PDF Attached

Under

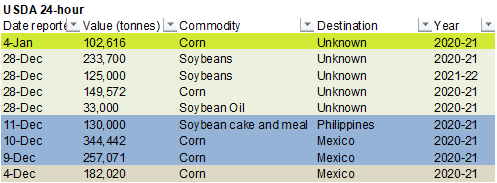

the USDA 24-hour reporting system, private exporters sold 102,616 tons of corn to unknown. We are eyeing $14.50 soybeans, $5.25 corn, and now $7.00 wheat.

CME

Margin Changes per Reuters:

-

CME

RAISES WHEAT FUTURES (W) MAINTENANCE MARGINS BY 10% TO $1,650 PER CONTRACT FROM $1,500 FOR MARCH 2021 -

CME

RAISES SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 14.6% TO $2,750 PER CONTRACT FROM $2,400 FOR JAN. 2021 -

CME

RAISES CORN FUTURES (C) MAINTENANCE MARGINS BY 12.9% TO $1,100 PER CONTRACT FROM $975 FOR MARCH 2021 -

CME

LOWERS CRUDE OIL FUTURE NYMEX (CL) MAINTENANCE MARGINS BY 4.7% TO $4,525 PER CONTRACT FROM $4,750 FOR FEB. 2021 -

SAYS

INITIAL MARGIN RATES ARE 110% OF THESE LEVELS -

SAYS

RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON JAN. 6, 2021

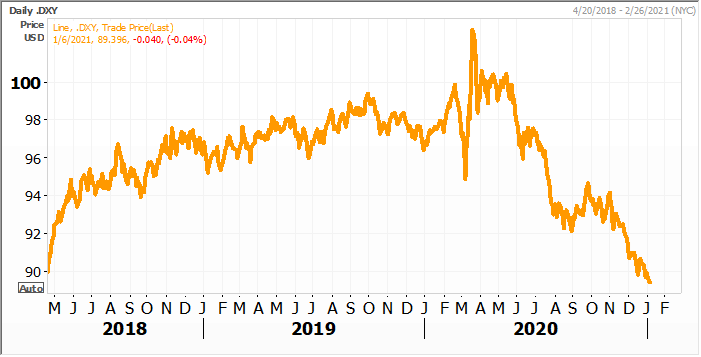

USD

Index

Source:

Reuters and FI

Weather

Greatest

World Weather Interests of The Day

- China’s

coldest temperatures of the season are expected tonight with extreme lows falling into the negative and positive single digits Fahrenheit in the Yellow River Valley and areas to the north - Very

little snow cover is present which may raise the potential for a little crop damage - Wheat

is favorably established and may withstand the cold after recent hardening, but some temperatures could be low enough to induce some negative impact - Beneficial

rainfall has occurred central and southern Buenos Aires and from northwestern Santiago del Estero into Salta Tuesday and overnight - Rainfall

was heavy in parts of southern Buenos Aires where generalized 1.00 to 2.00 inch totals were noted - Local

extremes reached 5.48 in the far southeast of Buenos Aires and 3.30 inches in interior southwestern Buenos Aires.

- Net

drying occurred elsewhere - Temperatures

were mild to cool in the southwest with highs in the 60s and 70s Fahrenheit while readings in the northeast were in the 80s and lower to a few middle 90s - Argentina’s

weather still looks unsettled enough for late this coming weekend through next week to raise the potential for some additional relief for parts of the nation’s drier areas - However,

relief is not likely to be very great in southern Santa Fe, Entre Rios or north-central into northeastern Buenos Aires where crop stress may worsen in the coming week and then only get partial relief after that - Timely

rain may occur in many other areas next week to restrict the worse crop conditions to smaller portions of the nation, but ongoing

- Speculation

over possible returning dry and hot weather in Argentina is in the marketplace for later this month - World

Weather, Inc. believes there will be a period of less rain and warmer temperatures, but the impact of that on crops will be largely determined by the rain distribution next week and into the following weekend - Brazil

rainfall Tuesday and early today was greatest in Mato Grosso do Sul, western Parana, Santa Catarina and neighboring areas - Amounts

reached nearly 3.00 inches in central Mato Grosso do Sul and 1.00 to 2.14 inches in southwestern Parana while amounts to 0.70 inch occurred often in other areas - The

remainder of Brazil was left in a net drying mode. - High

temperatures Tuesday were mostly in the seasonable range with a slight cooler bias in the interior south - Brazil’s

weather outlook today has not changed much from that of Tuesday - Sufficient

rain will fall to support crops in nearly all areas allowing the improving trend for pod setting and filling in soybean production areas to continue - Recent

dryness and that expected periodically in the next few days will not last long enough to seriously raise crop moisture issues - The

mix of sunshine, rain, seasonable temperatures and mostly good soil conditions will support normal crop development - There

are some pockets of dryness remaining, but the majority of the nation is seeing much better conditions over those of earlier this growing season - Coffee,

citrus, rice, cotton corn, soybeans, cocoa and other crops will all benefit from a good distribution of rain - Morocco

will receive waves of rain over the coming week bolstering soil moisture for improved wheat and barley establishment

- This

is the beginning of the third year of drought in southwestern Morocco making the coming week of rain extremely important and welcome - Some

rain began in a part of the nation Tuesday, but amounts were light in the southwest - Northwestern

Algeria has also been drier biased this season and some rain will fall there as well

- Most

of the Mediterranean Sea region of southern Europe will receive frequent rainfall resulting in greater soil moisture, but also inducing some potential for flooding - Rainfall

will be greatest in eastern Spain, Italy, the eastern Adriatic Sea nations and from parts of Greece and Bulgaria to Russia’s Southern Region - Waves

of rain and snow will impact Russia’s Southern Region through the next ten days resulting in a welcome boost to soil moisture in areas that have no frost in the ground - Snow

will pile up on top of the ground in areas where temperatures are coldest, but the snow will melt during the warmer days and weeks ahead in late winter and early spring to improve soil conditions for better winter crop establishment - Additional

rain fell in northern India Tuesday resulting in further improvement in topsoil moisture - Additional

moisture totals varied from 0.20 to 0.75 inch with local totals to 2.00 inches in the far north of the nation - Recent

precipitation from eastern Rajasthan and northern Uttar Pradesh into Jammu and Kashmir has bolstered soil moisture for improved winter crop conditions - Dry

weather will return to northern India today and will prevail for a while - Some

rain will fall in central India Thursday and Friday of this week with amounts of 0.20 top 0.75 inch and a few totals over 1.00 inch - Madhya

Pradesh and Maharashtra will be most impacted - Some

areas in Maharashtra will receive 1.00 to 2.00 inches of rain as will Karnataka and Tamil Nadu where delays to late season summer crop harvesting is expected - Precipitation

in these more southern locations in India will last more than Thursday and Friday with some areas getting rain well into next week - Too

much rain is expected in far southern India and flooding may result; rice, sugarcane, unharvested cotton and some groundnuts may be negatively impacted by the moisture - Waves

of rain will impact the Philippines starting late this week and lasting a full week - Excessive

moisture is expected resulting in new flooding for parts of the nation especially in eastern most islands - Flooding

has already been an issue for the nation at times in recent months and additional damage to crops and property will be possible - Frequent

rain in Indonesia and Malaysia will eventually result in some new flooding - Recent

flooding in Peninsular Malaysia caused damage to crops and personal property, although that situation will improve before new excessive rain and flooding impacts a part of the region in the coming week to ten days - Other

areas in Indonesia and Malaysia are likely to become too wet over time with Java and northern Borneo as well as peninsular Malaysia impacted from time to time.

- Mainland

areas of Southeast Asia will be dry over the next ten days except coastal areas of Vietnam where waves of rain are expected - Eastern

Australia received additional showers Tuesday in northern New South Wales and southern Queensland - Amounts

varied from 0.05 to 0.71 inch with a few totals to 1.47 inches - Greater

rain fell near the Townsville area of Queensland where more than 5.00 inches occurred Tuesday and flooding in that area is far more serious because of multiple days of heavy rain - Eastern

Australia will receive additional showers and thunderstorms into Friday and then net drying is expected for a while in key grain and cotton production areas - Another

0.50 to 2.50 inches of rain and locally more will occur by Saturday morning in southeastern Queensland - Not

much other precipitation is expected there or in New South Wales for a full week - Southern

parts of the Cape York Peninsula and the upper Queensland, Australia coast will experience frequent waves of rain through the next ten days resulting in more flooding

- The

area near Townsville, Queensland has received excessive rainfall in the past week and will be getting much more resulting in damage for sugarcane and some other agriculture - South

Africa will receive frequent showers and thunderstorms over the next ten days bringing rain to most summer crop areas and ensuring aggressive crop development - Western

areas may be wettest for a while - U.S.

weather Tuesday was dry except for a little rain and snow mix in the Missouri River Valley and in random locations in the eastern states - The

Pacific Northwest was wettest as it has been with the Puget Sound getting waves of rain - Temperatures

were a little warmer than usual in many areas across the nation - U.S.

weather changes were minor overnight - Rain,

snow and a little freezing rain will occur today from the eastern Dakotas and western Minnesota into Missouri and eastern Kansas

- Moisture

totals will vary from 0.05 to 0.40 inch and locally more - Snowfall

of 1 to 4 inches is most likely, but a few areas could receive locally more

- The

storm system responsible for rain and snow in the western Corn Belt today will also produce widespread rainfall across the Delta and into the southeastern states late today into early Friday - Hard

red winter wheat areas will receive their greatest precipitation during the weekend as snow and rain fall from Colorado to western and northern Texas

- Moisture

totals will vary from 0.10 to 0.35 inch with local totals of 0.35 to 0.75 inch and possibly more

- Some

significant snowfall is possible in the high Plains region - Rain

this weekend in the heart of Texas will move too far to the south to bring much moisture to the Delta or southeastern states, but some of the Gulf of Mexico coast and Florida will get rain Sunday into early next week - Waves

of rain and mountain snow will impact the Pacific Northwest throughout the coming two weeks maintaining wet conditions in some of those areas - Colder

air moving into North America near mid-month may drop a cold front through the north-central and eastern U.S. with a little snow and rain accompanying it - Additional

waves of cool air and brief bouts of snow will move from northwest to southeast across the central and eastern United States in the third week of this month and progressive cooling is expected - Some

of the bitter cold impacting China this week will reach North America near mid-month and will prevail into the end of January with Canada Prairies, the U.S. northern Plains and Midwest all experiencing notably colder weather over time. Temperatures may not

fall far below average outside of these areas and most of these areas will experience a more seasonably cool temperature bias - West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +18.64 today which is the highest this index has been in the current La Nina episode - Mexico

and Central America weather will continue to generate erratic rainfall - Far

southern Mexico and portions of Central America will be most impacted by periodic moisture - Canada

Prairies will remain unseasonably warm this week and warmer than usual through day ten before cooling occurs during the weekend and next week - Southeast

Canada will receive less than usual precipitation this week and temperatures will continue a little warmer than usual

Source:

World Weather Inc. and FI

Wednesday,

Jan. 6:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - China’s

CNGOIC to publish soy and corn reports - HOLIDAY:

Russia, Poland

Thursday,

Jan. 7:

- FAO

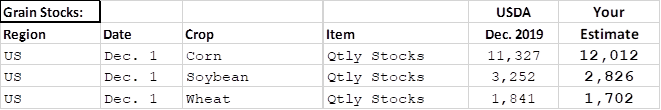

World Food Price Index - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia, Ghana, Egypt

Friday,

Jan. 8:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Trading

of China’s hog futures to begin on Dalian Commodity Exchange - HOLIDAY:

Russia

Source:

Bloomberg and FI

US

jobless claims report will be out on Thursday and monthly unemployment on Friday.

