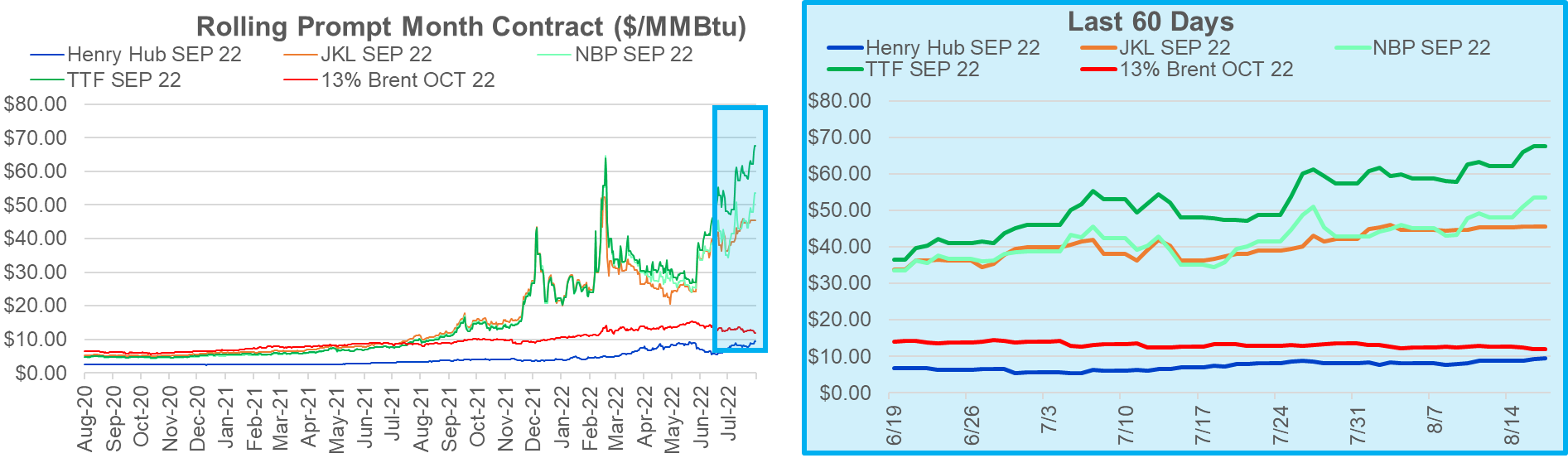

Yesterday’s Henry Hub rally looks to be a result of TTF touching new record highs. Despite European storage is sitting at the 5Yr average (75% full, +23% YoY), the unreliable supply from Russia is setting this market into unknown territory again. Adding to this story is the European drought that is drying up rivers and stopping the transport of coal and oil, which is forcing utilities to use more gas during this extremely hot/dry summer.

TTF and NBP is now trading at a extreme premium to JKM through the winter.

The US looks to be producing as much #LNG as possible, but the higher ambient temps look to be capping overall facility utilization. As the peak summer ends, we expect liquefaction at major facilities to pick up. That being said, we will be entering peak hurricane season which can impact LNG exports in many different ways. We also need to consider that high utilization of the LNG facilities this summer will likely require timely maintenance, and potentially longer maintenance.

Today’s Fundamentals

Daily US natural gas production is estimated to be 97 Bcf/d this morning. Today’s estimated production is -0.98 Bcf/d to yesterday, and -1.54 Bcf/d to the 7D average. Yesterday, we saw mor than a +1 Bcf/d revision in late day nomination; therefore we should expect a similar move today.

Natural gas consumption is modelled to be 77.7 Bcf today, -0.27 Bcf/d to yesterday, and +0.62 Bcf/d to the 7D average. US power burns are expected to be 40 Bcf today, and US ResComm usage is expected to be 8.1 Bcf.

Net LNG deliveries are expected to be 10.9 Bcf today.

Mexican exports are expected to be 7.2 Bcf today, and net Canadian imports are expected to be 5.1 Bcf today.

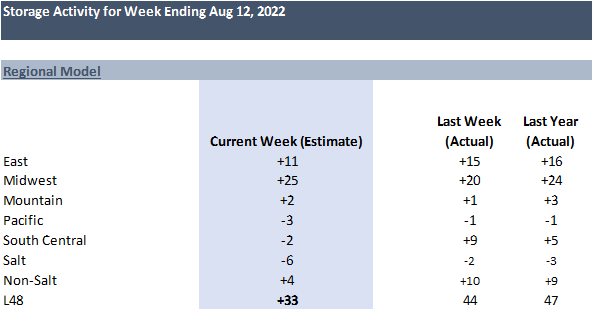

For week ending Aug 12th, the S/D storage model is point to a +25 Bcf injection and flow model is point to a +33 Bcf . The flow model performance has been strong lately, hence we take an average of the two as our final estimate. Our final estimate is +29 Bcf this week (with some high side risk)

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.