WEATHER

EVENTS AND FEATURES TO WATCH

-

Welcome

rain fell in Argentina during the weekend -

The

precipitation was erratic, but most significant from the northeast half of Buenos Aires and Entre Rios through central and southern Santa Fe to Cordoba. -

The

greatest rainfall was in northeastern Buenos Aires, Entre Rios and a few areas in both central Santa Fe and northern Cordoba where 1.00 to 2.00 inches and local totals of 2.00 to 3.00 inches resulted -

Southeastern

Cordoba reported 1.73 inches -

Most

other amounts varied from 0.15 to 0.85 inch -

Temperatures

were greatly eased from readings that were well over 100 degrees last week down to a more seasonable range the past couple of days -

Argentina

dryness and excessive heat seriously stressed crops during most of last week and highest temperatures Friday and Saturday were in the range of 100 to 111 with a few extremes to 113 -

The

heat was not quite as great as advertised earlier last week, but the impact was nearly the same -

No

soil moisture was present in much of the nation and the combination of extreme heat and dryness with no rain was very stressful to crops -

Relief

that began Sunday favored east-central and northeastern areas leaving the southwest still waiting for rain, but that is expected later this week -

Argentina

temperatures will be more seasonable this week due to the rain that impacts central and southern areas -

Additional

rain is expected in central Argentina today and then a brief break in the precipitation is expected Wednesday into Thursday -

A

new wave of rain will then begin in Buenos Aires Thursday night into Friday that will expand northwest to Cordoba, San Luis and neighboring areas into the weekend

-

The

precipitation will then shift to the northwest part of Argentina Sunday -

Argentina

will see scattered showers and thunderstorms early to mid-week next week alternating with periods of sunshine -

All

of the heavy rain will be over by Saturday -

Drier

biased weather is expected from late next week into the last days of this month -

Argentina’s

bottom line remains one of significant improvement during the coming week; however, there will be more ridge building in February. That ridge of high pressure should not be as brutal as the one that just passed, but it will be important that Argentina continues

to see timely rainfall to protect late season crops. A big boost in late season planting and some replanting is likely as a result of the recent rainfall.

-

Brazil

weather also improved during the long holiday weekend with less frequent and less significant rain occurring so that early soybeans and corn could mature better -

Too

much rain in late December and early January threatened summer crop quality and was threatening to delay harvesting of soybeans, but this weather change has turned those worries around -

The

environment should be more favorable for crop maturation and fieldwork -

Brazil’s

weekend precipitation was greatest from eastern Santa Catarina through central, eastern and northern Parana to southern Minas Gerais where 0.50 to 1.50 inches occurred most often -

A

few locations reported up to 2.00 inches, but mostly east of key crop areas.

-

Rain

in southern Rio Grande do Sul varied from 0.30 to 1.00 inch through Monday morning -

Nearly

40% of Brazil was dry during the weekend and temperatures were mostly seasonable except near the Paraguay border and in Rio Grande do Sul where extremes of 95 to 106 Fahrenheit were noted -

Brazil

rainfall during the last week of this month will turn more normal with periods of rain and sunshine intermixing to support all kinds of crop development and fieldwork

-

The

outlook will be quite favorable -

South

America’s high pressure ridge aloft is not going away this week, but will be relocated over Paraguay resulting in hot and dry conditions in Paraguay, Formosa, parts of Chaco and areas nearby into extreme western portions of Mato Grosso do Sul and western Parana,

Brazil -

Cotton

areas of Argentina and minor northern grain and oilseed areas will see chronic dryness persist, but the nation that will be most seriously hurt is Paraguay -

Paraguay

has already suffered losses to its corn, soybean, cotton, rice and other crops because of dry and warm to hot weather during much of the summer season -

Additional

damage to crops is expected this week while high pressure dominates the nation -

The

high pressure ridge will gradually move back to the west settling over northern Argentina, southern Bolivia and western Paraguay during the middle part of next week -

This

will likely keep some pressure on northern Argentina cotton and minor grain and oilseed production areas as well as all crops in Paraguay.

