PDF Attached

USDA: Private exporters reported sales of 124,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year.

![]()

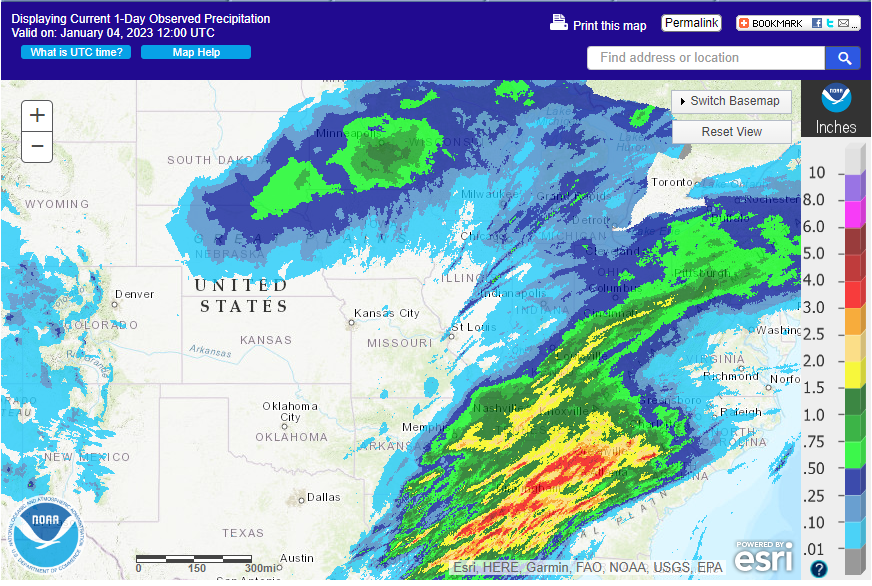

Weather

Argentina’s weather forecast turned slightly negative than that of Tuesday. Mostly dry weather is seen through Saturday. Brazil’s Santa Catarina and RGDS will see limited rain this week while the rest of the country is in good shape, with exception across parts of Mato Grosso where rain may delay harvesting progress. The Great Plains and WCB will trend drier through Friday. Eastern and central TX will see rain this weekend.

MOST IMPORTANT WEATHER FOR THE COMING WEEK

- Hot temperatures will be returning to Argentina late this week and into early next week

- Extreme afternoon readings will range from the middle 90s to 106 degrees Fahrenheit most often with a few readings of 106 to 110 – mostly in the northwest

- Argentina rainfall will be minimal through the weekend and into Monday of next week

- A frontal system will bring cooling to the nation early to mid-week next week and the contrast in temperatures will support a few showers and thunderstorms

- There will be potential for locally heavy rainfall, but most of the precipitation is expected to be brief and light

- No serious break from drought is expected even though temperatures will trend cooler for a few days during mid- to late-week next week

- Another bout of heat is expected briefly before the next frontal system arrives shortly after mid-month

- Argentina’s bottom line is not very good for bringing significant relief to the nation’s summer crop production region

- The nation will continue facing a stressful environment with too much heat and not enough moisture resulting in lower crop production potentials

- Rio Grande do Sul, Brazil along with Uruguay crop areas will experience very warm temperatures and limited rainfall for an extended period of time resulting in rising crop moisture stress and lower production potentials

- This situation is not critical, and crops have not lost much production potential thus far, but there timely rain must fall to maintain favorable production potentials.

- Most other areas in Brazil will experience a good mix of rain and sunshine during the next two weeks

- There is a rising potential for excessive moisture and flooding in Sao Paulo, southern Minas Gerais and northeastern Parana during the next ten days because of frequent heavy rain and saturated soil

- Temperatures will be near to be low normal

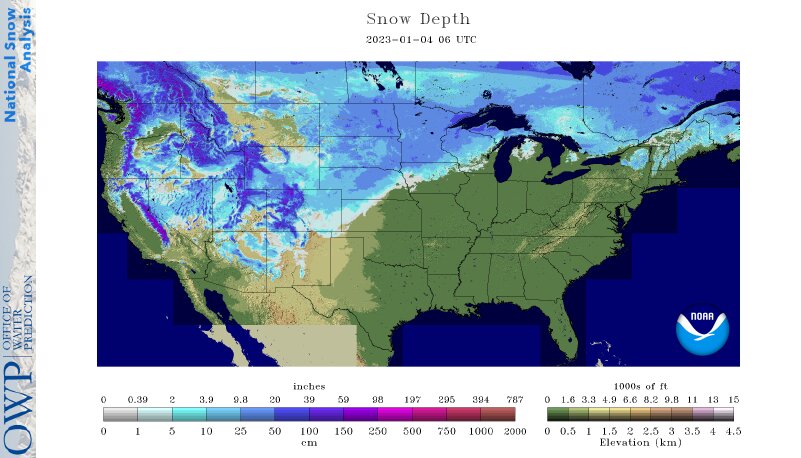

- Central U.S. snowstorm has wound down, but impressive accumulations have been reported this week

- 6 to 18 inches occurred from northeastern Colorado and far northwestern Kansas to southern South Dakota and southwestern Nebraska

- Local totals of 18-27 inches occurred from central Nebraska to southeastern South Dakota

- Moisture content in the snow varied from 0.30 to 0.75 inch with a few areas getting more than 1 inch of moisture

- Frost in the ground may limit the moisture penetration potential into the soil when the snow melts

- Additional snow will impact the upper U.S. Midwest today into Friday with another 2 to 8 inches of accumulation expected from eastern South Dakota to upper Michigan

- Snowfall of 1 to 3 inches will also occur in Iowa, northern Illinois, northern Indiana and Lower Michigan by Friday afternoon

- An impressive storm system will be impacting northern and central California and a part of both the Pacific Northwest and the Great Basin over the next ten days

- Excessive rainfall and impressive mountain snowfall is expected resulting in some flooding in the northern California

- Improved runoff potential will occur in northern and central California that may raise water reservoir levels in the spring and summer

- If the wet bias can continue periodically into spring there may be some potential for water restrictions to be reduced for agricultural areas, but that will not happen before spring

- U.S. hard red winter wheat production areas will not receive much precipitation in the next ten days – especially not from central Kansas to the Texas Panhandle where it has been driest for the longest period of time

- Precipitation in the Midwest will be light over the next ten days maintaining favorable soil moisture, but greater precipitation is needed to improve river and stream flows in some areas

- Moisture totals of 0.05 to 0.50 inch will occur over the next ten days in Midwest while the Tennessee River Basin and Delta will get 0.40 to 1.50 inches of moisture and locally more

- The southeastern states will experience some precipitation, but most of it will not be very great

- U.S. temperatures during the next two weeks will be warmer than usual in the central and especially the eastern states

- Temperatures in the west will be a little cooler biased for a while this week before warming slightly above normal during the weekend and next week

- West Texas will also be mostly dry, especially in the high Plains region

- Northwestern U.S. Plains will receive minimal amounts of rain and snow in this next ten days and the light precipitation may continue through Jan. 18.

- Canada’s Prairies will experience limited precipitation and warmer than usual temperatures during the next week to ten days

- Cooling is expected in western parts of the CIS this week with temperatures falling well below normal late this week through much of next week

- Bitter cold temperatures are expected, but most of the impacted area will be covered in snow to protect wheat and rye from subzero degree Fahrenheit low temperatures

- Europe weather this week will continue wet across the North and Baltic Sea regions and from there through the Baltic Plain into western Russia, Belarus and northern Ukraine where moisture totals of 0.50 to 1.50 inches will result

- Southern Europe will trend drier than usual through this workweek

- A wetter bias is expected to impact all of Europe next week with the exception of central and eastern Spain and the southernmost Balkan Countries where precipitation will be less than 0.50 inch keeping soil moisture lighter in those areas relative to the remainder of Europe

- China precipitation will continue restricted through the weekend

- Precipitation will increase across east-central China during the middle to latter part of next week

- East-central parts of the nation may be wettest, and some significant snow may accumulate, although confidence in the changes advertised is low

- India is expected to continue mostly dry over the next ten days with the exception of a few far northern and extreme southern parts of the nation where some periodic showers are possible

- A few showers might also occur briefly and without significance in east-central parts of the nation in the next few days

- The bulk of India’s winter crop region needs precipitation to support the best yield potentials

- Winter crops will begin reproducing in the last days of January and February.

- Precipitation is not expected to be as abundant as it has been in recent past winters

- Turkey will be drier than usual over the next week, but December was wetter biased in many areas and that lingering moisture in the soil should maintain favorable crop and field conditions for a while

- Some increase in precipitation is expected next week

- North Africa weather remains drier than usual with little prospect for rain over the next ten days

- East-central Africa precipitation is expected to be abundant in Tanzania over the next ten days to two weeks while that which occurs in Uganda, southwestern Kenya and Ethiopia is more sporadic and light.

- Coffee and cocoa conditions should remain favorable in all production areas, despite the anomalies

- South Africa weather will continue to be favorably mixed over the next two weeks supporting normal summer crop development

- West-central Africa dryness will continue through the next ten days to two weeks

- Dry conditions are normal at this time of year

- No excessive heat is expected in this coming week, although warmer than usual conditions may begin to evolve a week from now and continue into January 10.

- Indonesia, Malaysia and the Philippines rainfall has been and will continue to be erratic with pockets of excessive rain and local flooding expected to continue for a while

- Weekend precipitation was greatest in parts of Java where more than 8.00 inches occurred in a couple of locations

- More than 5.00 inches of rain fell in northeastern Luzon Island, Philippines

- Philippines rainfall may be abundant excessive at times in the coming ten days to cause some threat of damaging floods

- Lower coastal areas of Vietnam may be vulnerable to flooding rain from through the weekend

- Personal property and some agricultural areas may be negatively impacted by the excessive rainfall

- Australia winter and summer crop areas are unlikely to get much precipitation during the coming week

- The environment will be good for fieldwork, including late season harvest progress in southern winter crop areas

- Rain is needed in interior east-central portions of the nation, although the situation is not a crisis

- Unirrigated sorghum, cotton and other crops will need rain soon especially with temperatures trending hotter

- Some increase in precipitation is expected in the east next weekend and into the following week

- Rain is expected in parts of the Middle East this week, although the resulting precipitation should be mostly light to locally moderate

- Iran, Iraq, Saudi Arabia and Afghanistan will be wettest

- Today’s Southern Oscillation Index was +19.62today and it will likely stay strongly positive over the next few days due to the presence of two tropical low pressure systems in northern Australia near Darwin that will thwart the index anomalously high

Source: World Weather INC

- No major event scheduled

Thursday, Jan. 5:

- Census Trade Balance

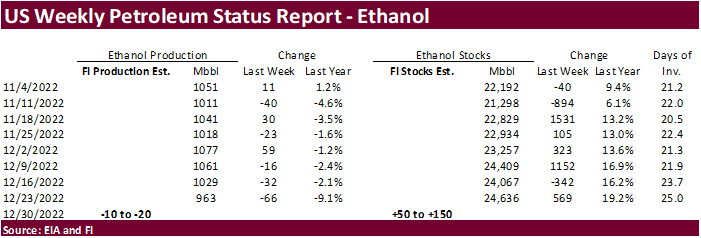

- EIA weekly US ethanol inventories, production

- Port of Rouen data on French grain exports

- Malaysia’s Jan. 1-5 palm oil exports

Friday, Jan. 6:

- FAO Food Price Index

- Net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

Macros

US ISM Manufacturing Dec: 48.4 (est 48.5; prev 49.0)

– Prices Paid: 39.4 (est 42.9; prev 43.0)

– Employment: 51.4 (prev 48.4)

– New Orders: 45.2 (prev 47.2)

US JOLTS Job Openings Nov: 10.458M (est 10.050M; prev R

108 Counterparties Take $2.230 Tln At Fed Reverse Repo Op (prev $2.188 Tln, 99 Bids)

US MBA Mortgage Applications Dec 30: -10.3% (prev -0.9%)

US MBA 30YR Mortgage Rate Dec 30: 6.58% (prev 6.34%)

US, Taiwan To Hold Trade Talks Jan. 14-17

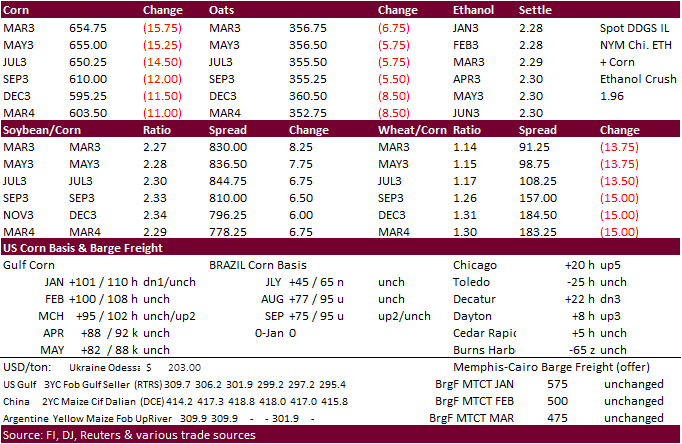

· CBOT corn futures traded lower from sharply lower WTI crude oil and wheat. March corn saw its largest daily loss since August 29, and the contract today hit a December 21 low. Most of the selling today was technical. The USD was lower. The upper Midwest will see precipitation (snow) through Thursday.

· WTI crude oil fell sharply on Wednesday over global demand concerns (2023 recession?) and the surge in China COVID cases possibly slowing that countries reopening. Meanwhile, OPEC is expected to show an increase in December mineral oil output, according to news surveys.

· The Czech Republic reported a bird flu outbreak on a poultry farm west of Prague, resulting in the culling of 750,000 hens, largest outbreak recorded for that country.

· The USDA EPA opened comments to its RFS draft, closing March 6. Comments will provide congress an update on the impacts of the environmental and resource conservation impacts of RFS.

· The USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed up 1 percent. Cumulative placements from the week ending January 8, 2022, through December 31, 2022 for the United States were 9.79 billion. Cumulative placements were up 2 percent from the same period a year earlier.

Export developments.

Updated 01/03/23

March corn $6.35-$7.10 range. May $6.25-$7.25

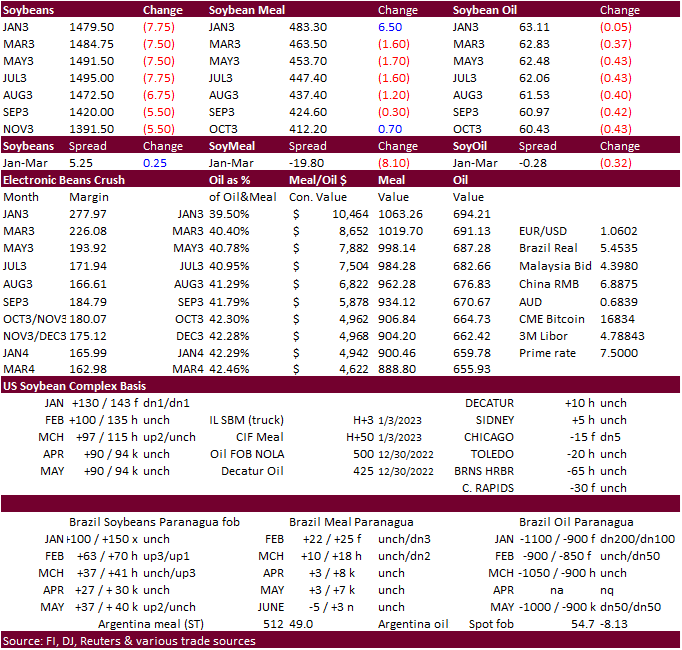

· The non-expiring CBOT soybean complex traded lower on another day of risk off trading across the commodity space. WTI crude oil was down sharply and this weighted on agriculture markets. Soybeans and meal did see a two-sided trade. Argentina weather concerns supported those markets earlier.

· March soybeans hit a June 17 high on Friday and now the contract is back below $15.00. March soybean meal could test a support level of $455. Soybean oil price influence, in our opinion, will remain largely tied to the mineral oil market over the short term.

· USDA announced 124,000 tons of soybeans sold to unknown for 2022-23 delivery. Traders ignored the sales after it was later rumored Brazil was selling soybeans for February shipment.

· Thursday Census will release US trade data for November. We have a working estimate of 360 million bushels, slightly above October but down from 389 million year earlier.

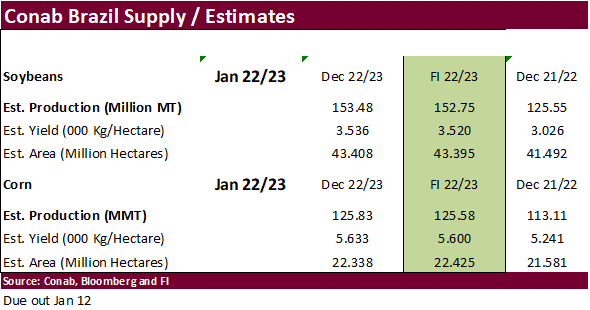

· Brazil’s Parana soybean crop conditions fell 10 points for the good and excellent categories from the previous week to 80 percent. Deral pegged production for the state at 21.4 million tons versus 12.3 million tons year earlier.

