PDF Attached

USDA

reported another 2 cargoes of soybeans to China.

- The

Tropics and Subtropics should be closely monitored - We

are quickly moving into the a more favored period for tropical cyclone development; the most favored period for storm development will occur next week through the end of this month - Tropical

Storm Josephine will not be a threat to the United States - It

remains several hundred miles east southeast of the northern Leeward Islands today and it will pass to the northeast of the Antilles and Bahamas this weekend and early next week - The

system will weaken late Saturday into early next week and may dissipate well east of the U.S.

- A

pair of mid-latitude low pressure centers moving off the middle U.S. Atlantic Coast will have potential for development into tropical or subtropical cyclones

- The

first low pressure system comes off the North Carolina coast today and the second comes off the Delmarva Peninsula Sunday

- A

trough of low pressure expected to be over the southeastern U.S. next week may breed a low pressure center just off the central or northeastern Gulf of Mexico Coast during the middle to latter part of next week and that system will need to be closely monitored

for development as well - The

favorable tropical cyclone formation potential will shift farther to the east into the Atlantic Ocean in the week of August 24 - A

monsoon low pressure center in the northern Bay of Bengal may attempt to develop a little more before move from the upper east coast of India to Rajasthan and Gujarat next week

- This

system could produce excessive rain a part of eastern and central India next week - A

second monsoon low may evolve late next week and into the week of Aug. 24 producing additional excessive rainfall - India’s

potential for flooding in central parts of the nation will increase greatly next week and through the following weekend due to the monsoon lows noted above

- The

greatest rain will be falling a week from now and into the week of Aug. 24 - Madhya

Pradesh, Chhattisgarh and southern Rajasthan may be most at risk of flood damage, but it is too soon to get any more details - U.S.

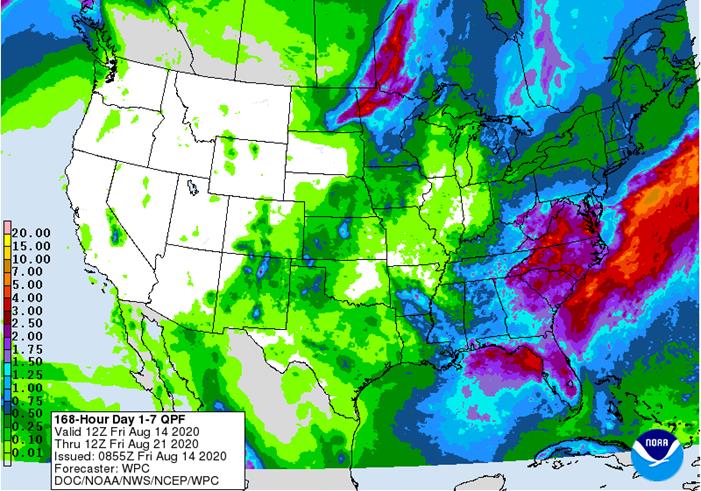

outlook continues to trend drier for the second half of this month and possibly extending into early September

- Most

forecast models have toned down the rainfall outlook for the Midwest and Great Plains over the past couple of days

- The

GFS is still wettest and probably too wet - Net

drying is expected in the heart of the Midwest and in much of the Great Plains with parts of the Delta also expecting only a restricted amount of rain as time moves along - The

wettest areas in the U.S over the next ten days will be in the southeastern states from Virginia to Florida where frequent rain is expected and moderate to some locally heavy amounts expected - The

far northern parts of the Midwest will also experience some significant rain periodically - The

environment is not unusual for late summer and still fits in with what is considered mostly normal summer weather; however, with the active tropical season to influence North America soon the drying bias may fester for “some” areas long enough to raise a little

late season soybean and sorghum stress especially in the areas that are already a little dry - Milder

temperatures during the next couple of weeks will slow some of the drying, but it is still the middle of summer and “normal” usually promotes net drying - The

U.S. weather pattern dominating through the end of August may prevail into September as well with a few “brief” interludes of somewhat warmer and a little wetter conditions -

