PDF Attached

![]()

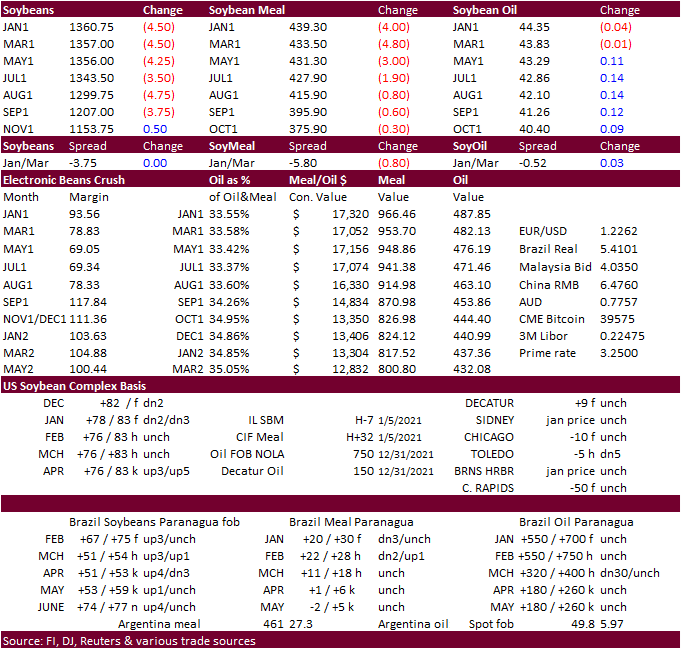

Attached are updated US soybean complex S&D’s, trade charts, and seasonal price charts.

FI changes as follows:

Soybeans

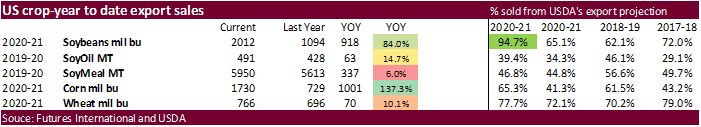

• Exports raised 5 million bushels to 2.320 billion

• Imports lowered 1 million to 22 million

Soybean Meal

• Exports raised 50,000 short tons

• Imports raised 50,000 short tons

Soybean Oil

• Exports lowered 50 million pounds to 2.800 billion

• Imports unchanged at 250 million pounds

World Weather Interests Of The Day

- China low temperatures slipped to the positive and negative single digits Fahrenheit in many wheat production areas from Shandong and Hebei to central and northern Shaanxi this morning in areas with little to no snow on the ground

- World Weather, Inc. is concerned that at least some winter crop damage has resulted, but it will not be assessable until spring when greening normally occurs and a complete understanding of the impact may not be possible until the harvest is complete

- Losses may not be tremendous because of sufficient crop hardening over the past week to ten days by cool conditions, but the lack of snow and abundant moisture in the crop’s leaf mass should have led to at least some negative impact

- India’s northern rain ended Wednesday and drier weather is expected in that region for the coming week

- Central India will receive some showers today and Friday and that, too, will be beneficial

- Rain at this time of year can improve crop development ahead of reproduction in late January and February bolstering production potentials

- Wheat has likely benefited most from the precipitation in northern India, but a few other crops have also benefited

- Rainfall in northern India in the past week varied from 0.27 to 1.69 inches except in Himachal Pradesh where much greater amounts resulted

- Far southern India has been a little too wet recently and additional moisture is expected

- The precipitation has been good for winter rice and some other winter crops, but not so good for late season harvesting of cotton, groundnuts and other crops

- The additional rain will slow sugarcane harvesting as well as the harvest of other late season crops

- Argentina rainfall Wednesday diminished greatly, but some lingering rain occurred in the far south and extreme northwest

- This week’s weather has improved crop and field conditions in portions of western and southern Argentina, but central and east-central crop areas have not seen much rain and may be the last to get rain in the coming ten days

- Rain is expected to impact many areas in Argentina over the next ten days with western and northern areas wettest

- The precipitation will be most significant next week and there will be at least some rain in the driest areas, but most likely the amount of rain that occurs in southern Santa Fe, Entre Rios and northern Buenos Aires will not be enough to fully restore soil moisture which will raise the potential for greater crop stress a little later in January when drier and warmer weather returns

