PDF attached include CFTC report

CFTC Commitment of Traders

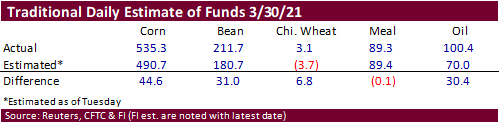

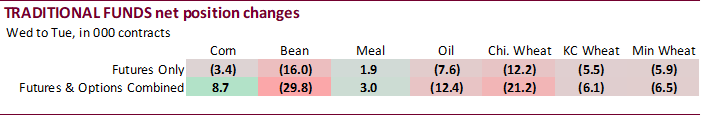

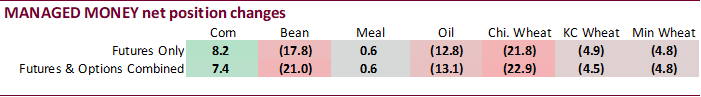

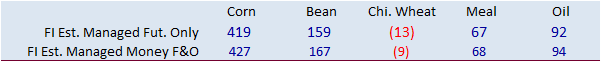

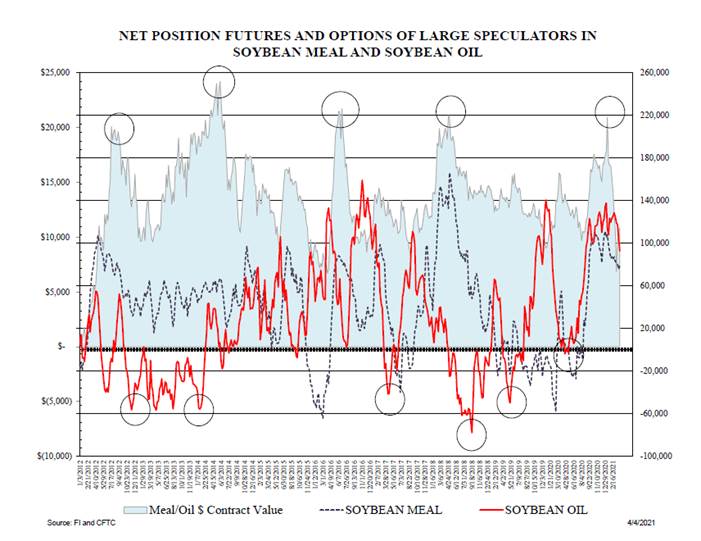

Traders again missed the traditional fund net long estimate for corn but considering there was an increase in volatility ahead of the USDA reports, a miss of 44,600 contracts could be viewed as having little influence on prices. Funds for soybeans were also much more long than expected, by 31,000 contracts, and funds were more long for soybean oil by 30,400 contracts. Managed money positions declined for soybeans, SBO and wheat and increased for corn. Meal net long for managed money was up 600 contracts.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 362,124 6,642 418,986 978 -746,116 3,180

Soybeans 98,701 -27,685 164,864 -1,735 -249,398 35,489

Soyoil 48,822 -12,388 121,138 -930 -184,837 20,412

CBOT wheat -39,927 -19,154 157,379 -1,213 -105,191 21,511

KCBT wheat 1,654 -3,640 64,274 -2,277 -63,538 6,803

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 395,584 7,410 248,782 5,827 -726,557 -3,751

Soybeans 141,880 -20,972 91,598 -49 -236,854 35,948

Soymeal 58,235 616 70,587 -965 -177,974 1,022

Soyoil 80,840 -13,136 97,741 4,619 -205,327 14,887

CBOT wheat -14,711 -22,871 98,508 4,978 -92,009 17,386

KCBT wheat 21,722 -4,520 42,110 -1,271 -55,059 8,211

MGEX wheat 10,384 -4,840 5,280 343 -17,367 8,402

———- ———- ———- ———- ———- ———-

Total wheat 17,395 -32,231 145,898 4,050 -164,435 33,999

Live cattle 83,237 3,680 84,646 211 -174,626 -6,683

Feeder cattle 5,111 4,404 7,570 116 -3,800 -1,112

Lean hogs 78,112 2,017 58,455 -3 -146,436 -4,829

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 117,185 1,314 -34,994 -10,800 2,320,111 -20,948

Soybeans 17,542 -8,858 -14,166 -6,068 1,175,658 -1,115

Soymeal 20,640 2,403 28,511 -3,076 470,594 -1,873

Soyoil 11,868 725 14,876 -7,096 589,479 -25,815

CBOT wheat 20,474 1,652 -12,261 -1,146 511,903 -3,797

KCBT wheat -6,383 -1,535 -2,390 -886 242,246 3,403

MGEX wheat -327 -1,669 2,031 -2,236 85,271 -4,218

———- ———- ———- ———- ———- ———-

Total wheat 13,764 -1,552 -12,620 -4,268 839,420 -4,612

Live cattle 20,122 2,722 -13,378 69 392,487 3,620

Feeder cattle 4,351 -512 -13,233 -2,895 53,357 -1,480

Lean hogs 16,653 1,561 -6,785 1,253 355,881 14,569

Source: Reuters and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.