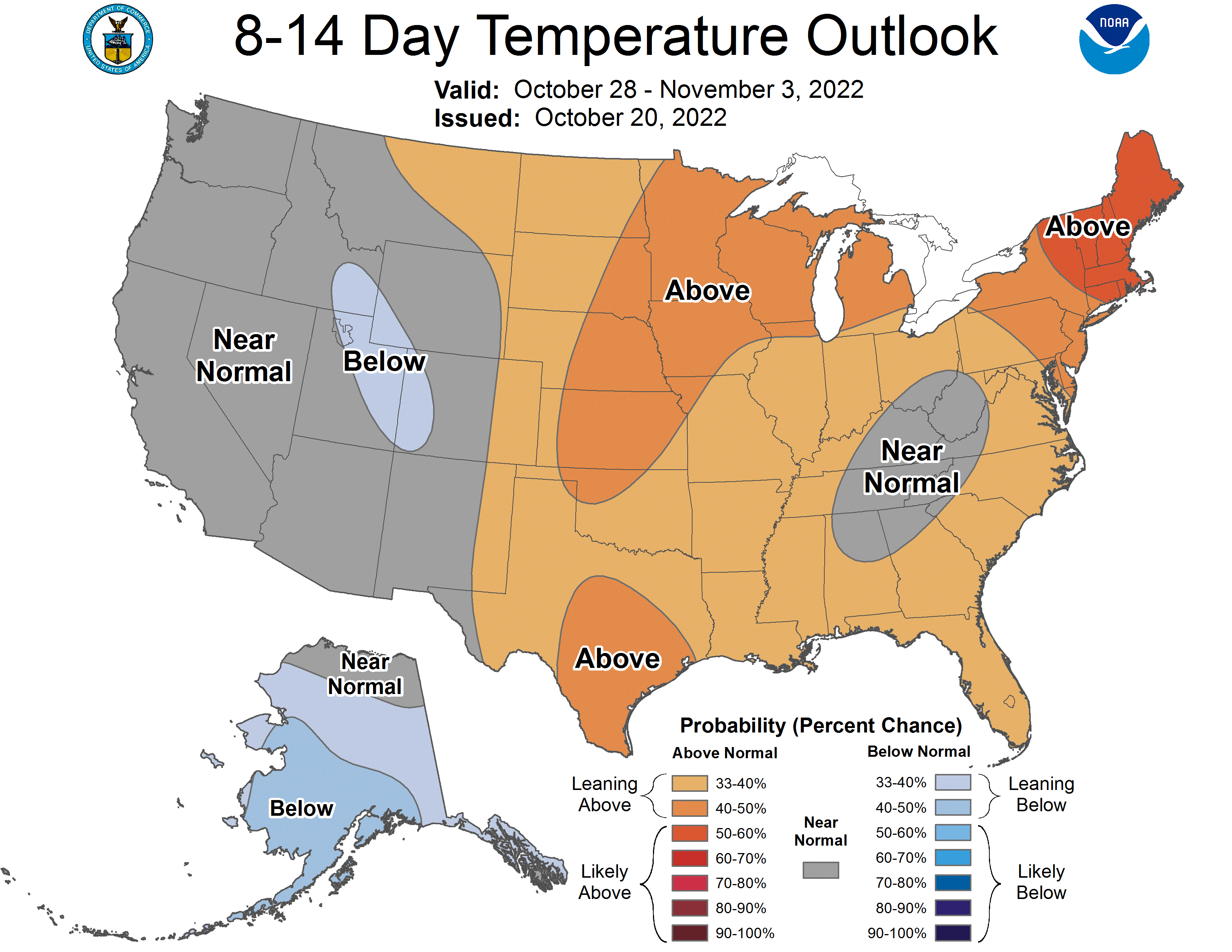

Natgas market move much lower this morning as weather continues to warm past this weekend. Both the GFS Ensemble and Euro Ensemble warmed significantly taking it much below normal in the short-term.

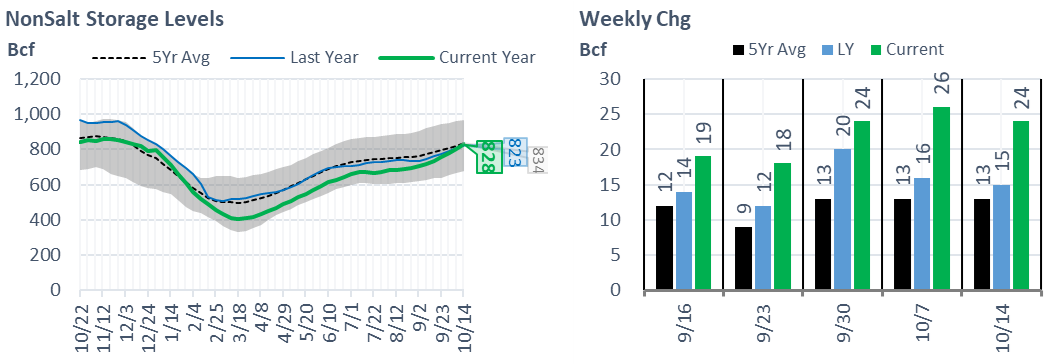

Adding to the bearish note was yesterday’s storage report. The EIA reported a +111 Bcf injection for the week ending Oct 14th, which came in right at our estimate of +109. This storage report takes the total level to 3342 Bcf, which is 106 Bcf less than last year at this time and 183 Bcf below the five-year average of 3,525 Bcf. This is the 5th consecutive triple-digit build. Noteworthy has been consistently stronger than expected SC Non-Salt builds that now take levels above last year. This is the only region that is currently sitting at a surplus to last year.

Our fundamental storage model once again is short by 1.0-1.3 Bcf/d. When the error is so consistent, we hate that we cannot explain whether we are missing it on the production side or the demand side. At this point, I’d say we are undershooting demand just because our production numbers are much higher than the rest of the industry estimates. For this report, below are some good details to explain the +111 Bcf build:

- Total domestic production fell off the record high set in the previous week. Total lower 48 production dropped by -0.3 Bcf/d.

- Gas consumption rose once again with the cooler temps starting to set in across much of the country. The Midwest and the entire East coast pushed below normal leading to a pick up in RC gas consumption rise. During the reporting week, CDDs were relatively flat while HDDs rose by 0.6F. Here is a view of the temps by EIA region.

- With CDDs relatively, power loads also remained flat. As usual, the power mix did change. The big movers this week did not include natural gas. Wind rose by 8.3 aGWh, which was entirely offset by Nuke generation dropping by 7.3 aGWH. Despite the jump in wind, we should have expected at least 45 aGWh for this time of the year.

- LNG feedgas levels remained unchanged.

We calculate this reported injection to 6.1 Bcf/d loose YoY – (wx adjusted), which has been instrumental in reducing the YoY storage deficit. [We compare this report to LY’s rolling 5-week regression centered around week #42]

Today’s Fundamentals

Daily US natural gas production is estimated to be 100.3 Bcf/d this morning. Today’s estimated production is +0.28 Bcf/d to yesterday, and -0.1 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 76.7 Bcf today, -7.59 Bcf/d to yesterday, and -4.12 Bcf/d to the 7D average. US power burns are expected to be 29.4 Bcf today, and US ResComm usage is expected to be 17.2 Bcf.

Net LNG deliveries are expected to be 11.5 Bcf today.

Mexican exports are expected to be 6.3 Bcf today, and net Canadian imports are expected to be 5.5 Bcf today.

The storage outlook for the upcoming report is +59 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.