PDF attached

CFTC Commitment of Traders

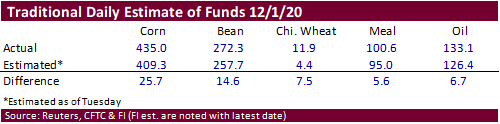

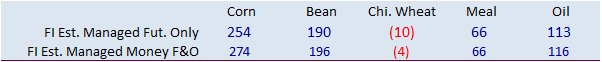

Funds were again more long than expected as of last Tuesday for corn and soybeans, and were more long for wheat, meal and soybean oil.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 296,452 -13,390 389,281 1,148 -657,758 18,543

Soybeans 166,311 -10,646 186,233 -7,727 -350,615 23,090

Soyoil 75,735 -4,995 129,988 -607 -224,269 6,200

CBOT wheat -28,845 -21,891 136,967 -2,387 -90,400 26,195

KCBT wheat 23,263 -581 69,156 -2,541 -94,078 2,489

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 270,633 -16,967 241,804 2,498 -628,469 18,543

Soybeans 194,683 -9,127 118,029 -4,808 -353,324 23,060

Soymeal 70,386 -749 71,120 -882 -189,186 5,075

Soyoil 104,715 -626 89,777 -2,270 -232,405 8,109

CBOT wheat -4,397 -19,696 87,549 334 -80,497 22,288

KCBT wheat 44,506 -3,915 42,319 -998 -89,769 2,578

MGEX wheat 4,755 -1,099 2,099 -23 -10,478 3,948

———- ———- ———- ———- ———- ———-

Total wheat 44,864 -24,710 131,967 -687 -180,744 28,814

Live cattle 39,813 -211 65,455 -2,906 -117,591 -1,203

Feeder cattle 1,067 1,764 7,749 671 -3,686 -758

Lean hogs 38,359 1,926 48,004 -69 -87,999 -2,320

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 144,006 2,227 -27,974 -6,300 2,078,871 -57,572

Soybeans 42,539 -4,408 -1,928 -4,717 1,253,881 -8,466

Soymeal 22,209 -1,662 25,470 -1,782 475,823 -9,372

Soyoil 19,365 -4,615 18,547 -599 545,609 8,864

CBOT wheat 15,066 -1,008 -17,721 -1,918 475,976 -15,536

KCBT wheat 1,286 1,701 1,658 633 223,335 -8,644

MGEX wheat 3,429 -197 195 -2,627 66,959 -2,417

———- ———- ———- ———- ———- ———-

Total wheat 19,781 496 -15,868 -3,912 766,270 -26,597

Live cattle 25,408 4,048 -13,084 272 326,450 -269

Feeder cattle 1,888 27 -7,019 -1,706 43,860 2,144

Lean hogs 14,615 -1,210 -12,979 1,674 250,974 -313

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.