PDF Attached

Wild

trade in the soybean complex with soybean meal making the last firework move to the upside at 1:13 CT, before the regular session close, by jumping $3.00 pm 2,300 contracts. Soybeans ended mostly lower along with soybean oil that followed weakness in palm

and energy markets. Corn was lower in the nearby contracts and wheat fell after trading in wide ranges. Positioning was noted along with a higher USD.

Weather

MOST

IMPORTANT WEATHER AROUND THE WORLD

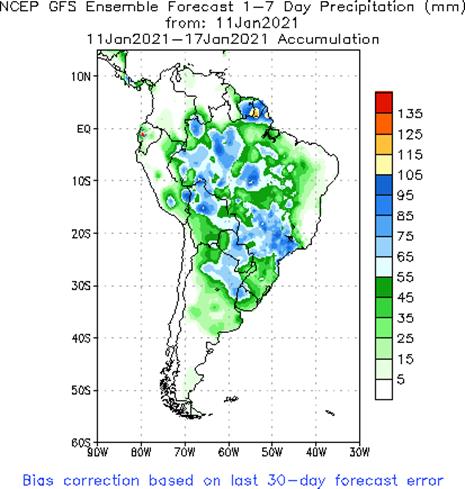

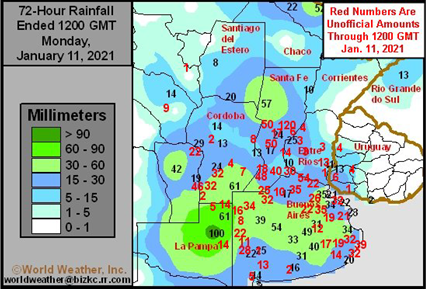

- Argentina’s

overnight rainfall was a little better than expected a little farther to the south - Rain

was widespread during the weekend, but amounts varied quite a bit with some areas in central Cordoba not getting quite enough to counter evaporative moisture losses, but there was rain in that region late last week - Rain

totals of 0.30 to 1.00 inch occurred in many areas with local totals of 1.00 to 2.00 inches - Santa

Rosa, La Pampa reported nearly 4.00 inches of rain while 2.25 inches occurred in northwestern Santa Fe and 4.72 inches occurred in central Santa Fe - Argentina

rainfall will continue in some east-central and northeastern crop areas today with a follow up precipitation event expected Friday into Saturday - Rain

today will impact the east-central and northeast - 0.40

to 1.50 inches and local totals over 2.00 inches will occur in the northeastern half of the nation

- Showers

will linger in the north Tuesday and pop up randomly in the west Wednesday, although both days will have net drying - Showers

central and southwest Thursday with rainfall under 0.50 inch favoring La Pampa, San Luis, western Buenos Aires and southern Cordoba - Rain

Friday into Saturday morning in the northeast half of the nation will be significant with 0.60 to 2.00 inches common and local totals to 3.00 inches - Restricted

rainfall is expected in the southwest - Saturday

afternoon through Jan. 22 will be dry or mostly dry - Isolated

to scattered showers and thunderstorms are expected Jan. 23-25 with daily rainfall of 0.15 to 0.60 inch and local amounts to 1.00 inch or more - Confidence

is low and rainfall is expected in the central and north - Coverage

should be low and most amounts will be light continuing a net drying bias in some areas - Argentina

temperatures will be warmer than usual during mid-week this week and again next week; some excessively warm conditions are expected late next week.

- Argentina’s

bottom line remains one of concern especially in the southwest where rainfall is expected to be lightest and least frequent. The entire nation will dry down next week making this week’s rain extremely important. Soil moisture last Friday was very short across

Santa Fe, Chaco, Corrientes and Entre Rios as well as eastern Cordoba and far northeastern La Pampa and a few areas in northern Buenos Aires. Most of this dry region has either received rain overnight or soon will this week. The drying bias that resumes Saturday

and lasts through Jan. 22 will start the drying trend again and it will not be long before crop moisture stress resumes especially in the southwest half of the nation where this week’s rain will be most limited.

- Brazil

weather during the weekend was dry or mostly dry from much of Sao Paulo into Rio Grande do Sul and in parts of Mato Grosso do Sul.

