PDF attached

CFTC Commitment of Traders report

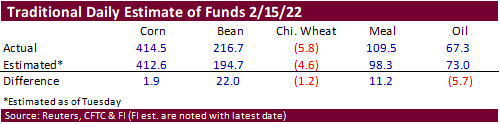

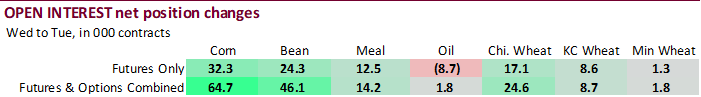

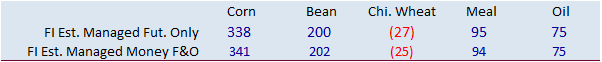

The traditional fund was more long than estimated for soybeans and meal. They were in line with corn and less long than expected for soybean oil. We see no impact on futures prices when they reopen Monday as the trade will be digesting three days of weather model changes for South America.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 259,453 5,840 434,908 -6,847 -666,112 3,596

Soybeans 140,298 776 190,352 2,553 -297,073 -5,534

Soyoil 31,737 -812 120,689 1,720 -166,335 -2,405

CBOT wheat -55,988 -5,754 146,811 3,650 -87,336 1,895

KCBT wheat 12,614 748 57,435 337 -70,607 1,285

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 325,514 -11,818 289,981 11,311 -667,107 -4,189

Soybeans 175,372 9,057 131,763 4,458 -306,822 -10,297

Soymeal 89,170 1,031 92,305 -645 -227,598 -932

Soyoil 70,381 -2,402 91,982 2,356 -173,658 -2,362

CBOT wheat -34,658 -5,106 96,188 2,576 -71,311 1,603

KCBT wheat 36,050 1,578 26,919 -66 -61,033 789

MGEX wheat 5,268 1,672 2,107 -259 -17,004 -2,264

———- ———- ———- ———- ———- ———-

Total wheat 6,660 -1,856 125,214 2,251 -149,348 128

Live cattle 86,061 4,219 83,598 -281 -170,896 -4,658

Feeder cattle 3,256 2,541 6,954 388 -2,619 -1,034

Lean hogs 79,242 571 62,392 305 -135,250 -2,113

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 79,860 7,285 -28,249 -2,589 2,062,677 64,665

Soybeans 33,264 -5,421 -33,577 2,204 1,124,836 46,146

Soymeal 16,866 1,386 29,259 -840 524,560 14,213

Soyoil -2,613 911 13,908 1,498 486,365 1,797

CBOT wheat 13,267 718 -3,487 210 511,039 24,561

KCBT wheat -2,495 69 558 -2,370 249,029 8,655

MGEX wheat 4,783 874 4,846 -24 74,066 1,797

———- ———- ———- ———- ———- ———-

Total wheat 15,555 1,661 1,917 -2,184 834,134 35,013

Live cattle 21,479 2,314 -20,241 -1,594 406,721 14,573

Feeder cattle 2,453 -753 -10,045 -1,142 58,181 1,799

Lean hogs 7,383 1,132 -13,768 106 367,616 9,460

=================================================================================

Source: Reuters, CFTC and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.