PDF Attached

Trade

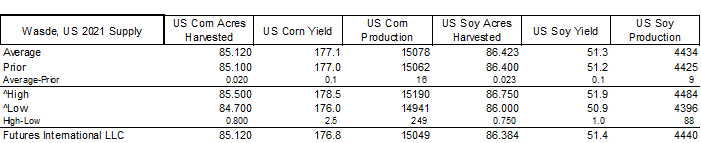

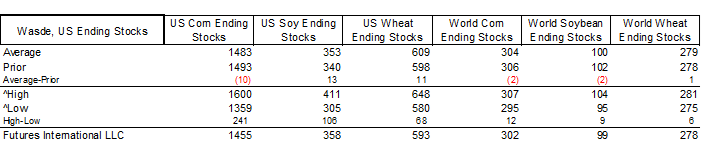

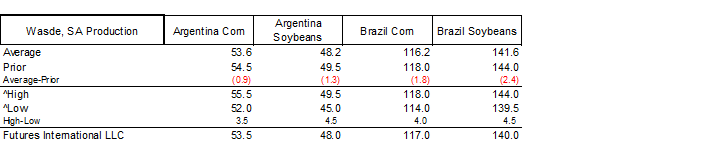

estimates for USDA January reports are starting flow out. Bloomberg estimates can be found in the comment above the corn section. We don’t agree with US soybean stocks average for the US. US corn ending stocks suggest USDA will upward revise demand. SA production

estimates for corn and soybeans are heavier than expected.

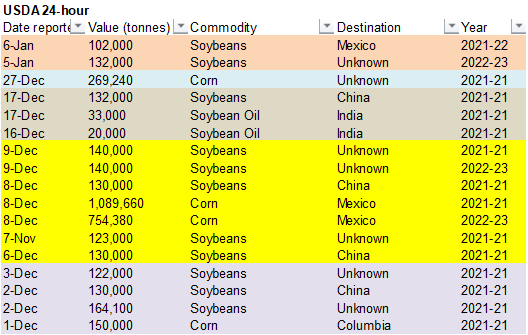

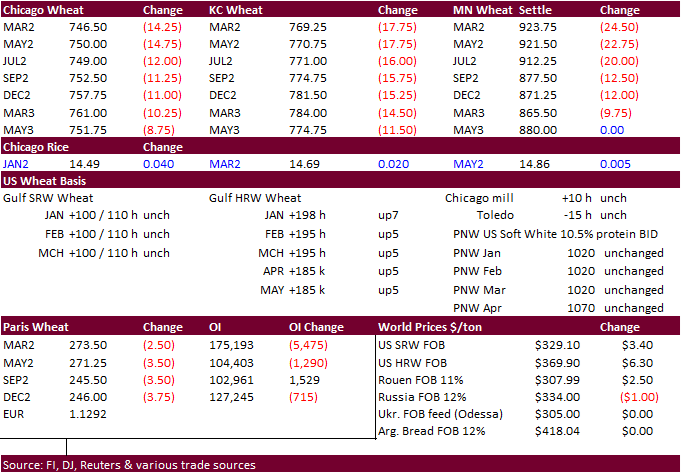

Lower

trade in the soybean complex and sharply lower wheat. Corn closed higher in the front months in part to unwinding of spreads. Outside markets, omitting energy, kicked off the selling. Under the 24-hour announcement system, private exporters reported 102,000

tons of soybeans were sold to Mexico for the 2021-22 marketing year. USDA Export Sales were poor all around, but it was a holiday week. Marketing year lows were posted for soybeans, soybean meal, soybean oil, wheat, and beef.

![]()

Weather

WEATHER

EVENTS AND FEATURES TO WATCH

- Crop

conditions in Argentina are deteriorating a little every day that goes by without rain - Topsoil

moisture is rated very short in much of the nation with those areas getting rain most recently having “short” topsoil moisture - Temperatures

Wednesday were more seasonable, but the weather was dry - Temperatures

this weekend through all of next week will be in the range of 95 to 110 degrees Fahrenheit and extremes of 110 to 115 cannot be ruled out for some of the driest areas in the north - Subsoil

moisture is also becoming depleted in many crop areas in the central and north making the situation critically dry already and the longest stretch of hot, dry, weather has not begun yet - Subsoil

moisture in southern Cordoba, northeastern La Pampa, southeastern San Luis and areas southeast to central Buenos Aires has been good in recent weeks supporting crops while rainfall has been restricted, but the subsoil moisture in this region is now marginally

adequate to short and another ten days of dry and warm to hot weather will deplete that inducing more serious stress in this more important summer crop region - The

market has been more focused on day 10-15 weather than the next ten days and some of Argentina’s poor weather has already been factored into market trade, but World Weather, Inc. is concerned that some of the trade may be missing the fact that some crops could

fail during this period of time - The

most recently planted crops will run the highest risk of failure without rain and with temperatures excessively hot - Week

two weather in Argentina, Jan. 15-19, will offer some scattered showers and thunderstorms, but it is unclear today how significant that rain may or may not be - The

GFS model may be generating too much rain and confidence is low about the amounts, but moderately high that some rain will fall - Temperatures

may also trend a little less hot during that period of time - Southern

Brazil weather is advertised a little drier today than yesterday suggesting less relief from dryness in western Parana and southern Mato Grosso do Sul as well as Paraguay

- Rio

Grande do Sul gets little to no rain during the next ten days suggesting it will experience the greatest potential decline in crop development if the forecast is correct - Less

rain in southwestern Brazil relative to previous days should raise a flag of caution since the region could become drier biased again threatening late season crops after recent relief from dryness - Northern

Brazil rainfall should continue frequent and abundant from Minas Gerais into Tocantins and eastern Mato Grosso during the next week to ten days - The

wet bias will maintain concerns over crop quality, although daily rain amounts are not likely to be great enough to cause any “epic-like” flood event, but concern about local flooding should continue - Less

frequent and less significant rain should evolve in northern crop areas late next week into the following weekend, although showers and thunderstorms will continue periodically with a little more sunshine intermixing - Paraguay

is unlikely to get nearly as much rain as neighboring areas of Brazil may get and crop stress in the nation will remain serious – like that of Argentina - Brazil

weather Wednesday and early today included rain in Mato Grosso and from Goias into western and southern Minas Gerais and northeastern Sao Paulo - Locally

heavy rainfall was reported in west-central Minas Gerais, although it has not been verified yet - Most

of the rain totals varied from 0.20 to 1.50 inches except in central Mato Grosso where 2.68 inches resulted - Very

little rain fell elsewhere including the most of the south where afternoon temperatures were in the upper 80s through the lower 90s Fahrenheit - U.S.

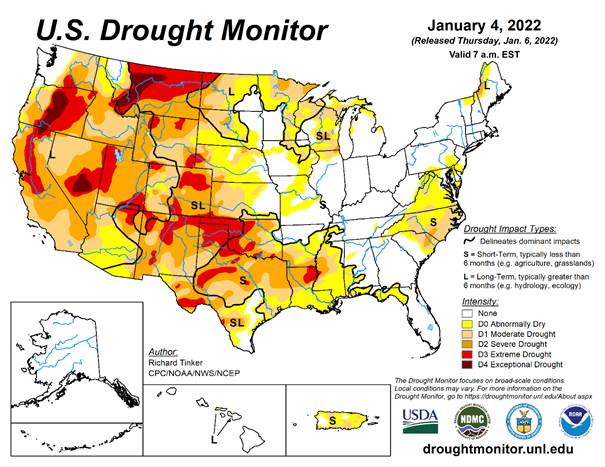

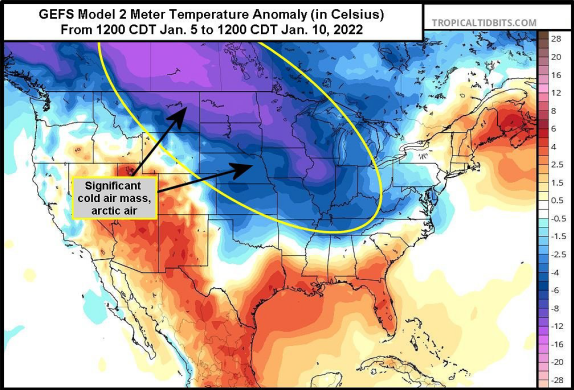

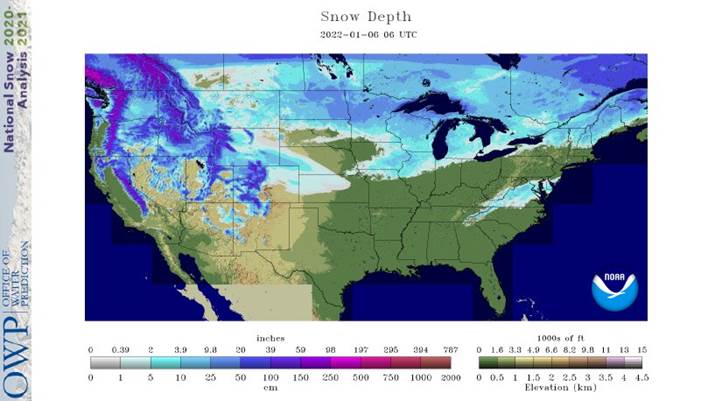

weather was relatively tranquil Wednesday, but snow and blowing snow did impact the upper Midwest as the next surge of bitter cold air arrived on strong northerly winds - Some

snow also fell in the central Plains to protect winter crops against colder temperatures the next two days - Some

rain and mountain snow continued in the Pacific Northwest with the next two days bringing some strong wind speeds and heavier precipitation

- Southwestern

British Columbia and the Puget Sound ports could be impacted by the adverse weather the next few days - Limited

snow cover in parts of South Dakota this morning may have left winter wheat unprotected from low temperatures in the negative teens - Some

winterkill may have impacted the state’s winter crops in the past couple of weeks, although the loss may not have a big impact on national production - Some

concern over possible winterkill also exists in the lower Midwest where low temperatures Friday morning will slip near or slightly below zero Fahrenheit from parts of Missouri to Indiana - Most

of the temperatures in this region will not be low enough for permanent crop damage, but the lack of snow cover in the region will leave crops at least vulnerable to damage if conditions get unexpectedly cold - A

weak nor’easter will bring light to locally moderate snow up the middle and northern U.S. Atlantic Coast today into Friday resulting in 3 to 8 inches of accumulating snow - U.S.

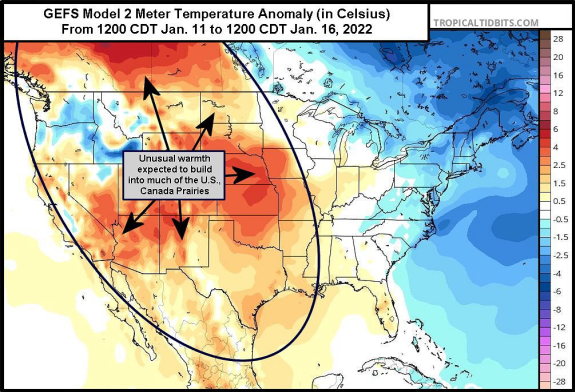

temperatures will turn warmer next week after this first week’s readings are quite cool in the central and eastern states for a few days - West

and South Texas precipitation should be restricted over the next ten days to two weeks - Today’s