US

ADP Employment Change Dec: -123K (est 75K; prevR 304K; prev 307K)

US

DoE Crude Oil Inventories (W/W) 01-Jan: -8010K (est -2700K; prev -6065K)

–

Distillate Inventories: +6390K (est 1200K; prev 3095K)

–

Cushing Crude Inventories: +792K (prev 27K)

–

Gasoline Inventories: +4519K (est -900K; prev -1192K)

–

Refinery Utilization: 1.30% (est 0.40%; prev 1.40%)

OPEC

December Oil Output Up 280,000 Bpd Month On Month To 25.59 Mln Bpd, 6th Monthly Gain In A Row – RTRS Survey

OPEC

Oil Output Rise Led By Higher Supply From Libya And UAE

OPEC

States’ Compliance To OPEC+ Output Cut Pledges 99% In December, Down From 102% In November

Saudi

Arabia Keeps Oil Supply Steady In December At Just Below 9 Million Bpd

US

Factory Orders Nov: 1.0% (est 0.7%; prev 1.0%)

–

Factory Orders Ex-Transportation Nov: 0.8% (prev 1.0%)

–

Durable Goods Orders Nov F: 1.0% (est 0.9%; prev 0.9%)

–

Durable Goods Ex-Transportation Nov F: 0.4% (est 0.4%; prev 0.4%)

–

Cap Goods Ship Nondef Ex-Air Nov F: 0.5% (prev 0.4%)

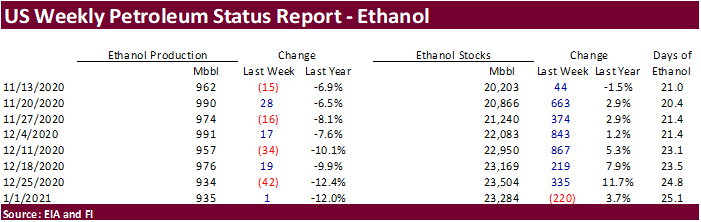

EIA-U.S.

WEEKLY ETHANOL OUTPUT UP 1,000 BPD TO 935,000 BPD

EIA-U.S.

WEEKLY ETHANOL STOCKS OFF 220,000 BBLS TO 23.28 MLN BBLS

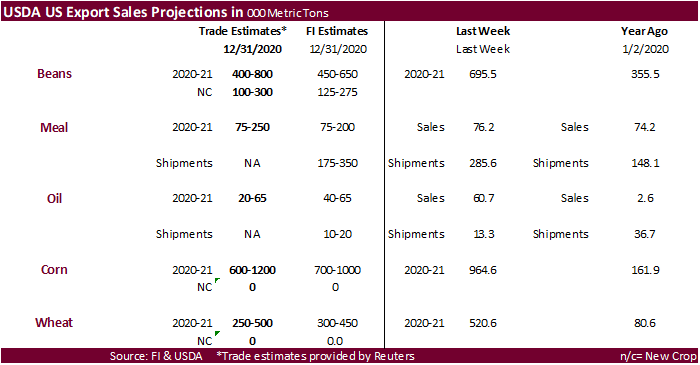

FI

Estimates for USDA Grain Stocks

Corn.

-

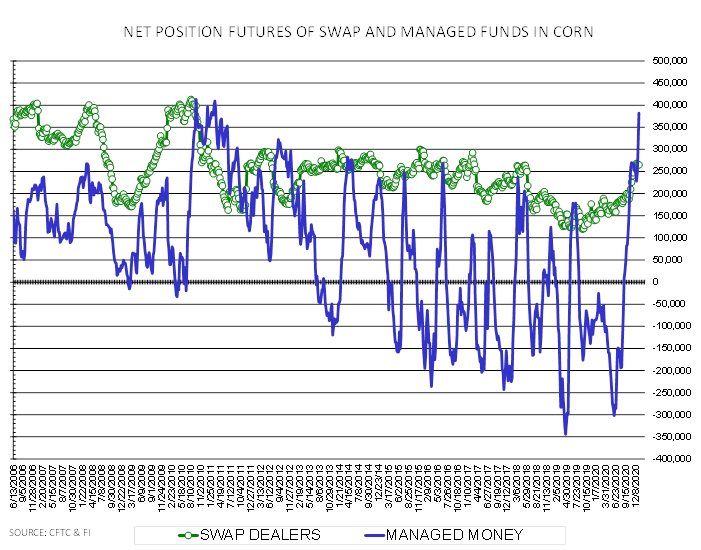

CBOT

corn

ended higher despite some negative sentiment CBOT futures are overbought and the fund position is increasingly in a danger zone on the long side after no fresh bullish news hit the markets this week other than a couple confirmed cargo private sales were reported

over the tapes. Argentina’s restrictions of corn export commitments go only beyond February. We feel US export demand for US corn exports will remain strong after that date, but price advantage and currency values will dictate origin (US/Argentina). Ukraine,

we see knocked out by then. -

EIA’s

weekly US ethanal production and stocks update had little impact on market prices today.

-

On

Wednesday, funds bought an estimated net 13,000 contracts. -

Hungary

plans to cull 90,000 turkeys amid bird flu. -

Germany

will cull 62,000 poultry after discovering H5N8 bird flu. -

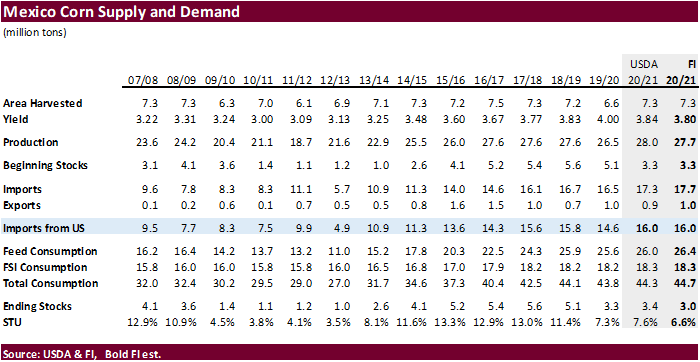

The

story that came out late Sunday on Bloomberg mentioning Mexico’s initiative to phase out GMO corn imports has created a stir in the market, but many believe it will not become a reality unless some extreme measures takes place such as a dramatic shift in global

trade flows (where they source non GMO) and/or domestic planting expansion. We think it’s more geared for white corn human consumption. Livestock producers tend to import and feed yellow corn. Bottom line is Mexico depends on at least 16 plus million tons

of corn imports every year for domestic feed and industrial consumption, and much of the corn imports come from the United States. We applaud that Mexico aims to become self-sufficient but achieving this over a three year period with what land may be available

to expand farmland, might be out of reach.

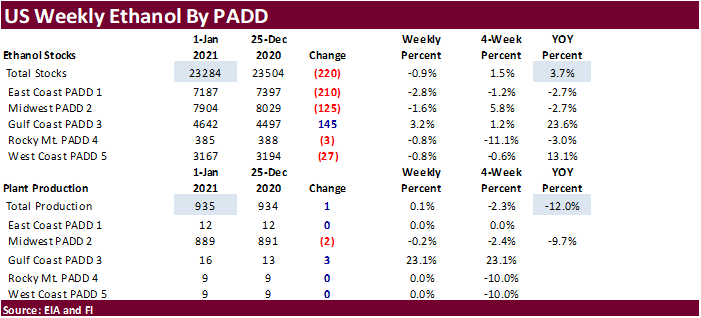

EIA

weekly ethanol data

US

ethanol production unexpectedly expanded 1,000 barrels to 935,000 barrels, still 12 percent below this time a year ago. Traders were looking for a 7,000 decline. Corn crop year to date (September through early January) is running 7.3 percent below the same

period a year earlier. There were no ethanol imports. US ethanol stocks declined 220,000 barrels to 23.284 million. Traders were looking for an increase of 241,000. This was the first decrease in stocks in ten weeks. US gasoline demand fell 687,000 barrels

to 7.441 million, down 8.5 percent from a year ago. The refinery and blender net input of oxygenates fuel ethanol (blender input) was 719,000 barrels, down 99,000 from the previous week and 10.2 percent below year ago. The percent of ethanol blended into

finished motor gasoline was 89.5 percent.

Corn

Export Developments

- Under

the USDA 24-hour reporting system, private exporters sold 102,616 tons of corn to unknown.

- Turkey

seeks 155,000 tons of corn on January 12 for Jan 25-Feb 15 shipment.

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12.

Below

is wheat the managed money futures and options position may look like when update on Friday

Updated

1/5/20

March

corn is seen

trading in a $4.50 and $5.25 range

-

CBOT

soybean complex ended higher led by soybeans and soybean meal, not oil as indicated at the beginning of the session after palm futures were up 122 points. News has not changed the theme of the bullish undertone. This week the situation in Argentina turned

south again as producers planned a strike set for January 11-13. Either way, vegetable oil premiums are again on the rise across the Black Sea and South America, Malaysia and EU as global stockpiles dwindle ahead of Southern Hemisphere harvest. Feed grain

supplies are not in question as much as vegetable oil abundancy headed into second half 2021.

-

We

are hearing US soybean end users have bought a lot of soybeans this week as elevators selling soybeans to meet margin calls. A raise in CME margins again will likely shake out more shots in the market.

-

CBOT

crush was active and there are indications commercials are covered through first half April. Rolling of the March Crush to May was noted today.

-

Meanwhile,

someone was active trading SA soybean futures. A graph of Santos Platts versus rolling Chicago futures shows a good correlation. We eventually would like to see the exchanges embrace several more cash settled OTC global locations to entice superior hedging.

-

China’s

Sinograin was seeking US soybeans for October and November shipments and at least one cargo was bought. China also bought at least one Brazilian soybean cargo for March shipment.

-

On

Wednesday, funds bought an estimated 13,000 soybean contracts, 5,000 soybean meal and 4,000 soybean oil lots.

Oilseeds

Export Developments

MPOB

Jan. 11 palm estimates:

Range Median

Production

1,296,000-1,386,000 1,326,283

Exports

1,272,000-1,650,000 1,500,000

Imports

60,000-150,000 100,000

Closing

stocks 1,107,000-1,477,200 1,218,535

Palm

futures – nearby rolling third month

Source:

Reuters and FI

Argentina

Oilseeds and Products Update

Updated

1/05/20

March

$12.50 and $14.50 range

March

$415 and $480 range

March

is expected to trade in a 42.50 and 46.00 cent range

- US

wheat futures traded in par with movement with the USD, and EU wheat futures that with that said we think had more influence over CBOT price action as there was not much news to trade with. Euronext wheat futures sank after hitting a 2-year high, natural as

that contract sees less volatility, long term, versus the US markets over recent years.

- On

Wednesday funds sold an estimated net 5,000 Chicago SRW wheat contracts. - Ukraine

grain exports were 26.4 million tons so far in 2020-21, down from 31.49 million at the same date in 2020-economy ministry. Ukraine winter grain crops remain in good conditions.

- EU

March milling wheat was down 1.75 at 175.00 euros. - China

was set to sell another, or at least offer, 4

million tons of wheat from reserves, so this may have dampened bull trader optimism.

- Looking

at the larger picture, we see no major draw in global wheat stocks over the next 12-24 months, so bull traders in soybeans and corn must be aware that sometimes a huge upswing in commodity agriculture futures is predicated on movement on all aspects of the

industry, not just a hiccup in one or two of the major commodities. Weather is good across the Black Sea and we see not major setback to winter grain/oilseed production across the rest of the northern hemisphere. But it only takes two major back to back

weather events to send off an unpresented price event, IMO.

Export

Developments.

- Japan

this week seeks 120,228 tons of food wheat from the United States, Canada and Australia in a regular tender.

- Turkey

seeks 155,000 tons of feed barley on January 12. - Ethiopia

canceled an import tender for 600,000 tons of wheat that was set to close back on November.

- Bangladesh

seeks 50,000 tons of wheat in January 13 for shipment within 40 days of contract signing.

- Bangladesh

also seeks 50,000 tons of wheat in January 18 for shipment within 40 days of contract signing.

Rice/Other

·

Cotton futures are on track for their longest rally in 11 years.

Updated

1/6/20

March

Chicago wheat is seen in a $5.90‐$7.00 range (top up from $6.65)

March

KC wheat is seen in a $5.70‐$6.20 range

March

MN wheat is seen in a $5.75‐$6.15 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.