with persistent dryness. With SA crops stabilizing and no issues so far with second crop corn in Brazil, a setback below $5.00 basis the March contract is not

out of the question. This will depend on money manager fund movement and snap corn import tenders by China. China domestic corn prices hit a record earlier this week, so don’t discount them buying corn to add to government inventories. Problem with China

is that corn for industrial demand has sharply declined in response to poor margins, making the country a little less dependent on corn.

-

Funds

on Wednesday sold an estimated net 9,000 corn contracts. -

Argentina

producers sold 1.07 million tons of 2020-21 corn to exporters between January 7 and 13, up from 334,300 tons during the same period last year. About 20 percent of new-crop corn has been sold.

-

Datagro:

Brazil corn production 109.93 million tons versus 114.04 previous.

-

Iraq

reported a H5N8 bird flu outbreak on a farm in the city of Samaraa in the center of the country.

-

Germany

reported another 30 cases of African Swine fever in wild boar. -

China

will auction off 30,000 tons of pork on Jan 21. -

Late

yesterday the EPA granted three biofuel blending waivers to oil refiners, two for the 2019 compliance year and one for 2018. 30 waiver requests remain outstanding for 2019 and 15 for 2020. Details are lacking.

-

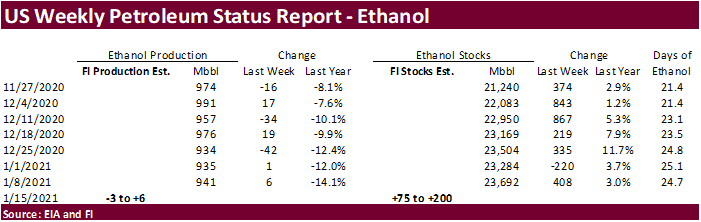

EIA

ethanol data will be released on Friday. -

A

Bloomberg poll looks for weekly US ethanol production to be down 3,000 at 938,000 barrels (925-957 range) from the previous week and stocks up to 174,000 barrels to 23.866 million.

-

Due

to the Federal holidays of Dr. Martin Luther King Jr. and the Presidential Inauguration the next U.S. Export Sales Report will be released on Friday, January 22, 2021.

Corn

Export Developments

- Taiwan’s

MFIG bought 65,000 tons of feed corn sourced from the United States at 201.71 U.S. cents a bushel c&f over the Chicago July contract for March or April loading. One offer was made for 52,000 tons of South African corn at a premium of 216.00 U.S. c&f over the

Chicago July contract.

March

corn filled a gap today.

Updated

1/20/21

March

corn is seen trading in a $4.75 and $5.50 range. May corn could fall below $5.00, then trade down to $4.80-$4.90 area if US domestic and export demand slows.

-

CBOT

soybeans opened sharply lower in improving South America weather and long liquidation. China may slow US soybean imports after this month as they shift to South America. During the trade we heard three US soybean cargoes traded to China of the PNW. We will

have to see if 24-hour sales show up Thursday morning. Today was a US government holiday, so sales over the past day may also be reported in the morning.

-

Technicals

are getting bearish for March soybeans. Some noted recent RSI levels. The March soybean contract briefly traded below 13.5275, its 38.2% retracement level from a 4-week high.

-

The

CBOT crush saw support today after soybean oil rallied. March soybean oil NEARLY saw an upside day higher in part to technical buying from an oversold oil share, unwinding of meal/oil product spreads, and bottom picking in soybean oil. March soybean oil

hit a low of 41.03, unable to test the low made yesterday of 41.01 cents. There was thought some Gulf soybean oil business might have been done. Note Gulf soybean oil basis fell to 575 over as of late Friday from 700 over at this time a week earlier.

-

Soybean

meal was under a good amount of pressure. News has been light for US domestic feed sector. Rail soybean meal basis for selected US locations fell $1.00 short ton, including Chicago (+3), Decatur (IL +3), Morristown (+3), and Fostoria (OH +3). Truck soybean

meal was up $7.00 at Frankfort, IN to 22 over. -

ICE

March canola fell $15.80 or 2.4% to $648.40 per ton. -

We

are hearing China lockdowns are increasing over virus outbreaks. It’s unknown if another widespread outbreak will delay soybean arrivals.

-

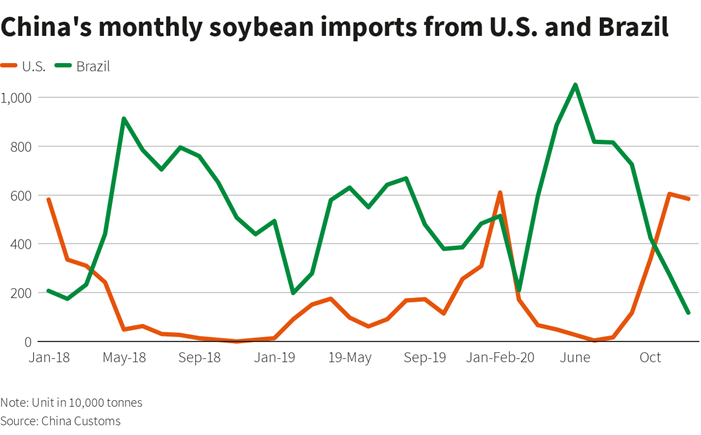

China’s

breakdown of December soybean imports showed 2020 imports from the United States increased 52.8% from a year earlier ay 25.89 million tons, up from 16.94 million tons in 2019. China imports from Brazil were 64.28 million tons, up 11.46% from 2019’s 57.67

million tons. China’s soybean imports in 2020 were a record 100.33 million tons.

-

The

driver strike in Argentina that started Jan 15 is still ongoing and truck arrivals at ports are significantly down from normal.

-

Funds

on Wednesday sold an estimated net 10,000 soybeans, sold 5,000 soybean meal and bought 5,000 soybean oil.

-

IHS

MARKIT: Brazil 2020-21 soybean crop 133 million tons versus 132.5 previous.

-

Datagro:

Brazil soybean production 135.61 million tons versus 134.98 previous. -

AmSpec:

Malaysian Jan 1-20 palm exports down 41.1% to 632,827 tons. ITS reported a 43.1 percent decline. SGS reported a 43.3 percent decrease.

- Egypt’s

GASC seeks 3,000 of local soybean oil and 2,000 tons of local sunflower oil on Jan 23 for arrival between February 18 and March 5.

- Today

the USDA seeks 6,390 tons of vegetable oil under the PL480 program for March 1-31 shipment (Mar 16-Apr 15 for plants at ports).

Updated

1/19/21

March

soybeans are seen in a $13.25 and $14.75 range (unchanged and down 25 cents)

March

soymeal is seen in a $410 and $480 range (down $10 & $20)

March

soybean oil is seen in a 41.00 and 43.50 cent range (down 1 & 2 cents, respectively)

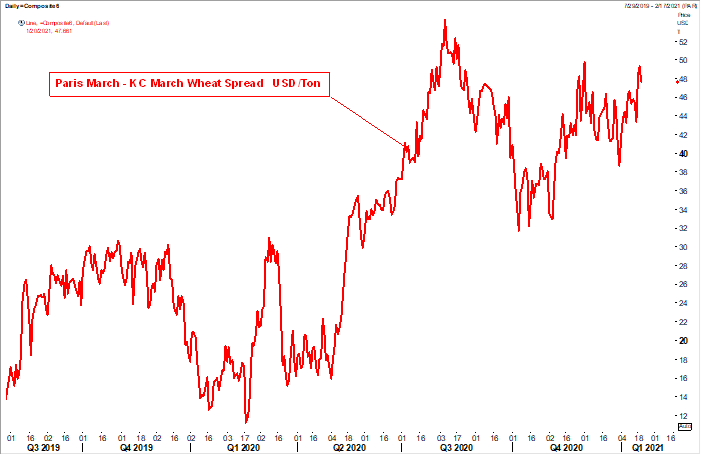

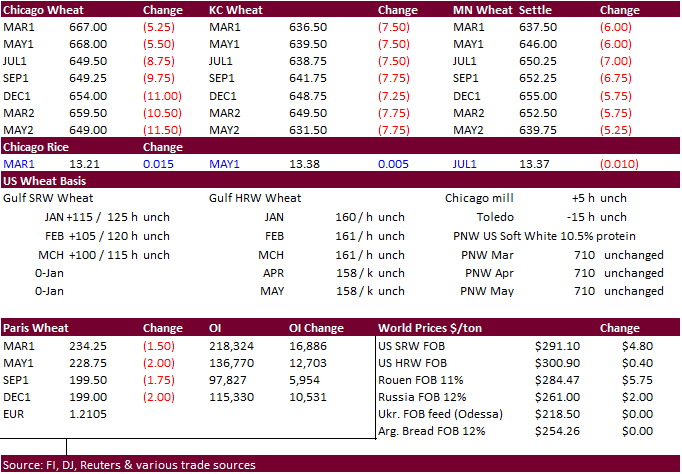

- US

wheat futures settled lower after rallying the past week on Russian export tax developments. Heavy selling in soybeans and corn prompted the selling. Another reason for the selloff was a weather forecast calling for good precipitation across the eastern

portion of the US Great Plains. Algeria bought at least 330,000 tons of wheat and they paid more than $20/ton than their December 31 import tender.

- EU

March milling wheat was down 1.75 at 234.00 euros. - Funds

on Wednesday sold an estimated net 4,000 Chicago wheat contracts. - Russia’s

Deputy Prime Minister estimated the 2021 grain crop at 131 million tons, down from 133 million tons in 2020.

- SovEcon

may project the Russia wheat export forecast as high as 38 million tons, up from current 36.3 million tons

- Algeria

bought at least 330,000 tons of wheat for (originally) February 15-28 shipment at around $312 and $314 a ton c&f. Some put it at $313.50 to $314 a ton c&f. They last bought wheat at $292/ton on December 31. - Jordan

bought 120,000 tons of milling wheat, optional origin, at $277.40/ton c&f. Possible shipment combinations are between June 1-15, June 16-30, July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

-

Amended

to include white wheat: Turkey seeks 400,000 tons of milling wheat for Jan through Feb 25 shipment.

-

Results

awaited: Syria seeks 200,000 tons of wheat on Jan 18 for shipment within 60 days after contract signing.

- Jordan

seeks 120,000 tons of animal feed barley on Jan. 26. - The

UN bought 120,000 tons of Black Sea-origin wheat for Ethiopia, for shipment between February and mid-March. No prices were provided.

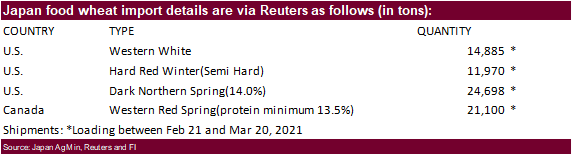

- Japan’s

AgMin in a SBS import tender seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival by March 18, on January 27.

-

Japan

seeks 72,653 tons of milling wheat later this week.

- Turkey

moved their import tender for 400,000 tons back to January 22 for January 29-February 26 shipment.

- Bangladesh

seeks 50,000 tons of wheat January 25 for shipment within 40 days of contract signing.

·

Bangladesh’s lowest prices for 60,000 tons of rice on January 20 was $417 a ton CIF liner out.

·

Bangladesh seeks 50,000 tons of rice on Jan. 24.

- Bangladesh

seeks 50,000 tons of rice on January 26.

·

South Korea seeks 113,555 tons of US, Thailand, and China rice on Jan 21 for April 30 through July 31 arrival.

·

Syria seeks 25,000 tons of rice on February 9.

Updated

1/12/21

March

Chicago wheat is seen in a $6.35‐$7.15 range

March

KC wheat is seen in a $6.00‐$6.50 range

March

MN wheat is seen in a $6.00‐$6.55 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.