- The moisture next week in northern and west-central Argentina will be sufficient to maintain or possibly improve crop and field conditions with Cordoba, Santiago del Estero, Chaco, northern Santa Fe, Formosa and a part of Corrientes wettest

- Argentina’s potential for drier and warmer weather in the last ten days of January are moderately high which will stress those crop areas that receive the lightest rainfall next week and into the following weekend

- That warrants a very close watch on the rain distribution during the next ten days

- Brazil rainfall has been sporadic and light at times this week

- Net drying has occurred in many areas, but good soil moisture is still present supporting crop needs

- A boost in precipitation will occur in Brazil grain, oilseed and cotton areas during the weekend and next week that should replenish soil moisture and improve crop conditions

- There is some concern for light rainfall in southern Brazil from Parana into Rio Grande do Sul which would be typical of La Nina

- These areas will not be totally dry, but rain amounts may be a little lighter than desired to sustain the best crop conditions for more than ten days warranting some increase in rainfall soon thereafter

- Rio Grande do Sul is already beginning to dry down and even though some rain will fall in the state next week there will be a higher demand for moisture soon to prevent plant moisture stresses from becoming significant

- Rainfall relative to normal in Mato Grosso and Tocantins may be below average during the coming two weeks, but totally dry weather is not likely

- The lighter than usual rainfall is expected to make the timing of rain far more important in supporting the best yields than usual

- There is no reason to expect crop failings, but greater rainfall will be needed to protect production potentials and induce the best yield potentials

- Morocco will receive waves of rain over the coming week bolstering soil moisture for improved wheat and barley establishment

- This is the beginning of the third year of drought in southwestern Morocco making the coming week of rain extremely important and welcome

- Some rain began in a part of the nation Tuesday and Wednesday, but amounts were light in the southwest

- Northwestern Algeria has also been drier biased this season and some rain will fall there as well

- Most of the Mediterranean Sea region of southern Europe will receive frequent rainfall resulting in greater soil moisture, but also inducing some potential for flooding

- Rainfall will be greatest in eastern Spain, Italy, the eastern Adriatic Sea nations and from parts of Greece and Bulgaria to Russia’s Southern Region

- Waves of rain and snow will impact Russia’s Southern Region through the next ten days resulting in a welcome boost to soil moisture in areas that have no frost in the ground

- Snow will pile up on top of the ground in areas where temperatures are coldest, but the snow will melt during the warmer days and weeks ahead in late winter and early spring to improve soil conditions for better winter crop establishment

- Waves of rain will impact the Philippines starting late this week and lasting a full week

- Excessive moisture is expected resulting in new flooding for parts of the nation especially in the east-central islands

- Flooding has already been an issue for the nation at times in recent months and additional damage to crops and property will be possible

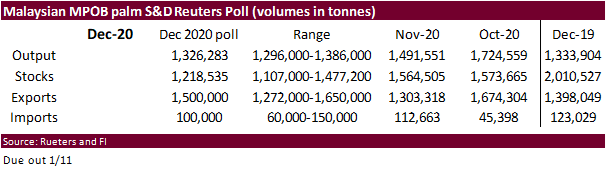

- Frequent rain in Indonesia and Malaysia will eventually result in some new flooding

- Recent flooding in Peninsular Malaysia caused damage to crops and personal property, although that situation will improve before new excessive rain and flooding impacts a part of the region in the coming week to ten days

- Other areas in Indonesia and Malaysia are likely to become too wet over time with Java and northern Borneo as well as peninsular Malaysia impacted from time to time.

- Mainland areas of Southeast Asia will be dry over the next ten days except coastal areas of Vietnam where waves of rain are expected

- East-central Australia received additional showers Wednesday impacting northeastern New South Wales and southeastern Queensland

- Rainfall varied from 0.10 to 0.68 inch with a few local totals over 1.00 inch

- As much as 4.39 inches occurred in far southeastern Queensland near the Pacific Coast

- Much needed drier weather occurred in the Cape York Peninsula and around the Townsville area where copious rainfall has occurred in the past week

- East-central Australia will receive additional showers and thunderstorms into Friday and then net drying is expected for a while in key grain and cotton production areas

- Another 0.50 to 2.50 inches of rain and locally more will occur by Saturday morning in southeastern Queensland

- Not much other precipitation is expected there or in New South Wales for a full week

- Southern parts of the Cape York Peninsula and the upper Queensland, Australia coast will experience a return of frequent rain through the next ten days resulting in more flooding

- The area near Townsville, Queensland has received excessive rainfall in the past week and will be getting much more resulting in damage for sugarcane and some other agriculture

- South Africa will receive frequent showers and thunderstorms over the next ten days bringing rain to most summer crop areas and ensuring aggressive crop development

- Western areas may be wettest for a while

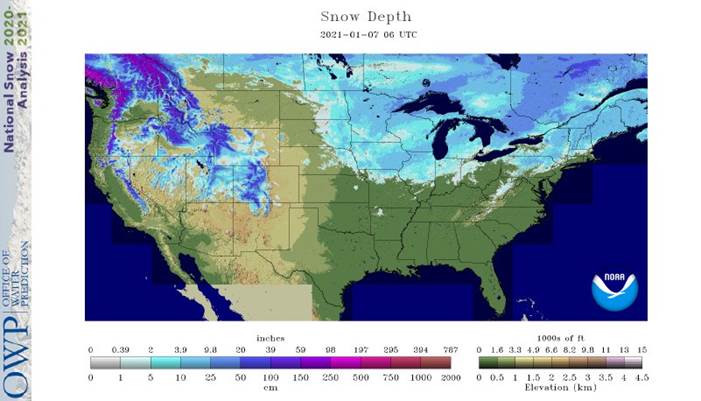

- U.S. weather Wednesday brought rain and snow to the middle Missouri River Valley and then a more generalized area of rain in parts of eastern Texas and the western and lower parts of the Delta.

- Some rain and mountain snow also continued in the Pacific Northwest

- U.S. weather changes were minor overnight

- Rain will move from the Delta through the southeastern states today and Friday with 0.30 to 1.00 inch of moisture and local totals to 1.50 inches

- Rain and snow are still expected in the southwestern U.S. Plains this weekend with moisture totals of 0.15 to 0.60 inch and locally more

- Several inches of snow will impact the Texas Panhandle, eastern New Mexico, West Texas cotton areas and southeastern Colorado

- Rain from the southwestern Plains rain and snow event will push through the lower Delta to the southeastern states early next week

- Waves of rain and mountain snow will continue in the U.S. Pacific Northwest in this coming week

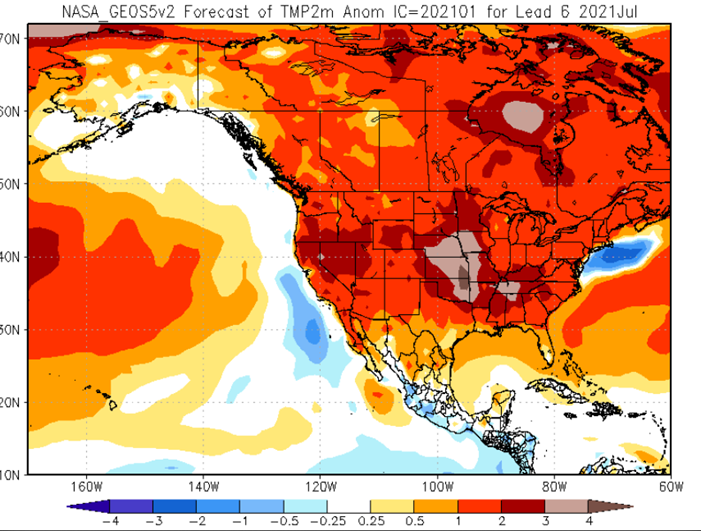

- Cold air surging southward from Canada late next week into the following weekend will bring snow with it across the northern Plains and Midwest

- Follow up cold surges are expected during the second week of the U.S. outlook bringing temperatures below normal in the north-central parts of the United States and across Canada’s Prairies

- Cooling will occur in the lower Midwest and Atlantic Coast States, too, but no excessive cold will occur in those areas

- Waves of snow will accompany the shots of cold air during the January 14-20 period with a larger storm eventually expected along the middle and north Atlantic Coast States

- West Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days

- East-central Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days

- Southern Oscillation Index remains very strong during the weekend and was at +19.23 today which is the highest this index has been in the current La Nina episode

- Mexico and Central America weather will continue to generate erratic rainfall

- Far southern Mexico and portions of Central America will be most impacted by periodic moisture

- Canada Prairies will remain unseasonably warm through mid-week next week and then much colder in the following week.

