PDF attached

CFTC Commitment of Traders report

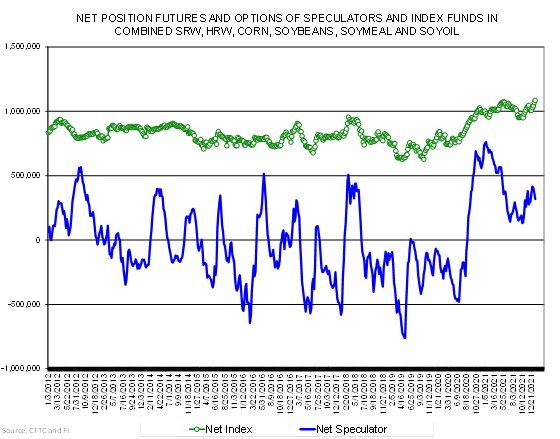

A record net long position was recorded for the index funds combined SRW, HRW, Corn, Soybeans, Soybean Meal, and Soybean Oil net long position.

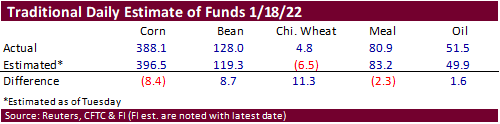

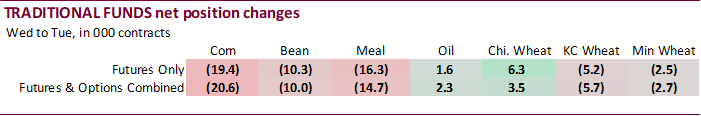

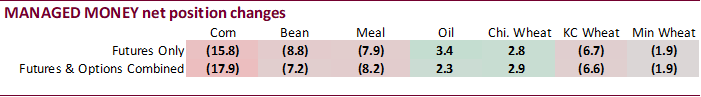

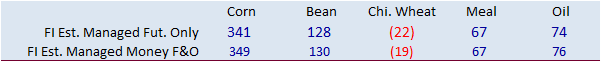

No major surprises were noted other than the net position for traditional funds Chicago wheat were more long than expected.

As of Friday – estimated

Reuters table below

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 224,828 -15,379 442,156 -3,418 -632,545 24,572

Soybeans 71,317 -13,970 205,264 11,650 -237,855 6,019

Soyoil 11,956 1,515 119,003 -242 -140,432 -761

CBOT wheat -42,144 3,032 137,820 4,533 -86,509 -8,118

KCBT wheat 11,824 -5,347 54,949 1,726 -69,835 4,350

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 326,523 -17,855 291,693 5,590 -630,775 20,808

Soybeans 99,639 -7,241 160,062 10,938 -249,506 2,721

Soymeal 64,743 -8,177 100,120 6,049 -209,131 7,385

Soyoil 58,208 2,302 88,934 363 -147,295 -2,156

CBOT wheat -24,901 2,863 92,388 5,240 -72,881 -9,245

KCBT wheat 36,119 -6,555 26,159 4,390 -59,756 1,998

MGEX wheat 3,857 -1,878 1,977 -357 -11,400 3,249

———- ———- ———- ———- ———- ———-

Total wheat 15,075 -5,570 120,524 9,273 -144,037 -3,998

Live cattle 62,177 235 82,279 1,834 -152,722 -2,680

Feeder cattle 5,465 -1,004 4,531 495 -2,073 360

Lean hogs 48,795 -10 60,290 889 -99,995 837

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 46,997 -2,767 -34,440 -5,777 1,828,316 -33,213

Soybeans 28,530 -2,720 -38,726 -3,699 841,473 7,505

Soymeal 14,295 -6,566 29,973 1,308 458,623 4,365

Soyoil -9,320 2 9,473 -511 434,799 4,136

CBOT wheat 14,560 589 -9,167 553 468,778 13,184

KCBT wheat -5,584 899 3,062 -731 239,872 -2,898

MGEX wheat 3,040 -772 2,526 -241 71,926 734

———- ———- ———- ———- ———- ———-

Total wheat 12,016 716 -3,579 -419 780,576 11,020

Live cattle 18,666 1,326 -10,401 -716 377,575 4,584

Feeder cattle 787 158 -8,709 -8 53,133 1,467

Lean hogs 7,166 -1,789 -16,256 73 276,468 8,997

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.