- Soil

moisture in this region late last week was favorably rated except in Rio Grande do Sul and in parts of Sao Paulo and immediate bordering areas - These

areas likely experienced further net drying and some increase in crop stress - Rain

fell in many other areas from Mato Grosso through Goias to western Bahia and Minas Gerais (southwestern Minas Gerais was left mostly dry) - Amounts

were highly variable ranging from 0.30 to 1.00 inch most often, but several 1.00 to 2,00-inch amounts were noted as well - Temperatures

were seasonably warm with above average temperatures in Mato Grosso, northern Minas Gerais, Bahia and Rio Grande do Sul - Brazil

weather is still expected to be favorable for summer crop development over the next ten days to two weeks - Precipitation

is expected in most of the nation at one time or another during the next ten days; northeastern areas may experience the lightest and least frequent rain, but amounts will be sufficient to support crops - Rainfall

of 0.80 to 2.00 inches will be common during the first week of the outlook; similar amounts will occur next week with the far south trending much drier over time - This

week’s rain will start out erratic leaving some areas in a net drying mode for a little longer - Timely

rainfall should impact Rio Grande do Sul to help prevent crops from having to endure serious moisture stress, although there will be some stress from time to time - Northeastern

Brazil rainfall is also expected to be a little erratic, but most of the grain and oilseed areas that need moisture will get it in sufficient timing to support crop development - Brazil

temperatures will be seasonable during much of the coming two weeks - Brazil’s

bottom line looks very good for the coming ten days with all crop areas in the nation getting rain at one time or another. Some of the model forecasts are too great with rainfall in the interior southern parts of the nation. Crop development should advance

favorably even though there will be some pockets of moisture stress for a little while early this week.

- Central

Spain received heavy snowfall during the weekend - Up

to 20 inches of snow fell near the Capital City of Madrid - Snow

and rain fell in many areas in the nation, but the greatest amounts were in the central and east where moisture totals varied from 0.40 to 1.61 inches - The

moisture was welcome for use in the spring, but travel issues are present today

- Temperatures

turned much colder following the snow event as well - Western

Texas, eastern New Mexico and southeastern Colorado received snow Saturday night and Sunday with some of it reaching the Delta overnight - Accumulations

of 1 to 3 inches occurred in southeastern Colorado and the Texas Panhandle while 3 to 6 and local totals to 9 inches occurred from east-central and southeastern New Mexico through West Texas to Central Texas - Snowfall

farther to the east varied from a trace to 4 inches - Heavy

snow also fell during the weekend in the southern Appalachian Mountains and into North Carolina where crop areas received less than 2 inches, but up to 8.5 inches occurred in the mountains – most of this occurred Friday into Saturday morning. - U.S.

Midwest, Delta, the northern and central Plains and interior western states were left mostly dry during the weekend - Temperatures

were still warmer than usual in many areas in the northern parts of the nation while more seasonable in the south - Sudden

Stratospheric Warming evolved last week raising the potential for a polar Vortex to evolve over the Hudson Bay area later this month and a cool temperature bias to follow into February - This

phenomenon will have a more significant impact on eastern Europe and the western Commonwealth of Independent States next week, but the phenomenon will require a couple of weeks for the coldest air to evolve - In

North America, temperatures will begin cooling gradually over the next couple of weeks, but temperatures will not likely turn bitterly cold until the last ten days of January and into February and it is a little too soon to get specific about which areas will

be most impacted, but the eastern parts of North America are usually impacted in this phenomenon possibly beginning in the Plains and western Midwest before advancing farther to the east - A

couple of winter storm systems will move through the northern and eastern Midwest and Atlantic Coast states as the cold air pools in the heart of the nation

- Precipitation

in the central and northwestern U.S. Plains will continue lighter than usual, although some snow will occur as colder air moves through the middle of the nation in brief waves beginning this weekend and continuing next week - This

includes hard red winter wheat areas as well as the drier biased northwestern Plains - Waves

of snow will impact these areas, although the amount of moisture in the snow will be low due to colder temperatures - The

Delta, lower eastern Midwest, Tennessee River Basin and middle Atlantic Coast states will be wetter biased in the coming two weeks as the pattern changes - South

Africa will continue to be impacted by periods of rain over the next two weeks support most of its crops in a highly favorable manner - Temperatures

will be seasonable - India

weather over the next couple of weeks will include some periodic rainfall in the far south, but the bulk of the nation’s winter crops will not be impacted by significant moisture - Weekend

precipitation occurred in a few areas from southern Rajasthan through western Madhya Pradesh to western and southern Maharashtra and in much of far southern India - Moisture

totals varied from 0.08 to 0.75 inch with a few totals of 1.00 to 2.00 inches near coastal areas - Last

week’s rain in northern India has likely improved winter crops from eastern Rajasthan and northern Uttar Pradesh into Punjab - Showers

during the weekend may have benefited a few winter crop areas, but the rain noted in far southern India was less welcome and may have continued to disrupt harvesting of sugarcane, late cotton and groundnuts - Australia

rainfall during the weekend was greatest along the central and upper Queensland coast where rainfall reached up close to 10.00 inches in a few spots while most of it varied from 1.00 to 3.50 inches - Southeastern

grain and cotton areas reported up to 1.10 inches – most of which occurred early in the weekend followed by drier biased conditions - Temperatures

were hot in Western Australia while mild to cool in the far eastern parts of the nation.

- Australia

summer grain and cotton areas will be mostly dry through Saturday - Rain

will develop in southeastern Queensland and northeastern New South Wales Sunday into Monday of next week offering some short term reprieve from this week’s drying - Precipitation

may be more limited for a while again next week - Temperatures

will be hotter in the central and western parts of the nation this week while more seasonable readings prevail in the east - Russia’s

Southern Region, Middle Volga River Basin and northwestern Kazakhstan began to receive precipitation during the weekend and this week will continue the trend

- Sufficient

snow cover is expected in time to protect winter crops from colder temperatures expected later this month - Cooling

is expected in Russia later this week into next week with some of the cold expected to be notable, but mostly in the north this week and it will push to the southwest staying mostly in western Russia next week - Europe

temperatures trended cooler during the weekend and the cooler bias will prevail this week, although no extreme cold is anticipated - Europe

precipitation will be erratic and should impact most of the continent this week, but it will be light – no flooding is expected - Very

little precipitation is expected this weekend and next week - A

boost in snow cover is needed to protect winter crops from bitter cold temperatures which may occur in bout ten days - China

weekend precipitation was quite limited temperatures were non-threatening - China

weather this week will be seasonably dry except for some light snow in the northeast and a few rain showers in the southwest - Temperatures

will be near normal this week and then slightly warmer biased during the weekend and next week - Rain

in Northern Africa during the weekend was greatest in north-central Morocco

- Rainfall

was greatest in north-central Morocco where amounts varied from 1.00 to nearly 4.00 inches - Rainfall

of 0.05 to 0.75 inch occurred elsewhere with amounts in southwestern Morocco’s drought region varying from 0.60 to 1.25 inches with the greater amounts along the coast - The

rain failed to be significant in the interior southwest where drought has been prevailing for more than two years - Northern

Africa will experience much less precipitation after today and during the coming week to ten days - Additional

rain is needed in southwestern Morocco as well as northwestern Algeria - Waves

of rain will impact the Philippines over the next week to ten days - Excessive

moisture is expected resulting in new flooding for parts of the nation especially in the east-central islands - Flooding

has already been an issue for the nation at times in recent months and additional damage to crops and property will be possible - Heavy

rain during the weekend occurred over Samar and southeastern Luzon where 4.00 to more than 13.00 inches resulted in some flooding - Frequent

rain in Indonesia and Malaysia will eventually result in some new flooding - Recent

flooding in Peninsular Malaysia has abated, but other areas in Indonesia and Malaysia are likely to become too wet over time with Sumatra and parts of northwestern Borneo wettest this week - Heavy

rain has occurred in interior northern Sumatra and in southern Kalimantan during the weekend with rainfall of 4.00 to more than 6.00 inches resulting - Mainland

areas of Southeast Asia will be dry over the next ten days except coastal areas of Vietnam where waves of rain are expected - More

than 2.00 inches of rain fell along the central Vietnam coast during the weekend - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +19.40 today and the index will begin falling this week - Mexico

and Central America weather will continue to generate erratic rainfall - Far

southern Mexico and portions of Central America will be most impacted by periodic moisture which is greater than usual at this time of year - Canada