West

Texas was hot again Thursday with highest temperatures of 100 to 112 from southern Oklahoma and southern parts of the Texas Panhandle southward into Mexico -

West

Texas will get some showers and thunderstorms periodically during the coming week, but they will be brief and light failing to soak the region and failing to change soil or crop conditions by much -

Sufficient

moisture will be present late this weekend into next week to help keep temperatures from becoming excessively hot -

Highest

temperatures into Saturday will range from 95 to 108 degrees Fahrenheit -

Temperatures

will not be quite as warm late in the coming weekend or next week due to some higher relative humidity and a few showers

-

High

temperatures may slip to the upper 80s and 90s

-

U.S.

northwestern Plains and southwestern Canada’s Prairies will not receive much rain for the next ten days favoring harvest progress for early season crops, but stressing some of the late season crops

-

Eastern

Saskatchewan and western Manitoba received some needed rain Thursday and overnight to ease dryness and benefit some of the region’s corn, soybeans, flax and late season canola -

Rain

totals reached 1.00 to 2.00 inches in southwestern Manitoba and to 1.18 inches in southeastern Manitoba while up to 0.62 inch occurred elsewhere -

Rain

will fall additionally in southeastern Manitoba today and early Saturday and then drier weather is expected for a while

-

Western

and northern Alberta and far northwestern Saskatchewan remain favorably moist while much of central, west-central, southwestern and south-central Saskatchewan along with southern Alberta remains too dry -

Dryness

in the central and southwestern Prairies is promoting early season crop maturation and harvest progress, but rain is needed in some areas for late season crops -

The

lack of moisture during the next ten days to two weeks will likely leave late season crops stressed -

Far

western U.S. weather will be mostly dry and warm during the next ten days as the monsoon flow remains sporadic and light -

Ontario

and Quebec weather is mostly good with alternating periods of rain and sunshine over the next two weeks -

Recent

rain bolstered topsoil moisture and removed concern over dryness -

Some

net drying is expected especially in Ontario - Argentina

remains too dry and concern remains for its wheat and barley production potential - Cordoba

remains driest with parts of Santa Fe, La Pampa and northwestern Buenos Aires drying out recently - The

trend will not change much until Aug. 25 and after that period there may be “some” rain to ease dryness in parts of Buenos Aires and immediate neighboring areas - Cordoba

is unlikely to see significant rain for the next two weeks - World

Weather, Inc. is looking for a little better opportunity for some rain in September in the driest areas - China’s

Yangtze River Basin is drying out - The

drying trend will continue for the next week and then some showers will begin to pop up periodically into the end of this month - China

reported locally heavy rain in central and northeastern Sichuan and from Shandong to Heilongjiang Thursday - Amounts

varied from 1.00 to 2.75 inches often with local totals of 3.00 to more than 5.00 inches - Local

flooding resulted - One

location in southeastern Liaoning reported 13.14 inches of rain - Some

heavy rain also fell along the Guangdong coast and in southern Guangxi where flooding also occurred - Rainfall

elsewhere in eastern China was more erratic and light while temperatures were warm - China’s

weather will continue to provide net drying in the Yangtze River Basin over the next two weeks while alternating periods of rain and sunshine occur elsewhere - Some

localized areas of flooding will continue in the north and in central Sichuan for a while - Damage

to crops is not very likely - Some

locally heavy rain and local flooding is still possible in northern parts of the nation periodically in the next two weeks, but no new crop damage is expected -

Xinjiang,

China weather Thursday was mostly warm and dry, although a few showers produced up to 0.30 inch of moisture near the mountains -

Highest

temperatures were in the 80s northeast and the lower to middle 90s elsewhere -

The

region will not likely see much change in weather over the next seven to ten days

- Russia’s

New Lands have either received significant rain recently or going to be receiving it in this coming week - Spring

wheat and sunseed crop improvements have occurred recently and will continue, although some of the coming improvement is occurring a little late

