PDF attached

CFTC Commitment of Traders

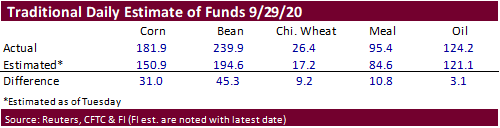

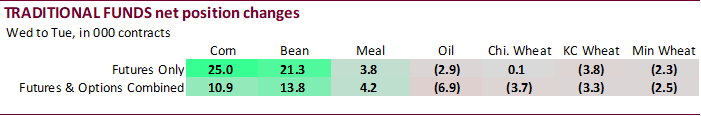

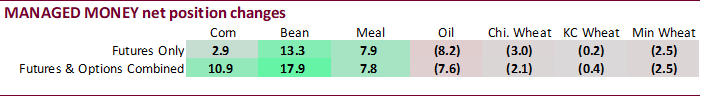

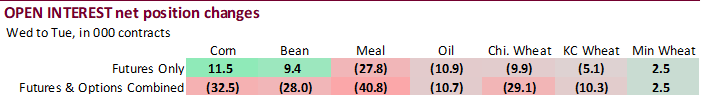

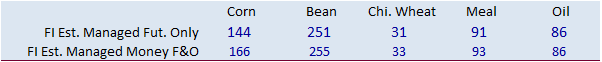

Traditional funds and Managed Money were much more long for corn and soybeans, and more long for wheat, meal and oil. Selling last week from harvesting pressure and positioning ahead of the September 1 stocks was not as large as the trade expected. With fund positions well more long than expected for corn and soybeans, prices are a little more vulnerable for movement to the downside if funds decide to liquidate positions. We see this as a bearish indicator.

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 106,820 10,908 177,381 -1,832 -307,243 -7,935

Soybeans 229,043 17,901 127,487 5,276 -351,874 -13,383

Soymeal 72,999 7,752 78,425 1,243 -195,229 -4,134

Soyoil 94,098 -7,604 89,780 73 -220,871 11,514

CBOT wheat 12,424 -2,119 93,373 3,690 -100,222 596

KCBT wheat 18,025 -438 42,785 -1,220 -58,714 5,880

MGEX wheat -4,830 -2,532 2,801 488 524 1,799

———- ———- ———- ———- ———- ———-

Total wheat 25,619 -5,089 138,959 2,958 -158,412 8,275

Live cattle 62,924 4,925 79,198 -701 -144,287 -2,818

Feeder cattle 875 165 4,547 -133 -4,188 -787

Lean hogs 40,807 -2,773 48,597 135 -95,827 3,778

Source: Reuters, CFTC, and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.