Wild

start to 2021 is not all that surprising since 2020 ended with an explosive week. Corn snapped a long consecutive bull run by closing slightly lower in the nearby. All major CBOT ag markets were higher to start on South American weather and Argentina economic

concerns, but as a new month and new quarter tend to bring new money, so did a new tax year that brought heavy producer selling.

CHANGES

OVERNIGHT AND MOST IMPORTANT ISSUES

- Weekend

rainfall improves topsoil moisture in parts of Cordoba, San Luis and Santiago del Estero, Argentina - Recent

rainfall in other parts of Argentina induced small pockets of improved topsoil moisture - Many

crop areas in Argentina still have short to very short top and subsoil moisture - Brazil’s

latest soil assessment shows good soil moisture from much of Mato Grosso through many areas in Goias and central and eastern Mato Grosso do Sul to Parana, Santa Catarina, Sao Paulo and central and southern Minas Gerais - Dryness

is a concern in northeastern Brazil, although some relief is coming later this week and next week to a part of that region - Rio

Grande do Sul has begun to dry down and more drying is expected - China

will experience some very cold temperatures during the middle to latter parts of this week and possibly again during mid-week next week - Thursday

will be coldest this week with extreme lows in the positive and negative single digits Fahrenheit near and north of the Yellow River with little to no snow on the ground - Winterkill

is not very likely, but the situation will be closely monitored because of temperatures near the damage threshold

- Sufficient

hardening has occurred over the past week and through the first part of this week to help limit the potential for permanent damage - Flooding

rain has occurred during the past few days in Peninsular Malaysia and a part of the Philippines resulting in some damage to personal property and agriculture - More

than 14.00 inches of rain fell in the first three days of this year in parts of Peninsular Malaysia resulting in serious flooding - Flooding

will continue periodically, but there should be enough of a reduction in rain intensity to reduce the severity of the flooding that has occurred recently - Waves

of rain and snow will finally reach Russia’s Southern Region and some immediate neighboring areas Thursday through most of next week - The

moisture will help increase soil moisture for use in the spring, although some of the precipitation will fall as snow may not reach into the soil until warming occurs - No

threatening cold will impact winter crop areas in the western CIS through the next ten days to two weeks

DETAILS

OF WEATHER AROUND THE WORLD

- Argentina

rainfall Thursday into this morning was limited to the far west from San Luis to Santiago del Estero where rainfall varied from 0.12 to 0.84 inch most often - Local

totals to 1.50 inches occurred in Santiago del Estero and to 1.92 inches in San Luis.

- Dry

weather occurred elsewhere, and temperatures were warm - Highest

afternoon temperatures Thursday through Saturday were in the 90s Fahrenheit with an extreme of 102 at Bahia Blanca in southwestern Buenos Aires and 104 in west-central Santiago del Estero - Lowest

morning temperatures were in the upper 40s and 50s in the far south and in the 50s and 60s in most other areas - A

few warmer readings occurred in Formosa - Argentina

weather will not change much through Saturday, although a few thunderstorms will occur today in southern and western Buenos Aires and La Pampa while continuing in San Luis, Cordoba and Santiago del Estero.

- Rain

totals this week will range from 0.20 to 0.80 inch except in west-central areas where 0.60 to 2.00 inches will result - Heavy

rain will fall in Salta - Net

drying is expected in all other crop areas including the key grain and oilseed production areas in the heart of the nation - Temperatures

will be seasonably warm, but not hot - Argentina

weather next week will include scattered showers and thunderstorms in some of this week’s driest areas, but no general soaking of rain is expected - Daily

rainfall will vary from 0.15 to 0.60 inch with coverage eventually reaching close to 85%, but day to day rainfall may not have nearly as great of coverage and intensity as that needed to seriously change soil moisture and crop conditions - Temporary

relief is expected and there will be a few pockets of 1.00 to 2.00-inch rainfall - Many

areas from eastern Buenos Aires through eastern Santa Fe and Entre Rios may struggle to get enough rain to counter evaporation leaving crops stressed

- Argentina’s

greatest rain will fall in the west where another 0.50 to 1.50 inches is possible during the week next week - Temperatures

will continue a little warmer than usual - Argentina’s

bottom line will remain one of concern for central and eastern crop areas in the nation where rainfall will be quite limited over the coming week with some relief occurring temporarily next week. Temperatures will continue warm biased, as well. Some crop improvements

are expected from Salta through Santiago del Estero and portions of Cordoba to San Luis

