PDF attached

CFTC Commitment of Traders

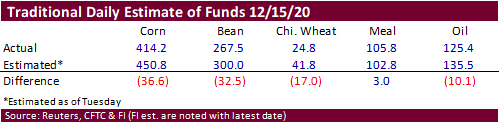

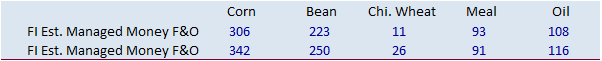

Traditional funds were much less long than expected for corn, soybeans, and wheat that what the trade expected.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 278,715 -14,526 393,944 4,264 -651,404 6,107

Soybeans 165,567 3,966 177,237 4,707 -341,977 -13,241

Soyoil 72,662 10,784 125,059 -4,566 -219,148 -6,804

CBOT wheat -18,122 10,371 133,789 -1,496 -98,541 -8,210

KCBT wheat 31,532 6,625 69,928 1,322 -102,011 -8,273

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 250,260 -19,322 247,282 5,511 -623,422 5,251

Soybeans 190,218 4,562 102,241 161 -337,815 -10,504

Soymeal 77,207 14,565 68,696 -2,004 -190,538 -11,353

Soyoil 97,719 8,656 89,511 -1,840 -230,686 -8,316

CBOT wheat 6,672 12,364 81,226 -2,714 -87,093 -7,174

KCBT wheat 52,613 7,838 42,528 652 -97,839 -8,441

MGEX wheat 3,389 851 2,767 578 -12,165 -3,322

———- ———- ———- ———- ———- ———-

Total wheat 62,674 21,053 126,521 -1,484 -197,097 -18,937

Live cattle 41,269 3,046 68,217 560 -122,606 -3,231

Feeder cattle 2,522 576 7,644 -246 -4,326 186

Lean hogs 31,744 -1,841 48,752 1,134 -78,643 3,958

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.