GFS model forecast is wetter in the southern Plains for mid- to late-week next week - The

disturbance may verify, but more so for the southeastern Plains and not in the drought areas of the western high Plains - Not

much rain will fall in California’s central valleys for a while and the heavy snow in the Sierra Nevada is over for a while - Heavy

rain, flooding and strong wind will impact the U.S. Pacific Northwest and British Columbia coasts today into Friday impacting shipping in the region - The

adverse conditions may be greatest later today into Friday - Some

flooding is possible - Not

much precipitation will impact the heart of the U.S. hard red winter wheat areas during the next two weeks, although a few brief bouts of snow and a little rain might occur, but moisture content in the precipitation will not change drought status - Today

Thursday will be the best chance of moisture in central and southern areas, but resulting amounts will not be great enough to change drought status - The

southwestern Plains will stay dry during much of the next ten days to two weeks maintaining drought status - Today’s

GFS model runs are trying to bring significant moisture to the southern Plains Wednesday into Friday of next week, but only southeastern wheat areas will be impacted - U.S.

Delta and interior parts of the southeastern U.S. along with most of the central and eastern Midwest will remain plenty moist over the next two weeks - Drying

is needed near and south of the Ohio River into the Tennessee River Basin and northern Delta - Canada’s

Prairies will receive waves of snow during the next two weeks with southern and eastern areas getting the greatest amounts - East-central

and southern Alberta and west-central and southwestern Saskatchewan are still in a serious drought and the snowfall in those areas will be light and provide very little relief when it melts - Temperatures

will trend much warmer next week - Northern,

central and eastern India will receive waves of rain over the next seven days that will moisten the topsoil and help support crop development ahead of reproduction - Wheat,

millet, rapeseed and some pulse crops will be among the beneficiaries of the precipitation

- Some

rain has already impacted northern India over the past couple of days - Southern

India will be relatively dry, although significant rain fell along the lower east coast during the weekend - Europe

weather has been and should continue to be good for dormant winter crops - Concern

about dryness in Spain may continue for a while, but soil moisture and snow cover should be sufficient for crops elsewhere over the next ten days - North

Africa precipitation will increase during mid- to late week this week in north-central and northeastern Algeria and northern Tunisia, but precipitation in Morocco will be quite limited - Southwestern

Morocco continues to be a notable multi-year drought and dryness is also a concern in northwestern Algeria - Crops

elsewhere are doing relatively well - Warmer

temperatures in parts of Ukraine and Russia’s Southern Region recently induced a little rain while snow fell frequently to the north - Snow

cover has been receding from eastern Europe, Ukraine and Russia’s Southern Region, but there is no threatening cold coming anytime soon - Cooling

next week and into the following weekend will reverse the trend putting back some of the snow lost - No

threatening cold weather is expected anytime soon in Europe or the western CIS - Snow

cover will remain widespread across much of Russia and the northernmost part of Ukraine as well as some areas in eastern Europe - Winter

crops are in good conditions no change is expected - China’s

weather will continue mostly uneventful for a while, although periods of rain and a little snow will impact the Yangtze River Basin during the next couple of weeks.

- The

moisture will preserve the integrity of the 2022 rapeseed and southern wheat crops - Snow

will fall periodically in the far northeast while the Yellow River Basin and southern coastal provinces receive little to no precipitation - Temperatures

will be near to slightly warmer than usual - Southeast

Asia oil palm, citrus, sugarcane, coffee, cocoa, rice and other crop areas of Indonesia, Malaysia and Philippines will receive frequent bouts of rain over the next two weeks - Some

heavy rain is possible, but no serious widespread flood problem is expected - Local

flooding will be possible, though - Mainland

areas of Southeast Asia will be mostly dry during the next ten days except Vietnam coastal areas where some moderate to heavy rain will be possible late this week and into the weekend - Australia

weather outlook has not changed much - Thunderstorms

are expected in central and eastern parts of New South Wales and a few interior southeastern Queensland locations into Friday with other showers occurring periodically over the next ten days - Rainfall

will be greatest along the western slopes of the Great Dividing Range in New South Wales - The

precipitation may continue next week as scattered showers and thunderstorms that will benefit summer crops in both Queensland and New South Wales, although the rain in Queensland will be most restricted - Southeastern

Australia will be wettest including southeastern crop areas of New South Wales and central through eastern crop areas of Victoria - Temperatures

will be near to above normal - Late

season winter crop harvesting in southern Australia should not be seriously impacted by rain since most of the crop has been harvested

- South

Africa will experience a good mix of rain and sunshine during the next two weeks - The

long term summer outlook remains favorable - Western

summer crop areas have the greatest need for rain and they should get at least some periodically - Temperatures

will be seasonable - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - East-central

Africa will be erratic, but it is expected daily through the next ten days supporting coffee, cocoa, rice sugarcane and other crops - Middle

East precipitation is expected to be erratically distributed over the next couple of weeks, but improved soil moisture is likely - Winter

crops will benefit from whatever rain falls, but it is not expected to be evenly distributed for a while - Mexico

weather will trend wetter in far southern and some extreme eastern crop areas during the coming week - Some

showers may evolve in north-central areas Jan. 12-13 - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica during the next ten days - A

few showers will occur in Guatemala periodically as well, although rainfall will be light - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillation Index was +11.13 and it was expected to drift lower for a while this week - New

Zealand rainfall is expected to continue getting less than usual precipitation this week with temperatures near to above normal

Source:

World Weather, inc.