Prairies will remain unseasonably warm this week before trending much colder late this week into next week in the east - Western

areas may continue warmer biased - Precipitation

will increase in the central and east this week as colder air arrives - Southeast

Canada will receive only light amounts of precipitation this week and temperatures will be warmer than usual - Cooling

is likely next week and precipitation may briefly increase

Source:

World Weather Inc. and FI

Source:

World Weather Inc. and FI

Monday,

Jan. 11:

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

winter wheat conditions, cotton harvested, 4pm - Malaysian

Palm Oil Board’s data on end-Dec. stockpiles, output and exports - MPOB’s

2021 economic review and palm oil outlook seminar - Malaysia’s

Jan 1-10 palm oil exports - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Japan

Tuesday,

Jan. 12:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, noon - USDA

quarterly soybean, sorghum, corn, barley stocks

Wednesday,

Jan. 13:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Vietnam

customs data on coffee, rice and rubber exports in December - FranceAgriMer

monthly crop report - ANZ

Commodity Price - Malaysia

Cocoa Board 4Q cocoa grind data - Conab’s

data on yield, area and output of corn and soybeans in Brazil

Thursday,

Jan. 14:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China

customs to publish 2020 trade data, including imports of soy, edible oils, meat and rubber - AB

Foods trading update - International

Grains Council monthly report - Port

of Rouen data on French grain exports - EARNINGS:

Suedzucker, Agrana

Friday,

Jan. 15:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 4Q 2020 cocoa grind data - Malaysia’s

Jan. 1-15 palm oil export data - New

Zealand Food Prices

Source:

