PDF Attached

Bear

spreading amid profit taking pressured March soybeans and March corn. Wheat was higher on Russian export tax concerns.

Attached

is our updated US corn balance sheet among several US corn charts.

·

We lowered FI corn for ethanol use by 50 to 5.0 billion, 50 above USDA

·

US corn exports were lowered 50 to 2.600 billion, 50 above USDA

·

US corn for feed was revised sharply lower to 5.6 billion, 50 below USDA

·

Supply was adjusted to reflect lower carry in stocks and lower US production.

·

US corn imports were lowered 5 million bushels to 30, 5 above USDA

·

Our US corn carryout is currently 1.506 billion bushels vs. 1.552 USDA.

Weather

NOT

MUCH CHANGE

South

America’s weather outlook has not changed

- Argentina

received welcome rain from La Pampa and many Buenos Aires locations into central Cordoba, San Luis and southern Santa Fe late Thursday and overnight - Moisture

totals varied from 0.20 to 0.88 inch most often with local totals of 1.00 to more than 3.00 inches in southern Santa Fe and southeastern Cordoba along with a few random 1.00 to 2.00-inch totals in La Pampa and western Buenos Aires - The

moisture coupled with that which fell earlier this week and that which is expected today, and Saturday will help crops coast into next week’s dry and warmer weather without much concern over stress - Timely

rain will be extremely important for the last week of this month and on into February, but for now conditions in the nation are improving - Brazil’s

rainfall has been a little erratic recently, but sufficient rain has been occurring in most of the important production areas - The

past two days of scattered showers and thunderstorms have removed concern over dryness in western and northern Sao Paulo as well as southwestern Minas Gerais - Similar

relief occurred last week in southern Goias - Brazil’s

weather outlook for the next two weeks will be mostly good with rain for most of the key grain, oilseed and cotton areas - Net

drying is expected from eastern Minas Gerais and Espirito Santo into eastern Bahia, but this will impact unirrigated coffee, cocoa and minor sugarcane areas more than coarse grain and oilseeds - Unirrigated

coffee areas of Zona de Mata, Espirito Santo and Bahia will need rain soon - Eastern

Australia will experience erratic rainfall of limited significance during the next ten days to two weeks - Net

drying is expected, although showers will occur to support irrigated crops - Some

of the dryland production area will have rising need for significant moisture soon.

- Russia’s

Southern Region will get additional snow and some rain through the weekend adding more moisture for crop use in the spring - Snow

cover will be sufficient to protect northern crops from any threatening cold that occurs over the next few days - No

crop damaging conditions are expected over the coming week because of sufficient snow on the ground in most of western Russia - Eastern

Europe snow cover is sufficient to protect most crops from any threatening weather that might evolve in the next week to ten days - No

threatening cold is anticipated, although temperatures will be cooler than usual - Europe

weather will continue abundantly moist over the next ten days to two weeks a frequent precipitation events continue while temperatures are mild to cool - Some

flood potential may rise in France, the United Kingdom and northern Spain as time moves along - Flood

potentials are already high in parts of Italy and the eastern Adriatic seas counties - China

weather will remain favorable for this time of year with no threatening cold and well established winter crops - Precipitation

will be light in this first week of the outlook, but will increase in the Yangtze River Basin and parts of the interior far south in the Jan. 23-29 period - India

will dry down in the far south finally after weeks of frequent rain - The

change will help improve late season harvest conditions for sugarcane cotton and groundnuts - Winter

crop conditions in the far south will also benefit from drier weather - India’s

key winter crop areas in the central and north are rated favorably with some need for rain in western and southern production areas - Rain

is always needed in all of India’s winter crop areas during the winter, but the situation is not critical in very many areas - South

Africa’s shower and thunderstorms pattern is expected to ease this weekend and net drying is expected through most of next week across the nation - Crop