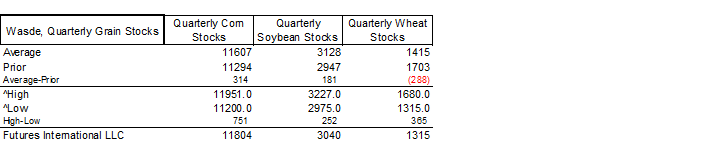

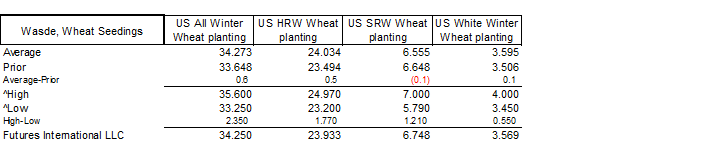

Bloomberg

Trade Estimates for the January USDA crop/stocks reports.

Thursday,

Jan. 6:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia

Friday,

Jan. 7:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Russia

Monday,

Jan. 10:

- USDA

export inspections – corn, soybeans, wheat, 11am - Malaysian

Palm Oil Board’s data for December output, exports and stockpiles - Malaysia’s

Jan. 1-10 palm oil exports - Ivory

Coast cocoa arrivals - HOLIDAY:

Japan

Tuesday,

Jan. 11:

- EU

weekly grain, oilseed import and export data - Brazil’s

Conab releases data on area, yield and output of corn and soybeans

Wednesday,

Jan. 12:

- China

farm ministry’s CASDE outlook report - USDA’s

monthly World Agricultural Supply and Demand Estimates (WASDE) report, noon - USDA’s

NASS 2021 summary of crop acreages and yields, noon - USDA’s

quarterly stockpiles data for commodities, including wheat, barley, corn, soybeans and sorghum, noon - EIA

weekly U.S. ethanol inventories, production - USDA’s

Farm Service Agency issues 2021 crop size data gathered from producers, 1pm - New

Zealand Commodity Price

Thursday,

Jan. 13:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Suedzucker

quarterly earnings - Agrana

nine- month earnings - International

Grains Council monthly report - Port

of Rouen data on French grain exports

Friday,

Jan. 14:

- China’s

December trade data - ICE

Futures Europe weekly commitments of traders report, ~1:30pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

Source:

Bloomberg and FI

USDA

Export Sales

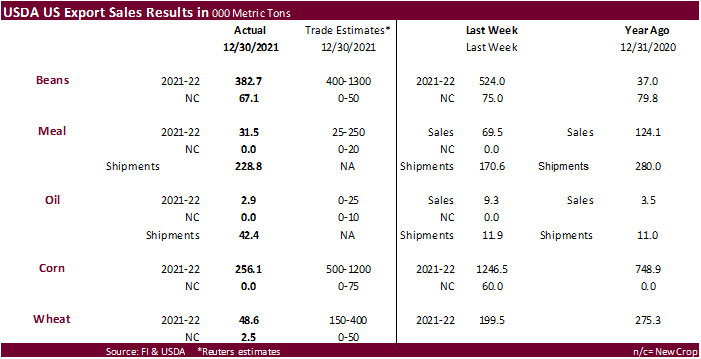

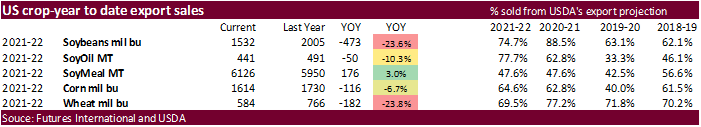

Poor

all around. Marketing year lows were posted for soybeans, soybean meal, soybean oil, wheat, and beef.

Export

sales for soybeans were below expectations at 382,700 tons for 2021-22 and a marketing-year low. Increases were primarily for China (353,900 MT, including 264,000 MT switched from unknown destinations and decreases of 3,700 MT), Mexico(183,900 MT, including

decreases of 200 MT), Spain (141,100 MT, including132,000 MT switched from unknown destinations), the Netherlands (68,800 MT, including 60,000 MT switched from unknown destinations), and Germany (64,900MT), were offset by reductions primarily for unknown

destinations (625,200MT). New-crop soybean sales were 67,100 MT for unknown destinations (66,000 MT) and Japan (1,100 MT). Soybean meal sales were a poor 31,500 tons, also a marketing year low and shipments were ok at 228,800 tons. Soybean oil sales of 2,900

tons, a marketing year low were for Guatemala and El Salvador.

Corn

exports sales were only 256,100 MT, down 80 percent from the previous week and 81 percent from the prior 4-week average. There were a number of country adjustments and increases primarily included Canada (150,500 MT), Mexico (115,100 MT), Colombia (90,500

MT, and Japan (81,500 MT). Sorghum sales of 22,800 MT for 2021/2022 were down 88 percent from the previous week and 93 percent from the prior 4-week average. China took all 22,800 tons. Net pork sales of19,400 MT for 2021 were up noticeably from the previous

week, but down 6percent from the prior 4-week average. Beef sales posted a net reduction of 3,900 tons (a marketing year low). All-wheat sales of 48,600 tons for 2021-22 were a marketing-year low.

IHS

Markit estimated the following, in million tons

Brazil

soybeans 142, down 3 from previous (USDA @ 144.0)

Argentina

soybeans 45, down 4.5 from previous (USDA @ 49.5)

Paraguay

soybeans 8.5, down 1.5 from previous (USDA @ 10.0)

Brazil

corn 117.8, down 2 from previous (USDA @ 118.0)

Argentina

corn 50, down 4.5 from previous (USDA @ 54.5)

Macros

US

Initial Jobless Claims Jan 1: 207K (est 195K; prev 198K; prevR 200K)

–

Continuing Claims Dec 25: 1754K (est 1678K; prev 1716K; prevR 1718K)

US

Trade Balance Dec 30: -$80.2B (est -$81.0B; prev -$67.1B; prevR -$67.2B)

Canadian

Int’l Merchandise Trade Nov: 3.13B (est 2.03B; prev 2.09B)

Reuters-Police

said they had killed dozens of rioters in the main city Almaty. State television said 13 members of the security forces had died, including two who had been decapitated.

