Calls: Higher based on crop progress

Soybeans 20-30 higher

Meal $4-$7 higher

SBO 50-100 points higher

Corn 7-13 higher

Wheat 7-15 higher

EPA headlines not expected to trump USDA CP

Reuters covering US EPA mandates:

- US EPA PLANS TO FINALIZE 2023 BIOFUEL BLENDING VOLUMES AT 20.94 BLN GALLONS, VERSUS 20.82 BLN GALLONS IN PROPOSED RULE – SOURCES

- US EPA PLANS TO FINALIZE 2024 BIOFUEL BLENDING VOLUMES AT 21.54 BLN GALLONS, VERSUS 21.87 BLN GALLONS IN PROPOSED RULE – SOURCES

- US EPA PLANS TO FINALIZE 2025 BIOFUEL BLENDING VOLUMES AT 22.33 BLN GALLONS, VERSUS 22.68 BLN GALLONS IN PROPOSED RULE – SOURCES

- U.S. EPA PLANS TO FINALIZE ETHANOL BLENDING MANDATE AT 15.25 BILLION GALLONS FOR 2023 AND 15 BILLION GALLONS FOR 2024 AND 2025 – SOURCES

- US EPA TO SET ADVANCED BIOFUEL BLENDING MANDATE AT 5.94 BILLION GALLONS IN 2023, UP FROM A PROPOSED 5.82 BILLION – SOURCES

- US EPA TO SET BIOMASS-BASED DIESEL MANDATE AT 2.82 BILLION GALLONS IN 2023, UNCHANGED FROM PROPOSAL – SOURCES

- US EPA TO SET BIOMASS-BASED DIESEL MANDATE AT 3.04 BILLION GALLONS IN 2024, UP FROM PROPOSED 2.89 BILLION GALLONS – SOURCES

- US EPA TO SET CELLULOSIC BIOFUEL MANDATE AT 840 MILLION GALLONS IN 2023, UP FROM A PROPOSED 720 MILLION GALLONS – SOURCES

- US EPA TO SET BIOMASS-BASED DIESEL MANDATE AT 3.35 BLN GALLONS IN 2025, UP FROM PROPOSED 2.95 BLN GALLONS – SOURCES

Slight increase in overall mandates can be read both ways. We will make no changes to our US balance sheets for corn and soybean oil. Perhaps some that bought into soybean oil last week looking for a higher advanced mandate may claw back on positions.

US corn yields, what we heard, are around 177 to 179 and 50.5-51.5 for soybeans. Odd trade today as profit taking offset bull traders looking at US weather forecasts, which called for mix events for the US Midwest over the next week.

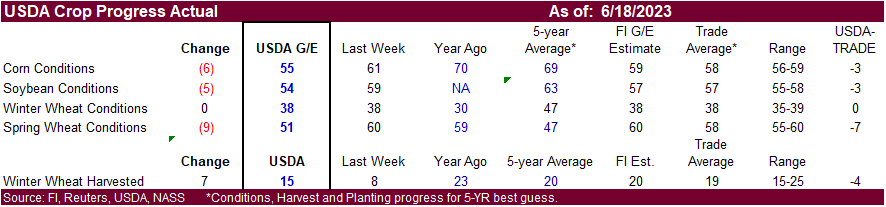

US WINTER WHEAT – 38 PCT CONDITION GOOD/EXCELLENT VS 38 PCT WK AGO (30 PCT YR AGO) -USDA

US SPRING WHEAT – 51 PCT CONDITION GOOD/EXCELLENT VS 60 PCT WK AGO (59 PCT YR AGO) -USDA

US RICE – 70 PCT CONDITION GOOD/EXCELLENT VS 67 PCT WK AGO (72 PCT YR AGO) -USDA

US CORN – 55 PCT CONDITION GOOD/EXCELLENT VS 61 PCT WK AGO (70 PCT YR AGO) -USDA

US COTTON – 47 PCT CONDITION GOOD/EXCELLENT VS 49 PCT WK AGO (40 PCT YR AGO) -USDA

US SOYBEAN – 54 PCT CONDITION GOOD/EXCELLENT VS 59 PCT WK AGO (68 PCT YR AGO) -USDA

US COTTON – 89 PCT PLANTED VS 81 PCT WK AGO (94 PCT 5-YR AVG) -USDA

US RICE – 99 PCT EMERGED VS 94 PCT WK AGO (97 PCT 5-YR AVG) -USDA

US SOYBEANS – 92 PCT EMERGED VS 86 PCT WK AGO (81 PCT 5-YR AVG) -USDA

US CORN – 96 PCT EMERGED VS 93 PCT WK AGO (94 PCT 5-YR AVG) -USDA

US SPRING WHEAT – 98 PCT EMERGED VS 90 PCT WK AGO (95 PCT 5-YR AVG) -USDA

US WINTER WHEAT – 94 PCT HEADED VS 89 PCT WK AGO (93 PCT 5-YR AVG) -USDA

US SPRING WHEAT – 10 PCT HEADED (2 PCT YR) (10 PCT 5-YR AVG) -USDA

US RICE – 6 PCT HEADED (5 PCT YR) (4 PCT 5-YR AVG) -USDA

US WINTER WHEAT – 15 PCT HARVESTED VS 8 PCT WK AGO (20 PCT 5-YR AVG) -USDA

US COTTON – 19 PCT SQUARING VS 11 PCT WK AGO (21 PCT 5-YR AVG) -USDA

US COTTON – 3 PCT SETTING BOLLS (5 PCT YR) (4 PCT 5-YR AVG) -USDA

US corn yields, what we heard, are around 177 to 179 and 50.5-51.5 for soybeans. Odd trade today as profit taking offset bull traders looking at US weather forecasts, which called for mixed rain events for the US Midwest over the next week.

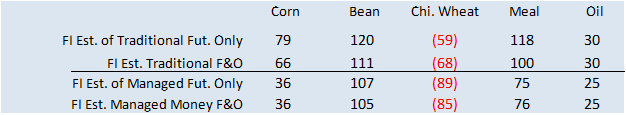

Fund estimates as of June 20 (net in 000)

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |