PDF attached

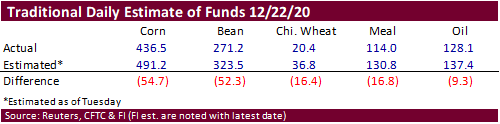

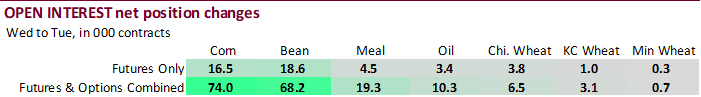

The trade missed the funds positions for soybeans and corn by a very large amount. Chicago wheat, meal and soybean oil were also less long than expected.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 297,888 19,173 399,550 5,605 -676,759 -25,356

Soybeans 178,243 12,675 179,658 2,420 -358,792 -16,815

Soyoil 77,577 4,916 123,391 -1,667 -223,014 -3,866

CBOT wheat -21,540 -3,418 133,160 -629 -96,964 1,578

KCBT wheat 30,797 -735 70,407 480 -100,798 1,212

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 265,713 15,454 243,890 -3,392 -641,500 -18,078

Soybeans 188,623 -1,595 100,702 -1,540 -351,975 -14,160

Soymeal 83,385 6,179 67,353 -1,342 -203,050 -12,511

Soyoil 101,253 3,534 88,457 -1,055 -233,265 -2,580

CBOT wheat 6,233 -438 81,164 -61 -85,639 1,453

KCBT wheat 51,544 -1,068 44,094 1,566 -98,142 -303

MGEX wheat 2,420 -969 2,733 -34 -12,336 -172

———- ———- ———- ———- ———- ———-

Total wheat 60,197 -2,475 127,991 1,471 -196,117 978

Live cattle 47,698 6,430 67,721 -498 -129,375 -6,769

Feeder cattle 3,358 835 7,665 22 -4,215 111

Lean hogs 32,854 1,109 49,114 362 -76,760 1,882

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.