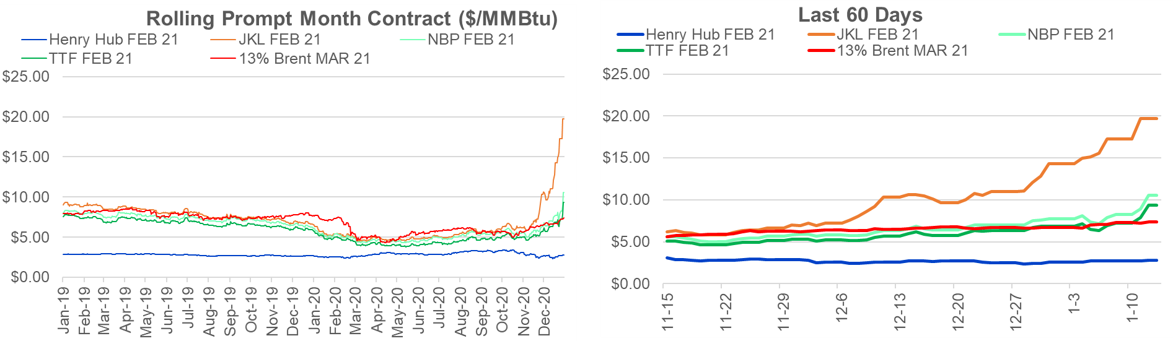

The rally in LNG prices shows no signs of slowing as a cold snap is forcing Asian utilities to pay prices never seen before. Last week, Exxon sold a spot cargo for the 2nd half of Jan to Kyushu Electric Power Co. for the mid-$30/MMbtu level. This comes with many other spot deals done in the mid $20s. The higher spot prices are dragging the forwards higher. The JKM Feb contract closed near $20/MMBtu.

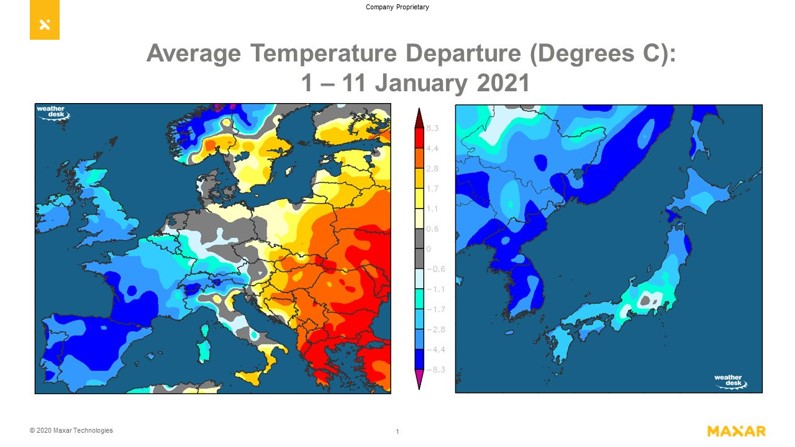

The maps below show why LNG prices are spiking. From the first third of January 2021, Western Europe and East Asia (China, the Korean Peninsula and Japan) has seen a blast of cooler temps. Utilities in the region are scrambling to find new LNG supplies with short timeframe deliveries.

Today’s Fundamentals

Daily US natural gas production is estimated to be 89.9 Bcf/d this morning. Today’s estimated production is +0.41 Bcf/d to yesterday, and -0.92 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 100.1 Bcf today, -5.31 Bcf/d to yesterday, and -7.37 Bcf/d to the 7D average. US power burns are expected to be 28.94 Bcf today, and US ResComm usage is expected to be 40.1 Bcf.

Net LNG deliveries are expected to be 10.7 Bcf today.

Mexican exports are expected to be 6 Bcf today, and net Canadian imports are expected to be 5.8 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.