Bloomberg and FI

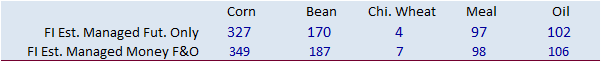

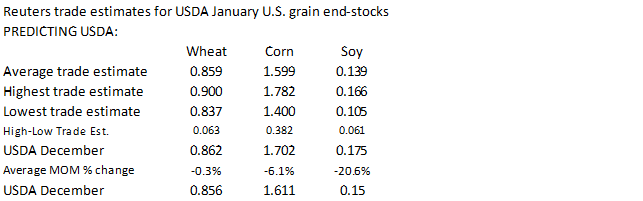

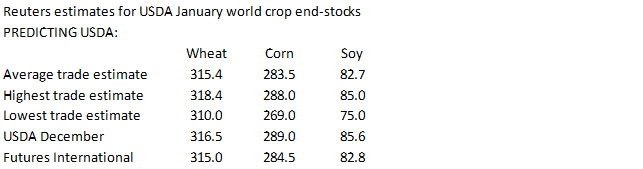

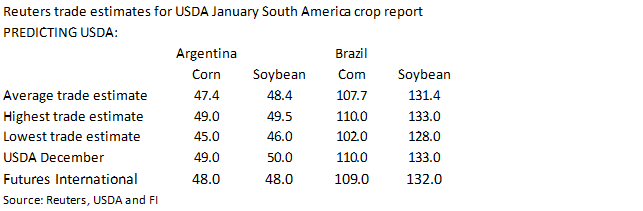

Reuters

trade estimates for USDA reports

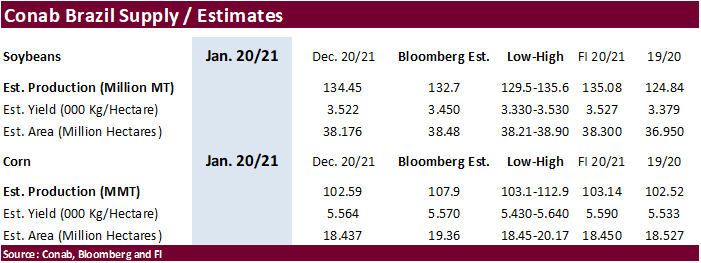

Conab

is due out Wed

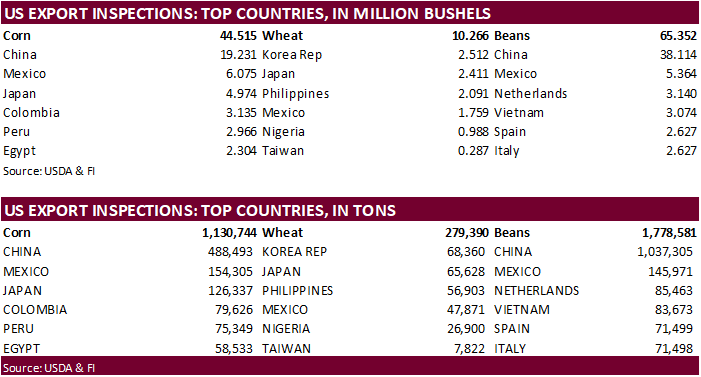

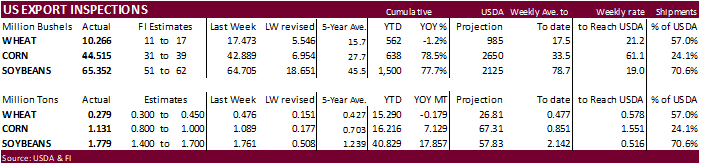

USDA

inspections versus Reuters trade range

Wheat

279,390 versus 250000-450000 range

Corn

1,130,744 versus 800000-1200000 range

Soybeans

1,778,581 versus 1000000-2000000 range

Includes

China as not previous reported in the 10:10 am email for inspections

Corn.

-

CBOT

corn

futures traded in a volatile range with March settling 4 cents lower on bear spreading. Argentina saw decent rain over the weekend and rain this week should stop crop conditions from deteriorating.

-

USDA

will be in focus on Tuesday. We remain bullish over the long run on tightening global supplies for feedgrains, wheat and oilseeds.

-

USDA

US corn export inspections as of January 07, 2021 were 1,130,744 tons, within a range of trade expectations, above 1,089,440 tons previous week and compares to 483,559 tons year ago. Major countries included China for 488,493 tons, Mexico for 154,305 tons,

and Japan for 126,337 tons. -

President

Trump may grant some biofuel blending waivers for 2019, according to sources. There are currently 32 pending petitions for 2019.

-

Argentina

lifted their suspension on current corn export registrations announced in late December by modifying it to a temporary 30,000 ton daily cap. They want to ensure domestic supply of old crop corn but in the meantime calm backlash by exporters and producers over

the original ban. -

Argentina

producers are still on strike that started early Monday. -

Today

was day 2 of the “Goldman Roll.” -

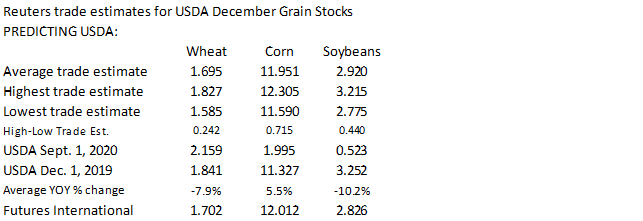

Funds

on Monday sold an estimated net 13,000 corn. -

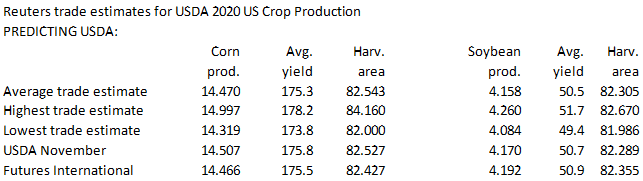

Traders

are looking for USDA to lower the 2020 US corn crop (14.470 Reuters estimate against USDA current 14.507 billion) and tighten US 2020-21 ending corn stocks to 1.599 billion from 1.702 billion. For December 1 US corn stocks, a Reuters trade guess stands at

11.951 billion bushels, up from 11.327 billion year earlier and if realized, a three year high.