- Southeast Canada will receive less than usual precipitation this week and temperatures will continue a little warmer than usual

Source: World Weather Inc. and FI

Thursday, Jan. 7:

- FAO World Food Price Index

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- Port of Rouen data on French grain exports

- HOLIDAY: Russia, Ghana, Egypt

Friday, Jan. 8:

- ICE Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- Trading of China’s hog futures to begin on Dalian Commodity Exchange

- HOLIDAY: Russia

Source: Bloomberg and FI

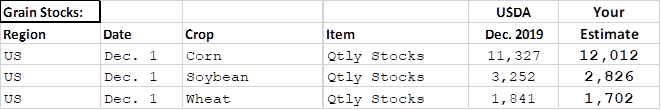

FI Estimates for USDA Grain Stocks

Macros

US Initial Jobless Claims Jan 2: 787K (est 800K; prevR 790K; prev 787K)

US Continuing Claims Dec 26: 5072K (est 5200K; prevR 5198K; prev 5219K)

US Trade Balance (USD) Nov: -68.1B (est -67.3B; prevR -63.1B)

US ISM Non-Mfg PMI Dec: 57.2 (est 54.6; prev 55.9)

– Business Activity Dec: 59.4 (est 55.0; prev 58.0)

– Employment Index Dec: 48.2 (est ; prev 51.5)

– New Orders Index Dec: 58.5 (est ; prev 57.2)

– Prices Paid Dec: 54.8 (prev 66.1)

Corn.

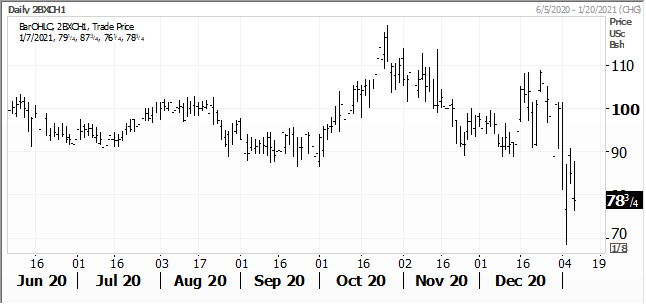

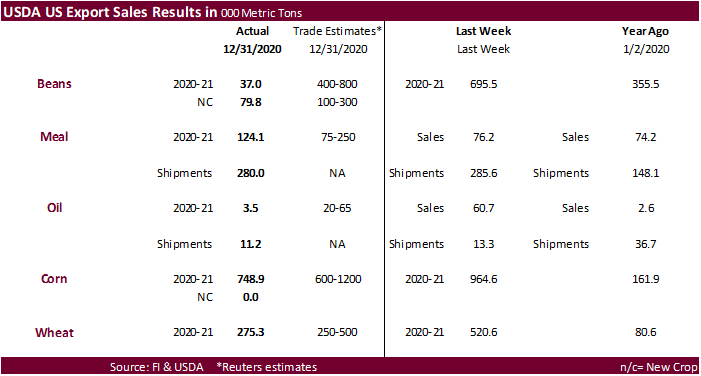

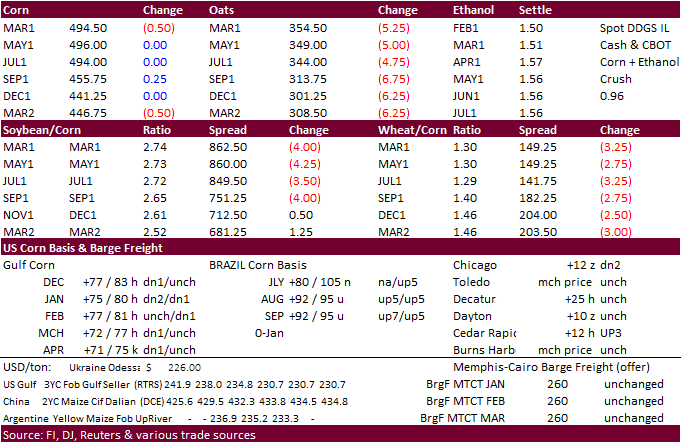

- CBOT corn futures closed slightly lower on profit-taking and technical selling following yesterday’s breach of $5.00/bu. The firm USD and corn export sales that came in the lower end of trade expectations also weighted on the market.

- The annual index rebalancing will start soon with the bulk of the trading taking place from January 8-14. With open interest so high, we see little impact on prices. This year it appears index funds will be clawing back on agriculture commodities led by corn. Meanwhile, with the USD declining as much as it has, and the new Biden Administration ability to issue more stimulus, we still look for investors looking to hedge against inflation to buy into commodities during first half 2021.

- On Thursday, funds sold an estimated net 6,000 contracts.

- Senegal reported an outbreak of the highly pathogenic H5N1 bird flu on a poultry farm, east of the capital Dakar, killing 58,000 birds.

- Hungary plans to cull 90,000 turkeys amid bird flu.

- Argentine Farmers and Government are getting close to a deal to lift the corn export tax. Details still forthcoming.

Corn Export Developments

- Turkey seeks 155,000 tons of corn on January 12 for Jan 25-Feb 15 shipment.

- Qatar seeks 100,000 tons of bulk barley on January 12.

- Qatar seeks 640,000 cartons of corn oil on January 12.

Updated 1/5/20

March corn is seen trading in a $4.50 and $5.25 range

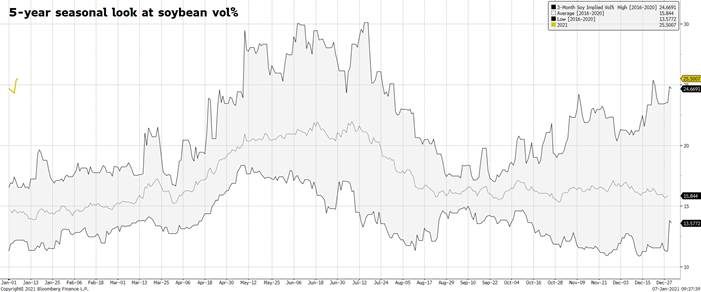

- CBOT soybeans were lower on profit-taking coupled with very poor USDA export sales and a higher USD. Soybean shipments were reported below 2 million tons at 1.857 million. Inspections suggested they should have been lower. Census reported November trade data and soybean exports came in 8 million bushels above our expectations at 408 million, below 420 million in October and compares to 98 million during November 2019. See attached table after the comment.

- In Argentina, grain inspectors and tugboat operators ending prolonged strikes

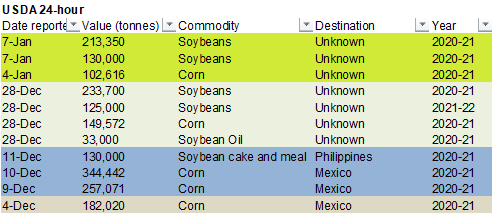

- Under the USDA 24-hour reporting system, private exporters sold over 340,000 tons of soybeans to unknown, some received.

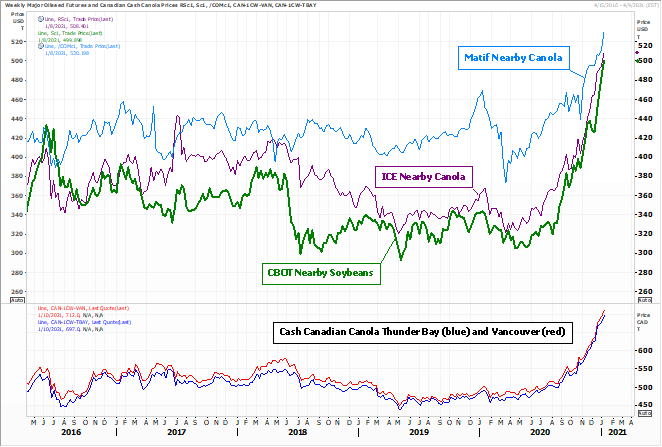

- China reportedly bought around 150,000 tons of European rapeseed oil earlier this week for JFM and is looking for offers out through June. Some think this is an indication China could lighten up on oilseed crushings. We still look for 2021 soybean imports to end up at or above 102 million tons.

- On Thursday, funds sold an estimated 12,000 soybean contracts, 6,000 soybean meal and 2,000 soybean oil lots.

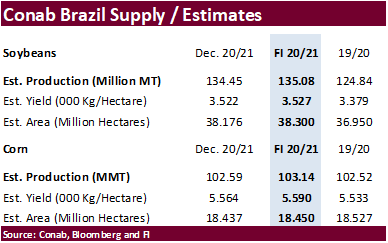

- Brazil saw needed moisture, unlike Argentina, which has some analysts looking for a near record crop again.

- USDA’s FAS lowered its 2019/20 soybean export forecast by 300,000 tons to 81.7 million tons

Oilseeds Export Developments

- 24-hour USDA sales: Private exporters reported to the U.S. Department of Agriculture the following activity:

- Export sales of 213,350 metric tons of soybeans received during the reporting period for delivery to unknown destinations during the 2020/2021 marketing year; and

- Export sales of 130,000 metric tons of soybeans for delivery to unknown destinations during the 2021/2022 marketing year.

March CBOT Crush

Source: Reuters and FI

Selected oilseed prices

Source: Reuters and FI

Updated 1/05/20

March $12.50 and $14.50 range

March $415 and $480 range

March is expected to trade in a 42.50 and 46.00 cent range

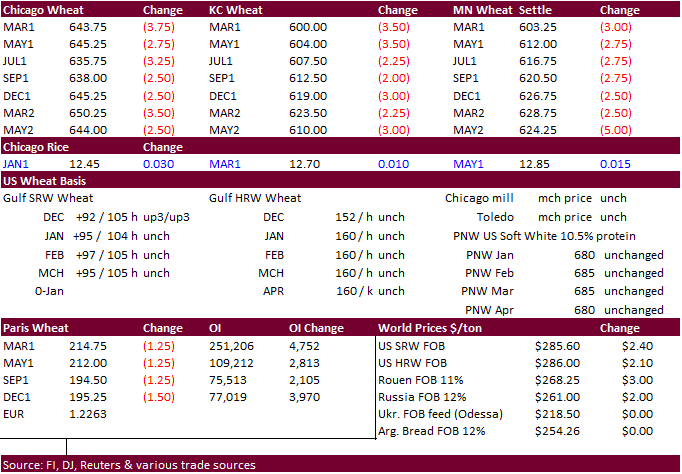

- US wheat futures were lower again on profit-taking following Tuesday’s six-year high. USDA reported export sales at a low 275,300 tons. We see wheat prices appreciating only if the rally in corn and soybeans continues, otherwise the trade will want to see an improvement in US exports before getting back behind the market.

- US weather is still an issue with below average late fall/early winter precipitation for the US Great Plains although Nebraska winter wheat crop ratings did improve from late November. Look for Texas and Oklahoma to update winter wheat crop ratings on Monday. They were not released this past Monday afternoon.

- On Thursday funds sold an estimated net 6,000 Chicago SRW wheat contracts.

- Argentina’s Buenos Aires Grains Exchange estimated the wheat 17 million tons, up 200,000 tons above their previous estimate. USDA is at 18 million.

- French soft wheat exports outside the European Union in December fell to 797,000 tons in December, below the 877,000 tons in November.

- EU March milling wheat was down 1.50 at 214.75 euros.

- Jordan seeks 120,000 tons of wheat on January 13 for July-August shipment.

- Japan this week seeks 120,228 tons of food wheat from the United States, Canada and Australia in a regular tender.

- Turkey seeks 155,000 tons of feed barley on January 12.

- Ethiopia canceled an import tender for 600,000 tons of wheat that was set to close back on November.

- Bangladesh seeks 50,000 tons of wheat in January 13 for shipment within 40 days of contract signing.

- Bangladesh also seeks 50,000 tons of wheat in January 18 for shipment within 40 days of contract signing.

· ICE cotton futures rallied gain on expectations for USDA to lower US carryout stocks.

· Syria seeks 25,000 tons of rice on February 9.

· Bangladesh seeks 60,000 tons of rice on January 20.

Updated 1/6/20

March Chicago wheat is seen in a $5.90‐$7.00 range (top up from $6.65)

March KC wheat is seen in a $5.70‐$6.20 range

March MN wheat is seen in a $5.75‐$6.15 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.