-

There

is potential that the ridge will break down during the latter part of next week -

This

ridge will not extend over all of Argentina and will only limit heat and dryness to the far north. Rain should fall farther to the south -

U.S.

weather during the weekend brought significant snowfall from central North Dakota through Iowa to Missouri and western Illinois and then from a part of the northern Delta into the middle Atlantic Coast states -

Snow

accumulations of 3 to 10 inches were common from North Dakota to Missouri with nearly 15 inches in Des Moines Iowa

-

Snowfall

in northwestern Arkansas reached 14 inches -

Snow

also fell Sunday into Monday from the Appalachian Mountain region into the lower eastern Midwest and from there into southern New England -

Snowfall

reached 15 inches in the mountains of western North Carolina -

Crop

areas in the lower Midwest reported up to five inches through Sunday evening -

Snowfall

in the northeastern U.S. varied from 8 to 25 inches with the greatest amounts near Lakes Erie and Ontario -

Moisture

totals reached 2.50 inches at Des Moines, IA while varying from 0.20 to 0.66 inch in Missouri with a few other amounts over 1.00 inch -

Rainfall

in the southeastern states varied from 1.00 to 2.18 inches and will help reverse the recent drying trend for the region especially with more rain coming.

-

Temperatures

turned quite cold behind the snow event in the Midwest with high temperatures in the 20s and 30s Fahrenheit in the lower Midwest and 30s and 40s in the Delta and Tennessee River Basin with subzero degree lows in the northern Midwest -

No

wheat damage was suspected -

U.S.

weather the remainder of this week into next week will be dominated by a series of cold air masses that will drop into the central and eastern parts of the nation resulting in a cooler than usual temperature regime in the Midwest, northern Plains and Atlantic

coast states during much of the next two weeks -

Energy

demand will be above average, but no extreme cold is expected for a while -

The

second half of this week and much of next week will be colder than usual and will induce a higher energy consumption rate -

Cold

air in the eastern U.S. during the next two weeks will bring waves of precipitation to the southeastern states preventing those areas from drying out

-

Florida

citrus areas will need to be monitored for a possible cold surge in the last week of this month, but confidence is very low for a serious threat to crops and there does not appear to be any threatening event on the forecast charts today.

-

West

Texas will be dry for the next ten days -

U.S.

hard red winter wheat production areas will be mostly dry for the next ten days -

California

and most of the western states in the U.S. will not see much precipitation of significance for a while and temperatures will be warmer than usual -

Western

Europe precipitation is expected to be restricted during the next ten days while eastern parts of the continent get precipitation periodically -

There

will be no threat of crop damaging cold -

Eastern

Europe will seed a boost in snow cover during the next week to ten days -

Western

parts of Russia, Ukraine and neighboring areas will see waves of snow and some rain during the next ten days keeping winter crops adequately protected from any threatening cold – if such a risk evolves -

No

damaging cold is expected -

Northwestern

Africa, Spain and Portugal will continue dry biased and a little warmer than usual during the next ten days and perhaps longer -

Southwestern

Morocco is driest along in the northeast Morocco/northwestern Algeria border area -

Rain

is needed in these areas, but winter crops are semi-dormant and do not need much moisture until the second half of February and March -

Northern

India will get some more rain late this week into early next week -

The

moisture will further support high yielding winter crops this year, although reproduction will occur mostly in February -

Recent

rain events and that coming up should have crops in better than usual conditions ahead of reproduction -

South

Africa’s forecast is a little drier than that of Friday -

The

change is welcome because there was some concern of too much rain evolving and this forecast will be better for crops

-

Australia’s

weather is expected to be favorably mixed over the next two weeks, but a larger volume of rain might be better for some dryland crop areas in Queensland

-

The

expected precipitation in this next ten days should be sufficient to help crops develop well -

Indonesia,

Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

-

Western

portions of Luzon Islands, Philippines will need a boost in rainfall soon -

A

tropical cyclone may threaten the southern Philippines next week, although confidence is quite low -

Northern

Laos and northern Vietnam received rain Sunday and it will continue today -

Most

other areas in mainland crop areas of Southeast Asia are unlikely to see much precipitation which is normal for this time of year -

Coastal

areas of Vietnam will get some rain periodically -

China’s

weather will be wettest in the Yangtze River Basin and interior southern parts of the nation through the next two weeks -

Winter

crops are dormant or semi-dormant and expected to remain in good condition for the next ten days -

Some

snow and freezing rain may occur during the middle to latter part of next week, but confidence is low -

Northern

China precipitation will be restricted for the next two weeks -

West-central

Africa precipitation will remain confined to coastal areas for a while -

Coffee

and cocoa maturation and harvest progress is advancing well -

There

is very little risk of a notable Harmattan wind that would threat crops -

Ethiopia

may get some rain this week while Tanzania and southwestern Kenya are the wettest east-central Africa nations for a while -

Today’s

Southern Oscillation Index is +1.86 down from +13.07 on Dec. 31 -

The

index may continue to drift a little lower as La Nina goes through a weakening phase, but most of the decline in the index is over -

New

Zealand rainfall will continue lighter than usual over the next ten days -

The

nation has been drying out in recent weeks -

Temperatures

have been seasonable -

Canada’s

Prairies will receive waves of snow and a little rain this week with temperatures warmer than usual in the west and cooler than usual in the east -

The

moisture will be welcome, but greatest in the far west and extreme east -

Drought

continues in southwestern parts of the Prairies -

Mexico

will experience and erratic rainfall pattern during the next two weeks -

No

general soaking of rain is expected -

Any

precipitation would be welcome, but greater amounts are desired especially in the next few weeks -

Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica -

Guatemala

will also get some showers periodically -

Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected

Source:

World Weather, inc.

Tuesday,

Jan. 18:

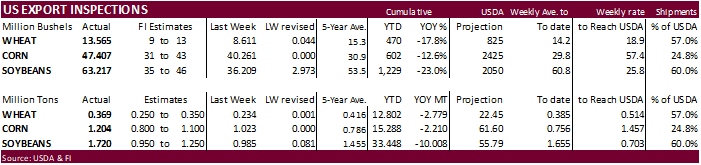

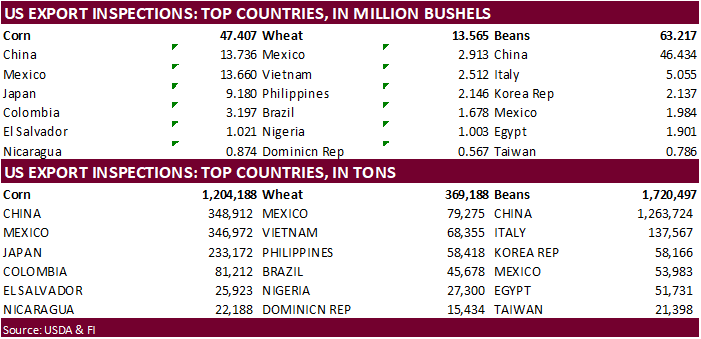

- USDA

export inspections – corn, soybeans, wheat, 11am

- China’s

second batch of December trade data - EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - HOLIDAY:

Malaysia

Wednesday,

Jan. 19:

- European

quarterly cocoa grindings report (tentative)

Thursday,

Jan. 20:

- USDA

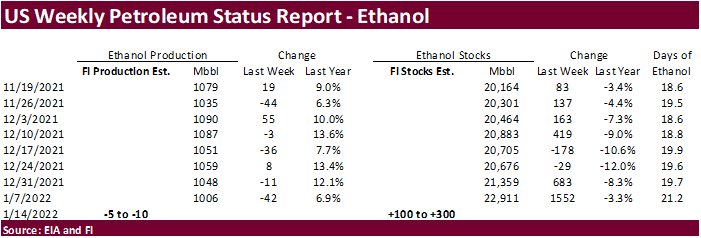

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EIA

weekly U.S. ethanol inventories, production - China’s

third batch of country-wise December trade data - Port

of Rouen data on French grain exports - Malaysia’s

Jan. 1-20 palm oil exports - New

Zealand food prices - USDA

red meat production, 3pm

Friday,

Jan. 21:

- ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

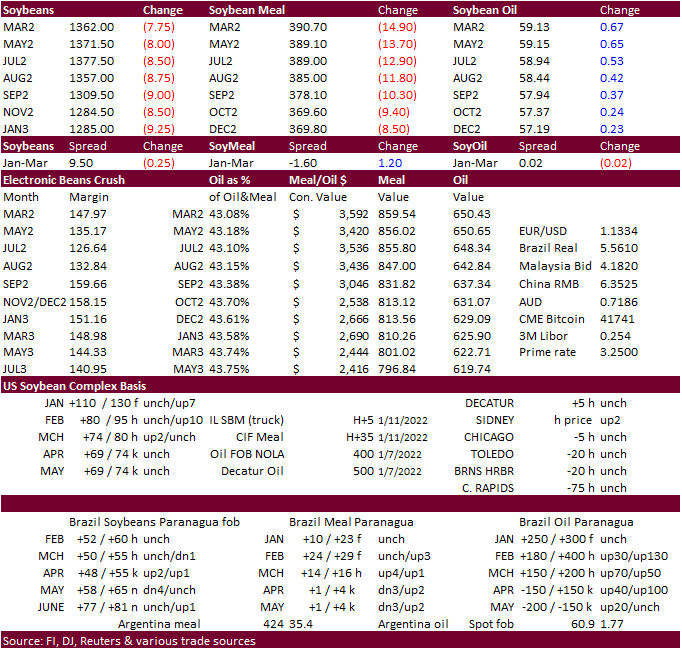

Soybean

and Corn Advisory

2021/22

Brazil Soybean Estimate Lowered 1.0 mt to 134.0 Million

2021/22

Brazil Corn Estimate Unchanged at 112.0 Million Tons

2021/22

Argentina Soybean Estimate Unchanged at 43.0 Million Tons

2021/22

Argentina Corn Estimate Unchanged at 51.0 Million Tons

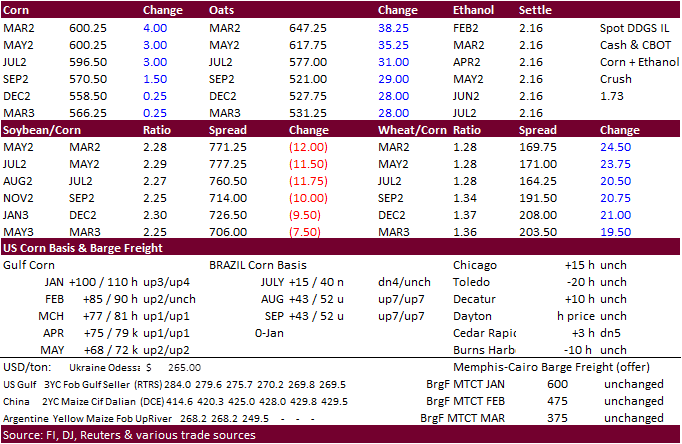

Corn

·

CBOT corn was higher in the front months amid higher wheat, but gains were trimmed as soybeans settled lower. News was light. China likely bought US sorghum over the weekend.

·

Hong Kong reported a ASF outbreak. Traders should monitor China over the next couple of weeks.

·

Spain reported a bird flu outbreak north of Madrid.

·

Bloomberg: U.S. Cattle on Feed Placements Seen Up 2.5%. December placements onto feedlots seen rising y/y to 1.89m head.

·

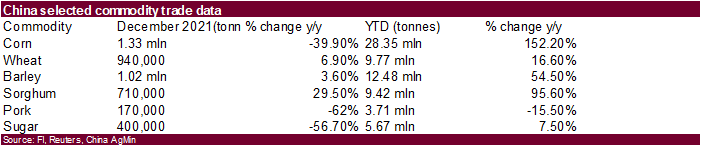

(Bloomberg) China Dec. Corn Imports 1.33M Tons, -39.9% Y/y

YTD

corn imports rose 152.2% y/y to 28.35m tons (record)

Dec.

wheat imports 940,000 tons, +6.9% y/y

YTD

wheat imports rose 16.6% y/y to 9.77m tons

Export

developments.

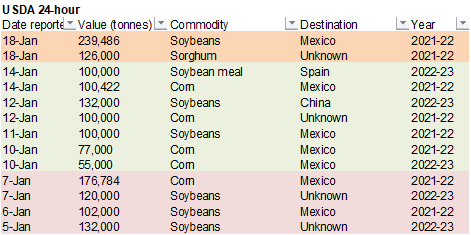

·

Under the 24-hour announcement system, private exporters sold 126,000 tons of sorghum to unknown.