- Brazil’s

weather pattern did not change greatly during the holiday weekend - Showers

and thunderstorms maintained favorable crop and field moisture from parts of Mato Grosso through portions of Goias to Minas Gerais and some northern Sao Paulo locations - Rain

also fell in Parana and a few eastern Paraguay locations - Amounts

in each of these areas varied from 0.40 to 1.35 inches with local totals to more than 2.00 inches - As

much as 3.74 inches of rain fell in eastern Minas Gerais - Net

drying occurred elsewhere in the nation with Bahia, northern Minas Gerais, Rio Grande do Sul, Santa Catarina and southern Paraguay reporting little to no rain along with parts of Mato Grosso do Sul - Highest

temperatures during the weekend were in the 80s and lower 90s Fahrenheit except in Mato Grosso, Tocantins, northern Minas Gerais and western Bahia where upper 90s to readings near 100 were noted - Brazil’s

weather is not expected to change greatly, although rain and thunderstorms will reach most crop areas at one time or another during the next two weeks - Resulting

rainfall is expected to be erratic and some areas will not get enough rain to counter evaporation while others will be plenty wet - Southern

and parts of eastern Mato Grosso may not receive much rain in this first week of the outlook with 0.40 to 1.50 inches resulting - Bahia,

eastern Piaui, Pernambuco and northeastern Minas Gerais will not receive enough rain to counter evaporation - Most

other areas will receive 0.65 to 2.50 inches of rain through Sunday with locally more

- Week

2 rainfall (Jan. 11-17) will scatter across a large part of Brazil with the week’s total moisture varying from 0.60 to 2.00 inches and locally more - Driest

in Rio Grande do Sul, southern Paraguay and a few far northeastern Brazil locations - Temperatures

will be seasonable with highs in the 80s and lower to a few middle 90s most days followed by lows in the 50s and 60s south and the 60s and lower 70s north - A

few extreme highs near 100 will occur in the drier areas - Brazil’s

bottom line should remain mostly favorable for its reproducing and filling soybean and corn crops. Sugarcane, citrus and coffee will also experience improving conditions as will cotton and rice. The environment will be good for production, but some of the

dryness from earlier this year already hurt production and some of that loss cannot be made up by improved weather in January.

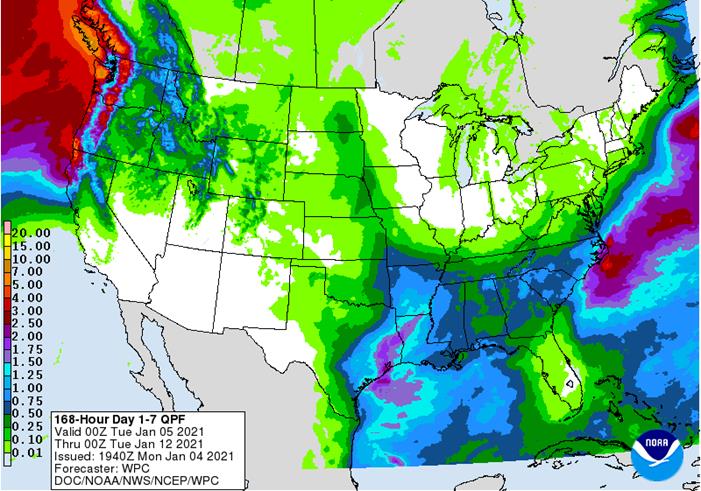

- U.S.

weather during the holiday weekend was abundantly moist across the Midwest, Delta and southeastern states - Moisture

totals from rain, snow, freezing rain and sleet varied from 0.20 to 0.85 inch with many amounts of 1.00 to 1.30 inches in the Midwest and 1.00 to 2.00 inches in the Delta

- Rain

totals in the southeastern states ranged from 0.80 to 2.00 inches with local totals of 2.00 to 3.58 inches from eastern Georgia to eastern North Carolina while varying from 2.00 to 4.50 inches in southern Georgia and northern Florida

- A

few reports of tornadoes were received in the southeastern states - Snow

accumulations of 3 to 6 inches occurred from parts of Texas through central Oklahoma and eastern Kansas to central and northern Illinois, northern India and Michigan - Local

snow totals reached 14 inches at Big Springs, Texas while up to 8 inches occurred in central Oklahoma, central Illinois and northeastern Indiana - Heavy

snow also fell in northern New England with upwards to 13 inches - Very

little precipitation occurred in the northern or west-central high Plains, the southwestern states or Great Basin while the Pacific Northwest reported abundant rain and mountain snow in western Washington and western Oregon

- Temperatures

in the central and eastern U.S. were trending warmer again during the holiday weekend after briefly cooling down following the snow and rain event late last week - U.S.

weather is expected to include a series of weather systems that will move through the Midwest, Delta and Atlantic Coast states the next two weeks - Moisture

totals in the coming ten days in the southern Plains, Delta and southeastern states will vary from 0.50 to 1.50 inches and a few greater amounts

- Central

Midwest precipitation amounts will vary from 0.10 to 0.65 inch with lighter amounts in the north and greater amounts in the far west - Moisture

totals in the northern and central Plains will vary from 0.15 to 0.35 inch

- Frequent

precipitation in the Pacific Northwest will maintain wet conditions along the coast from northern California to western Washington as well as in the northern Rocky Mountains

- Some

beneficial moisture will also impact the Colombia and Snake River Basins - Dry

conditions will prevail in the southwestern states - U.S.

hard red winter wheat areas will not get abundant precipitation, but a few brief bouts of very light precipitation will occur; the high Plains region will continue driest - U.S.

temperatures this week will be warmer than usual in the north-central through northeastern states and more seasonable elsewhere in the nation. Cooling is expected next week in portions of the west and northern states - Waves

of rain and mountain snow will fall across the Sierra Nevada with periods of rain in northern California over the next two weeks - The

precipitation will help improve soil moisture and mountain snowpack for better crop use in the spring - Snowpack

in the Sierra Nevada is well below average running close to the record low of 2014, but that will soon change - China

weather over the past few days was non-threatening, although quite cold in the northeast; precipitation was minimal - Australia

reported significant rain in summer crop and some livestock areas of New South Wales during the extra-long holiday weekend - Rainfall

of 1.00 to 2.16 inches occurred in north-central New South Wales while 0.20 to 0.84 inch occurred in other parts of the state - Queensland

was more limited with amounts mostly under 0.50 inch and some grain and cotton areas staying completely dry - A

spot or two in southern Queensland received up to 1.07 inches of rain - Rain

was abundant in the Cape York Peninsula and the upper Pacific Coast benefiting sugarcane - Local

rain totals reached 9.37 inches near Townsville, Queensland - Most

summer crop temperatures were seasonable - Australia

weather this week will generate a few showers and thunderstorms especially in the early to middle part of this week

- Rainfall

will vary from 0.65 to 1.50 inches with a few amounts to 3.00 inches in grain and cotton areas - Heavier

rain is expected along the upper coast especially near the Townsville area where flooding may result from rain totals that could reach above 10.00 inches by Thursday and more of the same could occur into the weekend - Flooding

of some sugarcane and mining areas is possible - The

weekend and early part of next week will trend drier and warmer with some hot temperatures away from the east coast - Rain

in northern India this week will bolster topsoil moisture for improved winter wheat and other crop conditions - Moisture

totals will vary from 0.30 to 1.00 inch with a few totals to 1.25 inches - Greater

amounts may occur from eastern Uttaranchal to southwestern Jammu and Kashmir where multiple inches may result - Showers

will also occur periodically in southern India slowing harvest progress in rice, sugarcane, cotton and some groundnut areas

- India’s

wetter bias in the south may last through much of next week while a few more showers may pop up in central parts of the nation briefly Friday through Sunday - India

weather during the weekend already brought some rain from northern areas from eastern Rajasthan and northern Uttar Pradesh through Haryana and Punjab to Jammu and Kashmir benefiting winter crops

- Some

rain also fell in the far south of India - Additional

frost and a few freezes occurred in northern India Thursday morning, but no permanent harm came to any winter crops - South

Africa received rain in central production areas during the holiday weekend - Rain

totals varied from 1.00 to 2.13 inches in southern and western Natal, eastern Free State and central North West - A

few areas of greater rain were noted - Most

other areas did not receive enough rain to counter evaporation and net drying resulted especially in the east - Highest

afternoon temperatures were in the 80s and lower 90s Fahrenheit in key summer crop areas - South

Africa temperatures in this coming week will be near average and rainfall will be near to above average with most all summer crop areas impacted - Moisture

totals will vary from 0.75 to 2.50 inches this week with a few local amounts as great as 4.00 inches

- Additional

showers and thunderstorms will occur next week keeping most summer crop areas favorably moist and poised to produce well - Southeast

Asia rainfall during the New Year’s holiday was widespread in central and southern Philippines with some flooding rainfall suspected - Mainland

areas of Southeast Asia reported very little rain - Heavy

rain and flooding occurred from Singapore into eastern Peninsular Malaysia where 7.00 to more than 12.00 inches resulted in some flooding - Flooding

rain may have also occurred in central Sulawesi - Rain

will continue to fall frequently in Philippines, Indonesia and Malaysia during the next two weeks; additional flooding will be possible - Western

Russia and Ukraine were plenty moist during the weekend with additional waves of rain and snow noted - Moisture

totals varied from 0.05 to 0.40 inch with a few totals to 1.00 inch in Belarus and to 0.75 inch in western Russia - Snow

depths increased in western Russia - Mostly

dry conditions occurred in Russia’s Southern Region, lower Volga River Basin and Kazakhstan - No

threatening cold occurred in winter crop areas in the western CIS, although bitter cold was common in the eastern New Lands where extreme lows fell to -42 Celsius

- Europe

will remain plenty moist over the next two weeks with frequent waves of rain and mountain snow anticipated

- The

Mediterranean countries will be wettest with frequent bouts of rain and mountain snow expected - France

and the U.K. will receive the lightest and least frequent precipitation, but they are plenty moist today - Some

precipitation will continue from Germany into Belarus and western Ukraine maintaining favorable soil moisture for use in the spring - Temperatures

will be mild to cool in the west and warm in the east - Much

needed rain will fall in Morocco and some Algeria locations this week easing long term dryness in some areas - Southwestern

Morocco has been driest and has the greatest need for rain - This

event will bring some relief to the region, but follow up rain will still be needed - Northwestern

Algeria is also drier than usual and will benefit from any rain that evolves

- West

Africa rainfall will remain mostly confined to coastal areas while temperatures in the interior coffee, cocoa, sugarcane, rice and cotton areas are in a seasonable range for the next ten days - East-central

Africa rainfall will continue limited in Ethiopia as it should be at this time of year while frequent showers and thunderstorms impact Tanzania, Kenya and Uganda over the next ten days - Southern

Oscillation Index remains very strong during the weekend and was at +17.98 today which is the highest this index has been in the current La Nina episode - Mexico

and Central America weather will continue to generate erratic rainfall - Far

southern Mexico and portions of Central America will be most impacted by periodic moisture - Canada

Prairies will remain unseasonably warm this week, but will trend colder during the weekend and next week - Southeast

Canada will receive less than usual precipitation this week and temperatures will continue a little warmer than usual

Source:

World Weather Inc. and FI

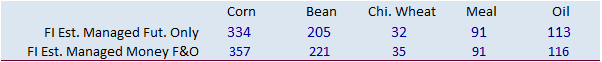

USDA

inspections versus Reuters trade range

Wheat

324,983 versus 300000-500000 range

Corn

912,802 versus 750000-1300000 range

Soybeans

1,305,786 versus 1000000-2000000 range

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 31, 2020

— METRIC TONS —

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/31/2020 12/24/2020 01/02/2020 TO DATE TO DATE

BARLEY

0 3,193 0 20,944 16,760

CORN

912,802 1,255,341 550,930 14,908,437 8,603,108

FLAXSEED

0 24 0 461 396

MIXED

0 0 0 0 0

OATS

0 0 0 2,393 2,295

RYE

0 0 0 0 0

SORGHUM

82,687 257,467 67,460 2,271,696 937,434

SOYBEANS

1,305,786 2,201,907 1,039,675 38,542,542 21,820,516

SUNFLOWER

0 0 0 0 0

WHEAT

324,983 406,975 420,653 14,859,935 14,907,290

Total

2,626,258 4,124,907 2,078,718 70,606,408 46,287,799

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

Brazil

selected commodities exports:

Commodity

December 2020 December 2019

CRUDE

OIL (TNS) 5,442,921 8,539,668

IRON

ORE (TNS) 33,165,506 24,990,225

SOYBEANS

(TNS) 274,082 3,269,636

CORN

(TNS) 5,006,035 4,164,806

GREEN

COFFEE(TNS) 254,552 189,831

SUGAR

(TNS) 2,983,359 1,437,471

BEEF

(TNS) 142,524 148,767

POULTRY

(TNS) 350,857 364,658

PULP

(TNS) 1,276,018 1,205,654

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

377,636 79,749 402,096 2,546 -754,343 -77,584

Soybeans

174,943 -3,300 173,087 -6,571 -343,790 15,003

Soyoil

89,072 11,494 125,015 1,624 -233,322 -10,308

CBOT

wheat -10,218 11,322 131,921 -1,239 -106,329 -9,365

KCBT

wheat 33,865 3,068 70,347 -60 -104,909 -4,111

=================================================================================

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

332,045 66,330 239,790 -4,101 -714,432 -72,932

Soybeans

196,487 7,864 92,865 -7,836 -336,247 15,728

Soymeal

89,487 6,102 69,726 2,372 -208,306 -5,256

Soyoil

112,989 11,736 88,376 -80 -242,531 -9,265

CBOT

wheat 13,360 7,126 78,289 -2,876 -93,233 -7,592

KCBT

wheat 55,560 4,016 40,824 -3,270 -98,716 -574

MGEX

wheat 3,933 1,513 3,247 514 -15,505 -3,168

———- ———- ———- ———- ———- ———-

Total

wheat 72,853 12,655 122,360 -5,632 -207,454 -11,334

Live

cattle 49,001 1,303 66,972 -748 -127,904 1,471

Feeder

cattle 3,726 368 7,637 -29 -3,718 497

Lean

hogs 33,770 916 50,256 1,142 -79,293 -2,532

US

Markit Manufacturing PMI Dec F: 57.1 (est 56.3; prev 56.5)

US

Construction pending (M/M) Nov: 0.9% (est 1.0%; prev 1.3%)