- There

is a little concern over late season wheat and sunseed quality for the early maturing crops, but the weather could improve prior to a serious problem evolving - Reports

of lower corn production have been received from Ukraine - Dryness

in Ukraine and Russia’s Southern Region has been serious in recent weeks and all unirrigated summer crop yields are likely down

- Eastern

and southern Ukraine and most of Russia’s Southern region away from Krasnodar and Georgia has been too dry for many weeks - Relief

from dryness is unlikely for at least another week to ten days, but some rain may come later this month - The

moisture will arrive too late, however. - Relief

from drought in France, Germany, Belgium, the U.K. and Netherlands is under way and will last into next week

- Rain

Thursday varied from 0.30 to 0.50 inch with coverage of 60% favoring the western and far southeastern parts of the nation - Additional

rain is expected in France and areas to the east and north over the next several days - Improving

soil moisture will be great for future winter crop seeding, but may only stop the recent declines in summer crop condition and yield - A

reversal in the production potential losses in France is highly unlikely, but the rain will stop the decline - West-central

Africa dryness in Ivory Coast, Ghana and neighboring areas is not unusual for this time of year, but the dryness started early and has festered long enough to be of some concern to rice, sugarcane, coffee and cocoa - Seasonal

rains are expected to return, albeit a little slower than usual - Once

the seasonal rains resume they may become heavy in late September and October -

More

frequent and more abundant rain is expected in mainland areas of Southeast Asia during the coming ten days -

The

moisture boost will be good for rice, sugarcane, coffee and a host of other crops -

Flooding

rain is expected in western and southern Myanmar over the next couple of weeks -

Rain

continues erratic in Sumatra, Java and parts of Borneo in Indonesia and Malaysia -

Temperatures

have been ebbing warmer than usual as well -

Rainfall

will continue erratic and light for a while in these areas, but some slowly increasing rainfall is expected through most of next week -

Philippines

rain recently has been bolstering soil moisture in many areas from western Luzon Island southward to northern Mindanao -

Recent

rainfall has been supportive of crops and little change will occur over the next ten days -

South

Africa rain will continue periodically in the southwest over the next week, but most of it will be near the coast and it will not be frequent enough to seriously bolster topsoil moisture for long term crop use -

Eastern

winter wheat and barley areas still need a general rain to support dryland crops which represent 8% of the total crop in the region -

Temperatures

will be cooler than usual -

Australia

rainfall will impact most winter crop areas during the next ten days -

However,

much of the resulting rain will be light and there will be some ongoing need for greater rain in Queensland and South Australia -

The

bottom line remains a very good outlook for the nation’s winter crops, although there will still need follow up rain to fix long term moisture deficits in Queensland as well as South Australia

-

Southern

Brazil will receive rain today through August 20 and it will be good for some winter wheat, corn planting and early corn establishment -

Most

of the precipitation will fall in Rio Grande do Sul, Santa Catarina, Parana, Paraguay and southern Mato Grosso do Sul leaving areas to the north drier biased; including Sao Paulo and a few locations in southern Minas Gerais and Rio Grande do Sul -

However,

flooding is expected in Parana and southern Mato Grosso do Sul which may raise the potential for wheat damage especially in Parana

-

Dry

weather is expected elsewhere in Brazil except coastal areas from Espirito Santo to Bahia where rain is expected periodically -

Mexico

precipitation in the coming week to ten days will be greatest in western and southern parts of the nation benefiting many corn, sorghum and dry bean production areas -

Coffee,

citrus, sugarcane and many fruit and vegetable crops will also benefit -

Northeastern

Mexico will be mostly dry -

Some

of the region is still drought stricken -

Central

America rainfall will increase this week and continue plentiful next week -

New

Zealand rainfall will be below average for a few more days and then trend above normal in parts of the nation next week into August 27

-

Southern

Oscillation Index was +4.52 this morning and it will continue positive into next week

Source:

World Weather Inc.

7

Day Precipitation Outlook

- Malaysia

palm oil export data for Aug 1-15 from AmSpec

MONDAY,

August 17:

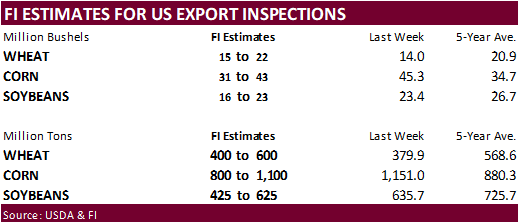

- USDA

weekly corn, soybean, wheat export inspections, 11am - U.S.

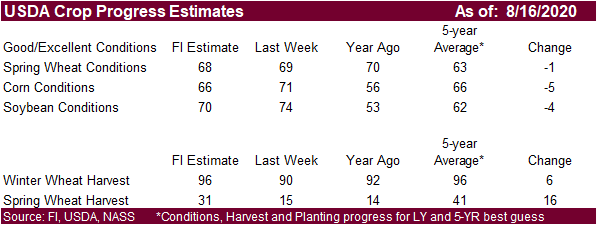

crop conditions for soybeans, corn, cotton; wheat harvesting progress, 4pm - U.S.

monthly green coffee stockpile data from Green Coffee Association - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals - HOLIDAY:

Indonesia

TUESDAY,

August 18:

- New

Zealand global dairy trade auction

WEDNESDAY,

August 19:

- EIA

U.S. weekly ethanol inventories, production, 10:30am - ISO

online conference on Sugar and Health - USDA

total milk production

THURSDAY,

August 20:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Brazil

Conab sugar, cane and ethanol production - Port

of Rouen data on French grain exports - China

International Cereals and Oils Industry Summit - USDA

red meat production, 3pm - HOLIDAY:

Malaysia - EARNINGS:

Cherkizovo

FRIDAY,

August 21:

- ICE

Futures Europe weekly commitments of traders report, 1:30pm (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - China

International Cereals and Oils Industry Summit, day 2 - Malaysia

palm oil export data for August 1-20 - U.S.

cattle on feed, 3pm

Source:

Bloomberg and FI

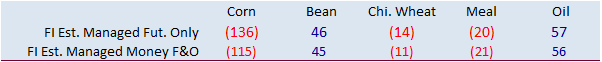

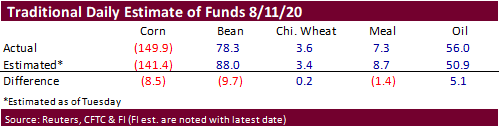

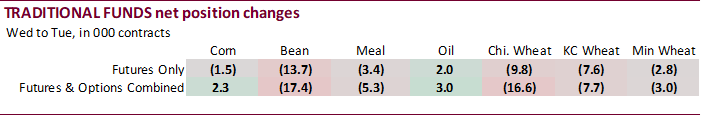

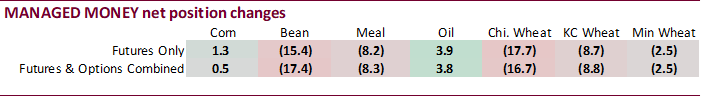

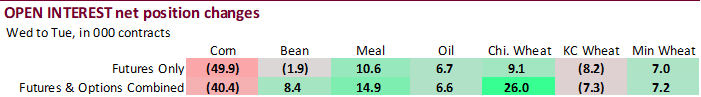

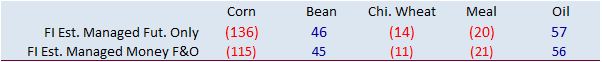

Commitment

of Traders

-No

major surprises

US

Retail Sales Advance (M/M) Jul: 1.2% (est 2.1%; prevR 8.4%; prev 7.5%)

US

Retail Sales Ex Auto (M/M) Jul: 1.9% (est 1.3%; prevR 8.3%; prev 7.3%)

US

Retail Sales Ex Auto, Gas Jul: 1.5% (est 1.0%; prevR 7.7%; prev 6.7%)

US

Retail Sales Control Group Jul: 1.4% (est 0.8%; prevR 6.0%; prev 5.6%)

US

Nonfarm Productivity Q2 P: 7.3% (est 1.5%; prevR -0.3%; prev -0.9%)

US

Unit Labour Costs Q2 P: 12.2% (est 6.9%; prevR 9.8%; prev 5.1%)

-

CBOT

corn ended 0.25 to 1 cent lower in the 4 front month contracts and mixed in the back months. Friday marked the first day this week that corn traded lower.

Light

profit taking was the main reason for the lower trade. Losses were limited on a drier US weather forecast with western IA in focus, and acreage loss from the storm earlier this week.

The

US will not be totally dry. The Midday weather models conformed a wetter outlook for NE and some ECB corn producing states. Another reason corn futures paired losses by the end of the day is the fact EU countries are losing corn production due to dry weather.

France reported a large decline in ratings from the previous week. We could see the EU importing corn from the America’s later this year to meet animal unit consumption requirements if EU feed wheat supplies start to erode. EU milling wheat export commitments

are healthy. For alternative feedgrains, EU end users have been competing with exporters amid large increase in barley shipments to China.

-

More

and more analysts are coming out with corn crop damage reduction estimates for production. The mid-point is around 200 million bushels of corn lost from the derecho storm that occurred on Monday. We look for a large drop in US corn conditions when updated

on Monday. -

Reuters

put out a story that painted a bleak picture of the devastation. The Iowa Soybean Association mentioned 37.7 million acres of farmland across the Midwest, including 14 million acres for IA, was impacted by the Monday storm, citing USDA. USDA said 8.18 million

acres of corn and 5.64 million acres of soybeans in Iowa, was affected. Crop holders of these areas in IA represent about 6 billion USD of product/infrastructure. The story by Reuters that ran today indicates the derecho caused more damage than we initially

thought. Previously we thought 1.0 million corn harvested acres would be affected, but now have to rethink that figure.

-

The

US and China postponed their Phase One talks that was set to start on Saturday.

-

France’s

corn crop rating tanked from the previous week. As of Aug 10, it fell to 65 percent from 74 percent! This is still above 60 percent a year ago.

-

There

has been a lot of talk about the unusually low US FSA crop insurance acreage reported after the close on report day but we would not read into this. October FSA numbers will be the month to take a hard look to revisit the planted area.

Ethanol

Production Profits during the COVID Pandemic

Corn

Export Developments

·

None reported

-

September

corn is seen in a $3.10 and $3.35 range. December $3.00-$3.50 range.

-

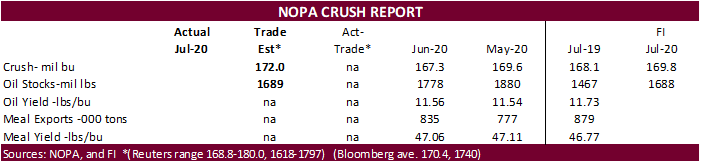

Soybeans

traded lower along with the products on light profit taking. Downside was limited from Chinese buying this week ahead of the US/China trade talks, which are now postponed. They were to start Saturday. SA and US Gulf cash prices for soybeans were down on

Friday, led by a steep decline in Brazil fob ($393-$394/ton; dn about $8).

-

The

trade should see China trade data sometime over the weekend. -

USDA

announced 2 cargoes of soybeans to China, 8th straight day of 24-hour sales.

-

We

heard China bought up to 4-5 US Q4 soybean cargoes out of the Gulf Thursday, and one PNW over the Nov. China still needs at least 7 million tons of Q4 coverage, and 4-6 million tons for January through FH Feb.

-

China

sold all 63,652 tons of imported soybeans from stockpiles at average 3126 yuan per ton.

-

India

imported 824,078 tons of palm oil during July, highest in ten months and 1.4 percent higher than a year earlier. July soybean oil imports were up 52 percent from a year ago to 484,525 tons. Strong vegetable oil imports by India are expected to slow in the

coming months on high import duties and prospects for a decent size domestic oilseed production.

-

China

cash crush margins as of this morning, using our calculation, were 136 cents per bushel (123 previous), and compares to 132 cents a week ago and 81 cents around this time last year.