· South Korea’s state-backed Agro-Fisheries & Food Trade Corp. bought about 6,000 tons (25,000 sought) of GMO-free food-quality soybeans, optional origin for arrival between December 2023 and June 2024.

· USDA announced private exporters reported sales of 124,000 tons of soybeans for delivery to unknown destinations during the 2022-23 marketing year.

Updated 01/03/23

Soybeans – March $14.55-$15.40

Soybean meal – March $440-$490

Soybean oil – March 58.00-70.00

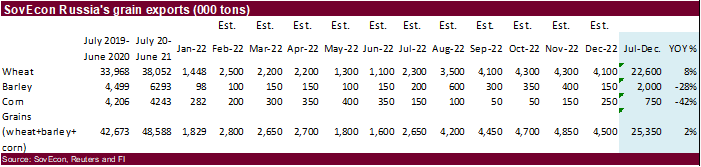

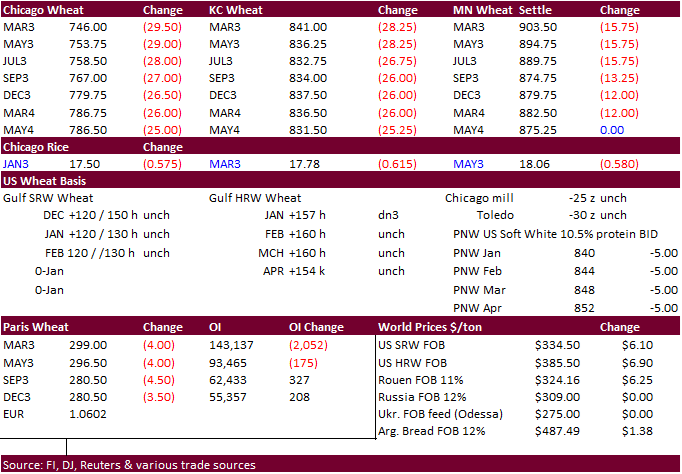

· US wheat futures extended losses from ongoing Russia competition and strong December Western Australia wheat exports. CBH Group (Western Australia) shipped 2.18 million tons of grain during December, up from previous record of 1.89 million tons for that month. SovEcon predicted Russia will export 21.3 million tons during the first half of 2023, a record. They see January shipments for wheat at least at 3.6 million tons. US wheat inspections were poor last week.

· The US Great Plains was mostly dry from late yesterday. Snowfall coverage for the central GP did improve over the last three days.

· Egypt will now allow GASC to contract directly with governments for wheat and vegetable oils. Previously they were allowed to contract with registered suppliers, companies, and the other selected entities like the World Bank. It appears they are extending their list to buy wheat directly from Russia and/or other countries. Since August, all but one cargo of wheat they bought was of Russian origin, from what we know was publicly reported.

· Bloomberg noted some ship insurers have altered their insurance policies, for the Black Sea region, for 2023 to exclude claims due to the war in Ukraine.

· SovEcon reported Russian wheat with 12.5% protein content from Black Sea ports were unchanged last week at $307-$311 per ton.

· Paris March wheat was 4.00 euros lower earlier at 589.50 euros a ton.

· Thailand bought about 75,200 tons of feed wheat today for April 1-20 shipment at $345/ton c&f, optional origin.

· Tunisia seeks 100,000 tons of soft milling wheat and 75,000 tons of barley on January 5, all optional origin. The wheat is sought for shipment between Jan. 10 and March 5, 2023, and barley between Jan. 10 and Feb. 28, 2023.

· The Philippines seek 110,000 tons of feed wheat on January 5 for Feb-Mar shipment. They are also in for barley.

Rice/Other

· Results awaited: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. seeks 113,460 tons of rice on December 29 from the United States for arrival in South Korea in 2023 between Feb. 1 and June 30.

Updated 01/04/23 (low end down 25-40 cents)

Chicago – March $7.00 to $8.25

KC – March 8.00-$9.40

MN – March $8.50 to $9.75

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.