Updated

1/18/22

March

corn is seen in a $5.80 to $6.20 range

·

Argentina rains were better than expected over the weekend and that sent CBOT soybean prices lower. The rain was expected to stop the crop production declines, not aid development, IMO.

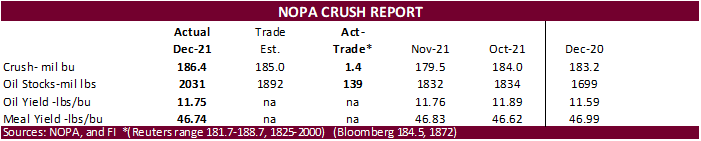

·

NOPA reported a record December US soybean crush of 186.4 million bushels, contributing to a higher-than-expected end of December soybean oil stocks of 2.031 billion pounds. This time last year we were thinking soybean oil stocks

would be around the 1.4-1.5-billion-pound area. Oil share has been struggling recently and we think that will be the case over the short term. However, it rallied today with soybean meal making an impressive trade lower. March SBM fell $15.50. Feed demand

is not going away anytime soon.

·

Last trade for Feb options is Friday.

·

Parana, Brazil, was 4 percent harvested for soybeans as of Monday. It will take a while to see the real damage to the crop(s). Overall Brazil is less than 2 percent harvested.

Export

Developments

·

Under the 24-hour announcement system, private exporters sold 239,486 tons of soybeans to Mexico.

·

The USDA seeks 7,540 tons of vegetable oil in 4-liter cans for Feb 16-Mar 15 shipment on January 19.

Updated

1/10/22

Soybeans

– March $13.00-$14.25

Soybean

meal – March $370-$435

Soybean

oil – March 54.50-61.00

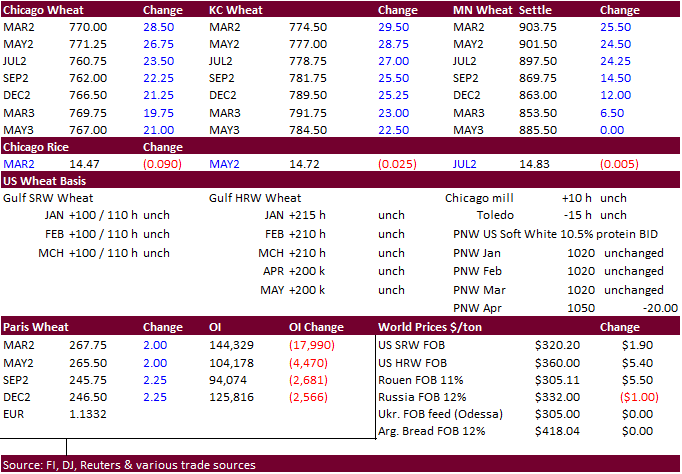

·

US wheat futures rallied after a few import tenders were announced over the long holiday weekend followed by strong USDA export inspections. Russian/Ukraine tensions were also supporting prices.

·

We are unsure if global trade flows will tip over if we see an escalation in countries barring business with Russia and/or Ukraine but looking back, agriculture trade should be exempt. At least that was the case with previous

wars.

·

Argentina harvested a record 21.8 MMT of wheat, above the previous record of 19 million tons in 2018-19. – Exchange

·

Turkey bought 335,000 tons of milling wheat.

·

Jordan passed on wheat.

·

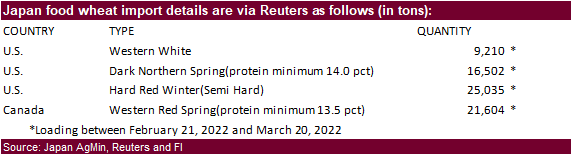

Japan seeks 72,351 tons of wheat on Thursday.

·

Taiwan seeks 49,395 tons of US wheat on Jan 20 for LH March shipment.

Rice/Other

·

South Korea seeks 46,344 tons of rice from (mainly) China on Jan 27.

Updated

1/18/22

Chicago

March $7.50 to $8.30 range

KC

March $7.65 to $8.55 range

MN

March $8.75‐$9.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.