PDF Attached

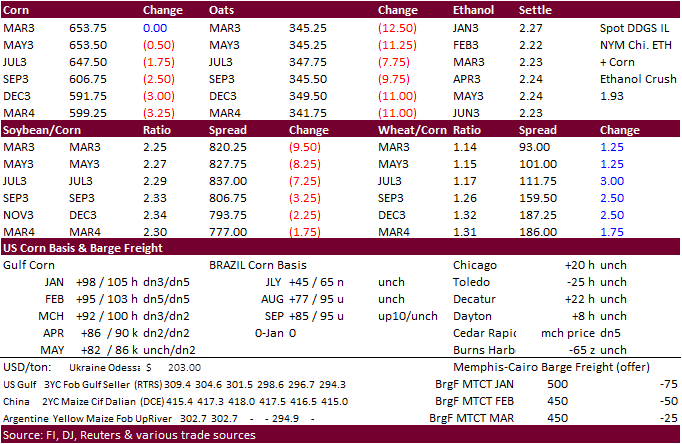

Attached are our US S&D’s. US jobless claims came in lower than expected. US payroll figures and USDA export sales are due out on Friday. WTI crude rebounded, and USD was sharply higher. Soybeans and soybean oil closed lower while meal was mixed. Corn was lower on poor ethanol production and lack of fresh news. Wheat traded two-sided with a mixed close combining all three markets. Natural gas futures were lower from a medium-term weather outlook calling for no threatening cold temperatures for North America. Lower natural gas prices are welcomed by ethanol and crush producers.

![]()

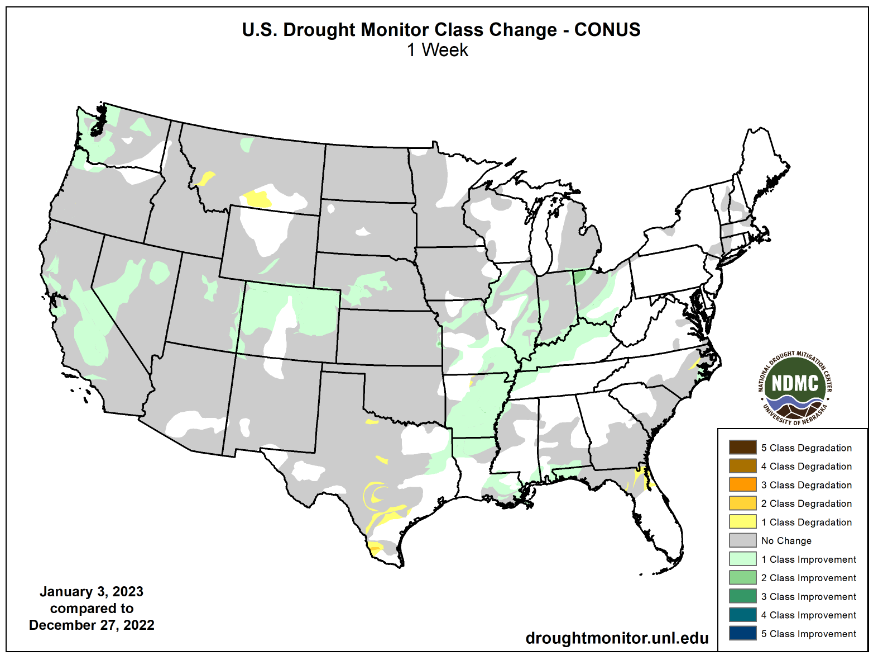

Weather

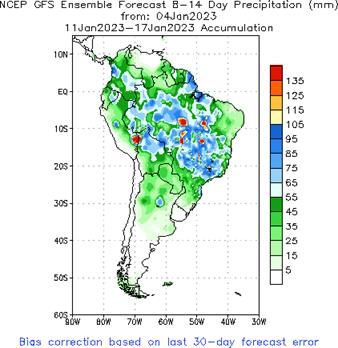

Argentina’s weather forecast again turned slightly negative than that of yesterday. Mostly dry weather is seen through Monday. Brazil’s Mato Grosso, Goias, Bahia, Minas, northeast MGDS, and Sao Paulo will see rain through Monday. Parts of center-south Brazil will see too much rain though mid next week. Rio Grande do Sul will dry down through the middle of next week. Additional areas of the US upper Midwest will see snow/rain today, and southwestern areas of the Midwest Saturday. The Great Plains and WCB will trend drier through Monday. Eastern and central TX will see rain this weekend.