Fed’s

Evans: US Economy Should Prepare For Period Of Very Low Interest Rates, Expansion Of Central Bank’s B/Sheet

–

Sees Coronavirus Crisis Brought Under Control ‘As Year Progresses’

–

Downward Bias To Infl. Expectations From Proximity To ZLB Is ‘Serious Problem’

–

Will Likely Take Years To Get Inflation Up To 2% On Avg; Policy To Be Accommodative ‘For A Long Time’

–

Rates Seen Low For Long Period, Fed Likely To Continue Asset Purchases For A While As Well

–

Should Not Rush To Raise Rates Unless Inflation Threatens To Be Uncomfortably High

–

Policy Should Not Put Benefits Of Strong Labour Mkt At Risk If Inflation Is Quiescent

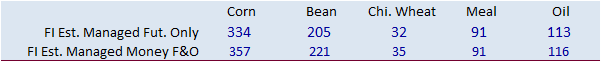

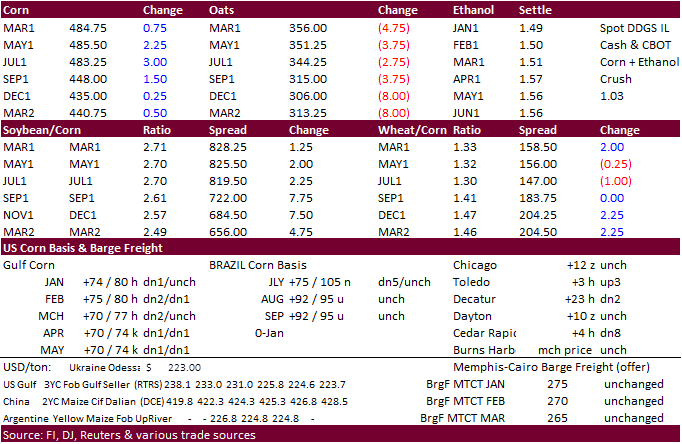

Corn.

-

CBOT

corn traded sharply higher overnight with the rolling nearby contract reaching a May 2014 high, only to end mixed. March snapped a 14 session winning streak. Earlier we heard Argentina export restrictions were affecting corn offers beyond March but didn’t

hear much in the way of Argentina news during the rest of the session. Producer

selling was a feature. For US 2020 crops, soybean producers are near 70-80% sold, and corn is near 60-70%. Several producers have new-crop (September) corn positions on as well. Some locations have corn basis around 20 over in southern locations versus 20

under for what it normally is around this time of year. -

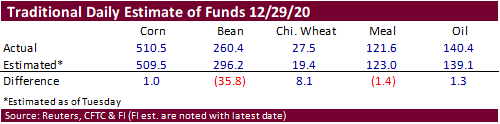

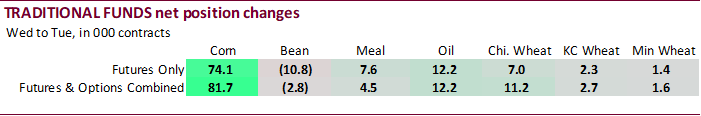

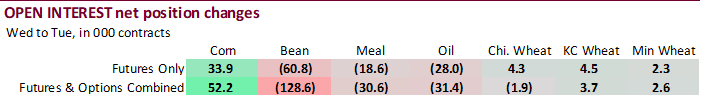

Funds

were even in corn. -

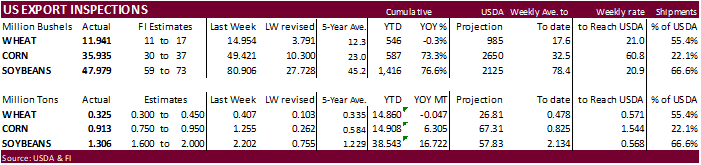

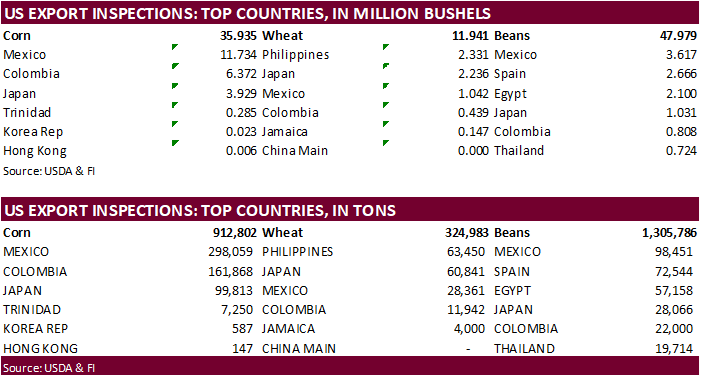

USDA

US corn export inspections as of December 31, 2020 were 912,802 tons, within a range of trade expectations, below 1,255,341 tons previous week and compares to 550,930 tons year ago. Major countries included Mexico for 298,059 tons, Colombia for 161,868 tons,

and Japan for 99,813 tons. -

StoneX

Brazil survey-based production lowered their soybean estimate to 132.64 million soybeans from 133.9 million previously. Corn was unchanged at 109.34 million tons. -

China

plans to increase its corn planted area across the main growing regions in efforts to reverse several years of contraction. They will focus on expanding corn acreage in the northeast as well as areas around the Yellow, Huai and Hai rivers. China planted

41.264 million hectares of corn in 2020, yielding 260.67 million tons. Note last week China’s National Energy Administration (NEA) warned local provinces to use more ethanol.

-

France’s

Bird Flu Outbreak Rises to 61 Cases as of Jan. 1 (Bloomberg) -

Vietnam

pork prices hit a 20-year record high in 2020. 6 million pigs were culled last year.

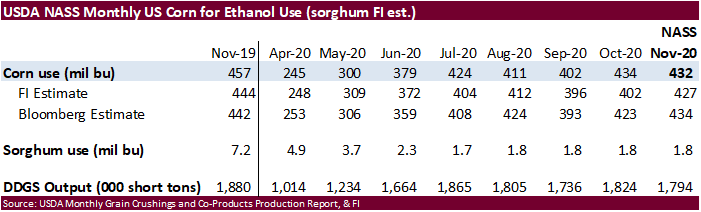

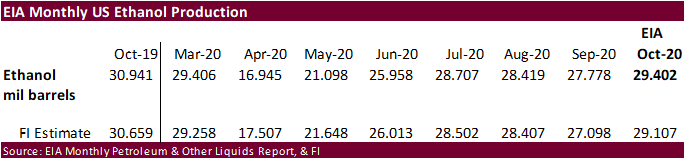

US

monthly EIA ethanol production came in slightly better than expected. We remain at 5.150 billion bushels of corn use, 50 above USDA.

Corn

Export Developments

-

Qatar

seeks 100,000 tons of bulk barley on January 12.

- Qatar

seeks 640,000 cartons of corn oil on January 12.

Updated

12/29/20

March

corn is seen

trading in a $4.35 and $5.00 range

-

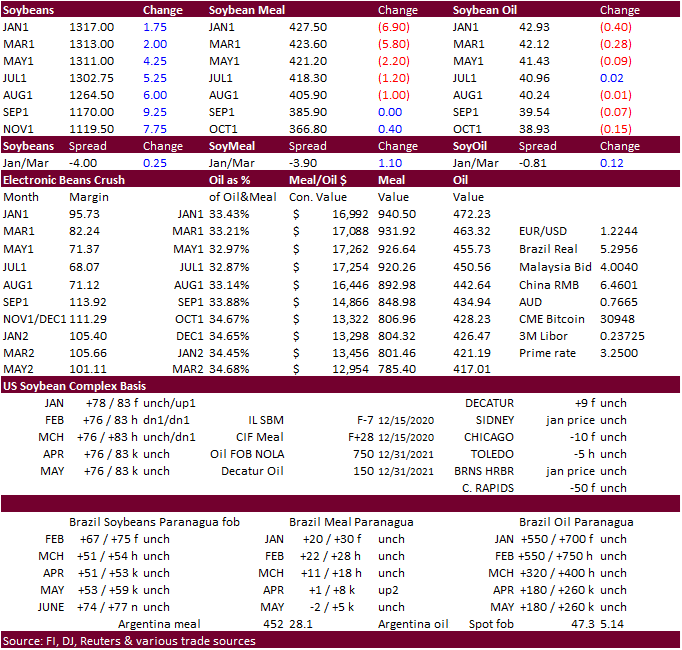

CBOT

soybeans ripped higher Sunday night on concerns over Argentina transportation disruptions and ongoing South America dry weather conditions (hit a July 2014 high) but collapsed on fund and producer selling. They ended higher despite soybean meal ending lower

in the front four months led by expiring January contract. Soybean oil followed the same path as soybean meal. As a result, we saw a wide range in the March crush of 81.75-104.00, ending around 82.75.

-

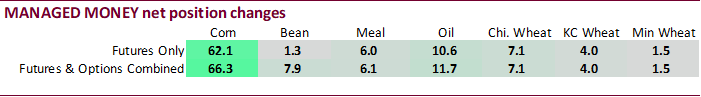

Soybeans

could slightly gain on corn tonight after the COT report showed a less than expected long position in soybeans and extremely long traditional fund position in corn.

-

Funds

were net buyers of 5,000 soybean contracts, sellers of 5,000 soymeal contracts, and sellers of 2,000 soybean oil contracts on the session.

