PDF attached

CFTC Commitment of Traders

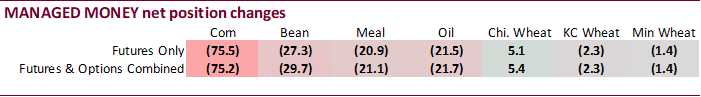

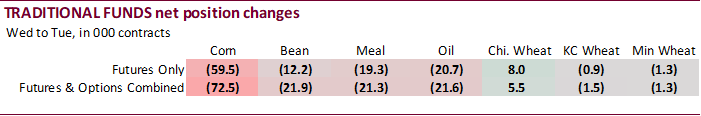

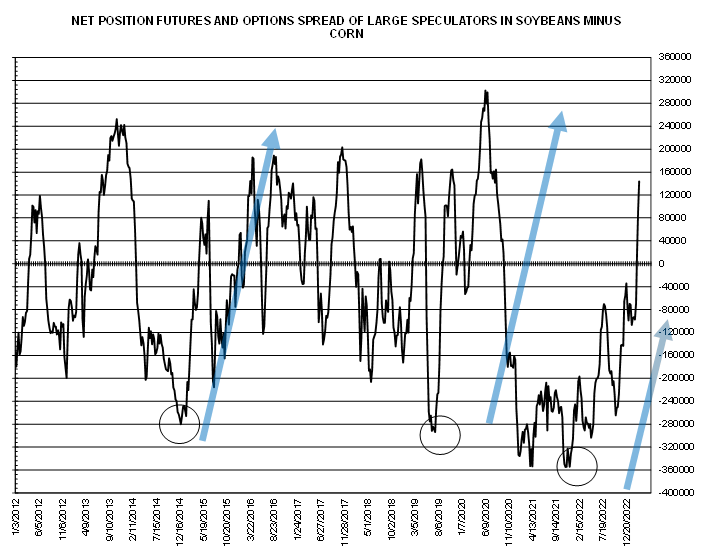

The net long position for corn and soybean oil really took a hit over the past 4 weeks (might be related to crude oil).

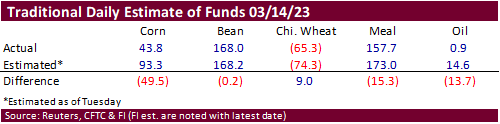

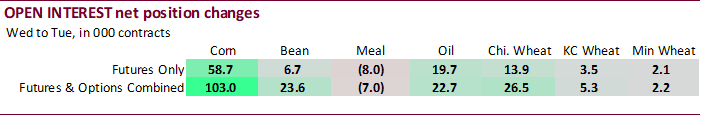

Reuters table

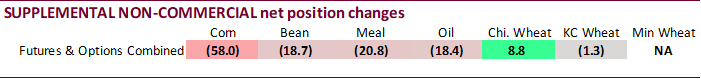

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn -77,633 -58,021 298,363 -13,468 -153,888 73,554

Soybeans 110,690 -18,657 127,514 -6,983 -195,006 24,573

Soyoil -23,589 -18,395 98,897 -2,263 -75,866 22,245

CBOT wheat -87,954 8,823 81,916 -5,368 4,224 -1,822

KCBT wheat -21,245 -1,315 42,743 -720 -20,104 1,647

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn -54,134 -75,192 230,515 8,766 -165,518 65,848

Soybeans 127,661 -29,669 94,280 -2,505 -196,708 23,336

Soymeal 133,970 -21,094 82,920 2,907 -255,693 18,927

Soyoil -1,189 -21,715 102,967 701 -101,002 22,460

CBOT wheat -95,257 5,379 64,592 329 5,446 -4,166

KCBT wheat -12,732 -2,313 36,144 -158 -22,286 1,286

MGEX wheat -4,447 -1,418 1,320 -32 1,348 1,410

———- ———- ———- ———- ———- ———-

Total wheat -112,436 1,648 102,056 139 -15,492 -1,470

Live cattle 92,565 -20,040 46,276 -1,496 -149,701 16,851

Feeder cattle 10,368 83 1,600 -58 -3,215 -2,053

Lean hogs 2,136 4,215 46,958 1,587 -46,871 -5,079

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 55,980 2,644 -66,842 -2,066 1,667,603 103,001

Soybeans 17,964 7,771 -43,196 1,066 840,290 23,599

Soymeal 19,585 -251 19,218 -489 489,810 -6,966

Soyoil -1,334 139 557 -1,587 501,748 22,739

CBOT wheat 23,405 90 1,813 -1,633 459,299 26,549

KCBT wheat 268 797 -1,393 387 191,175 5,305

MGEX wheat 3,098 120 -1,319 -80 57,302 2,172

———- ———- ———- ———- ———- ———-

Total wheat 26,771 1,007 -899 -1,326 707,776 34,026

Live cattle 23,559 2,879 -12,701 1,806 421,743 -15,508

Feeder cattle 2,768 1,692 -11,520 335 75,782 4,965

Lean hogs -2,082 -33 -141 -690 282,563 -6,500

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |