Files Attached

Good evening.

Calls:

Soybeans steady to 4 higher

Meal steady to lower (note deliveries below)

Soybean oil steady to 30 higher

Corn steady to higher

Wheat steady to 3 higher

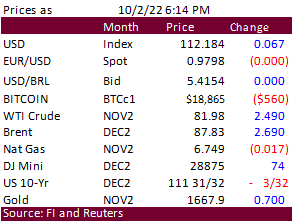

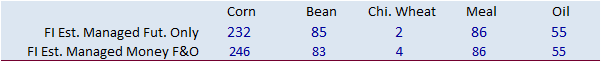

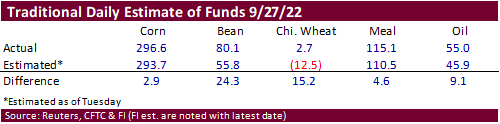

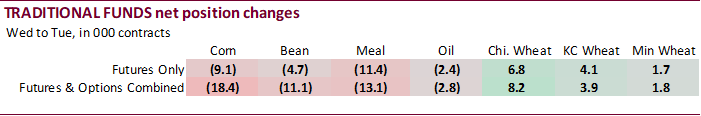

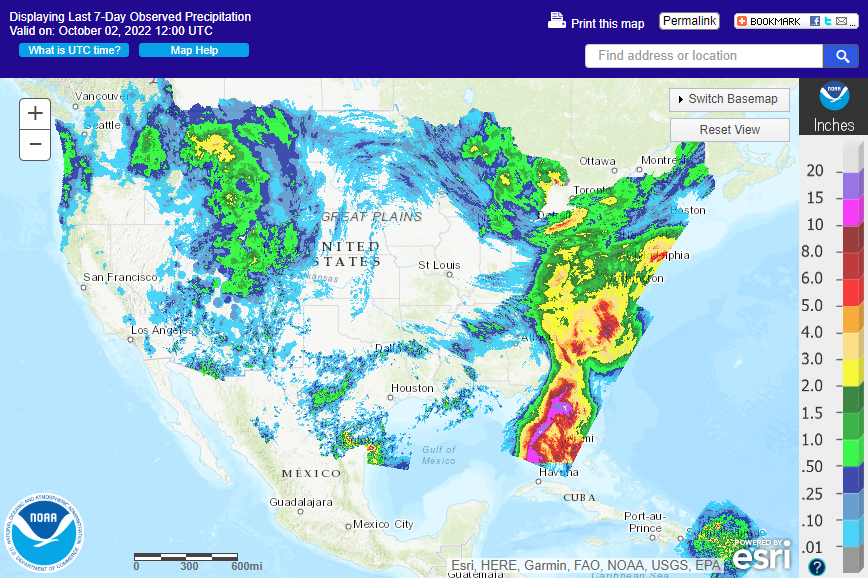

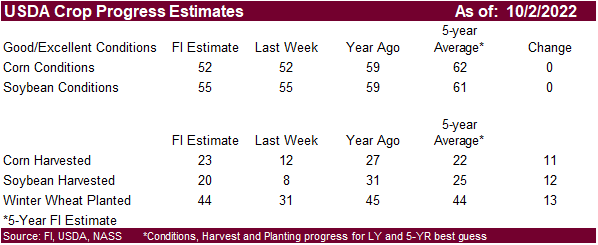

Crude oil was up about 3 percent after the overnight open. Funds held longer than expected net long positions as of last Tuesday, especially for soybeans, wheat and soybean oil. We see no major reaction to this but something to think about if looking to short the market. Europeans that did not trade the USDA reports may step in Sunday evening. Recall the soybean complex was lower led by soybeans on Friday, and grains were higher. Weekend harvest weather was ideal for the US, with temperatures warming from that of the workweek and little rain occurring for the major growing regions of the Midwest. Note the remnants from the hurricane did dump good rains across parts of the far eastern areas of the ECB. Overall Midwest weather conditions were and will remain drier than normal, exception upper WCB east of the Dakotas and ECB’s MI & OH states. Look for water levels for the Mississippi to continue to decline well into the workweek. Winter wheat plantings across the southwestern growing areas will remain a challenge with net drying this week while parts of the central and northern Great Plains will see some rain. Argentina will see rain this week across the northern, central and southwestern areas, welcome after a slow start to the corn planting season. Southern and central Brazil will see rain.

(Reuters) – Iraq plans to plant one million hectares with wheat and “a very small amount” of barley in its 2022-2023 winter crop planting season, the ministry of water resources said in a Sunday statement.

(Reuters) – Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC), said on Saturday it was seeking vegetable oils in an international purchasing tender for arrival Nov. 25-Dec. 10.

GASC said traders should submit bids for payment through 180-day letters of credit. The deadline for offers is Tuesday, Oct. 4.

GASC also set a tender for local vegetable oils on Saturday, seeking at least 3,000 tons of soyoil and 1,000 tons of sunflower oil for delivery Dec 1-15. The deadline for offers is also Oct. 4.

(Reuters) – A fifth vessel chartered by the United Nations World Food Program (WFP), NEW ISLAND, has arrived at Ukraine’s Black Sea port of Chornomorsk and will deliver Ukrainian wheat to Somalia, Ukraine’s infrastructure ministry said on Sunday.

(Reuters) – Ukraine’s grain exports fell by 23.6% year on year in September to 4.278 million tons, but reached the highest level since the Russian invasion, agriculture ministry data showed.

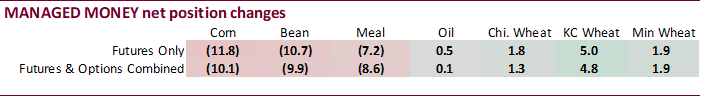

CFTC Commitment of Traders

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.