Yesterday, was a bit of a wild day. It appears a leaked PR regarding Freeport made it from one desk to the next faster than the release of the official statement. I personally saw it on enelyst.com about an hour earlier.

The interesting piece is that the official statement from Freeport did not include the last 4 of 6 paragraphs of the “leaked” version. Most of us did not bother to read the official statement. The red font was not included and holds critical info

5 August 3 Update re June 8 Incident

Freeport LNG Development, L.P. (Freeport LNG) and the Pipeline Hazardous Materials Safety Administration (PHMSA) have entered into a Consent Agreement related to the June 8 incident at Freeport LNG’s liquefaction facility. Freeport LNG has a long history of commitment to safety and safe operation and overall, the obligations under the Consent Agreement are intended to ensure that Freeport LNG can safely and confidently resume initial LNG production and thereafter ultimately return to full operation of all liquefaction facilities.

In the near term, the Consent Agreement includes certain corrective measures, many of which are currently underway, that Freeport LNG is to take to obtain PHMSA approval for an initial resumption of LNG production from its liquefaction facility. Freeport LNG continues to believe that it can complete the necessary corrective measures, along with the applicable repair and restoration activities, in order to resume initial operations in early October. Those initial operations are expected to consist of three liquefaction trains, two LNG storage tanks and one LNG loading dock, which the company believes will enable delivery of approximately 2 BCF per day of LNG, enough to support its existing long-term customer agreements. In addition to the repair and replacement of Freeport LNG’s physical infrastructure that was damaged in the incident, and as part of the corrective measures under the Consent Agreement, the company is evaluating and advancing initiatives related to training, process safety management, operations and maintenance procedure improvements, and facility inspections.

As noted, partial operations will initially utilize two of the three LNG storage tanks, and the dock one loading facilities, with dock two anticipated to return to service closer to year-end. We plan to utilize dock two as a lay berth until it is returned to service, in an effort to maximize the efficiency of marine operations and ship transits.

The preliminary findings of IFO Group’s root cause analysis of the June 8 incident are expected later this month, with final findings being subject to the results of metallurgical testing to be completed in mid-September. No facts have been revealed that would indicate that the incident was a result of Force Majeure.

IFO Group representatives met independently with FERC and PHMSA representatives on August 2 to conduct a root cause analysis session to develop the root cause and contributing factors. The meeting reportedly went well, with no surprises. PHMSA representatives have completed their interviews of Freeport LNG personnel, and calls with the agency have been reduced from daily to weekly. Responses have been submitted to substantially all data requests from the agencies, and the required 60-day notice of intent to restart the facility has been delivered to FERC. We continue to work closely with agency representatives to ensure that they are aligned with us on the plan and schedule for a return to operations, and our working relationship with the agencies continues to be positive.

We also continue to work closely with insurers to support the claim, and are close to having a fully accepted proof of loss agreed with the insurers. We anticipate an initial interim payment later this month, which is expected to advance a significant amount of anticipated recovery costs and business interruption recovery beyond the 60-day lost time element waiting period. Subsequent interim payments are expected on a quarterly basis.

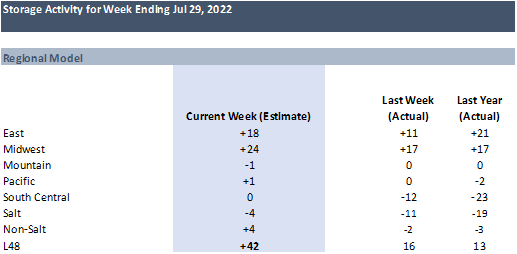

For today’s storage report our final projection is +37 Bcf (average of our S/D @ +32 and our Flow +42).

This is the results of our flow estimate.

The current Bloomberg survey is +28 and Bloomberg whisper is currently at +33 (the whisper is the average of the 17 top analysts).

Here are the current ICE storage future settles as of yesterday.

Week 1 is +35 [today’s report]

Week 2 is +47

Week 3 is +46

There current end of Summer 2022 (Nov 10th) is 3450. [Last week was 3500]

There current end of Winter 2022/23 (Apr 13th) is 1475. [no OI]

Today’s Fundamentals

Daily US natural gas production is estimated to be 96.9 Bcf/d this morning. Today’s estimated production is -0.12 Bcf/d to yesterday, and -0.88 Bcf/d to the 7D average. It looks like production for Aug is settling around ~97 Bcf/d, which is inline with late-July before the big burst in production we saw over the weekend.

Natural gas consumption is modelled to be 81.6 Bcf today, -2.02 Bcf/d to yesterday, and +0.22 Bcf/d to the 7D average. US power burns are expected to be 43.4 Bcf today, and US ResComm usage is expected to be 8.4 Bcf.

Net LNG deliveries are expected to be 11.1 Bcf today.

Mexican exports are expected to be 5.5 Bcf today (but these are artificially low because IENOVA pipes into Mexico are reporting bad data), and net Canadian imports are expected to be 5.4 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.