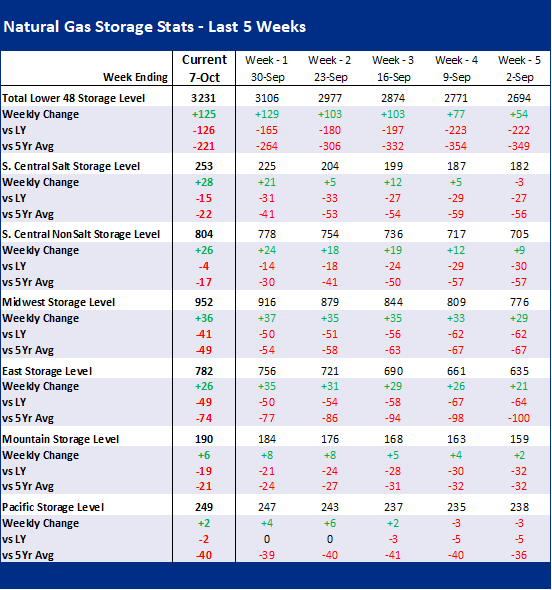

The EIA reported a +125 Bcf injection for week ending Oct 7th, which came in slightly lower than our estimate of +130. This storage report takes the total level to 3231 Bcf, which is 126 Bcf less than last year at this time and 221 Bcf below the five-year average of 3,452 Bcf. This is the 4th consecutive triple-digit build. Noteworthy in this report was the exceptional build in both Salt and Non-Salt storage. Both storage categories are now very close to historic norms.

The massive injection once again is puzzling as our fundamental storage model has been missing by 0.8-1.3 Bcf/d for the past 4 weeks. We are already factoring in a high supply number; hence we must be over estimating consumption. Factoring in this error adjustment, we did expect a loose number in the same ballpark as last week, but with a slightly different fundamental make up. Below are some details that somewhat tell the story:

- Total domestic production jumped once again by +0.7 Bcf/d. This is the highest weekly average recorded, and we figure there is more room for upside with the Northeast potentially ramping up as we go into the winter months. The increase in production came particularly from the Texas area this week. Canadian imports did start to weaken this week as well with small drops in volumes across multiple entry points.

- Gas consumption looks to have hit a seasonal low last week. This week with the cooler temps across much of the country, we see RC gas consumption rise. During the reporting week, CDDs decreased by 1.6F week-on-week while HDD start to slowly march higher by 1.6F.

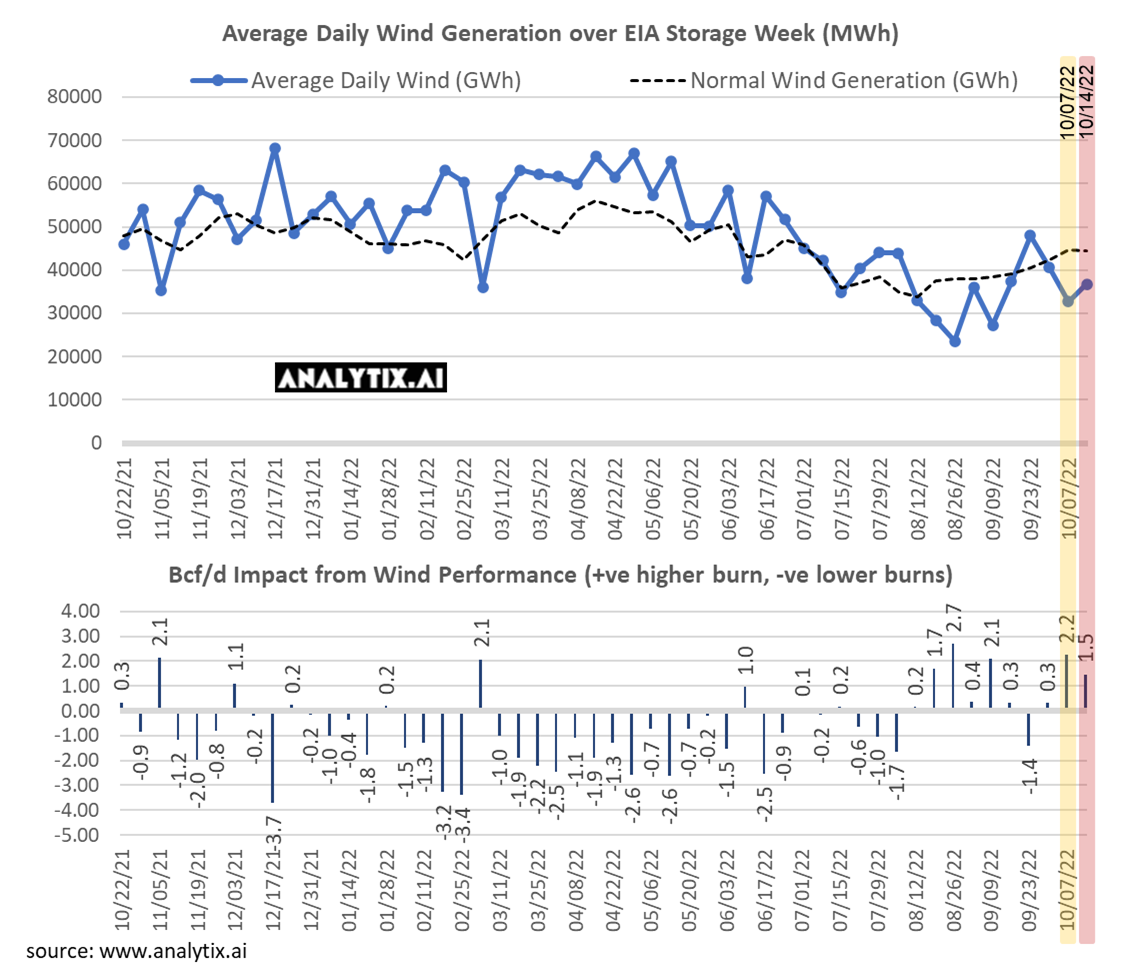

- Wind was particularly much lower than we would expect for this time of the year. According to our wind index, we would have expected wind output to be near 45 aGWh for this time of the year but our wind generation only averaged 32.7 aGWh. This misfire of wind added approximately 2.2 Bcf/d of gas burns. If wind did perform as expected then this storage number could have been even looser.

- LNG was another loosening factor with Cove Point starting its annual maintenance last week. The facility typically takes 0.77 Bcf/d, which was redirected into local markets.

We calculate this reported injection to +5.2 Bcf/d loose YoY – (wx adjusted), which is once again out of range from the most of the summer. [We compare this report to LY’s rolling 5-week regression centered around week #39]

As we noted above, wind and solar both underperformed during week ending Oct 7. If those two generation types had operated at expected levels then this storage report would have been even looser. It could have added up to 1.8 Bcf/d of additional looseness, or an extra 12-13 Bcf in storage injections. This would have taken last week’s storage injection to a new one-week record.

Today’s Fundamentals

Daily US natural gas production is estimated to be 100.4 Bcf/d this morning. Today’s estimated production is -0.41 Bcf/d to yesterday, and -1.68 Bcf/d to the 7D average. Northeast production once again seems to be declining below 34 Bcf/d.

Natural gas consumption is modelled to be 76.8 Bcf today, -0.46 Bcf/d to yesterday, and +1.7 Bcf/d to the 7D average. US power burns are expected to be 31.5 Bcf today, and US ResComm usage is expected to be 16.1 Bcf.

Net LNG deliveries are expected to be 11.1 Bcf today.

Mexican exports are expected to be 6.5 Bcf today, and net Canadian imports are expected to be 5.7 Bcf today.

The storage outlook for the upcoming report is +109 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.