German

CPI (Y/Y) Dec P: 5.3% (est 5.1%; prev 5.2%)

–

CPI (M/M) Dec P: 0.5% (est 0.4%; prev -0.2%)

–

CPI EU Harmonized (Y/Y) Dec P: 5.7% (est 5.6%; prev 6.0%)

–

CPI EU Harmonized (M/M) Dec P: 0.3% (est 0.2%; prev 0.3%)

·

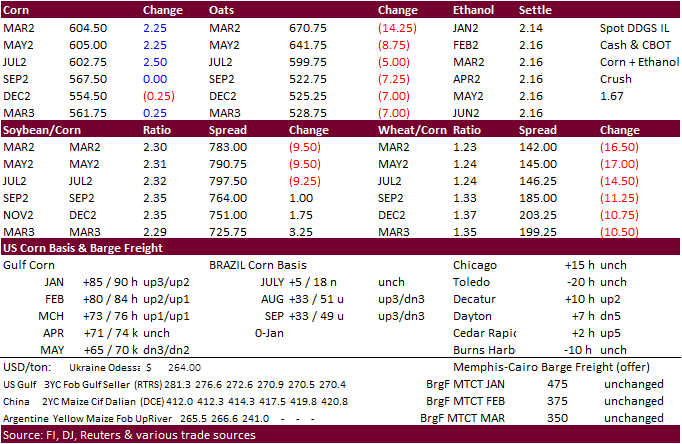

CBOT corn started lower on widespread commodity selling, omitting energy prices, after the FED released hawkish minutes early yesterday afternoon. But prices rebounded after South Korea bought corn and spreads started to reverse

with wheat trading sharply lower.

·

There was a larger than normal number of black trades today, including 2023 positions.

·

Funds were net buyers of an estimated net 2,000 corn contracts.

·

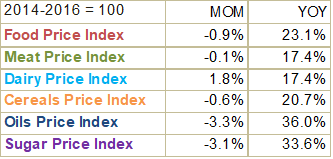

Earlier the bearish undertone was macro related. With some countries returning to lockdowns from an uptick in Covid-19 cases, analysts are downgrading GDP forecasts for some countries. One major bank lowered Australia’s GDP outlook

for Q1 to 1.3% from 2.3%. Meanwhile the FAO food price index hinted inflation slowed late in 2021.

Export

developments.

·

South Korea’s MFG buys two corn cargoes at $336.39/mt CFR for late March and April 1 arrival. They passed on one cargo.

·

South Korea’s FLC bought a cargo of corn at $335.29/mt CFR for February 1-20 shipment. Origin was thought to be South American.

U.S.

natural gas prices spiked in February 2021, then generally increased through October

https://www.eia.gov/todayinenergy/detail.php?id=50778&src=email

Updated

1/3/22

March

corn is seen in a $5.60 to $6.20 range

·

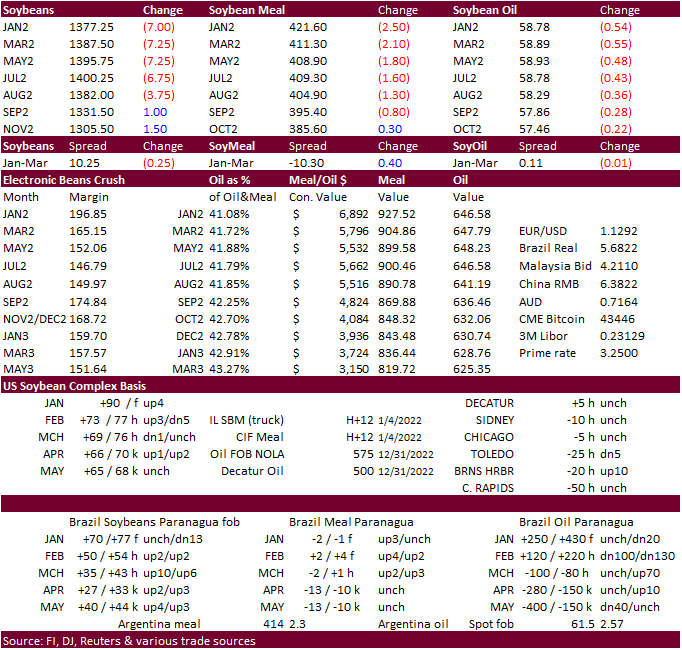

US soybeans, meal and soybean oil eased on SA crop loss concerns (or at least conditions stop deteriorating). Hot temperatures may moderate during week two of the weather forecast. Northern Brazil will see less rain during mid-January

which should promote harvesting activity. Poor export sales for the soybean complex added to the negative undertone today.

·

The funds sold 3,000 soybeans, sold 4,000 soybean meal and sold 2,000 soybean oi.

·

Widespread commodity selling, omitting energy prices, were initially weighing on prices.

·

AgResource: Brazil soybeans – 131 million tons versus 141 million previous

·

An article mentioned the Brazilian port shipping for this month is almost three million tons, with no product available. Paraná is usually first to harvest, “but the low yields that are reported show that there is no product for

that now.” https://www.noticiasagricolas.com.br/noticias/soja/306217-quebras-de-safra-ja-deixam-navios-esperando-para-embarcar-soja-2021-22-nos-portos-do-brasil.html#.YdboZ2jMKUn

·

Malaysian palm futures snapped a 4-day rally and traded lower by 51 ringgit to 4,985.

·

The Southern Peninsula Palm Oil Millers’ Association estimated production during Jan. 1-5 fell 45.8% from the same period in December.