Eyes

will also be on Argentina as USDA may trim the 2020-21 corn production estimate. About 65 percent of Argentina’s corn planted area is impacted by drought conditions. A Reuters trade guess looks for USDA to lower Argentina’s corn crop to 47.4 million tons

from 49 million current. Brazil corn production was estimated at 107.7 million tons from 110 million current.

-

China

corn and domestic non-GMO soybean Dalian futures reached contract higher on shortage concerns, while soybean meal futures are highest since 2014. Bloomberg noted China feed mills and refineries are building inventories before the Lunar New Year holidays, while

traders are hoarding corn on expectations for future price increases. In effort to boost domestic production of corn, China approved two genetically modified corn varieties from Bayer AG and Syngenta AG for imports. China’s Dalian Commodity Exchange will

raise the margin requirement on speculative trades in its corn futures to 11% from 9% after settlement on Wednesday. Hedging remains unchanged at 7%.

-

Hungary

reported an outbreak of H5N8 bird flu. -

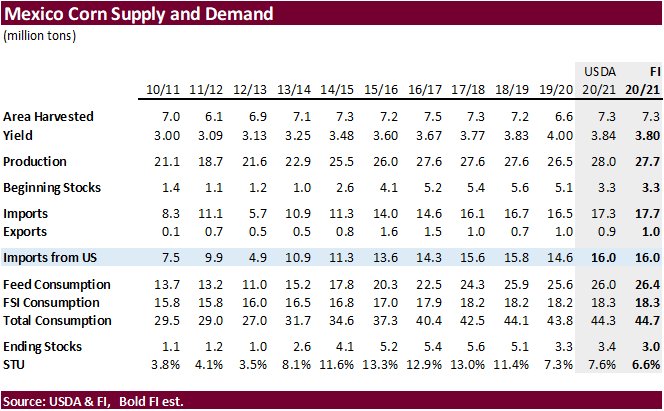

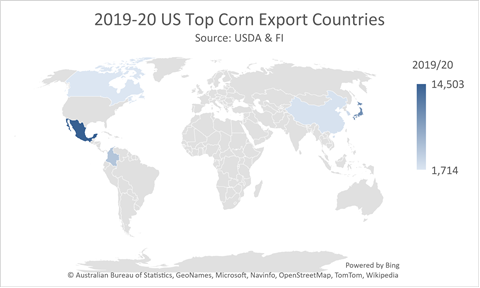

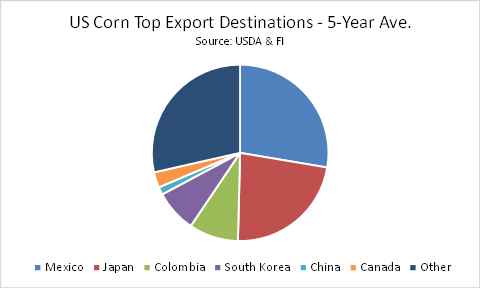

Update

on Mexico GMO import phase out announcement: A Bloomberg story that followed up on Mexico’s announcement they plan to phase out GMO corn imports over the next three years stated the government still has to decide whether it will, include corn for feed. Mexico’s

Agriculture department, Sagarpa, told Bloomberg that a meeting will take place later this week. Last week Mexico banned GMO corn and will aim to become self-sufficient in food production. “Mexico will revoke permits and stop issuing new ones for the release

of GMO corn seeds,” according to Bloomberg. Mexico also will phase out the use of glyphosate, a common herbicide used throughout the world. Mexico is the United States largest buyer of corn. In 2019-20, Mexico imported 14.5 million tons of corn out of 45.2

million tons total US exports (32 percent market share).

Corn

Export Developments

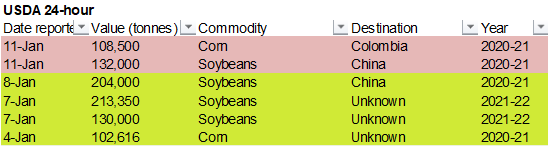

- Under

the 24-hour announcement system, private exporters sold 108,500 tons of corn to Colombia for 2020-21 delivery.

- Turkey

seeks 155,000 tons of corn on January 12 for Jan 25-Feb 15 shipment.

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12.

Updated

1/5/21

March

corn is seen

trading in a $4.50 and $5.25 range

-

CBOT

soybeans, which remain near a 6-1/2 year high, ended mostly lower on light bear spreading. Prices saw a volatile traded on positioning ahead of the USDA report, weekend rains across Argentina, and higher USD. China was a slow buyer of soybeans late last

week. They bought at least one US Gulf cargo for August shipment and one February shipment out of the PNW. -

USDA

US soybean export inspections as of January 07, 2021 were 1,778,581 tons, within a range of trade expectations, above 1,760,974 tons previous week and compares to 1,151,583 tons year ago. Major countries included China for 1,037,305 tons, Mexico for 145,971

tons, and Netherlands for 85,463 tons. -

The

US Supreme Court said on Friday they will review a lower court ruling (10th Circuit Court) that limits the government powers to exempt small refineries from RFS standards. The 10th Circuit Court made that ruling a year ago, and the Supreme

Court will review it in April. A reversal in that decision could benefit the biodiesel industry.

-

Funds

on Monday sold an estimated net 5,000 soybeans, bought 7,000 soybean meal and sold 7,000 soybean oil.

-

Last

we heard Il SBO basis was 125 over (dn 25 from previous week), East 150 over, West 100 over and Guld steady at 750 over. Argentina was about 720 over and Brazil 735 over.

-

Traders

are looking for USDA to lower the 2020 US soybean crop (4.158 Reuters estimate against USDA current 4.170 billion) and tighten US 2020-21 ending soybean stocks to 139 million bushels from 175 million current. For December 1 US soybean stocks, a Reuters trade

guess stands at 2.920 billion bushels, well down from 3.252 billion year earlier and if realized, a four year low.

-

A

Reuters trade guess looks for USDA to lower Argentina’s soybean crop to 48.4 million tons from 50 million current. Brazil soybean production was estimated at 131.4 million tons from 133 million current.

-

India’s

Soybean Processors Association of India left their soybean production estimate for 2020-21 unchanged at 10.46 million tons.

-

MPOB

sees 2021 Malaysian palm production at 19.7 million tons from 19.14 million tons produced in 2021. Average crude palm oil prices may rise to 3,000 ringgit/ton in 2021 from 2,685.50 ringgit in 2020. -

ITS

reported January 1-10 Malaysian palm exports at 260,080 tons, down from 402,880 during the same period in December. AmSpec reported palm exports at 271,789 tons, down 35% from 417,960 tons from the previous month.

-

Safras

– 57.7% of the 2020-21 Brazil soybean crop through Jan 8, up from 43.1% year ago and 38.6% average.

- Under

the 24-hour announcement system, private exporters sold 132,000 tons of soybeans to China for 2020-21 delivery.

- The

USDA bought 2,000 tons of package vegetable oil last week under the PL480 program for unknown destinations.

- USDA

seeks 6,390 tons of vegetable oil on January 20 under the PL480 program for March 1-31 shipment (Mar 16-Apr 15 for plants at ports).

-

The

USDA seeks 7,430 tons of vegetable oil under the PL480 program on January 14 for shipment during Feb 16 to Mar 15 (Mar 1-31 for plants at ports).

Updated

1/11/21

March

soybeans are seen in a $12.50 and $14.50 range

March

soymeal is seen in a $415 and $480 range

March

soybean oil is seen in a 42.00 and 45.50 cent range

-

US

wheat futures started the day session higher after a few import tender announcements were announced, but after a volatile session, ended lower on fund liquidation. Paris wheat ended higher in part to rumors Russia will increase their wheat planned export

tax quota from 25 euros to 50 euros. Turkey, Syria, South Korea and Bangladesh announced new import tenders. After the close Egypt announced they are in for wheat for Feb 18-Mar 5 shipment.

Egypt

recently said they have enough wheat to last 4.7 months. -

We

did not see an updated OK winter wheat crop rating at the time this was written.

- Lack

of fresh bullish news and slow US export developments may keep US wheat futures steady this week, like what we saw last week, unless USDA surprises the trade by reporting December 1 US wheat stocks out of the range of expectations.

- As

Polar Vortex Stirs, Deep Freeze Threatens U.S. and Europe https://www.bloomberg.com/amp/news/articles/2021-01-10/as-polar-vortex-stirs-a-deep-freeze-threatens-u-s-and-europe

-

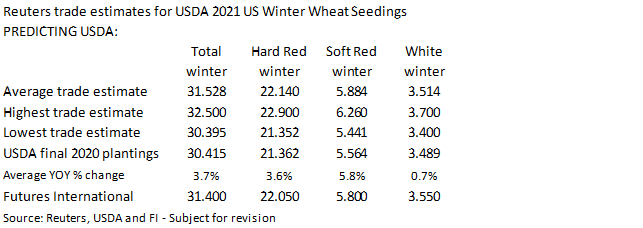

The

trade will also get a glimpse on the potential size of the 2021 US winter wheat crop when USDA reports winter wheat plantings.

A

Reuters trade guess put 2021 US winter wheat seedings at 31.528 million acres, up from 30.415 million planted during the 2020 campaign. Traders are looking for USDA to lower US all-wheat stocks by only 3 million bushels to 859 million from the previous month.

For December 1 US wheat stocks, a Reuters trade guess stands at 1.695 billion bushels, down from 1.841 billion year earlier.

- USDA

US all-wheat export inspections as of January 07, 2021 were 279,390 tons, within a range of trade expectations, below 475,524 tons previous week and compares to 561,774 tons year ago. Major countries included Korea Rep for 68,360 tons, Japan for 65,628 tons,

and Philippines for 56,903 tons. - Funds

on Monday sold an estimated net 4,000 Chicago wheat contracts. - EU

March milling wheat was up 1.25 at 218.00 euros. - Russia

is considering raising its wheat export tax from 25 euros ($30) per ton between Feb. 15 and June 30 – Russian Union of Grain Exporters. Some think it will go to 50 euros a ton.

-

Russian

12.5%

protein wheat

export prices from

Black Sea ports were $275 a ton FOB at the end of last week, up $13 from the end of 2020, according to IKAR.

-

For

the 2020-21 period, China offered little more than 78 million tons of wheat from reserves, selling 19.5 million tons to the domestic market. Last week China sold 2,099,199 tons of wheat, or 52.16 % of the total offered at an auction from state reserves, at

an average selling price of 2,365 yuan ($358.35) a ton.

-

South

Korea’s Kofmia seeks 25,560 tons of Canadian 13.5% wheat and 50,000 tons of US wheat on Tuesday for April loading.

-

Turkey

seeks 400,000 tons of milling wheat on Jan 19 for Jan through Feb 25 shipment. -

Pakistan

bought around 100,000 tons of optional origin wheat in recent days at about $306 per ton and $305 per ton, both C&F free out.

-

Syria

seeks 200,000 tons of wheat on Jan 18 for shipment within 60 days after contract signing.

- Results

awaited: Syria seeks 25,000 tons of Black Sea wheat on January 11. - Turkey

seeks 155,000 tons of feed barley on January 12. - Jordan

seeks 120,000 tons of wheat on January 13 for July-August shipment. - Bangladesh

seeks 50,000 tons of wheat in January 13 for shipment within 40 days of contract signing.

- Bangladesh

also seeks 50,000 tons of wheat in January 18 for shipment within 40 days of contract signing.

- (new

1/11) Bangladesh seeks 50,000 tons of wheat in January 25 for shipment within 40 days of contract signing.

·

South Korea seeks 113,555 tons of US, Thailand, and China rice on Han 21 for April 30 through July 31 arrival.

·

Bangladesh seeks 50,000 tons of rice on Jan. 24.

·

Bangladesh seeks 60,000 tons of rice on January 20.

·

Syria seeks 25,000 tons of rice on February 9.

Updated

1/6/21

March

Chicago wheat is seen in a $5.90‐$7.00 range (top up from $6.65)

March

KC wheat is seen in a $5.70‐$6.20 range

March

MN wheat is seen in a $5.75‐$6.15 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.