-

Eastern

Argentina missed out on rains over the weekend with precipitation limited to the western areas. Southern and western Buenos Aires and La Pampa will see a few rain events today and continue into San Luis, Cordoba and Santiago del Estero thereafter. Argentina

weather this week will include scattered showers and thunderstorms. Brazil saw scattered showers over the long holiday weekend. Brazil will see rain on and off over the next two weeks. Some areas will not receive adequate rainfall including the southern

and eastern Mato Grosso, Bahia, eastern Piaui, Pernambuco and northeastern Minas Gerais.

-

USDA

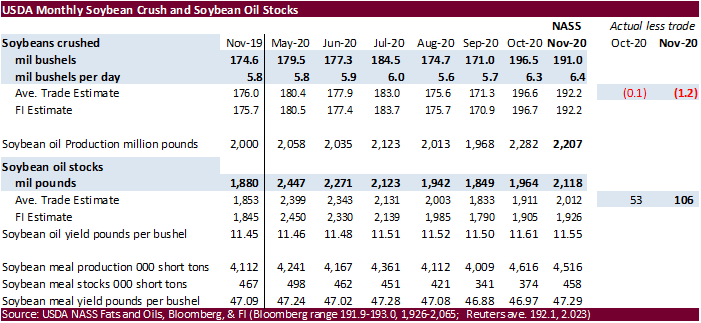

NASS US crush showed a slightly less than expected crush rate for the month of November. Table is below. We do not see much of a market impact.

-

USDA

US soybean export inspections as of December 31, 2020 were 1,305,786 tons, within a range of trade expectations, below 2,201,907 tons previous week and compares to 1,039,675 tons year ago. Major countries included Mexico for 98,451 tons, Spain for 72,544 tons,

and Egypt for 57,158 tons. -

Looking

ahead, USDA will release its December 1 grain stocks report and crop annual on January 12. Based on the latest NASS data, we need a day to adjust our December 1 grain stocks estimates.

-

Earlier

nearby rolling soybean meal reached its highest level since September 2014 and nearby rolling soybean oil traded at a March 2014 high.

-

Last

we heard as of late last week IL SBO basis was 150 over, East 175 over, West 100 over and Gulf 750 over, all unchanged from the previous week. Brazilian basis levels were nominally 815 over, fob. -

Reuters:

Renewable fuel (D6) credits traded at 79.5 cents each on Monday, the highest since December 2017. Biomass-based (D4) credits traded at $1.04 each, highest since November 2017.

-

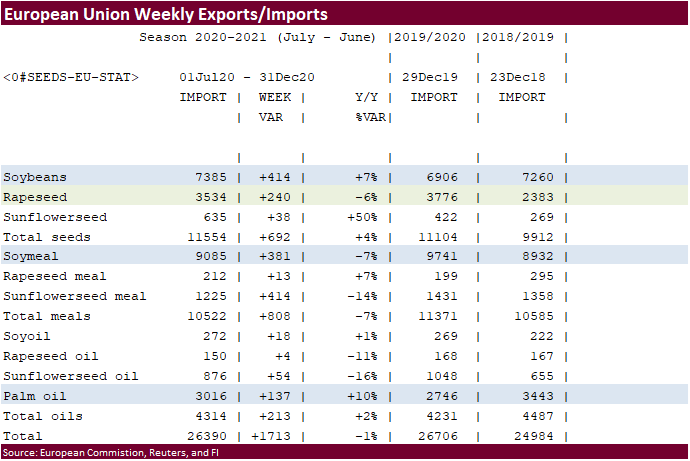

The

European Union reported soybean import licenses since July 1 at 7.385 million tons, below 6.906 million tons a year ago. European Union soybean meal import licenses are running at 9.085 million tons so far for 2020-21, below 9.741 million tons a year ago.

EU palm oil import licenses are running at 3.016 million tons for 2020-21, above 2.746 million tons a year ago, or up 10 percent. -

European

Union rapeseed import licenses since July 1 were 3.534 million tons, down 6 percent from 3.776 million tons from the same period a year ago.

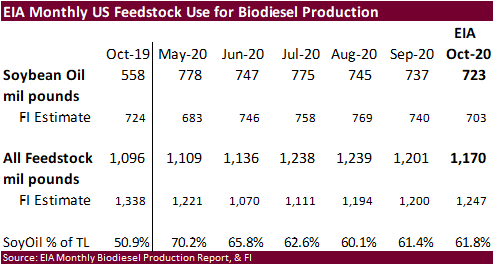

U.S.

production of biodiesel was 160 million gallons in October 2020, 1 million gallons higher than production in September 2020. There was a total of 1,170 million pounds of feedstocks used to produce biodiesel in October 2020. Soybean oil remained the largest

biodiesel feedstock during October 2020 with 723 million pounds consumed. We raised our 2020-21 US soybean oil for biodiesel production to 8.020 billion pounds from 8.000 billion, 80 million below USDA.