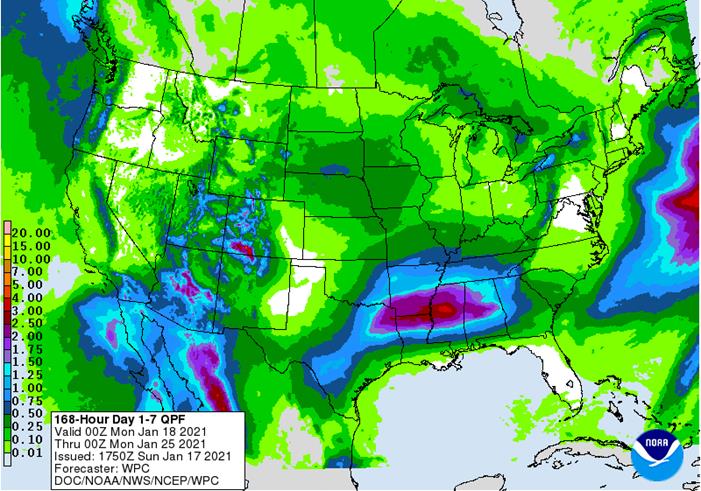

conditions will stay fine with good production potentials, although the need for rain will rise in many areas by the last days of January - U.S.

Midwest received snow and a little rain Thursday - Moisture

totals were varied up to 0.54 inch through dawn in eastern Minnesota, southwestern and west-central Wisconsin and a few Iowa locations - Snow

accumulations varied from 3 to 7 inches from eastern Minnesota and parts of western Wisconsin southward into the heart of Iowa with a dusting to 2 inches in immediate surrounding areas - Excessive

wind speeds occurred in the U.S. northern and central Great Plains Thursday - Speeds

of 25 to 40 mph were common with gusts of 50-65 mph and more - U.S.

weather outlook - Snow

and blowing snow will remain over the Midwest today and Saturday - Strong

wind speeds will continue, although not as windy as in the Plains the past two days

- Snow

accumulations will vary from a dusting to 3 inches most often, but greater snow will occur from southern Minnesota into Iowa where upwards to another 6 inches will occur

- Rain

and snow will occur through the weekend in the Atlantic Coast States, although New England, New York and southeastern Canada will get the greatest snowfall - Brief

periods of snow and rain will impact the heart of the nation and areas east across the Midwest and Atlantic Coast states next week until late week - The

next larger storm will impact the southern Plains Thursday and Friday, Jan. 21-22 before moving through the Delta to the lower half of the Atlantic Coast in the following weekend - Rain

and some snow will accompany this event - The

Midwest should be a little cooler at that time with a surface high pressure center settling over the region for a while - Cooling

is expected in the far western United States after Jan. 22 and the cold should bring on some needed snow in some of the drought stricken Rocky Mountain and Great Basin regions - A

couple of small storms will move across the central and eastern U.S. in the last week of January as reinforcing cold air shifts out of the western states and into the east - U.S.

temperatures will be near to above normal in this first week of the outlook and then colder in the north-central and northwestern states as well as Canada’s Prairies in the following week - Waves

of rain will impact the Philippines, Indonesia and Malaysia over the next week to ten days - Excessive

moisture is possible at times, but most of the greater rainfall that has been seen recently has abated for the next several days and then will return again - Flooding

has been an issue for the nation at times in recent months - Mainland

areas of Southeast Asia will be dry over the next ten days except coastal areas of Vietnam where scattered showers are expected - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - Some

rain fell in Ivory Coast and Ghana coffee and cocoa areas Monday, but resulting amounts were light - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +19.30 today and the index will remain very strong for a while longer - Mexico

and Central America weather will continue to generate erratic rainfall - Far

southern Mexico and portions of Central America will be most impacted by periodic moisture which is greater than usual at this time of year - Rain

advertised for central and northern Mexico next week would be welcome, but it is likely overdone - Canada

Prairies will remain warmer than usual over the coming week - Precipitation

will occur a little more often helping to improve snow cover and potential topsoil moisture in the spring - Southeast

Canada will receive rain and snow this weekend and then a little cooler with some follow up precipitation next week

Source:

World Weather Inc. and FI

Monday,

Jan. 18:

- China

customs to publish trade data, including corn, wheat, sugar and pork imports - China

4Q pork output - EU

weekly grain, oilseed import and export data - Brazil

coffee exporters group Cecafe releases December data - Ivory

Coast cocoa arrivals - HOLIDAY:

U.S. (Martin Luther King, Jr. Day)

Tuesday,

Jan. 19:

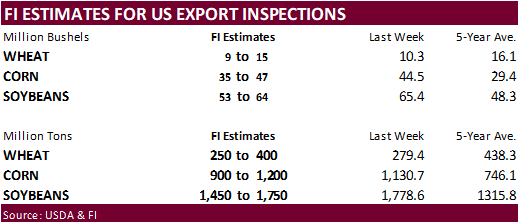

- USDA

weekly corn, soybean, wheat export inspections, 11am - New

Zealand global dairy trade auction

Wednesday,

Jan. 20:

- China

customs to publish import data split by country - European

Cocoa Association grinding data - Malaysia’s

Jan 1-20 palm oil exports

Thursday,

Jan. 21:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - USDA

red meat production

Friday,

Jan. 22:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - EIA

weekly U.S. ethanol inventories, production, 10:30am (two days later than usual due to federal holidays earlier in the week)

U.S.

Cattle on Feed, poultry slaughter

Source:

Bloomberg and FI

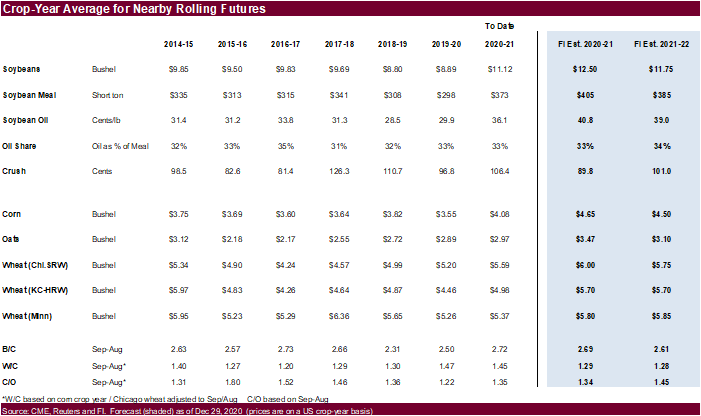

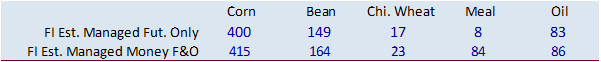

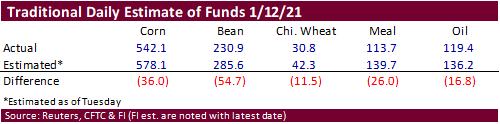

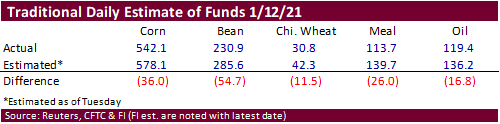

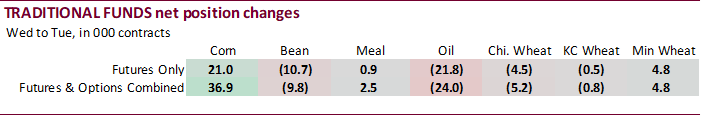

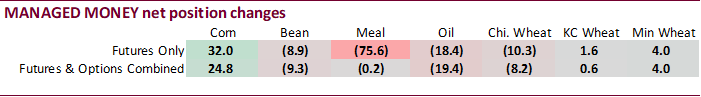

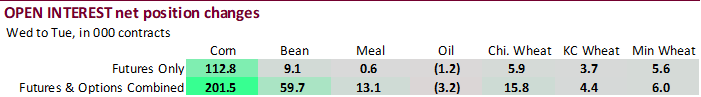

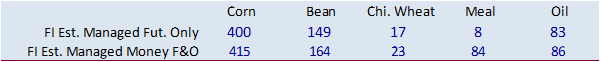

It

is safe to say the trade for the last several weeks has missed predicting how much the longs have gone long. “Traditional” fund positions for corn have hit another record for futures only and futures and options combined. Managed money positions have a short

stint to make new records, but this is a reminder they have room for the upside, and with open interest at a high level, higher prices can be achieved if the manage money plow another round of long positions in the markets.

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

435,357 39,740 399,292 -9,786 -808,165 -10,952

Soybeans

158,524 -6,692 159,369 -6,813 -320,896 10,921

Soyoil

69,029 -22,897 123,201 289 -213,755 20,178

CBOT

wheat -6,511 -4,778 137,518 503 -118,635 2,903

KCBT

wheat 34,493 1,682 70,391 -2,569 -106,938 -1,016

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

374,714 24,826 243,283 -4,611 -774,381 -13,327

Soybeans

166,485 -9,342 70,230 -9,618 -297,117 16,847

Soymeal

84,408 -187 64,887 -3,271 -203,625 -3,018

Soyoil

93,536 -19,382 83,956 -1,906 -219,282 23,488

CBOT

wheat 16,987 -8,224 82,881 2,211 -105,192 1,630

KCBT

wheat 55,062 605 42,709 -206 -100,404 -928

MGEX

wheat 11,797 4,049 3,401 211 -25,025 -4,501

———- ———- ———- ———- ———- ———-

Total

wheat 83,846 -3,570 128,991 2,216 -230,621 -3,799

Live

cattle 42,827 -3,160 76,489 7,941 -129,393 -1,861

Feeder

cattle 13 -1,758 7,547 -532 -1,852 816

Lean

hogs 38,742 1,664 53,195 2,563 -89,982 -1,961

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

182,867 12,113 -26,483 -19,001 2,580,675 201,473

Soybeans

57,399 -470 3,003 2,584 1,342,333 59,686

Soymeal

23,656 2,720 30,675 3,756 499,855 13,121

Soyoil

20,265 -4,631 21,526 2,431 568,408 -3,163

CBOT

wheat 17,695 3,009 -12,372 1,372 538,192 15,758

KCBT

wheat 578 -1,374 2,055 1,903 242,317 4,356

MGEX

wheat 4,651 748 5,175 -507 88,317 6,000

———- ———- ———- ———- ———- ———-

Total

wheat 22,924 2,383 -5,142 2,768 868,826 26,114

Live

cattle 25,378 -847 -15,302 -2,072 359,752 16,012

Feeder

cattle 2,033 885 -7,742 589 48,928 -87

Lean

hogs 10,661 -2,208 -12,616 -58 245,388 3,674

Macros

US

Retail Sales (M/M) Dec: -0.7% (est 0.0%, prevR -1.4%)

US

Retail Sales Ex-Autos (M/M) Dec: -1.4% (est -0.1%, prevR -1.4%)

US

Retail Ex Gas/Autos Dec: -2.1% (prevR -1.3%)

US

Retail Control Dec: -1.9% (est 0.1%, prevR -1.1%)

US

PPI Final Demand (Y/Y) Dec: 0.8% (est 0.8%, prev 0.8%)

US

PPI Final Demand (M/M) Dec: 0.3% (est 0.4%, rev 0.1%)

US

PPI exFood/Energy (Y/Y) Dec: 1.2% (est 1.3%, prev 1.4%)

US

PPI exFood/Energy (M/M) Dec: 0.1% (est 0.2%, prev 0.1%)

US

PPI exFood/Energy/Trans (Y/Y) Dec: 1.1% (prev 0.9%)

US

PPI exFood/Energy/Trans (M/M) Dec: 0.4% (prev 0.1%)

US

Univ. Of Michigan Sentiment Jan P: 79.2 (est 79.5; prev 80.7)

–

Conditions Jan P: 87.7 (est 97.0; prev 90.0)

–

Expectations Jan P: 73.8 (est 74.0; prev 74.6)

–

1-Year Inflation Jan P: 3.0% (est 2.5%; prev 2.5%)

–

5-10 Year Inflation Jan P: 2.7% (prev 2.5%)

US

Business Inventories (M/M) Nov: 0.5% (est 0.5%; prev 0.7%)

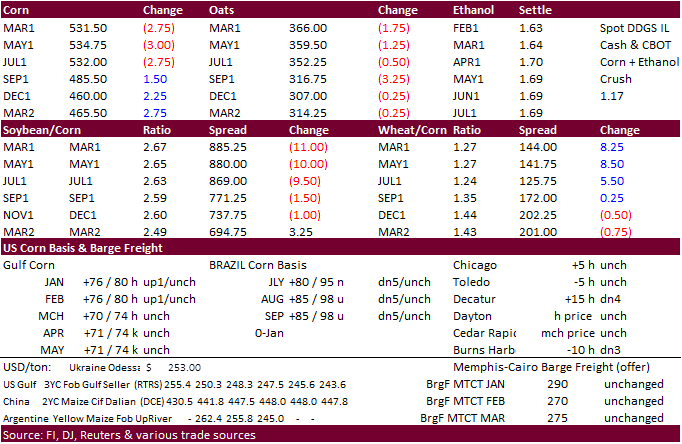

Corn.

-

Corn

futures traded 12.75 cents lower in the front month on profit taking ahead of the long US holiday weekend. US producer selling likely was active. One piece of news that should be monitored was an update from Mexico’s decision to phase out GMO corn. Apparently,

it will include GMO corn imports for feed. This could affect 15.5-18 million tons of GMO corn imports going forward. They could reverse their decision if they cannot source non-GMO corn, or replace supplies.

-

Funds

on Friday sold an estimated net 10,000 corn contracts. -

Traders

should be eyeing the March corn gap of 517.25 and 519. -

Brazil’s

Safras sees corn production at 113.5 million tons, up from 112.9 million previously.

-

China

will auction off 30,000 tons of pork late next week.

- So

far in January, Ukraine corn export prices rose $23-$26 per ton to $256-$264 fob Black Sea, according to APK-Inform. This is $6-$10 per ton higher than the previous record in May 2014.

Corn

Export Developments

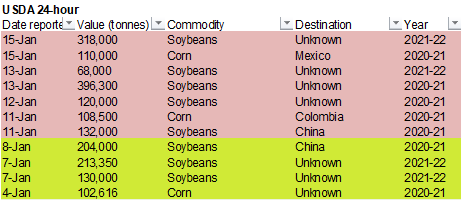

-

Under

the 24-hour USDA reporting system, private exporters reported export sales of 110,000 tons of corn for delivery to Mexico during the 2020-21 marketing year.

-

Results

awaited: Qatar seeks 100,000 tons of bulk barley on January 12.

- Results

awaited: Qatar seeks 640,000 cartons of corn oil on January 12.

Updated

1/12/21

March

corn is seen trading in a $4.75 and $5.50 range

-

CBOT

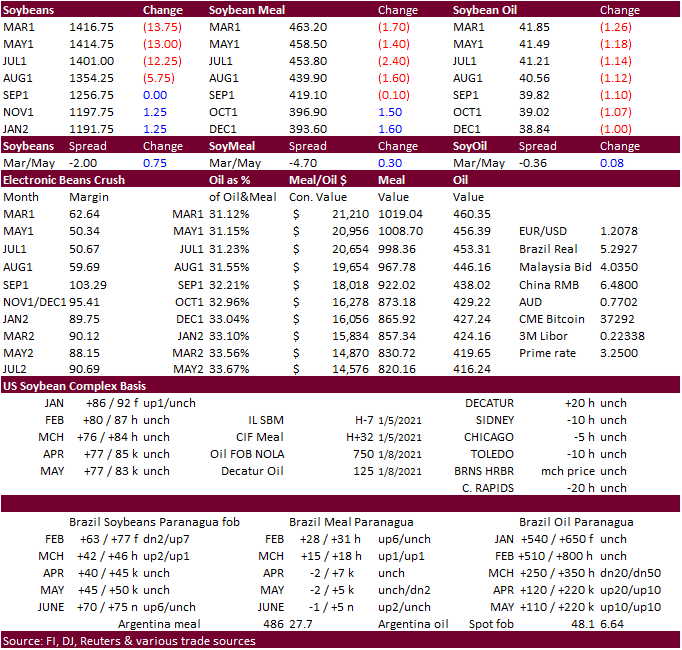

soybean complex traded lower led by the March contract on long liquidation headed into a three day holiday weekend for the US. Soybean meal was mostly lower while soybean oil dropped more than 110 points. Malaysian palm oil is at a three week low.

-

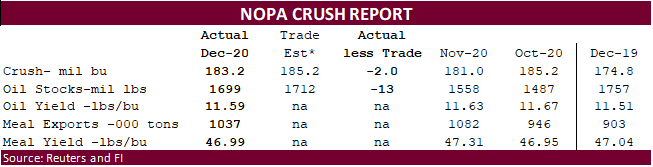

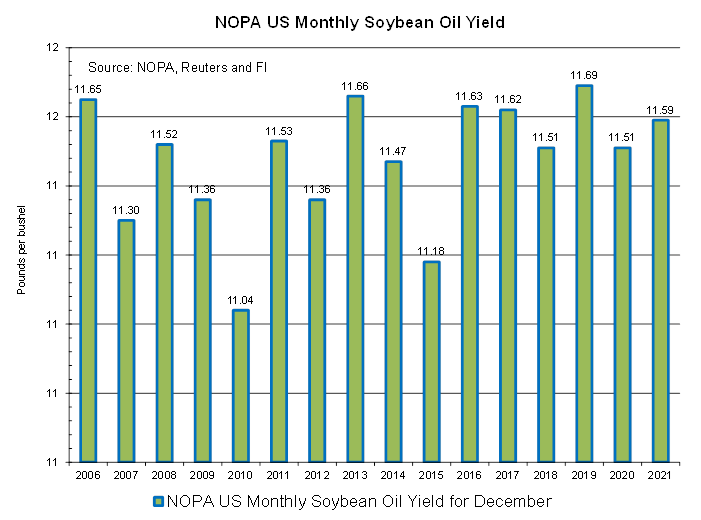

NOPA

December crush was reported 2 million bushes below a trade guess at 183.2 million bushels and soybean oil stocks came in at 1.699 billion, 13 million below an average trade guess. Note the soybean oil yield and soybean meal yield was lowered form the previous

month. While not uncommon to see this change from November to December, it’s important to keep in mind USDA raised their product yields in their January S&D update, to 11.62 and 47.24, respectively. We agree with USDA for the soybean oil yield.

-

China

cash crush margins on our calculation are 198 cents (178 previous), compared to 98 year ago.

-

China

bought a few cargoes of US soybeans on Thursday that included new crop US soybeans.

-

Funds

on Friday sold an estimated net 12,000 soybeans, sold 1,000 soybean meal and sold 12,000 soybean oil.

-

Under

the 24-hour USDA reporting system, private exporters reported export sales of 318,000 tons of soybeans for delivery to unknown destinations during the 2021-22 marketing year.

-

USDA

seeks 6,390 tons of vegetable oil on January 20 under the PL480 program for March 1-31 shipment (Mar 16-Apr 15 for plants at ports).

Updated

1/12/21

March

soybeans are seen in a $13.25 and $15.00 range

March

soymeal is seen in a $430 and $500 range

March

soybean oil is seen in a 42.00 and 45.50 cent range

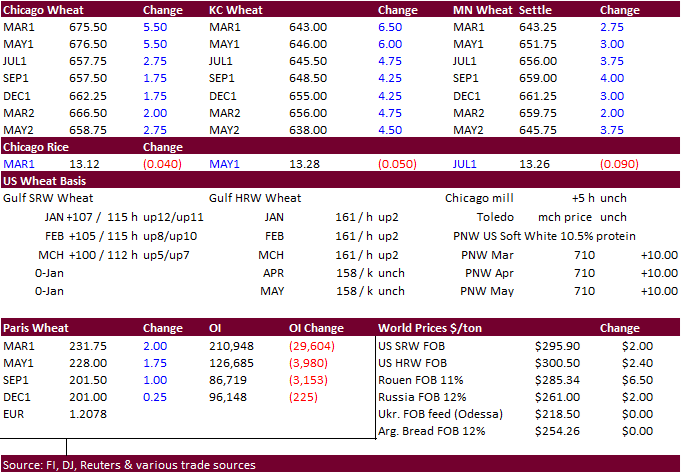

- US

wheat traded higher after Russia said they will impose higher export duties than what they previously planned. Russia will raise its wheat export tax to 50 euros ($60.68) per ton beginning March 1 until June 30 from the 25 euro-per-ton tax set for Feb. 15

to March 1 – economy minister via Reuters. They confirmed they will extend their wheat export tax beyond June 30, bullish US and Paris wheat futures, in our opinion.

- Funds

on Friday

bought an

estimated net 2,000 Chicago wheat contracts. - The

EU awarded 440,000 tons of Ukraine corn imports and 51,072 tons of Ukraine wheat imports.

- Ukraine

wheat export prices rose $3.00 per ton to $284-$293 fob Black Sea, according to APK-Inform.

- Ukraine

grain exports are running 18 percent lower from last season at 27.2 million tons. Flour exports are down 56% so far this year.

- Bangladesh

plans to seek wheat from Ukraine after Russia planned to increased wheat export taxes. Russia has supplied about 200,000 tons, half of the planned export target to Bangladesh.

- Parts

of TX and OK will see beneficial precipitation over the next few days. - CBOT

Chicago wheat open interest was up 7,155 contracts. -

EU

March milling wheat was up 2.00 at 231.75 euros.

-

Bangladesh

seeks 50,000 tons of wheat January 18 for shipment within 40 days of contract signing.

-

Syria

seeks 200,000 tons of wheat on Jan 18 for shipment within 60 days after contract signing.

-

Japan

in a SBS auction seeks 80,000 tons of feed wheat and 100,000 tons of feed barley for arrival in Japan by March 18 on January 19.

-

Jordan

seeks 120,000 tons of feed barley on Jan 19.

-

Jordan

seeks 120,000 tons of milling wheat, optional origin, on Jan. 20. Possible shipment combinations are between June 1-15, June 16-30, July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

-

Turkey

seeks 400,000 tons of milling wheat on Jan 19 for Jan through Feb 25 shipment.

-

Bangladesh

seeks 50,000 tons of wheat January 25 for shipment within 40 days of contract signing.

-

Bangladesh

seeks 10,000 tons of rice on January 18.

·

Bangladesh seeks 60,000 tons of rice on January 20.

·

Bangladesh seeks 50,000 tons of rice on Jan. 24.

-

Bangladesh

seeks 50,000 tons of rice on January 26.

·

South Korea seeks 113,555 tons of US, Thailand, and China rice on Jan 21 for April 30 through July 31 arrival.

·

Syria seeks 25,000 tons of rice on February 9.

Updated

1/12/21

March

Chicago wheat is seen in a $6.35‐$7.15 range

March

KC wheat is seen in a $6.00‐$6.50 range

March MN wheat

is seen in a $6.00‐$6.55 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.