·

Update: Iran bought 130,000 tons of South American soybean meal this week but passed on corn.

·

Under the 24-hour USDA export sales reporting system, private exporters reported 126,000 tons of soybeans to China for 2020-21.

-

September

soybeans are seen in a $8.70-$9.15 range. November $8.60-$9.25. -

September

soybean meal is seen in a $285 to $310 range. December $285-$320. -

September

soybean oil range is seen in a 30.00 to 32.50 range. December 29.75-33.00 range.

-

While

corn and soybeans were the stars for bull traders on Thursday, Friday was the day for wheat. US wheat futures

rallied

a good amount during the morning session but paired some of the gains by afternoon trading. They closed mixed with Chicago higher, KC mixed, and MN higher. Global import demand picked up late in the week with several major importers looking for high quality

product. Turkey announced during the trade that they are looking for a large amount of red milling wheat and durum wheat. Argentina remains too dry and the forecast calls for limited precipitation. Recall the Rosario Grains Exchange reduced their production

estimate for Argentina from 19 million tons to 18 million tons. -

Ukraine

2020-21 grain exports fell 23 percent to 4.19 tons so far this year. 1.64MMT corn and 1.64MMT wheat. Both are lower than last year.

-

Australia’s

Grain Industry Association GIWA expects Western Australia wheat crop up 63 percent from 2019 to 8.89 million tons.

-

Iraq

will donate 13,300 tons of wheat to Lebanon. -

The

MGEX was bought by MIH (Miami International Holdings) and the deal is expected to be complete by the end of the year.

-

Paris

December wheat was up 1.75 euros at 180.25, just over a 1-week high.

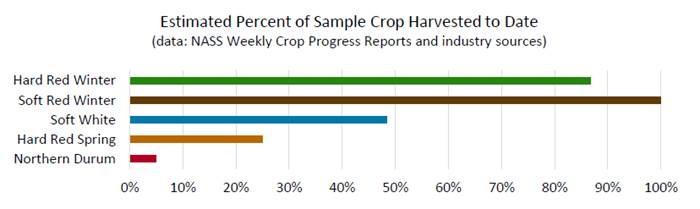

US

Wheat Associates

“The

HRW harvest moved close to 90% complete this week with very good crop quality. The SRW harvest is complete with final quality results still to come. With close to half the SW crop in the bin, protein, moisture and test weights are looking very good. HRS harvest

advanced and northern durum harvest started this week. Heat and dryness brought down official condition and yield potential ratings but will push crop maturity and harvest this week.”

https://www.uswheat.org/wp-content/uploads/2020/08/HR_2020-8-14.pdf

Export

Developments.

-

Turkey

seeks 390,000 tons of red milling wheat and 110,000 tons of durum wheat on August 25. They also seeks feed barley.

-

Red

wheat shipment period is between Sep 4 and Oct 10 -

Durum

shipment period is between Sept. 15 and Oct. 10. -

Feed

barley shipment period is between Sept. 11 and Sept. 25. -

Pakistan

bought 60,000 tons of wheat from the Black Sea at $227/ton c&f. Details were lacking.

-

Pakistan

seeks 1.5 million tons of wheat on August 18. -

Syria

looks to sell and export 100,000 tons of feed barley with offers by Sep 1.

-

Syria

seeks 200,000 tons of soft wheat from EU/Russia on Sept. 9 and 200,000 tons of wheat from Russia on Sept. 14.

·

Mauritius seeks 6,000 tons of white rice on August 17 for October through December delivery.

·

South Korea’s Agro-Fisheries & Food Trade Corp. seeks 60,556 tons of rice from Vietnam and other origins, on Aug. 19, for arrival in South Korea between Dec. 31, 2020, and February 28, 2021.

Updated

8/12/20

- Chicago

September is seen in a $4.70-$5.15 range. December $4.80-$5.30. - KC

September; $4.00-$4.40 range. December $4.10-$4.45. - MN

September $4.75-$5.05 range. December $4.95-$5.25.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.