PDF attached

Commitment of Traders

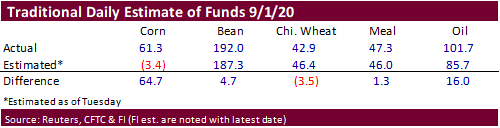

The trade really missed the estimate for the traditional fund corn position. Traditional funds as of 9/1 were net long 61,300 contracts, instead of an estimated net short 3,400 contracts. They trimmed their net short position and went long by adding net longs of 78,600 contracts in one week! December corn was around $3.5450 on August 25. On Tuesday (9/1) it settled at $3.58.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn -27,974 58,895 332,723 15,690 -260,244 -57,092

Soybeans 126,786 49,564 190,245 3,837 -312,470 -49,344

Soyoil 60,263 14,701 110,338 972 -189,314 -22,593

CBOT wheat 7,983 26,139 133,441 -105 -118,786 -22,620

KCBT wheat -1,308 20,360 60,113 3,820 -63,228 -24,806

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 18,659 80,148 173,886 1,777 -220,849 -57,414

Soybeans 162,607 53,319 118,391 -7,786 -309,923 -44,380

Soymeal 15,871 12,311 81,849 -592 -138,772 -15,199

Soyoil 81,557 13,867 90,343 -2,964 -206,010 -21,602

CBOT wheat 32,469 30,953 89,376 -7,902 -113,787 -20,495

KCBT wheat 3,160 24,276 48,394 -1,983 -61,958 -22,723

MGEX wheat -10,052 7,264 2,156 87 5,406 -4,821

———- ———- ———- ———- ———- ———-

Total wheat 25,577 62,493 139,926 -9,798 -170,339 -48,039

Live cattle 58,029 -4,073 83,430 -853 -145,455 5,033

Feeder cattle 6,190 -986 4,632 -244 -5,696 182

Lean hogs 28,777 1,575 48,031 21 -78,439 -1,133

Other NonReport

Source: Reuters and CFTC

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International │190 S LaSalle St., Suite 410│Chicago, IL 60603

W: 312.604.1366

AIM: fi_treilly

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.