PDF attached

CFTC COT

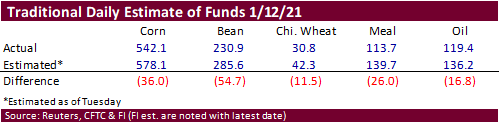

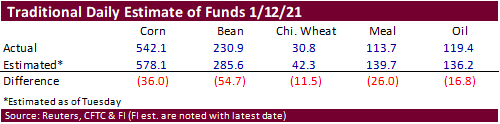

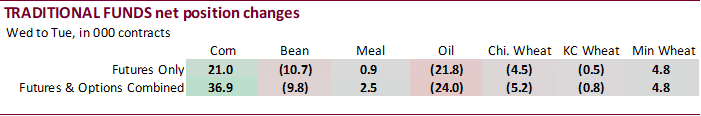

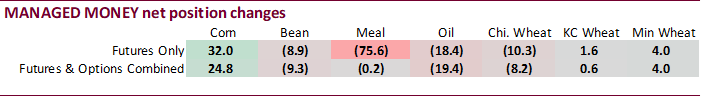

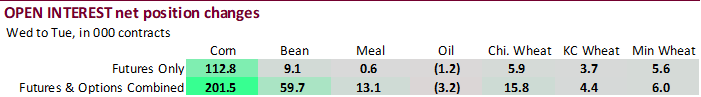

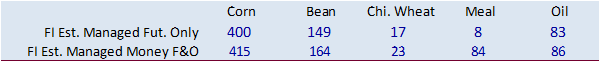

It is safe to say the trade for the last several weeks has missed predicting how much the longs have gone long. “Traditional” fund positions for corn have hit another record for futures only and futures and options combined. Managed money positions have a short stint to make new records, but this is a reminder they have room for the upside, and with open interest at a high level, higher prices can be achieved if the manage money plow another round of long positions in the markets.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 435,357 39,740 399,292 -9,786 -808,165 -10,952

Soybeans 158,524 -6,692 159,369 -6,813 -320,896 10,921

Soyoil 69,029 -22,897 123,201 289 -213,755 20,178

CBOT wheat -6,511 -4,778 137,518 503 -118,635 2,903

KCBT wheat 34,493 1,682 70,391 -2,569 -106,938 -1,016

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 374,714 24,826 243,283 -4,611 -774,381 -13,327

Soybeans 166,485 -9,342 70,230 -9,618 -297,117 16,847

Soymeal 84,408 -187 64,887 -3,271 -203,625 -3,018

Soyoil 93,536 -19,382 83,956 -1,906 -219,282 23,488

CBOT wheat 16,987 -8,224 82,881 2,211 -105,192 1,630

KCBT wheat 55,062 605 42,709 -206 -100,404 -928

MGEX wheat 11,797 4,049 3,401 211 -25,025 -4,501

———- ———- ———- ———- ———- ———-

Total wheat 83,846 -3,570 128,991 2,216 -230,621 -3,799

Live cattle 42,827 -3,160 76,489 7,941 -129,393 -1,861

Feeder cattle 13 -1,758 7,547 -532 -1,852 816

Lean hogs 38,742 1,664 53,195 2,563 -89,982 -1,961

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 182,867 12,113 -26,483 -19,001 2,580,675 201,473

Soybeans 57,399 -470 3,003 2,584 1,342,333 59,686

Soymeal 23,656 2,720 30,675 3,756 499,855 13,121

Soyoil 20,265 -4,631 21,526 2,431 568,408 -3,163

CBOT wheat 17,695 3,009 -12,372 1,372 538,192 15,758

KCBT wheat 578 -1,374 2,055 1,903 242,317 4,356

MGEX wheat 4,651 748 5,175 -507 88,317 6,000

———- ———- ———- ———- ———- ———-

Total wheat 22,924 2,383 -5,142 2,768 868,826 26,114

Live cattle 25,378 -847 -15,302 -2,072 359,752 16,012

Feeder cattle 2,033 885 -7,742 589 48,928 -87

Lean hogs 10,661 -2,208 -12,616 -58 245,388 3,674

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.