PDF attached

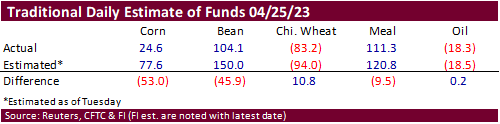

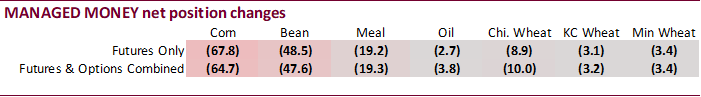

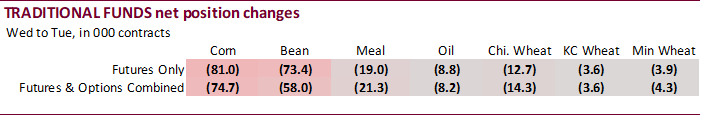

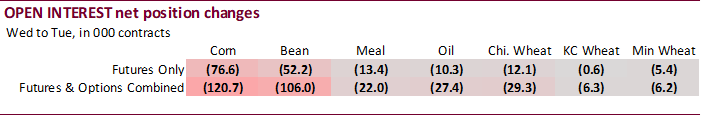

Traditional funds and managed money sold a lot more corn and soybeans than the trade predicted for the week ending April 25. The large drop in open interest during this period helps explain this. Look for possible technical short covering early next week for corn and soybeans.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn -89,330 -70,100 316,267 -1,574 -166,659 69,467

Soybeans 58,883 -52,373 131,514 -5,691 -159,603 58,015

Soyoil -42,331 -4,976 98,975 -4,751 -55,331 14,429

CBOT wheat -100,362 -10,940 73,190 -1,921 18,001 10,218

KCBT wheat -12,004 -1,696 40,478 -2,006 -25,970 6,015

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn -15,297 -64,730 237,767 7,358 -181,427 65,186

Soybeans 87,208 -47,573 94,921 7,859 -164,627 50,078

Soymeal 86,373 -19,309 91,828 1,253 -211,731 22,024

Soyoil -19,555 -3,811 107,093 -916 -83,229 13,807

CBOT wheat -113,012 -10,030 67,386 2,134 15,994 9,529

KCBT wheat 7,371 -3,219 32,718 -142 -28,091 6,080

MGEX wheat -3,410 -3,448 981 -244 -945 5,366

———- ———- ———- ———- ———- ———-

Total wheat -109,051 -16,697 101,085 1,748 -13,042 20,975

Live cattle 107,033 2,692 49,885 2,175 -167,404 -2,854

Feeder cattle 13,210 2,198 1,282 20 -4,056 -601

Lean hogs -20,663 3,907 47,585 709 -28,428 -4,250

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 19,234 -10,019 -60,278 2,205 1,569,537 -120,725

Soybeans 13,291 -10,414 -30,794 50 750,013 -105,995

Soymeal 15,797 -2,009 17,732 -1,959 482,573 -21,975

Soyoil -2,995 -4,379 -1,314 -4,701 495,888 -27,363

CBOT wheat 20,462 -4,276 9,171 2,643 429,579 -29,349

KCBT wheat -9,495 -405 -2,503 -2,313 184,479 -6,261

MGEX wheat 3,104 -876 270 -797 54,972 -6,185

———- ———- ———- ———- ———- ———-

Total wheat 14,071 -5,557 6,938 -467 669,030 -41,795

Live cattle 25,885 -1,827 -15,397 -186 427,739 7,256

Feeder cattle 2,011 -524 -12,447 -1,093 78,786 4,532

Lean hogs -3,489 826 4,996 -1,194 304,201 -27,777

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |