PDF attached

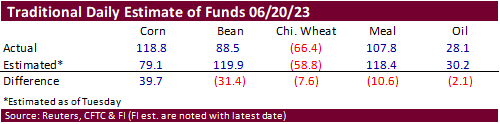

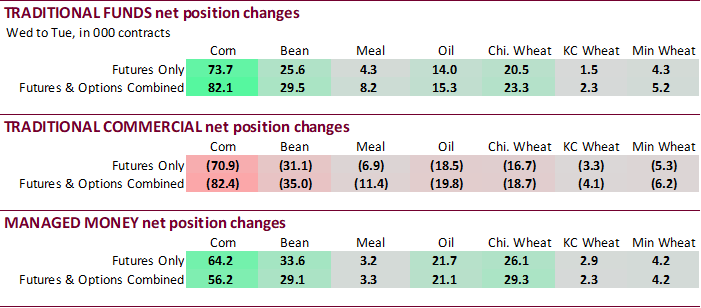

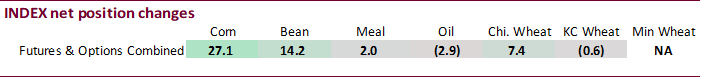

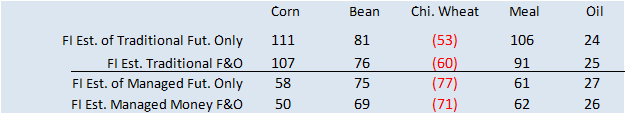

Funds were again more long than expected for corn. They were less long than expected for soybeans, meal and soybean oil. For wheat, more short than expected. Index funds were active in corn adding 27,100 contracts.

Reuters Table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn -7,631 56,151 345,525 27,057 -280,084 -83,489

Soybeans 44,392 16,606 123,882 14,208 -145,983 -36,326

Soyoil -84 15,798 112,175 -2,916 -114,470 -17,352

CBOT wheat -86,206 16,190 82,395 7,427 695 -19,026

KCBT wheat -8,403 2,572 39,519 -641 -27,344 -3,700

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 58,299 56,154 225,905 -7,213 -282,601 -75,148

Soybeans 76,950 29,069 64,342 -7,914 -125,550 -27,132

Soymeal 63,924 3,316 90,444 -1,773 -202,016 -9,657

Soyoil 29,817 21,069 110,082 -4,719 -141,860 -15,036

CBOT wheat -84,134 29,295 69,267 -1,526 163 -17,213

KCBT wheat 5,944 2,329 34,122 -784 -29,544 -3,323

MGEX wheat -3,262 4,160 1,041 87 -1,817 -6,247

———- ———- ———- ———- ———- ———-

Total wheat -81,452 35,784 104,430 -2,223 -31,198 -26,783

Live cattle 110,622 -9,300 50,828 1,437 -169,452 6,089

Feeder cattle 16,284 -3,202 893 -224 -7,365 1,597

Lean hogs 7,345 11,976 51,006 636 -54,303 -13,875

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 56,207 25,928 -57,811 281 1,876,435 101,014

Soybeans 6,550 466 -22,291 5,512 875,106 30,087

Soymeal 29,397 4,900 18,250 3,215 569,348 -6,490

Soyoil -418 -5,783 2,378 4,469 618,592 11,189

CBOT wheat 11,588 -5,966 3,117 -4,591 451,245 -14,086

KCBT wheat -6,751 9 -3,772 1,769 194,449 -8,844

MGEX wheat 2,875 1,058 1,162 942 60,246 -1,183

———- ———- ———- ———- ———- ———-

Total wheat 7,712 -4,899 507 -1,880 705,940 -24,113

Live cattle 27,426 2,529 -19,423 -754 420,823 -4,772

Feeder cattle 1,815 166 -11,626 1,664 75,290 -3,094

Lean hogs 206 3,543 -4,253 -2,279 276,029 -31,552

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |