PDF Attached

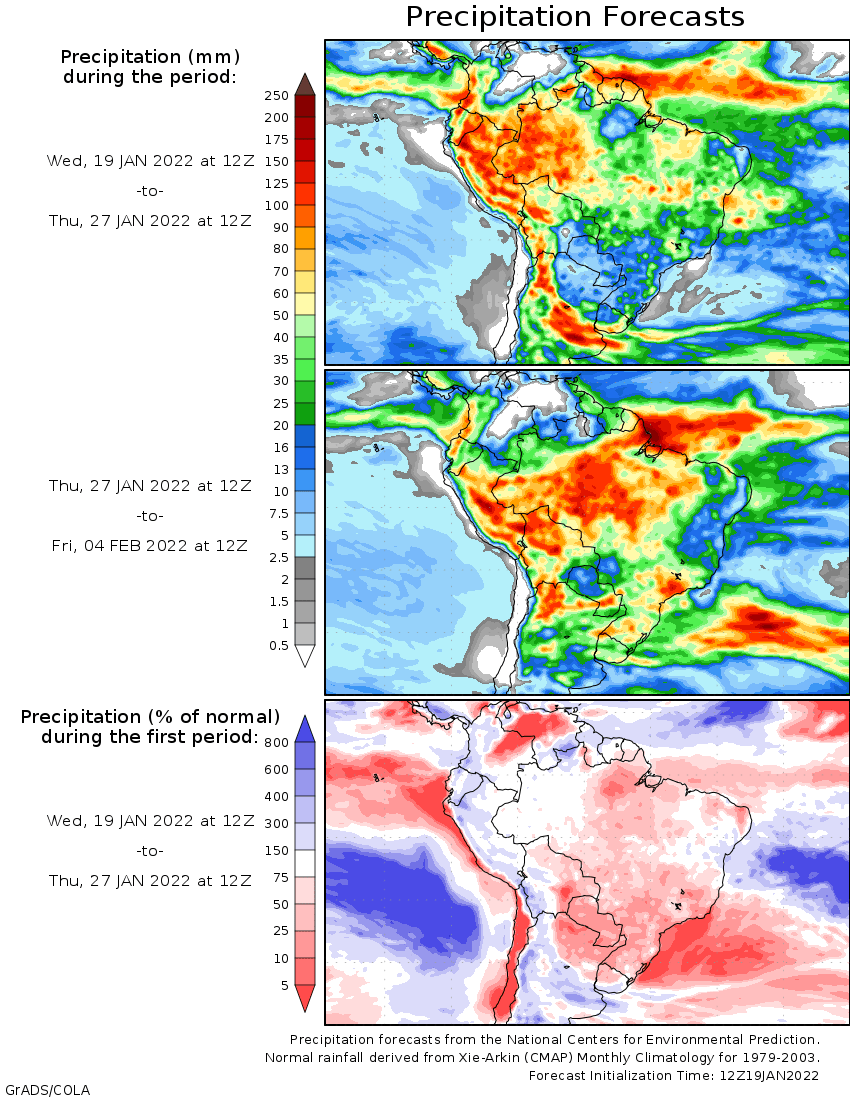

Today’s market was dominated by hot and dry early February forecast for South America and the Russia/Ukraine tensions for wheat. President Joe Biden held a press conference after the close which discussed Russia’s buildup on the border of Russia/Ukraine. President Biden initially made a statement at the press conference that said he thinks Putin will move in, “He Has To Do Something”. This statement was walked back by the White House after the presser with strong rhetoric around sanctions. WH: “If any Russian military forces move across the Ukrainian border, it will be met with a swift, severe, and united response from the United States and our allies”.

![]()

Weather

Thursday, Jan. 20:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- EIA weekly U.S. ethanol inventories, production

- China’s third batch of country-wise December trade data

- Port of Rouen data on French grain exports

- Malaysia’s Jan. 1-20 palm oil exports

- New Zealand food prices

- USDA red meat production, 3pm

Friday, Jan. 21:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- U.S. cattle on feed, 3pm

Source: Bloomberg and FI

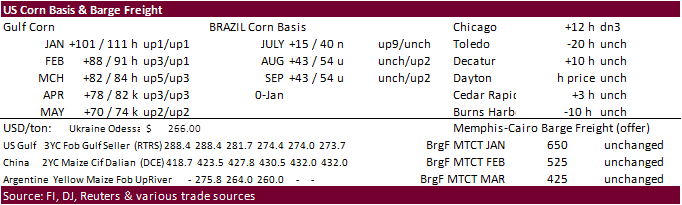

Corn

· CBOT corn rose on firmer wheat and hot and dry weather for South America expected the first week of February.

· US export developments slowed given the 2-day rally following the long weekend.

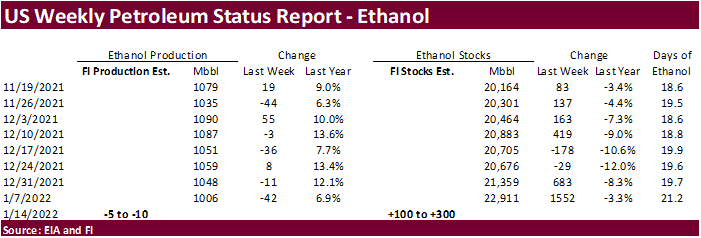

· A Bloomberg poll looks for weekly US ethanol production to be up 7,000 barrels to 1.013 million from the previous week and stocks up 259,000 barrels to 23.170 million.

· Bloomberg: U.S. Cattle on Feed Placements Seen Up 2.5%. December placements onto feedlots seen rising y/y to 1.89m head.

· Technically for corn, the bounce off the 50-day moving average @ $5.9000 basis CH2 is seen as bullish and the follow-thru buying from today’s session saw a breakout from the January range we have been trading in.

Export developments.

· None reported

POLL-U.S. December cattle placements seen up 2.6% from year ago -analysts – Reuters News

Jan 19 (Reuters) – The following are analysts’ estimates for the U.S. Department of Agriculture’s monthly Cattle on Feed report, which is due on Friday at 2 p.m. CST (2000 GMT).

All figures, except headcount, for feedlots with 1,000-plus head of cattle shown as percentage vs year ago:

Range Average Mln head

On feed January 1 99.5-100.1 99.8 11.943

Placements in December 100-105 102.6 1.892

Marketings in December 100-102.1 100.8 1.868

Updated 1/18/22

March corn is seen in a $5.80 to $6.20 range

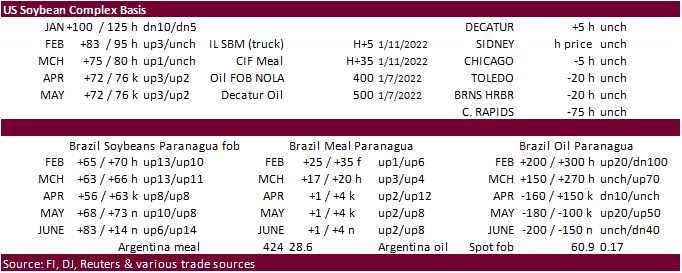

· Soybeans climbed today, breaking a three-session losing streak on hot and dry weather in the forecast for early February.

· With the South American crop developing, the warm and dry weather may cause continued crop stress which some hoped it may had overcome following last weekend’s rains.

· Meal shot up over $8.00 tracking soybeans and soybean oil rose along with crude and other global vegoils. Soybean oil saw its highest level since the end of November.

Export Developments

- The USDA seeks 7,540 tons of vegetable oil in 4-liter cans for Feb 16-Mar 15 shipment on January 19.

Updated 1/10/22

Soybeans – March $13.00-$14.25

Soybean meal – March $370-$435

Soybean oil – March 54.50-61.00

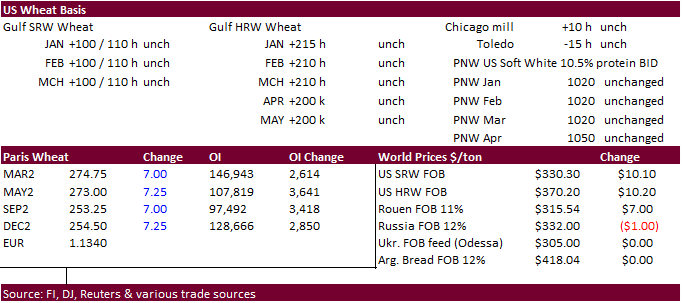

· US wheat futures rallied as Russian/Ukraine tensions escalated. The export market is also active which is lending support.

· We are unsure if global trade flows will tip over if we see an escalation in countries barring business with Russia and/or Ukraine but looking back, agriculture trade should be exempt. At least that was the case with previous wars.

· US weather is dry over the Great Plains and lack of adequate snow cover adds to the bullishness for US winter wheat.

· Iran’s GTC seeks 60,000 tons of milling wheat on January 20 for February – March shipment.

· Jordan seeks 120,000 tons of feed barley on January 26 for July – August shipment.

· Jordan retendered on wheat seeking 120,000 tons on February 1 for July – August shipment.

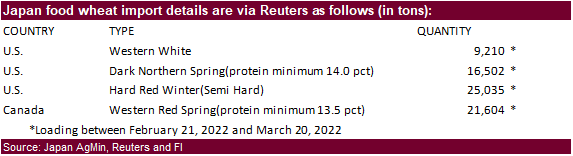

· Japan seeks 72,351 tons of wheat on Thursday.

· Taiwan seeks 49,395 tons of US wheat on Jan 20 for LH March shipment.

Rice/Other

· South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated 1/18/22

Chicago March $7.50 to $8.30 range

KC March $7.65 to $8.55 range

MN March $8.75‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.