- The

USDA/CCC seeks 2,000 tons of vegetable oil, packaged in 4 liter cans, for export to Kenya on January 5 for February 1-28 shipment (Feb 16 to Mar 15 for plants located at ports).

Updated

12/29/20

March

$12.00 and $14.00 range

March

$400 and $470 range

March

is expected to trade in a 40.50 and 43.50 cent range

- After

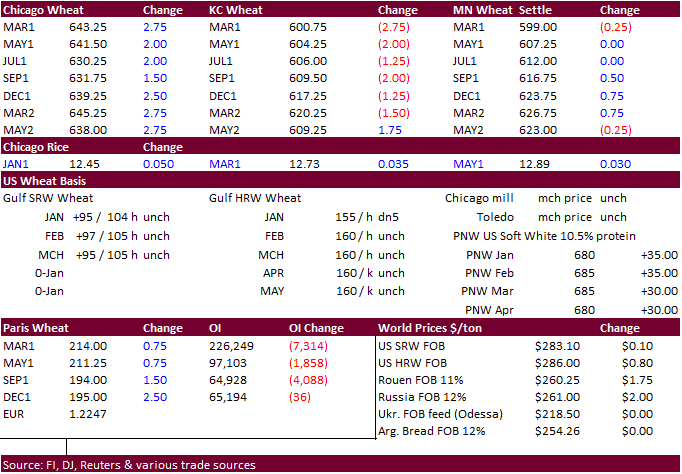

nearby rolling Chicago wheat reached its highest level since December 2014, prices faded after the open on long liquidation. Chicago ended higher, KC lower and MN mixed. The US Great Plains saw precipitation over the weekend. Funds in Chicago bought an

estimated net 2,000 SRW wheat contracts. - Wheat

prices may struggle to the upside going forward if US export developments fail to increase this week. USDA export inspections showed zero shipments to China in today’s report.

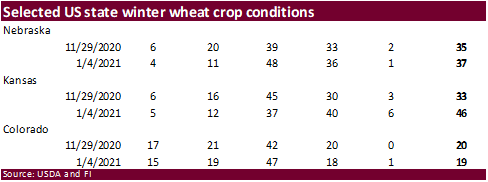

- Kansas

winter wheat crop ratings increased to 46 percent good/excellent from 33 percent at the end of November, according to state data. Nebraska increased to 37 percent from 35 percent over the past month and Colorado decreased one point to 19 percent.

- USDA

US all-wheat export inspections as of December 31, 2020 were 324,983 tons, within a range of trade expectations, below 406,975 tons previous week and compares to 420,653 tons year ago. Major countries included Philippines for 63,450 tons, Japan for 60,841

tons, and Mexico for 28,361 tons. - Iran

pegged wheat production at 13 million tons of during the next Iranian year beginning on March 20. - Australia’s

northern Queensland will continue to see a tropical low storm system, moving further inland, bringing widespread flooding rainfall.

- EU

March milling wheat was up 1.00 at 214.25 euros. It hit a two-year high today.

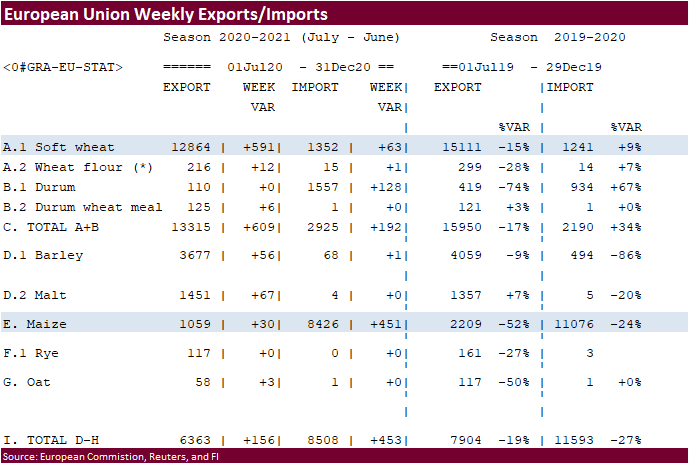

- The

European Union cumulative 2020-21 soft wheat export commitments were 12.864 MMT, well down from 15.111 million tons committed at this time last year, a 15 percent decrease. Imports are up 9 percent from year ago at 1.241 million tons.

- Bangladesh’s

lowest offer for 50,000 tons of wheat was $326.92 a ton CIF liner floated.

- Jordan

will be back in for animal feed barley (120k) on January 5. Possible shipment combinations are in 2021 for June 1-15, June 16-30, July 1-15 and July 16-31.

·

None reported

Updated

1/4/20

March

Chicago wheat is seen in a $5.90‐$6.65 range

March

KC wheat is seen in a $5.70‐$6.20 range

March

MN wheat is seen in a $5.75‐$6.15 range

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.