PDF Attached

Attached

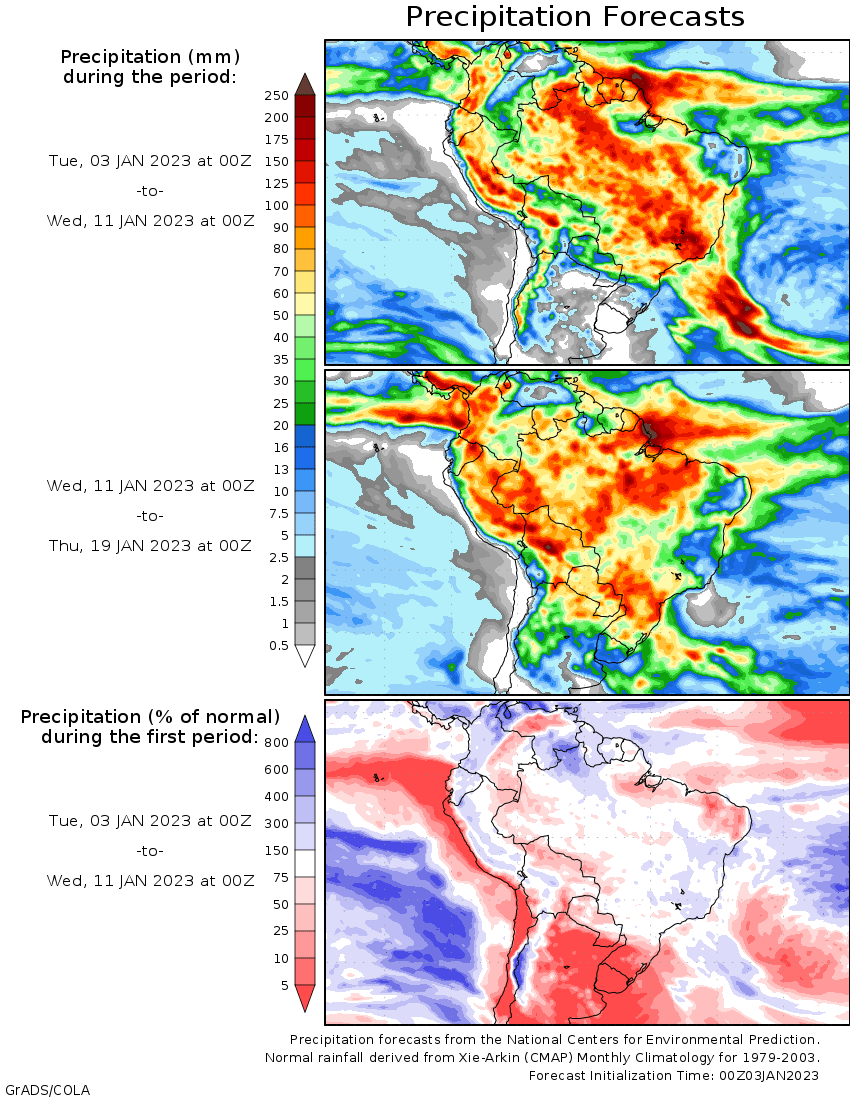

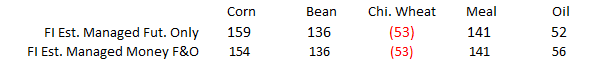

is our updated US all-wheat S&D and US acreage table. Lower trade to the start of the year in a risk off session. Many outside markets sold off. The USD was up 151 points by midafternoon. Some noted long liquidation today on positioning. Argentina saw welcome

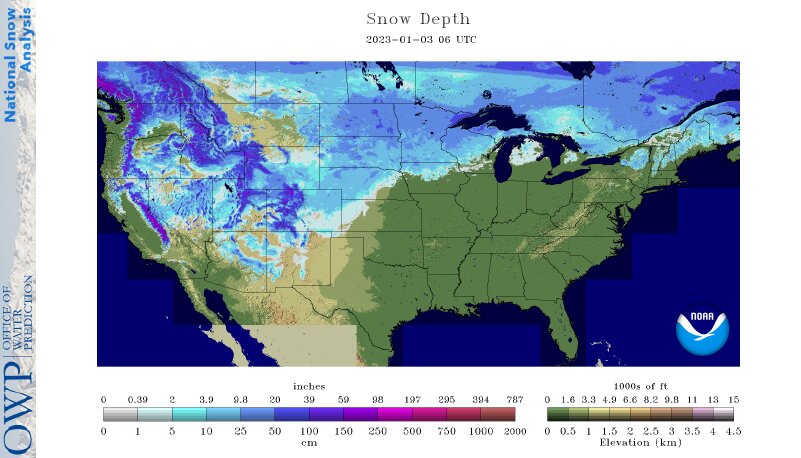

showers over the weekend. Selected US states reported winter wheat crop conditions. Kansas, Nebraska, Montana, and South Dakota declined while Oklahoma and Colorado improved.

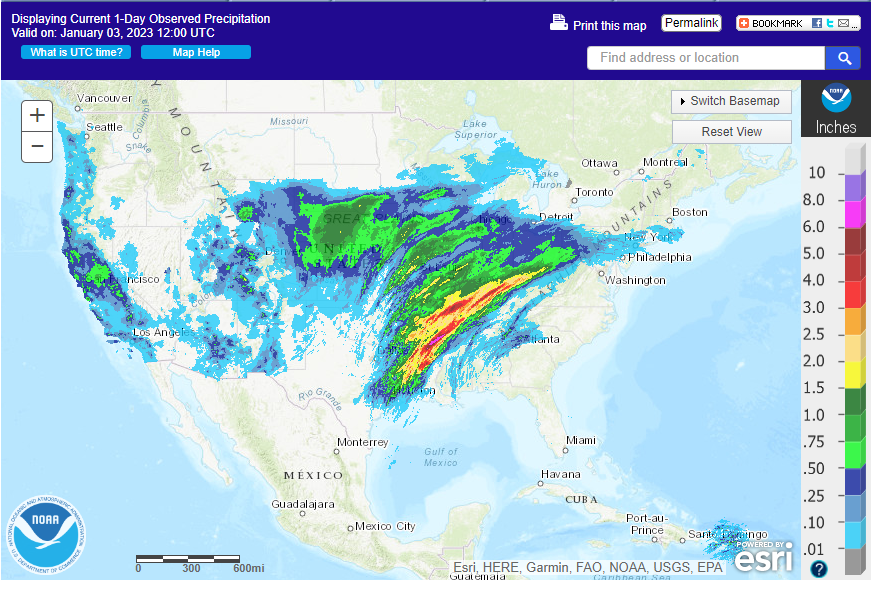

Weather