PDF attached

CFTC – weekly commitments of traders report

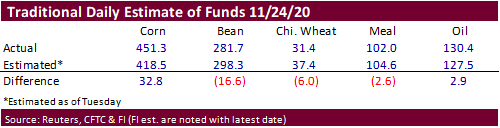

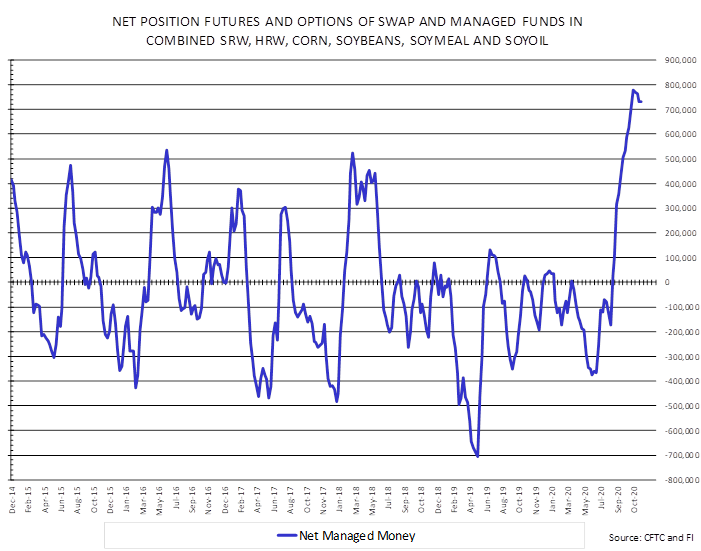

The traditional fund position in corn was 451,339 contracts, about 46,800 short of its record. Soybeans came in at 281,730, just shy of its record of 282,075 contracts.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 309,842 23,777 388,133 8,446 -676,301 -36,875

Soybeans 176,957 -3,174 193,960 -3,505 -373,705 7,564

Soyoil 80,729 3,121 130,595 1,546 -230,469 -3,077

CBOT wheat -6,954 7,886 139,354 324 -116,597 -5,607

KCBT wheat 23,843 556 71,697 2,649 -96,567 -4,295

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

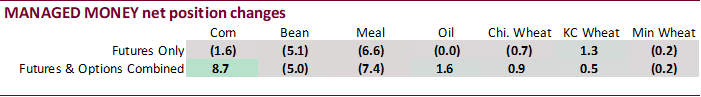

Corn 287,599 8,711 239,306 18,254 -647,010 -43,240

Soybeans 203,810 -4,964 122,838 -3,417 -376,384 7,646

Soymeal 71,135 -7,351 72,002 -2,208 -194,261 11,455

Soyoil 105,341 1,563 92,047 -3,080 -240,514 1,908

CBOT wheat 15,299 884 87,216 -4,169 -102,785 -2,029

KCBT wheat 48,421 455 43,317 2,027 -92,347 -4,196

MGEX wheat 5,854 -207 2,122 -671 -14,426 -407

———- ———- ———- ———- ———- ———-

Total wheat 69,574 1,132 132,655 -2,813 -209,558 -6,632

Live cattle 40,023 2,090 68,360 -141 -116,387 -974

Feeder cattle -697 115 7,078 85 -2,929 -360

Lean hogs 36,433 723 48,073 -560 -85,679 386

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.