Export

Developments

·

Under the 24-hour announcement system, private exporters reported 102,000 tons of soybeans were sold to Mexico for the 2021-22 marketing year.

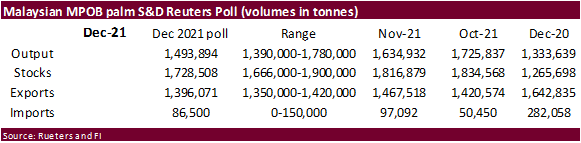

A

Reuters poll looks for Malaysia’s palm oil inventories at end-December to sink 4.9% from the previous month to 1.73 million tons, lowest in five months.

Updated

1/5/22

Soybeans

– March $13.00-$14.25

Soybean

meal – March $370-$435

Soybean

oil – March 53.00-61.00

·

US wheat ended sharply lower on weakness in outside related markets, technical selling, and easing food inflation. Argentina’s net drying and hot temperatures during December aided Argentina wheat yields, and that was reflected

in an upward revision to a production estimate this afternoon. The FAO food price index hinted inflation slowed late in 2021.

·

Funds sold an estimated net 9,000 SRW wheat contracts.

·

Chicago March wheat futures hit an absolute session low of $7.36, lowest since October 15, and below an early September / late November 50 percent retracement of $7.59.

·

The BA Grains Exchange estimated Argentina’s 2021-22 wheat harvest at 21.8 million tons versus 21.5 million tons previously, mainly on higher-than-expected yields. This is the fourth increase in more than one month.

·

March milling wheat settled down 3.00 euros, or 1.1%, at 273.00 euros ($308.44) a ton.

·

IKAR reported Russian wheat with 12.5% protein content loading from Black Sea ports for supply in January stood at $330 a ton free on board (FOB), unchanged from late 2021.

·

Ukraine exported 33.2 million tons of grain so far this year, up 26 percent from same period year ago.

·

Results awaited: Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

·

China plans to sell 500,000 tons of wheat from state reserves on January 12 to flour millers. Results are awaited on China selling 500,000 tons of wheat from state reserves on January 5 to flour millers.

Rice/Other

·

Bangladesh seeks 50,000 tons of rice on January 16.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

U.S. EXPORT SALES FOR WEEK ENDING 12/30/2021

|

|

||||||||

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

42.1 |

2,095.3 |

1,459.6 |

53.2 |

4,225.9 |

5,664.8 |

0.0 |

14.0 |

|

SRW |

0.7 |

689.8 |

495.1 |

49.4 |

1,622.2 |

1,082.3 |

2.5 |

37.0 |

|

HRS |

0.8 |

1,221.0 |

1,753.4 |

50.2 |

3,019.0 |

4,227.6 |

0.0 |

0.0 |

|

WHITE |

4.6 |

807.3 |

2,647.0 |

42.7 |

2,068.8 |

2,919.0 |

0.0 |

0.0 |

|

DURUM |

0.4 |

21.2 |

100.8 |

15.4 |

112.7 |

488.9 |

0.0 |

33.0 |

|

TOTAL |

48.6 |

4,834.5 |

6,455.8 |

210.9 |

11,048.6 |

14,382.6 |

2.5 |

84.0 |

|

BARLEY |

0.0 |

19.0 |

13.7 |

0.0 |

11.5 |

16.9 |

0.0 |

0.0 |

|

CORN |

256.1 |

26,344.1 |

28,688.1 |

985.1 |

14,652.8 |

15,256.3 |

0.0 |

1,512.0 |

|

SORGHUM |

22.8 |

3,695.0 |

3,102.6 |

74.4 |

1,613.1 |

1,985.3 |

0.0 |

0.0 |

|

SOYBEANS |

382.7 |

11,088.3 |

15,693.1 |

1,742.8 |

30,613.6 |

38,871.7 |

67.1 |

283.1 |

|

SOY MEAL |

31.5 |

2,984.0 |

2,697.4 |

228.8 |

3,142.4 |

3,252.6 |

0.3 |

36.2 |

|

SOY OIL |

2.9 |

248.1 |

286.0 |

42.3 |

192.6 |

205.1 |

0.1 |

0.4 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

12.0 |

177.0 |

201.7 |

1.7 |

582.3 |

787.0 |

0.0 |

0.0 |

|

M S RGH |

4.5 |

10.8 |

16.2 |

0.0 |

2.9 |

12.7 |

0.0 |

0.0 |

|

L G BRN |

0.1 |

3.8 |

9.6 |

0.3 |

27.1 |

22.1 |

0.0 |

0.0 |

|

M&S BR |

0.1 |

68.3 |

45.2 |

0.2 |

15.4 |

50.5 |

0.0 |

0.0 |

|

L G MLD |

11.9 |

57.9 |

70.1 |

48.4 |

392.9 |

295.1 |

0.0 |

0.0 |

|

M S MLD |

-1.0 |

100.8 |

181.5 |

2.7 |

179.2 |

196.2 |

0.0 |

0.0 |

|

TOTAL |

27.6 |

418.7 |

524.4 |

53.2 |

1,199.8 |

1,363.5 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

143.2 |

7,556.5 |

6,014.8 |

104.9 |

3,036.8 |

5,523.4 |

44.0 |

1,114.2 |

|

PIMA |

4.4 |

232.1 |

217.5 |

7.2 |

144.8 |

342.4 |

0.9 |

5.3 |

This

summary is based on reports from exporters for the period December 24-30, 2021.

Wheat: Net

sales of 48,600 metric tons (MT) for 2021/2022–a marketing-year low–were down 76 percent from the previous week and 87 percent from the prior 4-week average. Increases primarily for Italy (15,400 MT, including 15,000 MT switched from unknown destinations),

unknown destinations (13,900 MT), Mexico (9,600 MT, including decreases of 6,400 MT), the Dominican Republic (3,200 MT), and Thailand (3,000 MT), were offset by reductions for Colombia (600 MT) and China (200 MT). Total net sales of 2,500 MT for 2022/2023

were for Peru. Exports of 210,900 MT were down 37 percent from the previous week and 17 percent from the prior 4-week average. The destinations were primarily to Nigeria (52,900 MT), the Philippines (43,600 MT), Japan (32,100 MT), Taiwan (21,900 MT), and

Mexico (20,900 MT).

Corn:

Net sales of 256,100 MT for 2021/2022 were down 80 percent from the previous week and 81 percent from the prior 4-week average. Increases primarily for Canada (150,500 MT, including decreases of 10,700 MT), Mexico (115,100 MT, including decreases of 25,600

MT), Colombia (90,500 MT, including 92,000 MT switched from unknown destinations and decreases of 12,600 MT), Japan (81,500 MT, including 175,200 MT switched from unknown destinations and decreases of 56,500 MT), and Guatemala (10,500 MT), were offset by reductions

primarily for unknown destinations (212,500 MT). Exports of 985,100 MT were up 7 percent from the previous week, but down 2 percent from the prior 4-week average. The destinations were primarily to Japan (221,100 MT), Mexico (210,500 MT), Colombia (179,500

MT), China (135,100 MT), and Canada (113,400 MT).

Optional

Origin Sales:

For 2021/2022, options were exercised to export 60,000 MT to unknown destinations from other than the United States. The current outstanding balance of 381,000 MT is for unknown destinations (309,000 MT), Italy (63,000 MT), and Saudi Arabia (9,000 MT).

Barley:

No net sales or exports were reported for the week.

Sorghum:

Total net sales of 22,800 MT for 2021/2022 were down 88 percent from the previous week and 93 percent from the prior 4-week average. The destination was China. Exports of 74,400 MT were down 57 percent from the previous week and 62 percent from the prior

4-week average. The destination was to China (74,300 MT).

Rice:

Net sales of 27,600 MT for 2021/2022 were down 60 percent from the previous week and 56 percent from the prior 4-week average. Increases primarily for Mexico (12,600 MT), Haiti (6,900 MT, including decreases of 300 MT), Canada (4,800 MT), Guatemala (4,000

MT), and Saudi Arabia (600 MT), were offset by reductions for Japan (1,900 MT). Exports of 53,200 MT were up 70 percent from the previous week and 9 percent from the prior 4-week average. The destinations were primarily to Haiti (45,100 MT), Canada (2,800

MT), Mexico (1,700 MT), Honduras (1,000 MT), and Saudi Arabia (800 MT).

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 100 MT, all Canada.

Soybeans:

Net sales of 382,700 MT for 2021/2022–a marketing-year low–were down 27 percent from the previous week and 63 percent from the prior 4-week average. Increases primarily for China (353,900 MT, including 264,000 MT switched from unknown destinations and decreases

of 3,700 MT), Mexico (183,900 MT, including decreases of 200 MT), Spain (141,100 MT, including 132,000 MT switched from unknown destinations), the Netherlands (68,800 MT, including 60,000 MT switched from unknown destinations), and Germany (64,900 MT), were

offset by reductions primarily for unknown destinations (625,200 MT). Net sales of 67,100 MT for 2022/2023 were for unknown destinations (66,000 MT) and Japan (1,100 MT). Exports of 1,742,800 MT were up 1 percent from the previous week, but down 11 percent

from the prior 4-week average. The destinations were primarily to China (913,000 MT), Egypt (152,200 MT), Spain (141,100 MT), Pakistan (129,100 MT), and the Netherlands (68,800 MT).

Export

for Own Account:

For 2021/2022, new exports for own account totaling 28,400 MT were for Canada. The current exports for own account outstanding balance is 63,000 MT, all Canada.

Export

Adjustments:

Accumulated exports of soybeans to the Netherlands were adjusted down 64,918 MT for week ending December 16, 2021. The correct destination for this shipment is Germany.

Late

Reporting:

For 2021/2022, exports totaling 15,000 MT of soybeans were reported late to Costa Rica.

Soybean

Cake and Meal:

Net sales of 31,500 MT for 2021/2022–a marketing-year low–were down 55 percent from the previous week and 81 percent from the prior 4-week average. Increases primarily for the Dominican Republic (12,000 MT, including decreases of 600 MT), Canada (7,000

MT, including decreases of 400 MT), Jamaica (4,000 MT), Guyana (3,800 MT switched from unknown destinations), and the Philippines (2,300 MT), were offset by reductions primarily for unknown destinations (4,900 MT), El Salvador (1,000 MT), Spain (800 MT), and

Nicaragua (500 MT). Net sales of 300 MT for 2022/2023 resulting in increases for Japan (1,900 MT), were offset by reductions primarily for the Netherlands (1,500 MT). Exports of 228,800 MT were up 34 percent from the previous week, but down 14 percent from

the prior 4-week average. The destinations were primarily to the Philippines (48,900 MT), Spain (38,200 MT), Canada (27,000 MT), Morocco (25,600 MT), and Colombia (25,500 MT).

Optional

Origin Sales: For 2021/2022, the current outstanding balance of 50,000 MT is for Venezuela.

Soybean

Oil:

Net sales of 2,900 MT for 2021/2022–a marketing-year low–were down 69 percent from the previous week and 91 percent from the prior 4-week average. Increases primarily for Guatemala (1,900 MT) and El Salvador (1,000 MT), were offset by reductions for Colombia

(100 MT). Total net sales of 100 MT for 2022/2023 were for Canada. Exports of 42,300 MT were up noticeably from the previous week and from the prior 4-week average. The destinations were primarily to India (29,600 MT), Costa Rica

(4,000 MT), Colombia (3,700 MT), Mexico (2,900 MT), and El Salvador (1,900 MT).

Cotton:

Net sales of 143,200 RB for 2021/2022 were down 26 percent from the previous week and 48 percent from the prior 4-week average. Increases primarily for China (47,000 RB), Pakistan (20,800 RB), Turkey (18,900 RB), Vietnam (15,200 RB, including 1,000 RB switched

from South Korea), and India (14,500 RB), were offset by reductions primarily for Guatemala (2,100 RB) and South Korea (1,000 RB). Net sales of 44,000 RB for 2022/2023 primarily for Pakistan (40,500 RB), were offset by reductions for China (400 RB). Exports

of 104,900 RB were down 35 percent from the previous week and 22 percent from the prior 4-week average. The destinations were primarily to China (38,300 RB), Vietnam (15,900 RB), Pakistan (12,100 RB), Turkey (10,700 RB), and Indonesia (6,400 RB). Net sales

of Pima totaling 4,400 RB were down 38 percent from the previous week and 17 percent from the prior 4-week average. Increases were reported for China (2,600 RB, including decreases of 100 RB), Vietnam (1,000 RB), Thailand (600 RB), and Honduras (200 RB).

Total net sales of 900 RB for 2022/20223 were for India. Exports of 7,200 RB were up 3 percent from the previous week, but unchanged from the prior 4-week average. The destinations were primarily to India (2,400 RB), China (2,100 RB), and Thailand (2,000

RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the

current exports for own account outstanding balance is 100 RB, all Vietnam.

Hides

and Skins:

Net sales of 80,800 pieces for 2021 were up 55 percent from the previous week, but down 62 percent from the prior 4-week average. Increases primarily for China (43,600 whole cattle hides, including decreases of 14,200 pieces), South Korea (34,400 whole cattle

hides, including decreases of 5,500 pieces), and Mexico (8,300 whole cattle hides), were offset by reductions primarily for Vietnam (4,200 pieces). Net sales of 266,900 pieces for 2022 were primarily for China (215,200 whole cattle hides), South Korea (24,000

whole cattle hides), Mexico (19,300 whole cattle hides), Vietnam (4,200 whole cattle hides), and Japan (2,800 whole cattle hides). Total net sales reductions of 8,400 calf skins for 2023 were reported for Belgium. In addition, total net sales of 1,300 kip

skins were for China. Exports of 444,100 pieces were up 39 percent from the previous week and 18 percent from the prior 4-week average. Whole cattle hide exports were primarily to China (302,800 pieces), South Korea (78,800 pieces), Thailand (19,600 pieces),

Mexico (19,000 pieces), and Brazil (7,100 pieces). In addition, exports of 5,600 calf skins were to Italy.

Net

sales of 24,500 wet blues for 2021 were down noticeably from the previous week and down 59 percent from the prior 4-week average. Increases for Italy (18,100 unsplit), China (4,500 unsplit, including decreases of 1,200 unsplits), and South Korea (3,200 grain

splits), were offset by reductions for Vietnam (900 unsplit) and Thailand (400 unsplit). Net sales of 64,600 wet blues for 2022 were primarily for Italy (22,100 grain splits and 9,800 unsplit), Vietnam (22,100 unsplit), China (20,200 unsplit), and Thailand

(10,000 unsplit). Exports of 101,900 wet blues were up 35 percent from the previous week, but down 11 percent from the prior 4-week average. The destinations were to Italy (31,700 unsplit and 9,000 grain splits), China (27,900 unsplit), Vietnam (22,500 unsplit),

Thailand (9,200 unsplit), and South Korea (1,600 grain splits). Total

net sales reductions of 21,400 splits were for Vietnam. Net sales of 7,600 splits for 2022 were reported for Vietnam (5,000 pounds), China (2,000 pounds), and South Korea (600 pounds). Exports of 467,800 pounds were to Vietnam.

Beef:

Net sales reductions of 3,900 MT for 2021–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Increases primarily for Taiwan (100 MT, including decreases of 200 MT), the Netherlands (100 MT), Indonesia (100

MT), and Kuwait (100 MT), were more than offset by reductions primarily for South Korea (2,300 MT), China (1,200 MT), Japan (400 MT), Chile (100 MT), and Hong Kong (100 MT). Net sales of 11,800 MT for 2022 were primarily for South Korea (4,700 MT), Taiwan

(4,000 MT), Japan (1,500 MT), Canada (600 MT), and Hong Kong (500 MT), were offset by reductions for China (600 MT). Exports of 11,500 MT–a marketing-year low–were down 33 percent from the previous week and 35 percent from the prior 4-week average. The

destinations were primarily to South Korea (4,100 MT), Japan (2,700 MT), China (1,700 MT), Taiwan (900 MT), and Mexico (700 MT).

Pork:

Net sales of 19,400 MT for 2021 were up noticeably from the previous week, but down 6 percent from the prior 4-week average. Increases primarily for Mexico (16,100 MT, including decreases of 400 MT), Canada (1,400 MT, including decreases of 100 MT), China

(1,200 MT, including decreases of 2,000 MT), Japan (500 MT, including decreases of 1,000 MT), and Costa Rica (200 MT), were offset by reductions for Nicaragua (300 MT). Net sales of 18,600 MT for 2022 were primarily for Japan (5,900 MT), Mexico (5,200 MT),

South Korea (2,000 MT), Colombia (1,700 MT), and Guatemala (900 MT). Exports of 22,800 MT–a marketing-year low–were down 26 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily to Mexico (11,400 MT),

Japan (3,000 MT), China (2,600 MT), South Korea (2,400 MT), and Canada (900 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.