The EIA reported a +60 Bcf injection for the week ending July 1st, which helped negate the ultra bearish view the previous two reports put in place. The market consensus was in the low-70s, which already accounted for the full impact of the Freeport outage.

This storage report takes the total level to 2311 Bcf, which is 261 Bcf less than last year at this time and 322 Bcf below the five-year average of 2,633 Bcf. Overall, we estimate this +60 Bcf injection is ~2.4 Bcf/d loose vs last summer (wx adjusted). If we focus just on the storage injections from June through August, then this report was 2 Bcf/d loose vs last year. So in effect, if Freeport was still operational then this report would have been flat to last year which would have suggested a tight end of season – hence the large price response yesterday.

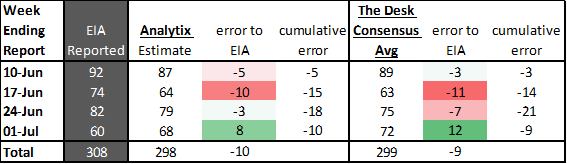

We always tend to put a little blame on the EIA or the operators reporting incorrectly to the EIA when the number is so far off expectations. I spoke with some people at the EIA yesterday, and they claim to receive input from 96% of working gas capacity each week – so absolutely no modeling error from their side. But there is still the possibility that the EIA gets incorrect data from the storage operators that are corrected in later weeks. If this was the case, this week’s low number would help correct the past cumulative error. Below is a table that shows the weekly error in our estimate and the market consensus for the past 4 weeks. As can be seen, this past week’s +60 does help correct some of the misses we had been seeing.

Today’s Fundamentals

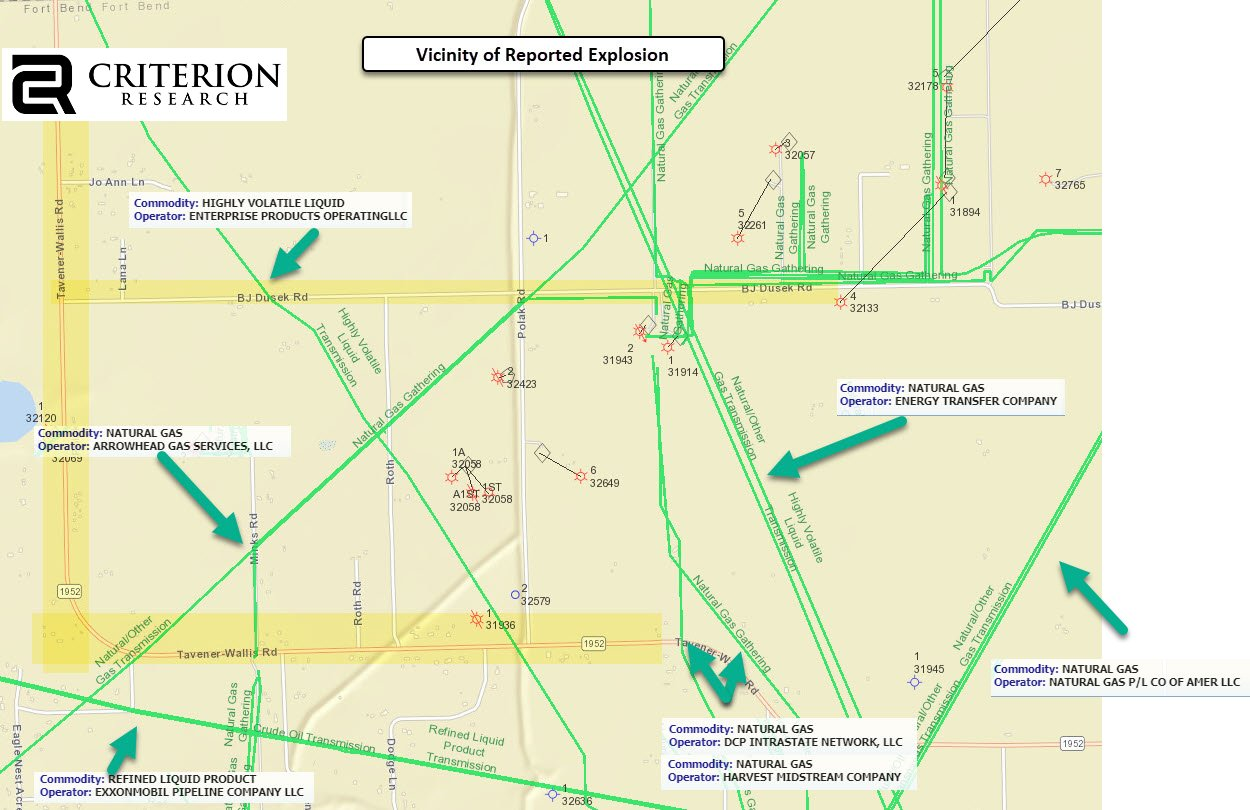

Daily US natural gas production is estimated to be 96.5 Bcf/d this morning. Today’s estimated production is +0.1 Bcf/d to yesterday, and -0.42 Bcf/d to the 7D average. The Fort Bend County ET pipeline explosion does not look to have impacted production. The explosion was officially reported as the Old Ocean Pipeline, which brings Permian supply down from Central Texas towards the Gulf Coast. That pipeline has a capacity of 160 Mmcf/d, and the outage could impact intrastate Permian Basin production receipts while offline. We see no evidence of that yet. Below is a good map from Criterion Research.

Natural gas consumption is modelled to be 79.3 Bcf today, -1.34 Bcf/d to yesterday, and +1.85 Bcf/d to the 7D average. US power burns are expected to be 41.6 Bcf today, and US ResComm usage is expected to be 8.2 Bcf.

Net LNG deliveries are expected to be 11 Bcf today.

Mexican exports are expected to be 7 Bcf today, and net Canadian imports are expected to be 6.1 Bcf today.

The storage outlook for the upcoming report is +57 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.