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- Argentina was dry Wednesday, and it began warming once again with highs mostly in the upper 80s and lower to middle 90s Fahrenheit

- Additional warming is expected in Argentina through the weekend and into Tuesday of next week with extreme highs eventually rising into the range of middle 90s to 106 degrees Fahrenheit

- Southern Brazil through much of Argentina will be dry or mostly dry during the next six days and temperatures will be trending warmer than usual

- Crop moisture stress will be on the rise in both nations

- Center south Brazil rainfall will be most frequent in that country resulting in significant runoff that will raise water levels on many reservoir systems

- Saturated soil conditions are likely in many areas and that will translate into a rising potential for flash flooding when heavy rain falls over an already saturated part of the nation

- A little crop damage will be possible, but most crops will “weather” the situation relatively well

- Brazil crop moisture stress will be on the rise from western Parana and parts of Paraguay into Rio Grande do Sul in the coming week with only partial relief likely during the middle to latter part of next week and into the following weekend

- Rio Grande do Sul will likely experience the toughest crop weather for a while

- Brazil’s center west and northeastern crop areas will continue to experience a great mix of rain and sunshine

- Some of the earliest harvesting of soybeans has begun in Mato Grosso and a few fields of Safrinha corn and cotton haves also been planted

- Argentina’s crop moisture stress will be most serious in central and northern parts of the nation because of ongoing drought and a general lack of change for the next several days

- Rain during mid- to late-week next week will offer some temporary break from heat and dryness, but crop stress will be quick to resume

- California’s weather over the next ten days will be quite active with frequent waves of strong wind, flooding rain and significant mountain snowfall

- Flooding is expected in northern portions of the states and in neighboring areas of Oregon that will also be impacted by the stormy weather

- A notable improvement in mountain snowpack is expected which should lead to improving water reservoir levels when the snow melts during the spring

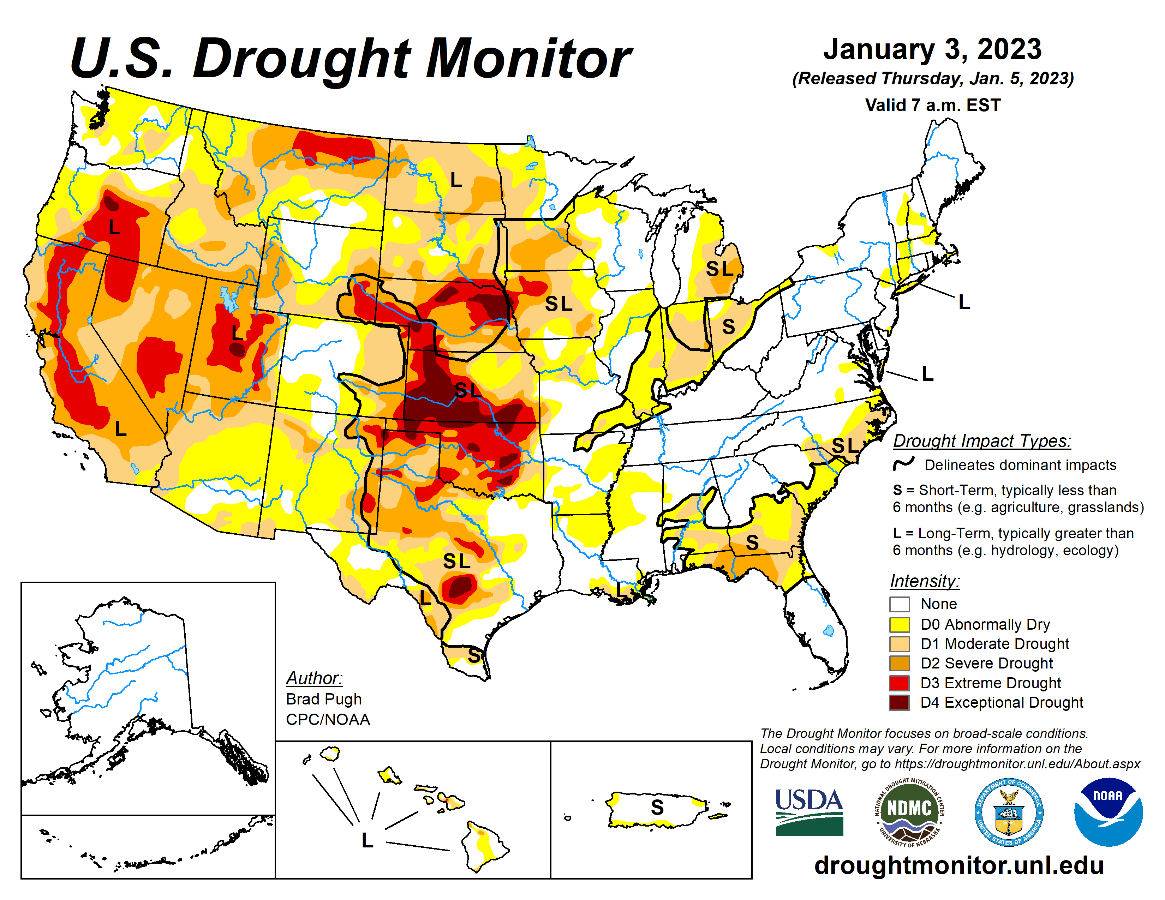

- Much of U.S. hard red winter wheat country will be dry or mostly dry during the next ten days and temperatures will be warmer than usual

- Wheat will remain dormant or semi-dormant with no risk of winterkill

- Tranquil weather with limited precipitation and mild to warm temperatures are expected in the U.S. northern Plains and Canada’s Prairies into early next week with some bouts of snow and a little rain possible briefly during mid- to late-week next week

- Not much seriously cold weather will occur prior to Jan. 20, but cooling is expected late this month and into February

- Waves of rain and snow will occur frequently in the U.S. Delta, Midwest and southeastern states during the next ten days

- The moisture will maintain status quo conditions for winter wheat, soil moisture and

- U.S. temperatures during the next two weeks will be warmer than usual in the central and especially the eastern states

- Temperatures in the west will be a little cooler biased for a while this week before warming slightly above normal during the weekend and next week

- West Texas will also be mostly dry, especially in the high Plains region

- Cooling is expected in western parts of the CIS over the next few days with temperatures falling well below normal late this week through much of next week

- Bitter cold temperatures are expected, but most of the impacted area will be covered in snow to protect wheat and rye from subzero degree Fahrenheit low temperatures

- Europe weather this week will continue wet across the North and Baltic Sea regions and from there through the Baltic Plain into western Russia, Belarus and northern Ukraine where moisture totals of 0.50 to 1.50 inches will result

- Southern Europe will trend drier than usual through this workweek

- A wetter bias is expected to impact all of Europe next week with the exception of central and eastern Spain and the southernmost Balkan Countries where precipitation will be less than 0.50 inch keeping soil moisture lighter in those areas relative to the remainder of Europe

- China precipitation will continue restricted through the weekend

- Precipitation will increase across east-central China during the middle to latter part of next week

- East-central parts of the nation may be wettest, and some significant snow may accumulate, although confidence in the changes advertised is low

- India is expected to continue mostly dry over the next ten days with the exception of a few far northern and extreme southern parts of the nation where some periodic showers are possible

- A few showers might also occur briefly and without significance in southeastern portions of the nation in the next few days

- The bulk of India’s winter crop region needs precipitation to support the best yield potentials

- Winter crops will begin reproducing in the last days of January and February.

- Precipitation is not expected to be as abundant as it has been in recent past winters

- Turkey will be drier than usual over the next week, but December was wetter biased in many areas and that lingering moisture in the soil should maintain favorable crop and field conditions for a while

- Some increase in precipitation is expected next week

- North Africa weather remains drier than usual with little prospect for rain through the weekend

- Showers that occur briefly next week will not likely have a big impact on crop conditions, but any moisture will be welcome

- Much of North Africa still has need for significant rain

- Improve rain potentials should come near and beyond mid-month

- East-central Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

- Coffee and cocoa conditions should remain favorable in all production areas, despite the anomalies

- South Africa weather will continue to be favorably mixed over the next two weeks supporting normal summer crop development

- Less frequent and less significant rainfall is expected for a while

- West-central Africa dryness will continue through the next ten days to two weeks

- Dry conditions are normal at this time of year

- No excessive heat is expected in this coming week, although warmer than usual conditions may begin to evolve a week from now and continue into January 10.

- Indonesia, Malaysia and the Philippines rainfall has been and will continue to be erratic with pockets of excessive rain and local flooding expected to continue for a while

- Weekend precipitation was greatest in parts of Java where more than 8.00 inches occurred in a couple of locations

- More than 5.00 inches of rain fell in northeastern Luzon Island, Philippines

- Philippines rainfall may be abundant excessive at times in the coming ten days to cause some threat of damaging floods

- Lower coastal areas of Vietnam may be vulnerable to flooding rain from through the weekend

- Personal property and some agricultural areas may be negatively impacted by the excessive rainfall

- Australia winter and summer crop areas are unlikely to get much precipitation during the coming week

- The environment will be good for fieldwork, including late season harvest progress in southern winter crop areas

- Rain is needed in interior east-central portions of the nation, although the situation is not a crisis

- Unirrigated sorghum, cotton and other crops will need rain soon especially with temperatures trending hotter

- Some increase in precipitation is expected in the east during mid-week next week and again in the following weekend

- Middle East rainfall is expected to be favorably mixed over the next ten days although the resulting precipitation should be mostly light to locally moderate

- Some rain will return to western Turkey next week ending a ten day period of dry weather

- Today’s Southern Oscillation Index was +19.71 today and it will likely stay strongly positive over the next few days due to the presence of two tropical low pressure systems in northern Australia near Darwin that will thwart the index anomalously high

Source: World Weather INC

Bloomberg Ag Calendar

- FAO Food Price Index

- Net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

Macros

ICE: “House Speaker Fight Goes To 10th Vote, Most Since Pre-Civil War”

US Initial Jobless Claims: 204K (est 225K, prevR 223K)

US Continuing Claims: 1694K (est 1728K, prev 1718K)

US Trade Balance Nov: -61.5Bln (est -$63Bln, prev -$78.2Bln)

Canada Trade Balance C$: -0.04Bln (est 0.61Bln, prevR 0.13Bln)

US EIA NatGas Storage Change (BCF) 30-Dec: -221 (est -240; prev -213)

– Salt Dome Cavern NatGas Stocks (BCF): -53 (prev -17)

US DoE Crude Oil Inventories (W/W) 30-Dec: +1.694M (est +1.500M; prev +718K)

– Distillate: -1.427M (est -1.173M; prev +283K)

– Cushing: +244K (prev -195K)

– Gasoline: -346K (est -1.000M; prev -3.105M)

– Refinery Utilization: -12.4% (est -1.5%; prev +1.1%)

106 Counterparties Take $2.242 Tln At Fed Reverse Repo Op (prev $2.230 Tln, 108 Bids)

· CBOT corn futures traded lower on lack of fresh news in a quiet session. US weekly ethanol data was bearish for corn futures. Funds sold an estimated net 2,000 corn contracts.

· Argentina producers sold 75.7% of their corn crop, leaving almost 15 million tons held by producers.

· US November corn exports came I near expectations at 96 million bushels, well below 176 million year earlier.

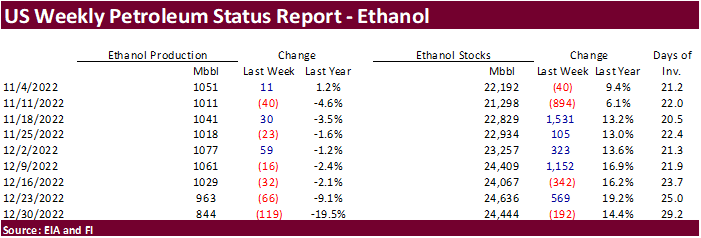

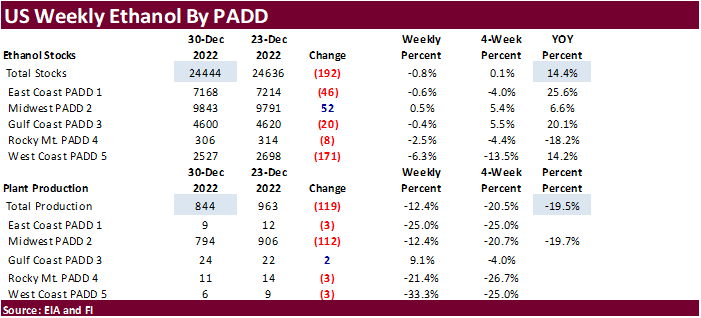

· The cold snap across the US likely slowed US ethanol production, and soybean crush. US weekly ethanol production plunged 119,000 barrels to 844,000 barrels. This was the largest weekly decrease since February 19, 2021. Ethanol production of a low 844,000 barrels was also lowest since the same date in February 2021, the height of the US Covid pandemic. The figures are way off from trade estimates. For comparison, a Bloomberg poll looked for weekly US ethanol production to be up 2,000 thousand barrels and stocks up 7,000 barrels. US plant production is down about 12 percent from a month ago and nearly 20 percent from a year ago. Early September 2022 to date cumulative US ethanol production is running 5.2 percent below the comparable period a year earlier, and 3.6% below the same period of early September 2019 to late December 2019, before the pandemic occurred. US gasoline demand was at a very low 7.514 million barrels, also lowest since mid-February 2021 and off 1.8 million barrels from the previous. On a rolling 4-week average, US gasoline demand was down about 9 percent from a year ago and off 8 percent from 2019 (pre-pandemic). US gasoline stocks fell 346,000 barrels to 222.7 million barrels.

Dow Jones: U.S. refinery activity utilization last week was just 79.6% of capacity, the EIA said, a massive 12.4 percentage-point drop from the previous week’s 92.0%, and the lowest since February 2021 when refinery activity fell to just 56%.

US DoE Crude Oil Inventories (W/W) 30-Dec: +1.694M (est +1.500M; prev +718K)

– Distillate: -1.427M (est -1.173M; prev +283K)

– Cushing: +244K (prev -195K)

– Gasoline: -346K (est -1.000M; prev -3.105M)

– Refinery Utilization: -12.4% (est -1.5%; prev +1.1%)

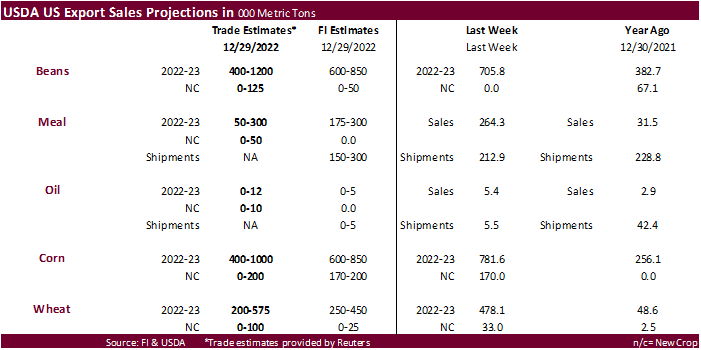

Export developments.

Updated 01/03/23

March corn $6.35-$7.10 range. May $6.25-$7.25

Soybeans

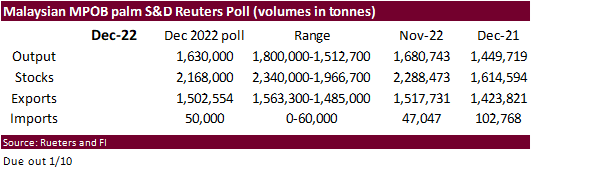

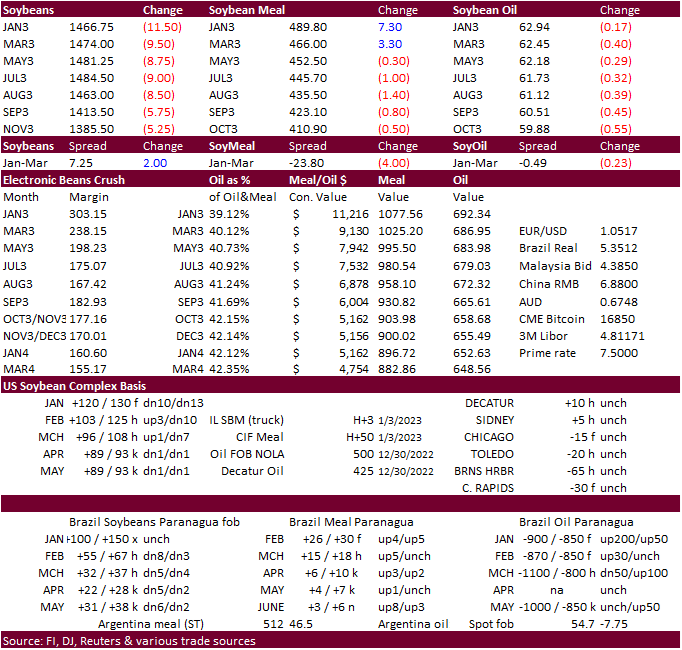

· CBOT soybeans traded lower, meal mixed, and soybean oil lower. The surge in COVID cases in China and global economic concerns continue to weigh on soybeans. Palm oil futures fell for the second straight session but estimates calling for a decline in Malaysian palm stocks at the end of December limited losses. Funds sold an estimated net 7,000 soybeans, bought 1,000 soybean meal and sold 2,000 soybean oil.

· Net drying in southern Brazil and Argentina is seen over the next six days.

· Argentine producers reportedly sold 80.1% of last year’s soybean crop, leaving about 9 million tons in farmers hands, held as a hedge against inflation. About 550,000 tons of soybeans were during the week ending December 28.

· Census reported US trade data for November. November soybean exports were 355 million, below working estimate of 360 million bushels and down from 389 million year earlier. We lowered our US soybean export estimate by 5 million bushels to 2.020 billion. November soybean oil exports were 23 million (lower than expected) and meal at 1.252 million short tons (higher than expected). We raised our meal export forecast by 50 to 13.850 million short tons.

· Earlier this week Decatur, IL, soybean meal was up about $5.00/short ton and Gulf was also higher. The barge markets were also firm. Export demand to Europe could be pretty good.

· On Wednesday evening, CBOT soybean registrations dropped 479 with ADM cancelling 229 in Quincy, Illinois, and 250 in Lincoln, Nebraska (250).

· Palm oil inventories at the end of December are seen at their lowest level since August.

· None reported

Updated 01/03/23

Soybeans – March $14.55-$15.40

Soybean meal – March $440-$490

Soybean oil – March 58.00-70.00

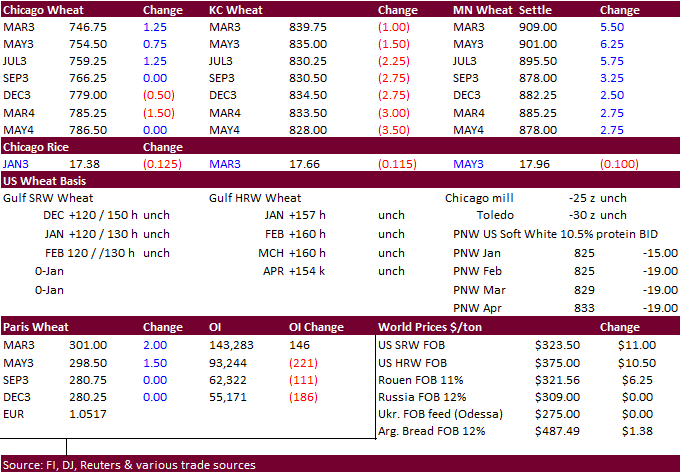

· US wheat futures traded two-sided, ending mostly higher for Chicago, lower for KC and higher for Minneapolis. The day session started higher on technical buying after plunging the last two sessions. The USD rallied today and was up 88 points by late afternoon. Funds bought an estimated net 1,000 Chicago wheat contracts.

· US all-wheat November exports were about 52 million bushels, about in line with a year ago.

· Bottom picking was seen after Chicago wheat after March futures traded around a 2-week low.

· Paris March wheat was up 2.00 euros at 301.75 euros a ton.

· The Philippines bought about 110,000 tons of feed wheat for Feb-Mar shipment. They were also in for barley.

Rice/Other

· Results awaited: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. seeks 113,460 tons of rice on December 29 from the United States for arrival in South Korea in 2023 between Feb. 1 and June 30.

Updated 01/04/23 (low end down 25-40 cents)

Chicago – March $7.00 to $8.25

KC – March 8.00-$9.40

MN – March $8.50 to $9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.